Written:

Feb 11, 2026

veTokenomics explained: how vote escrow works, revenue distribution mechanics for Curve, Aerodrome, and Velodrome, plus 12-month fee data for each protocol.

veTokenomics is the governance and revenue-sharing model that solved DeFi's biggest incentive problem: mercenary liquidity. Before vote escrow, liquidity providers farmed token emissions, dumped them immediately, and moved to the next protocol. Curve Finance introduced veCRV in 2020 to fix this by requiring token holders to lock their tokens for up to four years in exchange for governance power, fee revenue, and boosted rewards. The model worked. Since then, over 20 protocols have adopted veTokenomics variants, with Aerodrome and Velodrome emerging as the leading implementations on Base and Optimism respectively. This article explains how veTokenomics works mechanically, compares the three major implementations, and presents the revenue data showing what holders actually earn.

What Is veTokenomics?

veTokenomics (vote-escrow tokenomics) is a token design model where holders lock governance tokens for a fixed period and receive non-transferable veTokens in return. The "ve" stands for vote-escrow: tokens are escrowed (locked) in exchange for voting power and protocol rewards.

The core mechanic is simple: lock longer, get more power. A holder who locks 1,000 tokens for four years receives four times the voting power of someone who locks the same amount for one year. This voting power decays linearly as the lock period expires, creating a continuous incentive to extend locks.

veTokenomics grants holders three types of benefits:

Governance power: Vote on how protocol emissions are distributed across liquidity pools

Fee revenue: Receive a share of trading fees generated by the protocol

Boosted rewards: Earn higher yields on liquidity positions (in some implementations)

The model aligns incentives by ensuring that the people making governance decisions have a long-term financial commitment to the protocol's success. Short-term speculators cannot buy tokens, vote to extract value, and sell immediately.

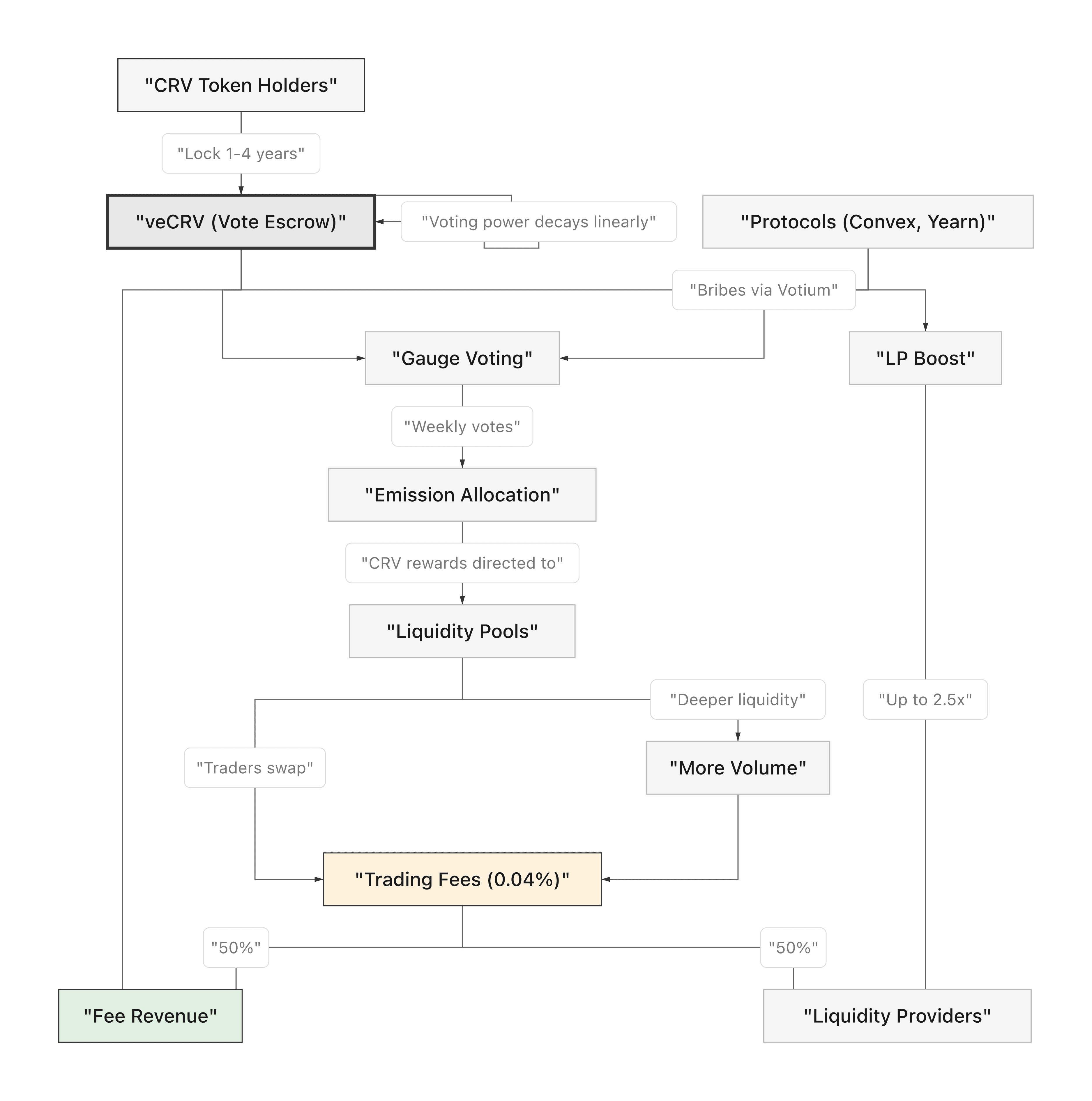

How the veTokenomics Flywheel Works

The veTokenomics model creates a self-reinforcing cycle that compounds over time. Understanding this flywheel is essential for evaluating whether a ve protocol can sustain its revenue distribution.

Step 1: Holders lock tokens. By locking tokens for extended periods (up to four years), holders remove supply from circulation. This reduces sell pressure and creates a committed governance base.

Step 2: Lockers vote on emission allocation. veToken holders vote weekly on which liquidity pools receive token emissions. Pools with more votes attract more emissions, which means higher yields for liquidity providers in those pools.

Step 3: Protocols offer bribes. DeFi projects that want liquidity for their token pairs pay veToken holders to vote for their pools. These bribes create an additional yield layer on top of base fee revenue. Platforms like Votium and Hidden Hand facilitate bribe distribution.

Step 4: Deeper liquidity attracts volume. Pools with high emissions attract more liquidity providers, which creates deeper markets. Deeper markets mean lower slippage for traders, which drives more trading volume.

Step 5: Volume generates fees. Every trade generates fees. In veTokenomics protocols, a portion (or all) of these fees flow back to veToken holders, completing the cycle.

The flywheel accelerates when new protocols launch tokens on the DEX and need liquidity. They bribe veToken holders to direct emissions to their pools, which funds yield for LPs, which creates deeper markets, which generates more volume and fees.

Curve Finance: The veTokenomics Originator

Curve Finance invented veTokenomics in 2020 with the veCRV system. Understanding Curve's implementation is the foundation for understanding every subsequent ve model.

How veCRV Works

Holders lock CRV tokens for anywhere from one week to four years. The lock period determines the initial veCRV balance:

1,000 CRV locked for 4 years = 1,000 veCRV

1,000 CRV locked for 2 years = 500 veCRV

1,000 CRV locked for 1 year = 250 veCRV

veCRV balance decays linearly as time passes. A holder with 1,000 veCRV from a four-year lock will have 500 veCRV after two years and zero when the lock expires. This decay incentivizes extending locks rather than waiting for expiration.

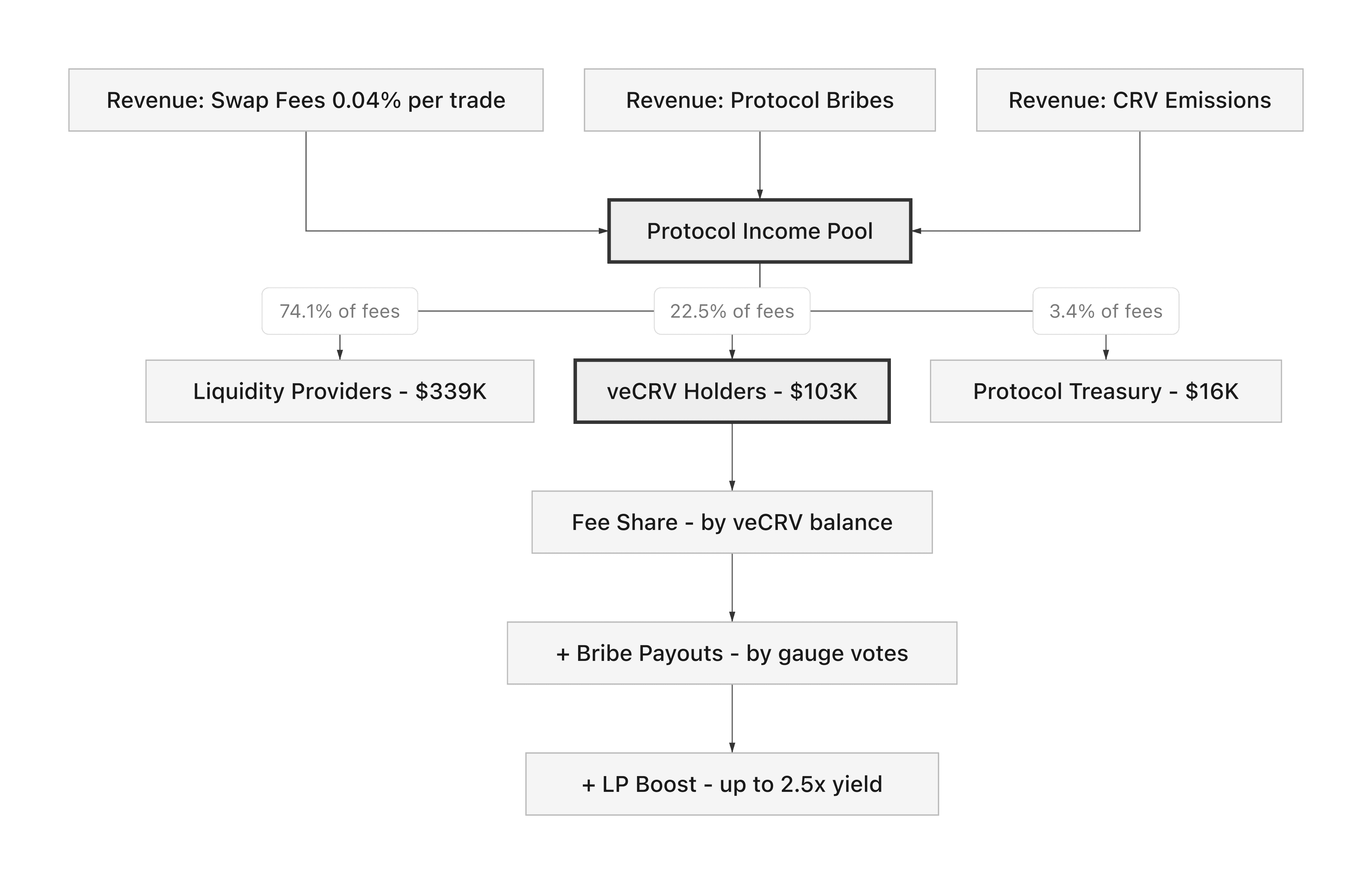

Revenue Distribution

Curve charges a 0.04% fee on every swap. This revenue splits two ways:

50% to liquidity providers in the pool where the trade occurs

50% to veCRV holders distributed proportionally based on veCRV balance

This is a passive distribution. All veCRV holders receive their share regardless of which pools they vote for.

The Gauge System and Boost

veCRV holders control CRV emission allocation through gauge voting. The GaugeController contract maintains a registry of all approved liquidity pools (gauges) and their weights. Each week, veCRV holders vote on how much of the daily CRV emissions each gauge receives.

Curve also offers a boost mechanism. veCRV holders can increase the CRV rewards they earn from providing liquidity by up to 2.5x, based on their proportion of total veCRV relative to their share of liquidity in a specific pool.

Curve Revenue Data

Over the 12 months from February 2025 through January 2026, Curve generated $458,000 in total fees and distributed $103,000 to veCRV holders (22.5% of fees). The monthly trend shows significant variability:

Month | Monthly Fees | Holder Revenue | Fee Share |

Feb 2025 | $10,511 | $5,248 | 49.9% |

Mar 2025 | $45,116 | $22,552 | 50.0% |

Jun 2025 | $28,472 | $14,234 | 50.0% |

Oct 2025 | $55,574 | $7,515 | 13.5% |

Nov 2025 | $74,537 | $7,038 | 9.4% |

Jan 2026 | $61,238 | $7,037 | 11.5% |

Source: tokenomics.com database, DefiLlama data. Selected months shown for readability.

The data reveals an important shift. Early in the period, Curve distributed close to 50% of fees to veCRV holders (matching its stated model). Later months show a declining holder share despite growing fees, likely reflecting the protocol's August 2025 update that introduced a protocol revenue split alongside the traditional holder distribution.

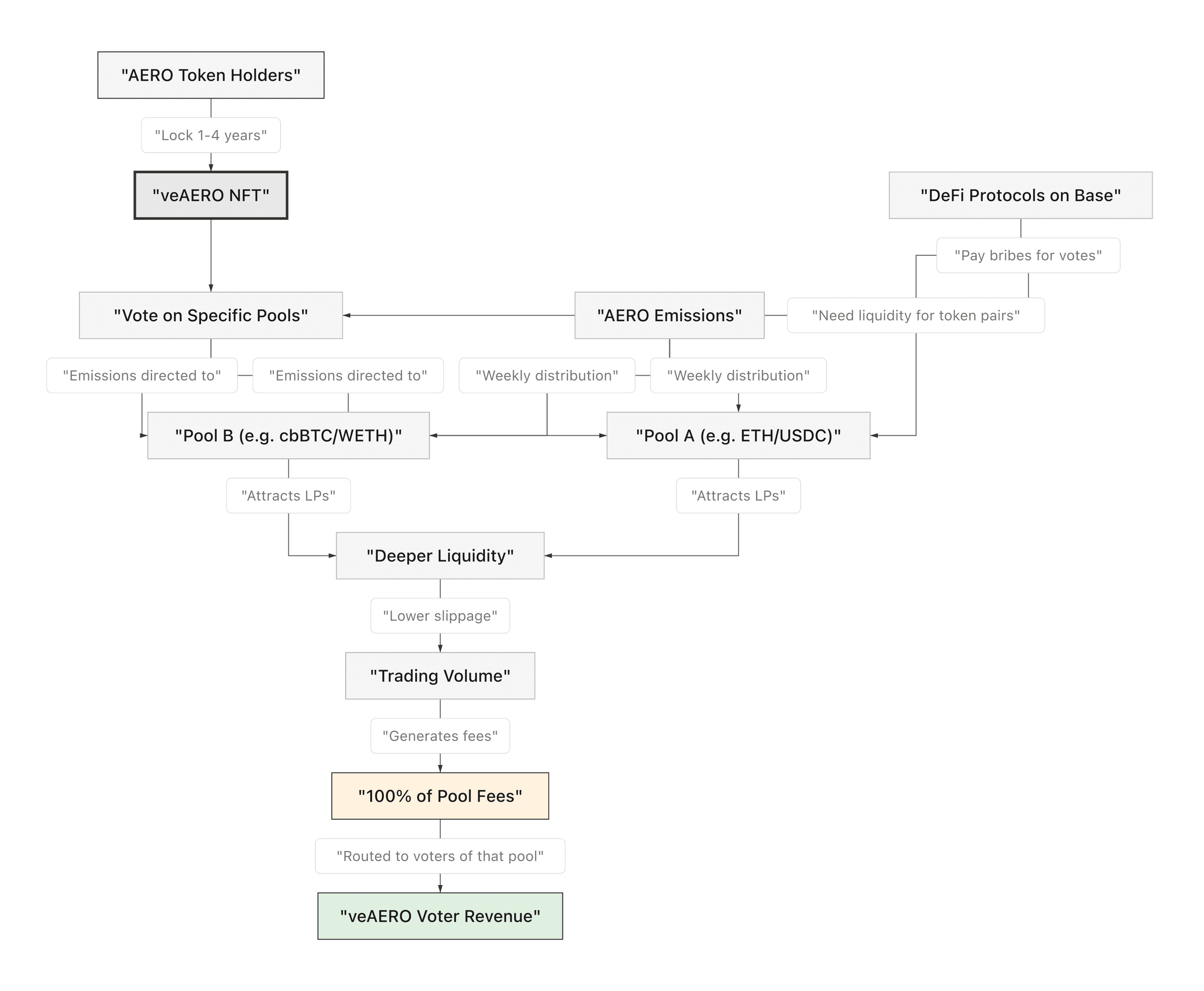

Aerodrome Finance: The Base L2 Leader

Aerodrome launched on Coinbase's Base in 2023 and quickly became the leading DEX on the network. Its veTokenomics model builds on Curve's foundation but makes one critical change: fees go to the pools you vote for, not protocol-wide.

How veAERO Works

Holders lock AERO tokens for up to four years and receive a veAERO NFT representing their position. Voting power scales linearly with both lock duration and token amount: 1,000 AERO locked for four years provides four times the voting power of a one-year lock.

The NFT-based approach means locked positions can potentially be traded on secondary markets, adding liquidity to what would otherwise be a completely illiquid commitment.

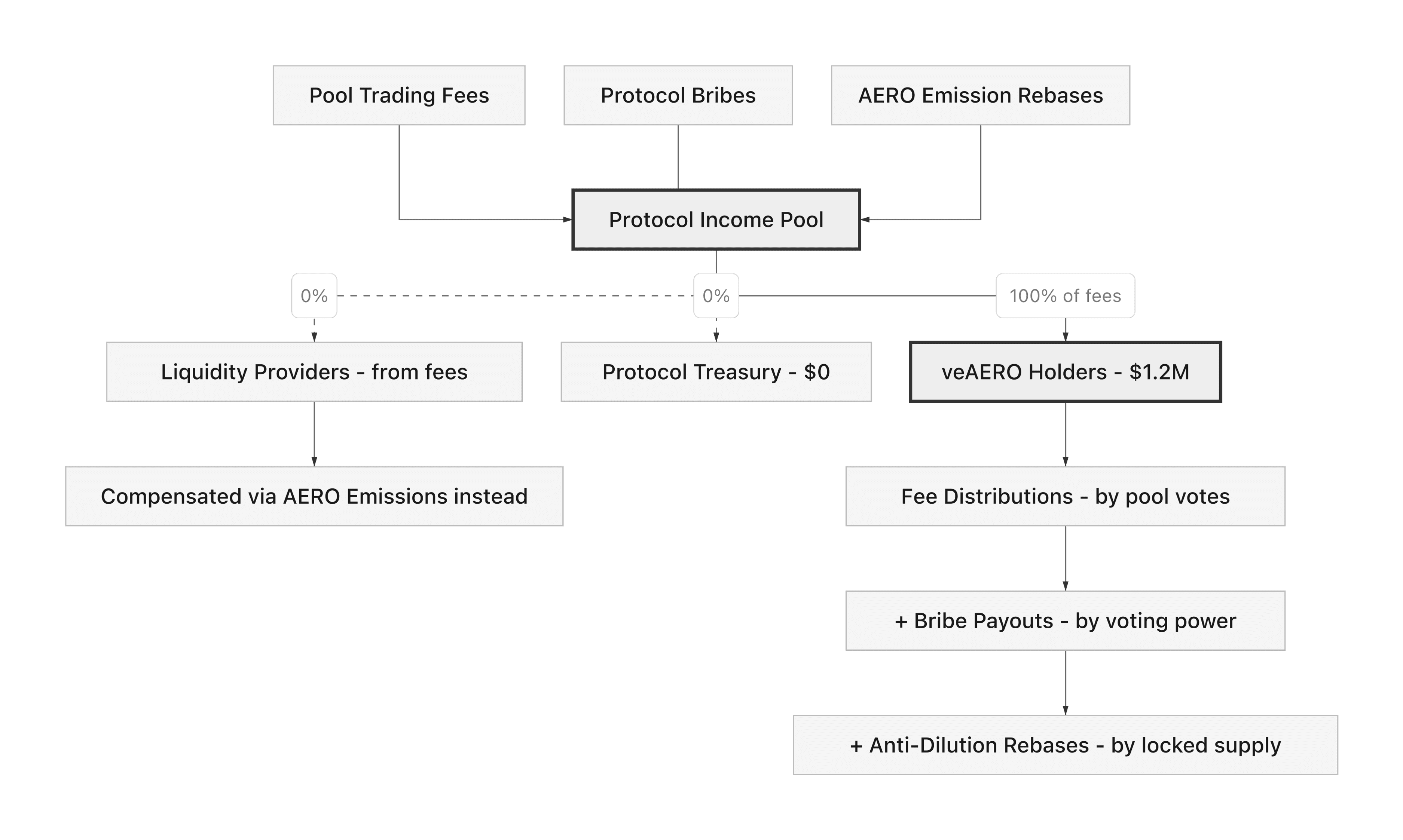

Revenue Distribution

Aerodrome distributes 100% of trading fees to veAERO holders. But unlike Curve's protocol-wide distribution, Aerodrome routes fees specifically to voters based on which pools they vote for. If you vote for the ETH/USDC pool, you receive the fees generated by the ETH/USDC pool.

This creates a direct incentive for voters to allocate emissions to high-volume pools rather than pools offering the highest bribes. The optimal strategy is to identify pools that will generate the most fees relative to the votes they receive.

Aerodrome Revenue Data

Over 12 months, Aerodrome generated $1.2 million in fees and distributed 100% to veAERO holders. Monthly trends show seasonal variation tied to Base network activity:

Month | Monthly Fees | Holder Revenue |

Feb 2025 | $131,072 | $131,072 |

May 2025 | $108,981 | $108,981 |

Aug 2025 | $142,545 | $142,545 |

Oct 2025 | $146,807 | $146,807 |

Jan 2026 | $60,887 | $60,887 |

Source: tokenomics.com database, DefiLlama data. Selected months shown.

The 100% passthrough rate is consistent across every month. Aerodrome retains zero protocol revenue, directing every dollar of fees to governance participants.

Velodrome Finance: The Optimism Pioneer

Velodrome launched on Optimism in 2022 as one of the first protocols to implement the ve(3,3) model, combining Curve's vote-escrow with game-theoretic incentives inspired by OlympusDAO. In late 2025, Dromos Labs announced the merger of Velodrome and Aerodrome into a unified DEX called Aero, reflecting the growing Superchain ecosystem connecting Base and Optimism.

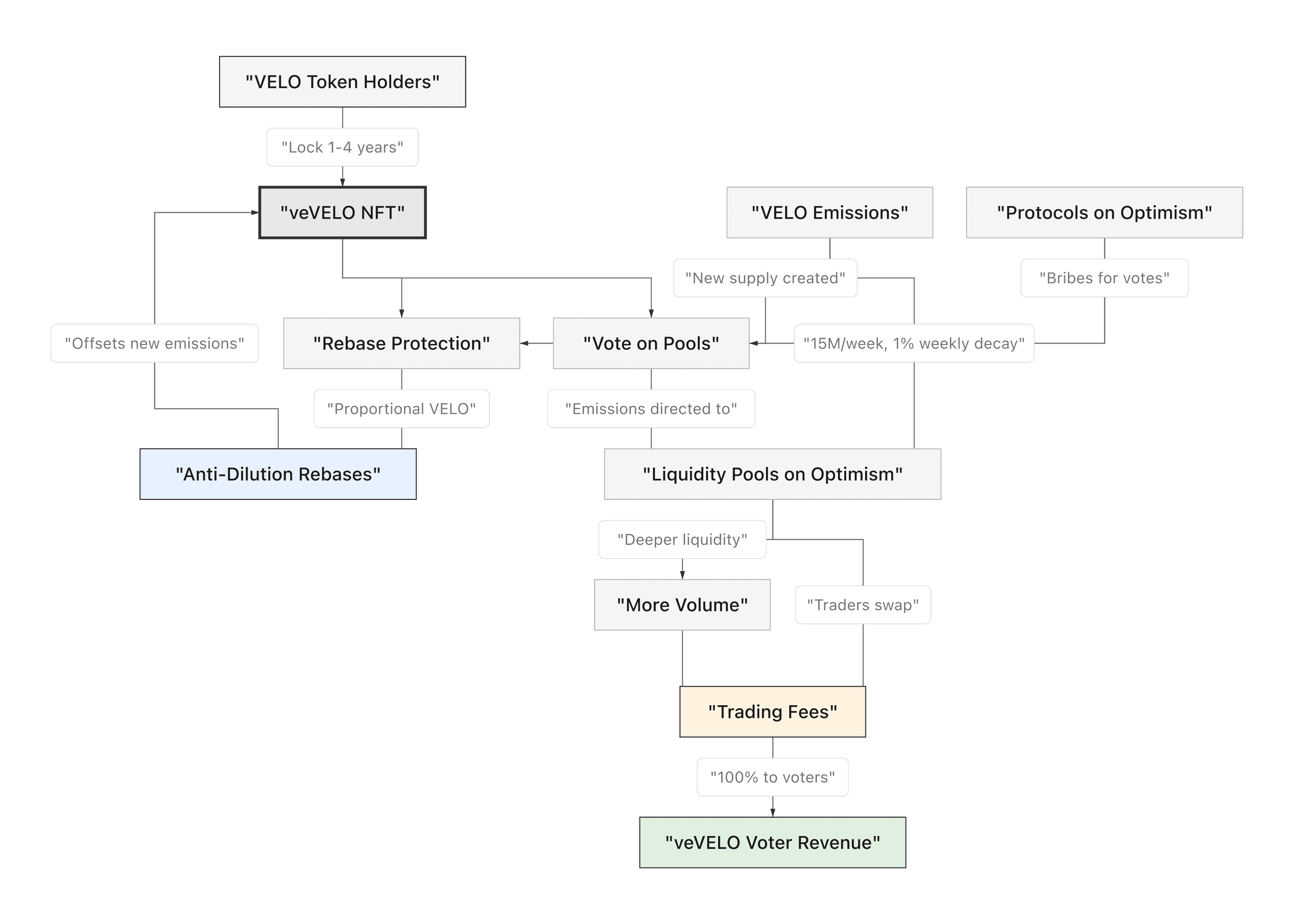

The ve(3,3) Model

Velodrome's ve(3,3) innovation adds a rebase mechanism on top of standard veTokenomics. veVELO holders receive additional VELO emissions proportional to their locked percentage of total supply, partially offsetting dilution from ongoing emissions. This addresses one of the core criticisms of traditional ve models: that new emissions dilute locked holders over time.

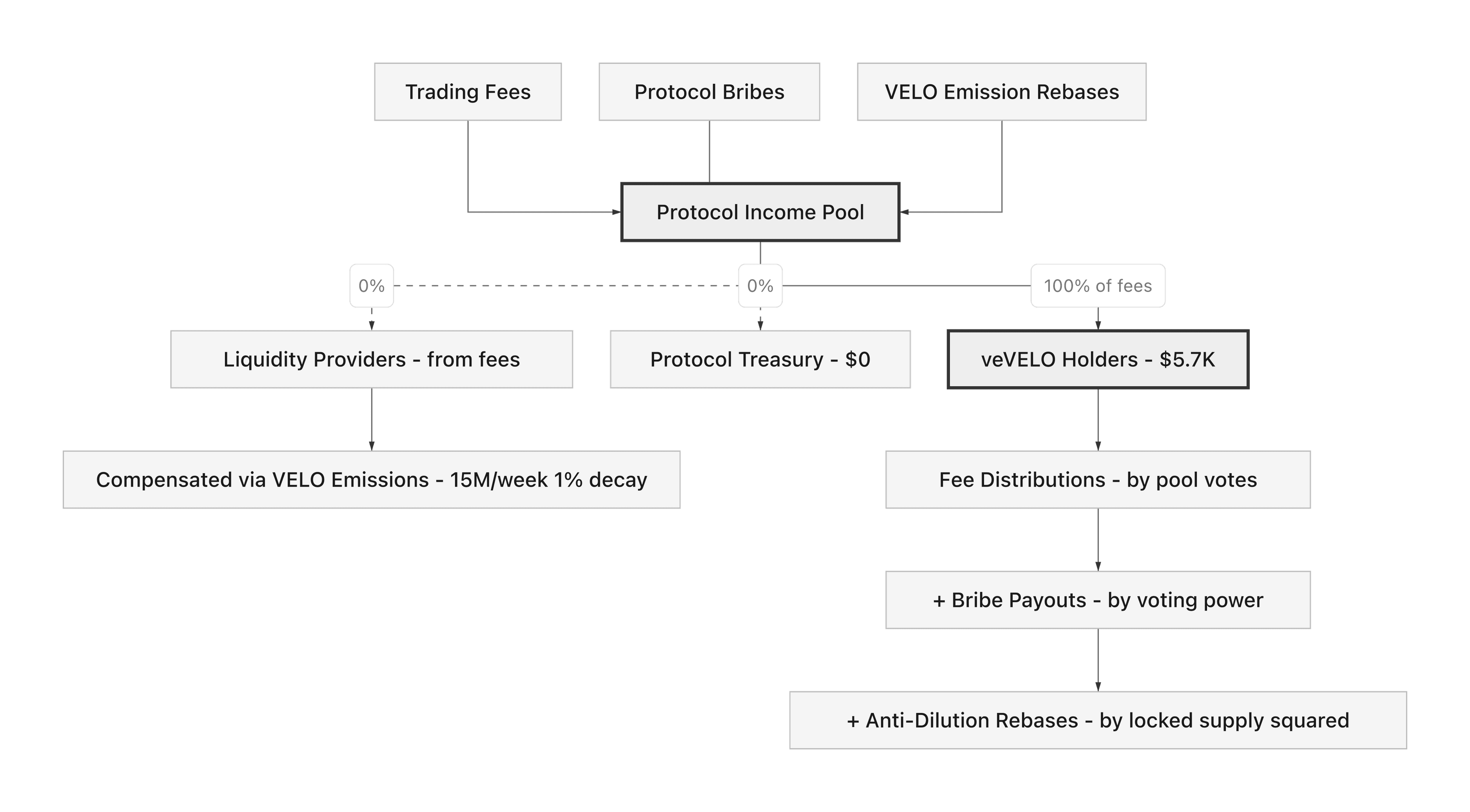

Revenue Distribution

Like Aerodrome, Velodrome distributes 100% of weekly revenue to veVELO holders through a combination of trading fees and bribes. The emission schedule started at 15 million VELO per week (3.75% of initial supply) with a 1% weekly decay rate, gradually reducing inflation.

Velodrome Revenue Data

Velodrome's on-chain fee generation is relatively small at $5,663 over 12 months, reflecting its position as the smaller sibling to Aerodrome. However, the 100% holder distribution rate matches Aerodrome's model.

Comparing the Three veTokenomics Implementations

Feature | Curve (veCRV) | Aerodrome (veAERO) | Velodrome (veVELO) |

Chain | Ethereum (multichain) | Base L2 | Optimism |

Launch | 2020 | 2023 | 2022 |

Max Lock | 4 years | 4 years | 4 years |

veToken Type | Fungible | NFT | NFT |

Fee Distribution | ~50% to holders (protocol-wide) | 100% to voters (pool-specific) | 100% to voters |

Boost Mechanism | Up to 2.5x LP rewards | None | None |

Model Type | Original ve | ve model | ve(3,3) |

12M Fees | $458K | $1.2M | Not Tracked |

12M Holder Rev | $103K | $1.2M | Not Tracked |

Holder Share | 22.5% | 100% | 100% |

Source: tokenomics.com database, February 2025 through January 2026.

The key differences come down to three design choices:

Fee routing. Curve distributes fees protocol-wide to all veCRV holders. Aerodrome and Velodrome distribute fees only to voters for specific pools. The pool-specific model creates tighter incentive alignment but requires more active management from holders.

Holder share. Aerodrome and Velodrome route 100% of fees to governance participants. Curve's current effective rate has dropped from 50% to roughly 15-20% following its protocol revenue update, with remaining fees going to protocol operations and treasury.

Boost vs simplicity. Curve's 2.5x boost mechanism rewards veCRV holders who also provide liquidity, creating a dual incentive. Aerodrome and Velodrome skip the boost in favor of a simpler model where all value flows through voting.

Risks and Limitations of veTokenomics

veTokenomics is not without drawbacks. Protocol designers and token holders should understand the trade-offs.

Liquidity lock risk. Tokens locked for four years cannot be sold regardless of market conditions. If the protocol declines or a better opportunity appears, holders are stuck. NFT-based ve positions (Aerodrome, Velodrome) partially address this through secondary market trading, but at a significant discount.

Governance concentration. Over time, large holders and protocols (like Convex for Curve) accumulate veTokens and dominate governance votes. This can create situations where emission allocation serves the interests of a few large voters rather than the broader community.

Emission dependency. The flywheel relies on token emissions to attract liquidity. If emissions decline (through scheduled decay) and fee revenue does not grow fast enough to compensate, the yield for lockers drops and the flywheel slows.

Complexity. Managing a ve position requires weekly voting, bribe optimization, and lock management. Passive holders who want exposure to a protocol's success may prefer simpler models like buyback-and-burn.

Key Takeaways

veTokenomics (vote-escrow tokenomics) requires locking governance tokens for up to four years in exchange for voting power, fee revenue, and boosted rewards. The model was invented by Curve Finance in 2020 and adopted by over 20 protocols since.

The veTokenomics flywheel works through a reinforcing cycle: lock tokens, vote on emissions, earn fees and bribes, attract liquidity, generate volume, and create more fees.

Aerodrome and Velodrome distribute 100% of fees to governance participants, while Curve distributes a declining share (currently ~15-22%) with the remainder going to protocol operations.

Aerodrome's pool-specific fee distribution (you earn fees from pools you vote for) creates tighter incentive alignment than Curve's protocol-wide distribution model.

The primary risks of veTokenomics are liquidity lock (cannot sell for years), governance concentration by large holders, emission dependency, and the complexity of active participation required to maximize returns.

Conclusion

veTokenomics transformed how DeFi protocols distribute value by tying rewards to long-term commitment. The model solved mercenary liquidity by making governance participation the gateway to fee revenue, replacing the farm-and-dump cycle with a flywheel that rewards patience. Curve proved the model works. Aerodrome refined it with pool-specific fee routing. Velodrome added ve(3,3) rebasing to protect lockers from dilution. For protocol founders evaluating whether veTokenomics fits their design, the question is whether governance participation matters enough to justify the complexity. When it does, ve creates the stickiest form of liquidity and the most aligned token holder base in DeFi.

veTokenomics FAQ

Author: Dominykas Golysenko

In 2022, founded, bootstrapped and scaled Blacktokenomics to $2M+ ARR designing the tokenomics of over 120 protocols, now two in the top 50, and +8 in the top 100 by MCAP.

In 2025, Blacktokenomics was acquired by Tokenomics.com.

I am now leading as the CTO within the combined entity, overseeing the tokenomics design vertical and contributing to the audit infrastructure, data pipelines, and analytics systems that power the audit platform.