Written:

Jan 29, 2026

Learn how token value accrual mechanisms like buybacks, burns, and fee switches are transforming crypto tokens into equity-like ownership instruments.

For years, the crypto industry sidestepped a fundamental question: what makes a token actually valuable? The answer increasingly points to token value accrual: the mechanisms that transfer protocol-generated value directly to token holders. As DeFi matures and regulatory clarity emerges, tokens are evolving from speculative instruments into something that looks remarkably like equity.

This shift matters because it changes how we evaluate crypto investments. Instead of relying on narratives about ""utility"" or network effects, investors can now analyze tokens using frameworks borrowed from traditional finance: revenue multiples, earnings ratios, and cash flow analysis. The protocols leading this transformation are building what some call ""ownership tokens,"" assets with programmatic economic rights enforced directly onchain. Understanding crypto value accrual has become essential for anyone serious about DeFi token valuation.

What is Token Value Accrual?

Token value accrual refers to the mechanisms by which protocols capture and distribute value to their token holders. This concept builds on the broader framework of value creation, value capture, and value accrual in crypto economics. Rather than hoping token prices rise due to speculation or adoption, crypto value accrual creates direct economic links between protocol success and token holder returns.

Think of it this way: when a decentralized exchange generates trading fees, where does that money go? In early DeFi, the answer was often unclear or disconnected from token holders. With proper token value accrual mechanisms, those fees flow back to token holders through buybacks, burns, or direct distributions.

This represents a fundamental shift in tokenomics design. The industry spent years marketing tokens as ""utility"" instruments to avoid securities classifications. Projects emphasized governance rights, platform access, or network participation. But utility alone doesn't create investment value. Cash flows do. Token value accrual bridges this gap by routing real revenue to holders.

For investors, mastering token value accrual analysis is now essential. Protocols generating substantial revenue but lacking value accrual mechanisms are leaving money on the table for token holders. Conversely, projects with strong crypto value accrual frameworks can justify higher valuations based on actual economic performance rather than speculation.

Token vs Equity

The token vs equity comparison reflects genuine structural similarities that are becoming more pronounced. Understanding both the parallels and differences helps investors make informed decisions about DeFi token valuation.

Traditional Shareholder Rights

Public company shareholders possess three core rights that underpin equity value:

Claims on proceeds: If the company sells, shareholders receive their proportional share of the sale price.

Bankruptcy rights: In liquidation, shareholders have claims on remaining assets after creditors are paid.

Proxy rights: Shareholders can vote on corporate matters and conduct proxy fights to influence management decisions.

Notably absent from this list? Direct claims on operating cash flows. Notably, shareholders are at the mercy of management's decisions on how they use those cash flows. This dynamic is no different from being a tokenholder.

This observation reframes the token vs equity debate entirely. Most public companies don't distribute all profits as dividends. Instead, management decides whether to reinvest, buy back shares, acquire competitors, or build cash reserves. Token holders face similar dynamics, except in crypto, these decisions can be encoded in smart contracts rather than left to management discretion.

How Tokens Mirror These Rights

Well-designed ownership tokens can replicate and even improve upon traditional shareholder rights:

Governance voting mirrors proxy rights, allowing token holders to vote on protocol parameters, fee structures, and treasury allocations.

Protocol revenue distribution mechanisms provide more direct cash flow access than most equity investors receive.

Token buyback mechanisms function like corporate share repurchases but execute automatically based on predefined rules.

Key Differences: Programmatic vs Legal Enforcement

The critical distinction in the token vs equity analysis lies in enforcement mechanisms. Equity rights derive from legal frameworks: corporate law, securities regulations, and court systems. Token rights derive from code, specifically smart contracts that execute automatically regardless of anyone's preferences.

This creates both advantages and risks. On the positive side, onchain rights are programmatic, predictable, and transparently verifiable. No board meeting required. No management can decide to skip a dividend payment if the smart contract mandates distribution.

However, the absence of legal frameworks means token holders often lack recourse when things go wrong. If a protocol's multisig controllers decide to change the rules, token holders may have governance votes but no courts to appeal to.

Token Value Accrual Mechanisms in DeFi

Protocols employ several strategies to create crypto value accrual, each with distinct implications for token holders and protocol sustainability. Understanding these mechanisms is crucial for accurate DeFi token valuation.

Comparing Value Accrual Mechanisms

Mechanism | How It Works | Value to Holders | Regulatory Risk | Example |

Token Buybacks | Protocol uses revenue to purchase tokens from market | Indirect (price support + supply reduction) | Lower | Hyperliquid (99% of revenue) |

Fee Switch Tokenomics | Protocol revenue distributed directly to stakers | Direct (cash flow) | Higher | Uniswap (trading fees to UNI holders) |

Burns | Tokens permanently removed from supply | Indirect (deflation) | Lower | Ethereum EIP-1559 |

Revenue Sharing | Protocol revenue distributed pro-rata | Direct (dividends) | Higher | GMX (ETH/AVAX to stakers) |

Token Buyback Mechanisms

Token buyback mechanisms use protocol revenue to purchase tokens from the open market, creating buy pressure and reducing circulating supply. This mirrors corporate share repurchases, which have become the dominant form of shareholder returns in traditional markets.

Hyperliquid provides the most aggressive example of token value accrual currently operating. The perpetual futures exchange directs 99% of its revenue (approximately $1.28 billion annualized) to token repurchases. This program has already bought back over 10% of the circulating HYPE supply, demonstrating how consistent buyback pressure can meaningfully impact token economics.

The mechanics are straightforward: trading fees accumulate in a protocol-controlled wallet, which automatically or periodically purchases tokens. Purchased tokens might be burned (permanently removed from supply) or held in the treasury for future use.

Token buyback mechanisms appeal to protocols for several reasons. They avoid some regulatory concerns associated with direct distributions. They benefit all token holders proportionally without requiring active claims. And they create predictable buy pressure that can support prices during market downturns.

Fee Switch Tokenomics and Protocol Revenue Distribution

Fee switch tokenomics represents the most direct form of token value accrual: turning on revenue sharing to token holders. Uniswap's recent fee switch activation exemplifies this approach, directing a portion of protocol trading fees to UNI token holders.

Protocol revenue distribution can take several forms:

Direct distributions: Protocol revenue flows to token holders in stablecoins or ETH, similar to dividends.

Staking rewards: Token holders must stake their tokens to receive distributions, adding an opportunity cost that can reduce selling pressure.

Gauge systems: Token holders vote on how revenue gets allocated across different pools or use cases, combining governance with economic rewards.

The distinction between direct and indirect crypto value accrual matters for DeFi token valuation. Direct accrual through fee switch tokenomics and protocol revenue distribution provides immediate, measurable returns. Indirect accrual (governance rights, protocol growth) may increase token value over time but with less certainty.

Burn Mechanisms

Burn mechanisms permanently remove tokens from circulation, reducing total supply. When protocol revenue funds burns, it creates a deflationary dynamic where increased usage leads to decreased supply, a powerful form of token value accrual.

Ethereum's EIP-1559 implementation pioneered this approach at scale, burning a portion of transaction fees. Many DeFi protocols have adopted similar models, using trading fees or protocol revenue distribution to buy and burn their native tokens.

Burns differ from token buyback mechanisms in one key respect: burned tokens can never re-enter circulation. Treasury-held buybacks could theoretically be sold later, diluting holders. Burns provide permanent supply reduction, which some investors prefer for long-term token value accrual.

The comparison to corporate buybacks is instructive. Companies often repurchase shares only to reissue them as executive compensation, negating the supply reduction. Onchain burns eliminate this possibility through programmatic enforcement.

The Valuation Disconnect

Despite improving fundamentals, DeFi tokens trade at significant discounts to traditional finance comparables. This valuation disconnect suggests either market inefficiency or unpriced risks, and likely both. Understanding token value accrual helps identify which tokens may be undervalued.

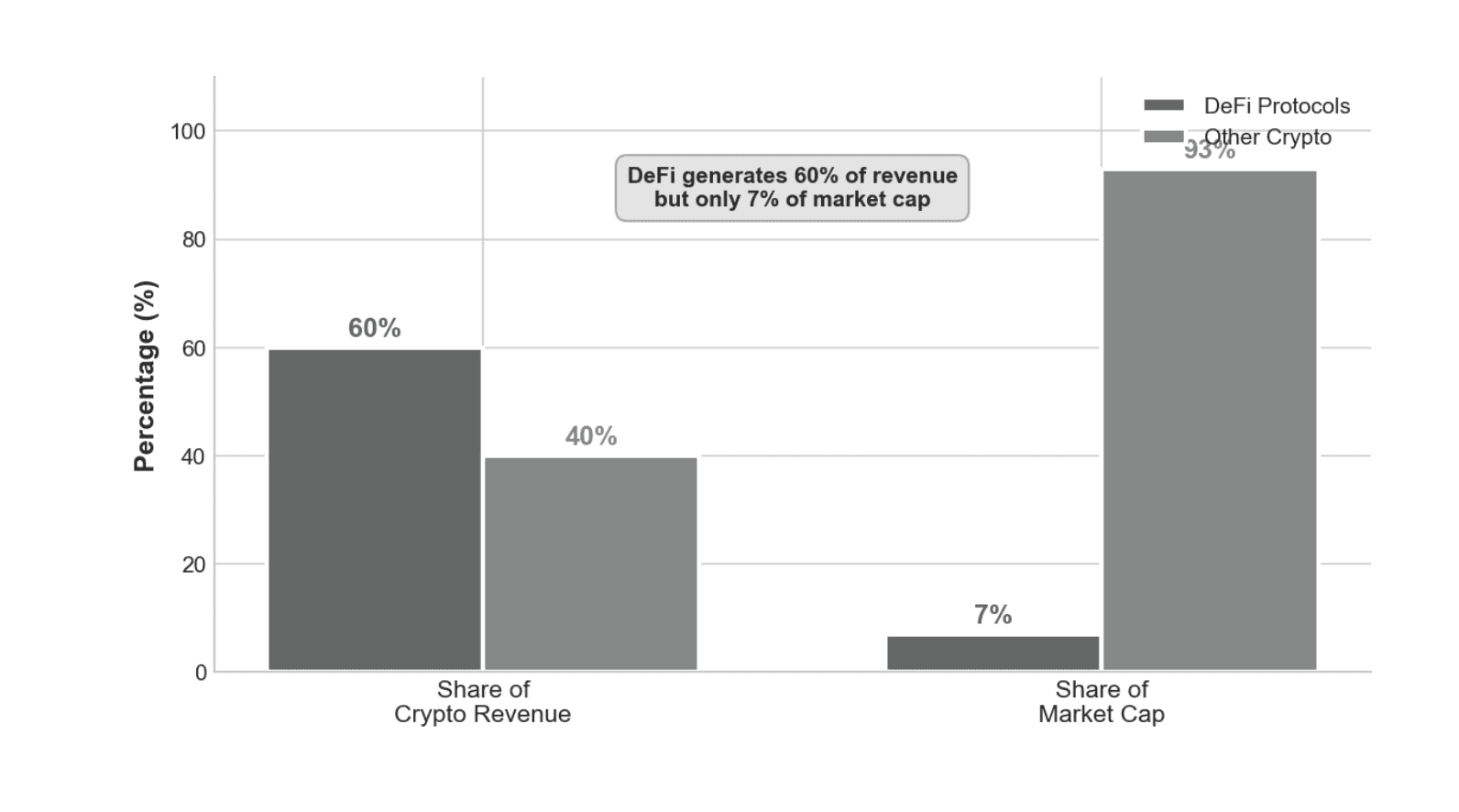

Consider the numbers: DeFi protocols generate over 60% of crypto's total revenue but represent only 7% of the sector's market capitalization. This disparity implies that revenue-generating protocols with strong crypto value accrual are either dramatically undervalued or that the market assigns substantial discounts for crypto-specific risks.

P/E comparisons sharpen this analysis. Hyperliquid trades at approximately 16.4x earnings based on its annualized revenue and buyback rate. Robinhood, a comparable centralized trading platform, trades at roughly 50x earnings. Both companies facilitate trading. Both generate revenue from similar activities. Yet the market values Robinhood's earnings at triple the multiple, despite Hyperliquid's superior token value accrual mechanisms.

Several factors may explain this gap:

Regulatory uncertainty: Token holders may face future restrictions or adverse regulatory actions.

Smart contract risk: Code vulnerabilities could result in total loss of protocol value.

Enforcement questions: Without legal frameworks, token holder rights remain uncertain.

Market maturity: Institutional investors haven't yet developed frameworks for DeFi token valuation.

However, as token value accrual mechanisms mature and track records develop, some of these discounts should compress. Quality ownership tokens with consistent buybacks, transparent revenue, and strong governance may see multiple expansion as the market recognizes their equity-like characteristics.

The Ownership Token Framework

The concept of an ""Ownership Token Index"" provides a framework for evaluating tokens based on their actual ownership characteristics rather than utility narratives. This framework helps investors assess token value accrual quality.

The core insight: ""If we want tokens to be investable and valuable assets, there is one ingredient we can't keep dodging: ownership."" For too long, the industry avoided ownership language to sidestep securities regulations. This created structural misalignment between what investors expected (ownership) and what they received (governance utility).

The ownership token framework evaluates tokens across several dimensions:

Control over protocol parameters: Can token holders meaningfully influence protocol decisions?

Revenue routing: Do mechanisms exist for protocol revenue distribution to token holders?

Anti-dilution protections: Are token holders protected from excessive inflation or treasury sales? Proper token allocation design is critical here.

Gauge systems: Do token holders control valuable resources like liquidity incentives?

Ownership tokens scoring high across these dimensions provide genuine ownership characteristics, not through legal structures but through programmatic rights enforced onchain. This represents crypto's unique value proposition: token value accrual rights that execute automatically, transparently, and without intermediaries.

What This Means for Tokenomics Design

Protocol designers face a strategic choice: optimize for regulatory caution or investor expectations. The best tokenomics find ways to satisfy both through thoughtful crypto value accrual design. For a comprehensive guide to building effective token economies, see our article on how to design tokenomics.

Best Practices for Token Value Accrual

Successful token value accrual implementations share common characteristics:

Transparency: Revenue and accrual activities should be verifiable onchain.

Predictability: Rules should be clear and resistant to arbitrary changes.

Proportionality: Benefits should accrue to all token holders fairly.

Sustainability: Accrual rates should not compromise protocol growth or security.

Protocols should also consider the tax and regulatory implications of different mechanisms. Token buyback mechanisms may receive more favorable treatment than direct distributions in some jurisdictions. Fee switch tokenomics that route to stakers create different obligations than burns that benefit all holders.

Balancing Regulatory Concerns with Investor Expectations

The industry's historical avoidance of ownership language reflected genuine regulatory risks. Securities laws in most jurisdictions create significant compliance burdens and liability exposure. Many protocols chose to emphasize utility to avoid these issues.

However, this approach may have reached its limits. Investors increasingly demand real economic value through protocol revenue distribution, not governance theater. Protocols without meaningful token value accrual struggle to attract and retain capital. The market is voting with its allocations, favoring protocols that provide tangible returns.

The path forward likely involves more explicit ownership structures combined with regulatory engagement. Some jurisdictions are developing frameworks specifically for tokenized securities. Others are clarifying how existing rules apply to token distributions. Protocols that proactively address compliance, often validated through a tokenomics audit, may gain competitive advantages as institutional capital enters the space.

The Future of Token Ownership Rights

As the ownership token thesis gains traction, expect continued innovation in token value accrual mechanisms. Potential developments include:

Hybrid structures: Combining onchain rights with legal wrappers for additional protection.

Dynamic accrual: Adjusting buyback or protocol revenue distribution rates based on market conditions.

Cross-protocol coordination: Shared standards for measuring and comparing crypto value accrual.

Institutional products: Indexes and funds focused on high token value accrual protocols.

Key Takeaways

Token value accrual creates direct economic links between protocol success and token holder returns through buybacks, burns, and protocol revenue distribution.

Ownership tokens increasingly mirror equity characteristics including governance rights, revenue sharing, and ownership protections, all enforced programmatically rather than legally.

Hyperliquid's 99% revenue-to-buyback model demonstrates how aggressive crypto value accrual can work, having repurchased over 10% of circulating supply.

DeFi generates 60%+ of crypto revenue but only 7% of market cap, suggesting significant valuation disconnects for quality tokens with strong token value accrual.

The ownership token framework evaluates tokens on control, revenue routing, anti-dilution, and gauge systems rather than utility narratives.

P/E comparisons favor DeFi: Hyperliquid at 16.4x vs Robinhood at 50x for similar trading businesses, highlighting the opportunity in fee switch tokenomics plays.

Programmatic rights through token value accrual offer unique advantages: transparent, predictable, and automatically enforced without management discretion.

Conclusion

The evolution toward token value accrual represents crypto's maturation from speculative instrument to investable asset class. Protocols that effectively capture and distribute value to token holders through buybacks, fee switch tokenomics, and protocol revenue distribution are building the foundation for sustainable tokenomics: economic models that reward holders based on actual performance rather than narrative momentum.

For investors, this shift demands new analytical frameworks. Understanding how protocols generate revenue, how that revenue flows to token holders through crypto value accrual mechanisms, and how those mechanisms compare to traditional equity becomes essential. The valuation disconnect between DeFi fundamentals and market cap suggests opportunities for those who can identify quality ownership tokens with strong accrual characteristics.

For builders, the message is clear: utility narratives no longer suffice. Token holders expect ownership, real economic rights that translate protocol success into holder returns through robust token value accrual. The protocols that deliver on this expectation will attract capital. Those that don't will struggle to compete.

The ownership token thesis isn't about making tokens legally identical to equity. It's about recognizing that value creation requires value distribution. Ownership rights implemented onchain are programmatic, predictable, and transparently verifiable. That's not just different from traditional equity; in many ways, it's better. Token value accrual is the mechanism that makes this possible.

Equity to Token Accrual FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure