Written:

Feb 7, 2026

Ether.fi tokenomics implements dual buybacks: 25% of revenue monthly plus 100% of withdrawal fees weekly to ETHFI stakers. Learn how the protocol generated $...

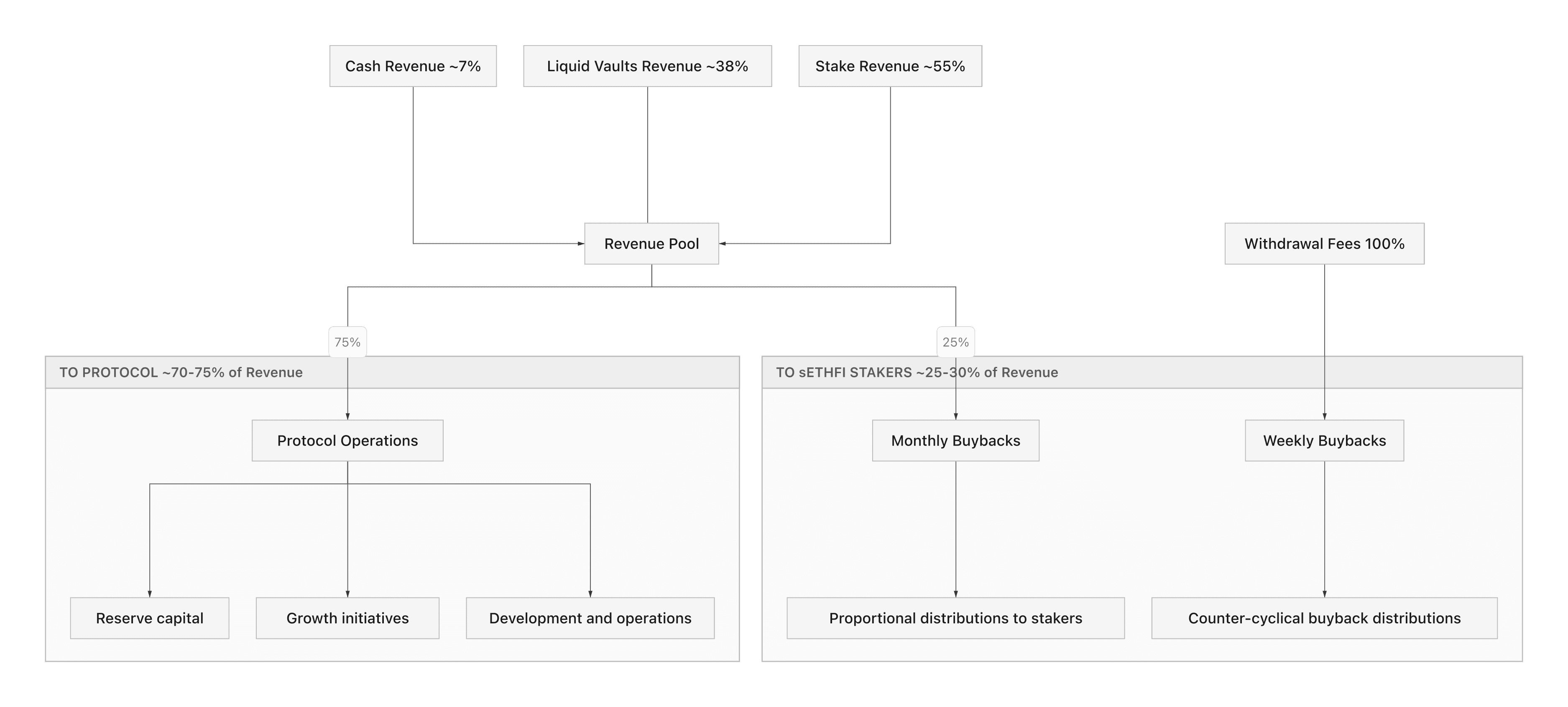

Ether.fi tokenomics channels 25% of protocol revenue into monthly ETHFI buybacks and distributes 100% of withdrawal fees through weekly buybacks, creating two distinct value accrual streams for stakers. As the dominant liquid restaking protocol with 60%+ market share and 2.15 million ETH staked, ether.fi generated $44.59 million in revenue during 2025. ETHFI operates with a fixed supply of 1 billion tokens and no additional issuance planned, meaning every buyback permanently increases each token's proportional claim on protocol revenue.

The protocol expanded beyond staking into three revenue pillars: Stake, Liquid Vaults, and Cash. The Cash product, a DeFi-native Visa credit card launched in January 2026, targets $60 million in revenue during its second year. This article examines how ether.fi tokenomics generates revenue across these three pillars and converts that revenue into direct value for ETHFI holders through its buyback-and-distribute mechanism.

What Is Ether.fi?

Ether.fi is a liquid restaking protocol that enables users to stake ETH and simultaneously restake on EigenLayer without locking their assets. Users deposit ETH and receive eETH, a liquid restaking token that automatically accrues ETH staking rewards, EigenLayer AVS rewards, and protocol loyalty points. The protocol operates a non-custodial architecture where stakers retain control of their withdrawal credentials.

The protocol launched as the first liquid restaking token offering native EigenLayer integration at the protocol level. Unlike wrapped restaking alternatives, ether.fi handles restaking natively, meaning users earn additional yield layers without manual interaction with EigenLayer contracts.

Ether.fi also offers weETH, a wrapped fixed-supply version of eETH designed for DeFi composability. While eETH rebases to include rewards automatically, weETH maintains a fixed token count with an increasing exchange rate, making it compatible with lending protocols and yield farming strategies that require non-rebasing tokens.

As of early 2026, the protocol has 2,148,329 ETH staked, representing 6.0% of all staked Ethereum and ranking third among staking providers. In the liquid restaking token category specifically, ether.fi commands over 60% market share with $3.2 billion in LRT deposits, more than the next three competitors combined.

Ether.fi Tokenomics: ETHFI Supply and Distribution

ETHFI serves as the governance and value accrual token for the ether.fi protocol. The token has a fixed total supply of 1 billion ETHFI with no inflation mechanism or additional minting capability.

Token Allocation

The initial ETHFI distribution allocated tokens across five categories designed to balance investor returns, team incentives, community participation, and protocol development.

Category | Allocation | Vesting |

Investors | 33.74% | 2-year vesting |

Core Contributors | 21.47% | 3-year vesting |

DAO Treasury | 21.6% | Protocol-controlled |

User Airdrops | 17.57% | Season-based distribution |

Partnerships | 5.6% | Strategic allocation |

Community-directed allocation (DAO Treasury plus Airdrops) totals 39.17%, exceeding the investor allocation of 33.74%. This structure prioritizes decentralized governance participation over investor concentration. The Season 1 airdrop distributed 6% of total supply to early users, rewarding protocol adoption.

Investor tokens follow a 2-year vesting schedule while core contributor tokens vest over 3 years. These extended lockup periods reduce sell pressure during the protocol's growth phase and align long-term incentives between the team, investors, and token holders.

Circulating Supply

As of early 2026, approximately 608 to 699 million ETHFI tokens circulate freely, representing 60-70% of the total supply. The remaining tokens continue vesting through investor and contributor schedules. No additional tokens will enter circulation beyond the 1 billion cap, meaning the circulating supply will plateau once all vesting completes.

The fixed supply design means that every ETHFI token purchased through buybacks and distributed to stakers comes from the open market, not from protocol reserves or new issuance. This creates genuine buy pressure rather than dilutive rewards.

How Ether.fi Generates Revenue

Ether.fi tokenomics operates on a three-pillar revenue model that diversifies income sources across staking infrastructure, DeFi yield optimization, and consumer financial products.

Pillar 1: Stake

The Stake pillar represents the core staking business. Users deposit ETH into ether.fi, which stakes it on the Ethereum beacon chain and simultaneously restakes on EigenLayer. The protocol earns commissions on staking rewards and charges fees on withdrawals.

Stake generated the majority of the $44.59 million in 2025 revenue. The protocol projected $40 million from this pillar in 2025, supported by 3.25 million ETH in total deposits. Revenue scales directly with ETH staked and Ethereum staking yields.

Withdrawal fees represent a particularly important revenue stream within ether.fi tokenomics. When users exit their staking positions, the protocol charges exit fees that vary based on withdrawal method. Instant withdrawals through the liquidity pool carry higher fees than standard delayed exits. These withdrawal fees feed directly into the weekly buyback mechanism.

Pillar 2: Liquid Vaults

Liquid Vaults deploy user capital across blue-chip DeFi protocols including AAVE, Curve, Gearbox, and Pendle. The vaults offer ETH, BTC, and stablecoin strategies with automated yield optimization and rebalancing.

This pillar projected $28 million in 2025 revenue, earning 2.5 to 3 times more per dollar deposited than base staking. Management fees range from 1.25% to 2% on vault deposits, providing recurring revenue proportional to assets under management.

Cross-chain deposits through Enso integration allow users to deposit from any supported chain without manual bridging. The vaults handle rebalancing automatically through account-abstracted, non-custodial smart contracts. This chain-agnostic approach removes friction that typically limits DeFi participation.

Pillar 3: Cash

The Cash product launched in January 2026 as a DeFi-native Visa credit card. Users borrow against their yield-bearing crypto collateral each time they swipe, earning up to 4% cashback on purchases at over 150 million Visa merchants globally. The card works with Apple Pay and Google Pay for contactless payments.

Cash generated $4 million in revenue during its first 8 months of operation in H2 2025, with monthly payment volumes reaching approximately $50 million by early 2026. The protocol targets $60 million or more in Cash revenue during 2026, making it the fastest-growing pillar.

Revenue comes from credit fees, foreign exchange spreads, and on-chain activity generated by the borrow-on-swipe mechanism. Each card transaction creates a micro-loan against the user's collateral position, generating interest revenue for the protocol.

Revenue Performance

The protocol generated $44.59 million in total revenue during 2025:

Quarter | Revenue |

Q1 2025 | $12.88M |

Q2 2025 | $7.52M |

Q3 2025 | $16.17M |

Q4 2025 | $8.02M |

Full Year 2025 | $44.59M |

Protocol forecasts project a $65-96 million annual run-rate with 30% profit margins. The team has stated a long-term target of $1 billion in annual revenue within 3-4 years, driven by scaling all three pillars simultaneously.

Dual Buyback Engine: How ETHFI Captures Value

The core value accrual mechanism within ether.fi tokenomics is a dual-frequency buyback system that purchases ETHFI from the open market and distributes it to sETHFI stakers.

Weekly Withdrawal Fee Buybacks

The first buyback mechanism allocates 100% of eETH withdrawal fees to ETHFI purchases. When users unstake their ETH through instant or delayed exits, the fees generated flow directly into a weekly buyback program.

This mechanism creates counter-cyclical buy pressure. During periods of market stress when more users withdraw their staked ETH, withdrawal fee revenue increases, generating larger weekly buybacks. The weekly cadence ensures consistent demand for ETHFI tokens regardless of broader market conditions.

Monthly Revenue Buybacks

The second mechanism allocates 25% of total protocol revenue across all three pillars to monthly ETHFI buybacks. Based on the 2025 run-rate forecast of $65-96 million, this translates to $16-24 million in annual buyback capacity from revenue alone.

As revenue scales with the Cash product expansion and continued staking growth, monthly buyback capacity increases proportionally. If ether.fi achieves its $1 billion revenue target, the 25% allocation would produce $250 million in annual buybacks.

Distribution to sETHFI Stakers

All purchased ETHFI tokens from both buyback mechanisms flow to sETHFI holders. Users who stake their ETHFI into the sETHFI contract receive proportional distributions from each buyback round. This creates a direct value loop: protocol revenue generates buybacks, buybacks create token demand, and stakers receive the purchased tokens as yield.

The distribution model resembles a traditional corporate dividend but operates through decentralized token mechanics. Unlike burn mechanisms that benefit all holders passively, the distribute model rewards active governance participants who stake their tokens.

Defensive Buyback Program

The ether.fi DAO proposed a $50 million buyback program that activates when ETHFI trades below $3. This defensive mechanism provides a price floor signal and demonstrates protocol commitment to token value during market downturns.

The foundation committed to expanding buyback capacity proportional to revenue growth. As the three-pillar revenue model scales, both regular and defensive buyback programs receive more capital, strengthening the value accrual flywheel within ether.fi tokenomics.

Ether.fi Products and Ecosystem

eETH: Liquid Restaking Token

eETH is the primary liquid restaking token that represents staked and restaked ETH. The token automatically rebases to include accumulated rewards from three sources: base Ethereum staking yield (approximately 3-4% APR), EigenLayer AVS rewards from restaking, and ether.fi loyalty points.

Instant withdrawals set eETH apart from traditional staking tokens that require 14-day unbonding periods. The protocol maintains a liquidity pool that allows immediate exits when sufficient liquidity exists, removing one of the primary friction points in ETH staking.

weETH: DeFi-Composable Wrapper

weETH wraps eETH into a fixed-supply token with an increasing exchange rate against ETH. DeFi protocols that cannot handle rebasing tokens integrate weETH for lending collateral, yield farming, and liquidity provision. This wrapper extends the utility of staked ETH across the DeFi ecosystem.

Liquid Vaults

Liquid Vaults automate yield strategies across ETH, BTC, and stablecoin denominations. The vaults deploy capital to AAVE, Curve, Gearbox, and Pendle with automated rebalancing. A dedicated USD vault supports USDC, USDT, DAI, and USDe deposits, providing stable yield options for users who prefer dollar-denominated returns.

Cash Card

The ether.fi Cash Visa card bridges DeFi and traditional spending. Available for individuals, families, and businesses, the card supports borrow-on-swipe functionality where each purchase generates a micro-loan against crypto collateral. Users never sell their underlying assets, maintaining investment exposure while accessing liquidity for everyday purchases.

Ether.fi vs Competitor Comparison

Ether.fi tokenomics competes within both the broader ETH staking market and the specialized liquid restaking segment.

Liquid Restaking Market

Protocol | LRT TVL | Market Share | Key Feature |

Ether.fi | $3.2B+ | 60%+ | Native EigenLayer, Cash card |

Renzo | $2.0B | ~25% | Multi-asset restaking |

Puffer | $1.3B | ~16% | Anti-slashing technology |

Kelp DAO | $740M | ~9% | Multi-chain approach |

EigenPie | $328M | ~4% | EigenLayer-focused |

Ether.fi holds more liquid restaking TVL than the next three competitors combined. First-mover advantage in native EigenLayer integration created network effects that newer protocols struggle to match. The multi-product approach (Stake, Liquid, Cash) builds a wider moat than single-product competitors.

Overall Staking Comparison

Metric | Ether.fi | Lido | Rocket Pool |

ETH Staked | 2.15M | 9.3M+ | <2M |

Staking Market Share | 6.0% (#3) | ~30% (#1) | <6% |

Token Supply | 1B (fixed) | 1B (fixed) | 18M (inflationary) |

Value Accrual | Buyback-distribute | Revenue sharing (planned) | Commission split |

Revenue (2025) | $44.59M | ~$80M est. | ~$15M est. |

Restaking | Native EigenLayer | Not integrated | Not integrated |

Capital continues rotating from traditional liquid staking toward liquid restaking protocols. The liquid restaking category grew from 6.3% to 7.6% of total staking market share in early 2025, adding over 550,000 ETH. This trend benefits ether.fi as the dominant category leader.

Unlike Lido, which provides only base ETH staking yields, ether.fi offers additional yield layers from EigenLayer AVS rewards. This yield premium attracts users seeking maximum returns on their staked ETH without managing multiple protocol interactions.

Key Takeaways

Ether.fi tokenomics implements a dual buyback system: 100% of withdrawal fees fund weekly ETHFI purchases, while 25% of revenue funds monthly buybacks worth $16-24 million annually.

ETHFI has a fixed supply of 1 billion tokens with no inflation, and all buyback tokens distribute to sETHFI stakers rather than being burned.

The protocol generated $44.59 million in 2025 revenue across three pillars: Stake ($40M target), Liquid Vaults ($28M target), and Cash ($4M in first 8 months).

Ether.fi dominates liquid restaking with 60%+ market share and $3.2 billion in LRT deposits, more than the next three competitors combined.

The Cash Visa card launched in January 2026 targets $60 million in year-two revenue through its borrow-on-swipe model at 150 million merchants.

With 2,148,329 ETH staked (6.0% market share), ether.fi ranks third overall and first in liquid restaking.

A $50 million defensive buyback activates when ETHFI trades below $3, providing protocol-backed price floor support.

Ether.fi tokenomics demonstrates how a liquid restaking protocol builds sustainable value accrual through diversified revenue and systematic buybacks. The three-pillar model spreads revenue risk across staking infrastructure, DeFi yield optimization, and consumer financial products. As each pillar scales, the 25% revenue allocation to buybacks grows proportionally, strengthening the distribution flywheel for sETHFI stakers. The fixed supply ensures that buyback pressure translates directly into increased per-token value rather than being offset by emissions.

Ether.fi Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.