Written:

Feb 7, 2026

Sky tokenomics deploys $1M daily through the Smart Burn Engine to buy and destroy SKY tokens. Learn how the protocol generates $435M in revenue and projects ...

Sky tokenomics introduced a systematic buyback-and-burn mechanism that deploys $1 million daily to purchase and permanently destroy SKY tokens. Formerly known as MakerDAO, the protocol rebranded to Sky in August 2024 and migrated its governance token from MKR to SKY at a 1:24,000 conversion ratio. With $435 million in annualized revenue and $611.5 million projected for 2026, sky tokenomics channels protocol surplus into the Smart Burn Engine while distributing 600 million SKY annually to USDS stablecoin holders.

The protocol operates the largest decentralized stablecoin ecosystem with $26 billion in combined DAI and USDS supply. This article examines how sky tokenomics generates revenue from real-world assets, stability fees, and liquidations, then converts that revenue into direct value for SKY holders through automated burns.

What Is Sky?

Sky is a decentralized lending and stablecoin protocol that allows users to deposit crypto collateral into vaults and borrow USDS, a dollar-pegged stablecoin. The protocol launched in 2017 as MakerDAO and operated as the original DeFi lending platform, pioneering overcollateralized crypto-backed stablecoins with DAI.

The protocol rebranded to Sky on August 27, 2024, introducing two new tokens: SKY (replacing MKR as the governance token) and USDS (a new stablecoin alongside DAI). Both legacy tokens remain functional. Users can convert MKR to SKY at a base ratio of 1:24,000 and swap DAI for USDS at a 1:1 rate. As of late 2025, approximately 81% of MKR holders had completed the migration.

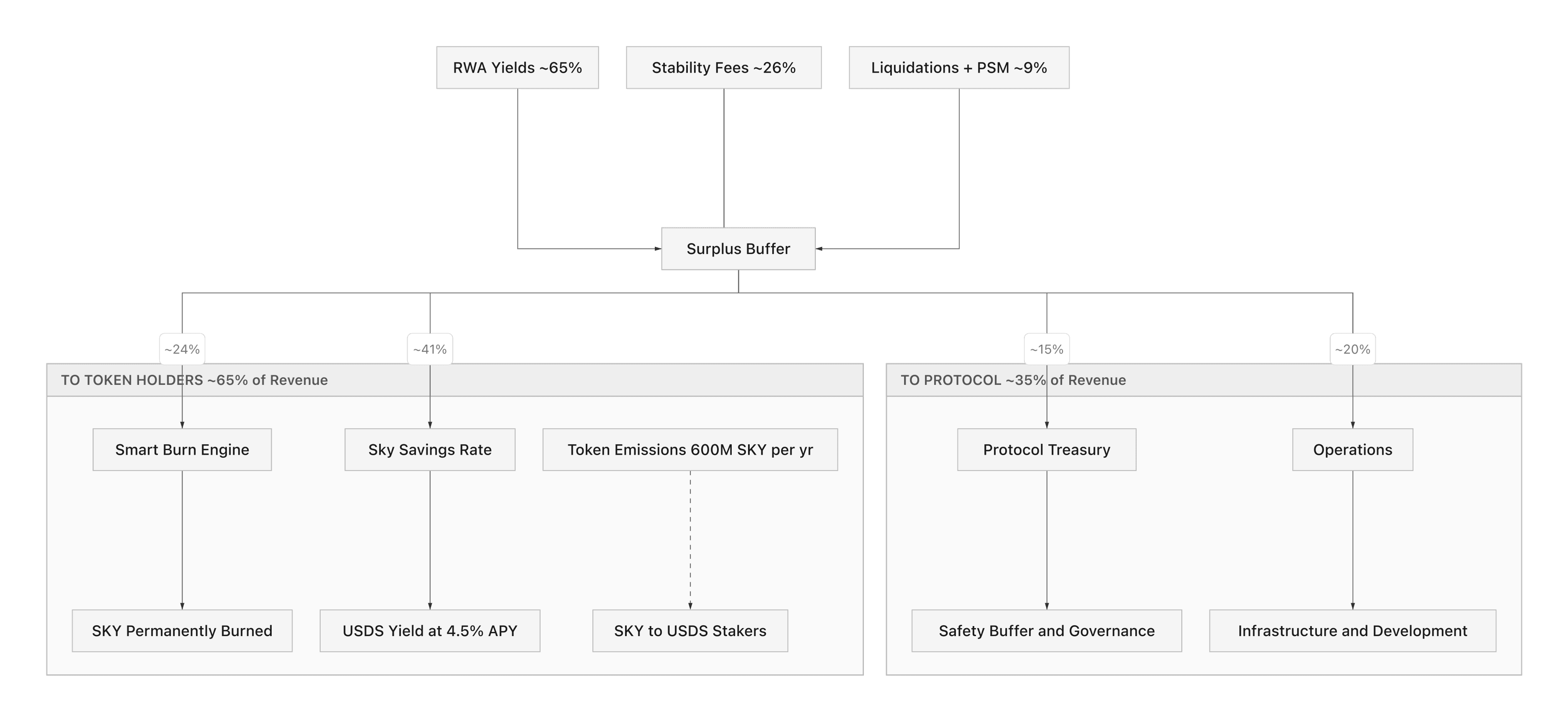

Sky generates revenue by charging stability fees on vault loans, earning yields on real-world asset investments, and collecting liquidation penalties when vaults become undercollateralized. The protocol then distributes this revenue through the Smart Burn Engine and staking rewards, creating multiple value accrual pathways for token holders.

The protocol supports multiple collateral types including ETH, WBTC, and stablecoins through the Peg Stability Module. Sky also invested heavily in real-world assets such as Treasury bills and structured credit, diversifying revenue sources beyond DeFi-native yields.

Sky Tokenomics: Distribution

The SKY token serves as the governance and value accrual mechanism for the protocol. Token holders vote on stability fee rates, collateral parameters, savings rate adjustments, and treasury management through decentralized onchain governance.

MKR to SKY Migration

The migration from MKR to SKY established a conversion ratio of 1 MKR to 24,000 SKY. The current circulating supply stands at approximately 23 billion SKY tokens. Unlike MKR, which had a maximum supply of roughly 977,000 tokens, SKY operates with a larger nominal supply designed to improve accessibility and governance participation.

The protocol introduced a penalty structure to encourage timely migration. A 1% penalty took effect on September 18, 2025, reducing the effective conversion to 1:23,760. This penalty increases by 1% every three months. By December 2025, the penalty reached 2%, making the effective ratio 1:23,520. Coinbase executed automatic MKR-to-SKY conversions for its users in January 2026 at this 2% penalty rate.

Approximately 19% of MKR tokens remain unconverted, representing roughly $316 million in value. Some of these tokens likely reside in lost wallets or belong to institutional holders timing their migration for tax optimization purposes.

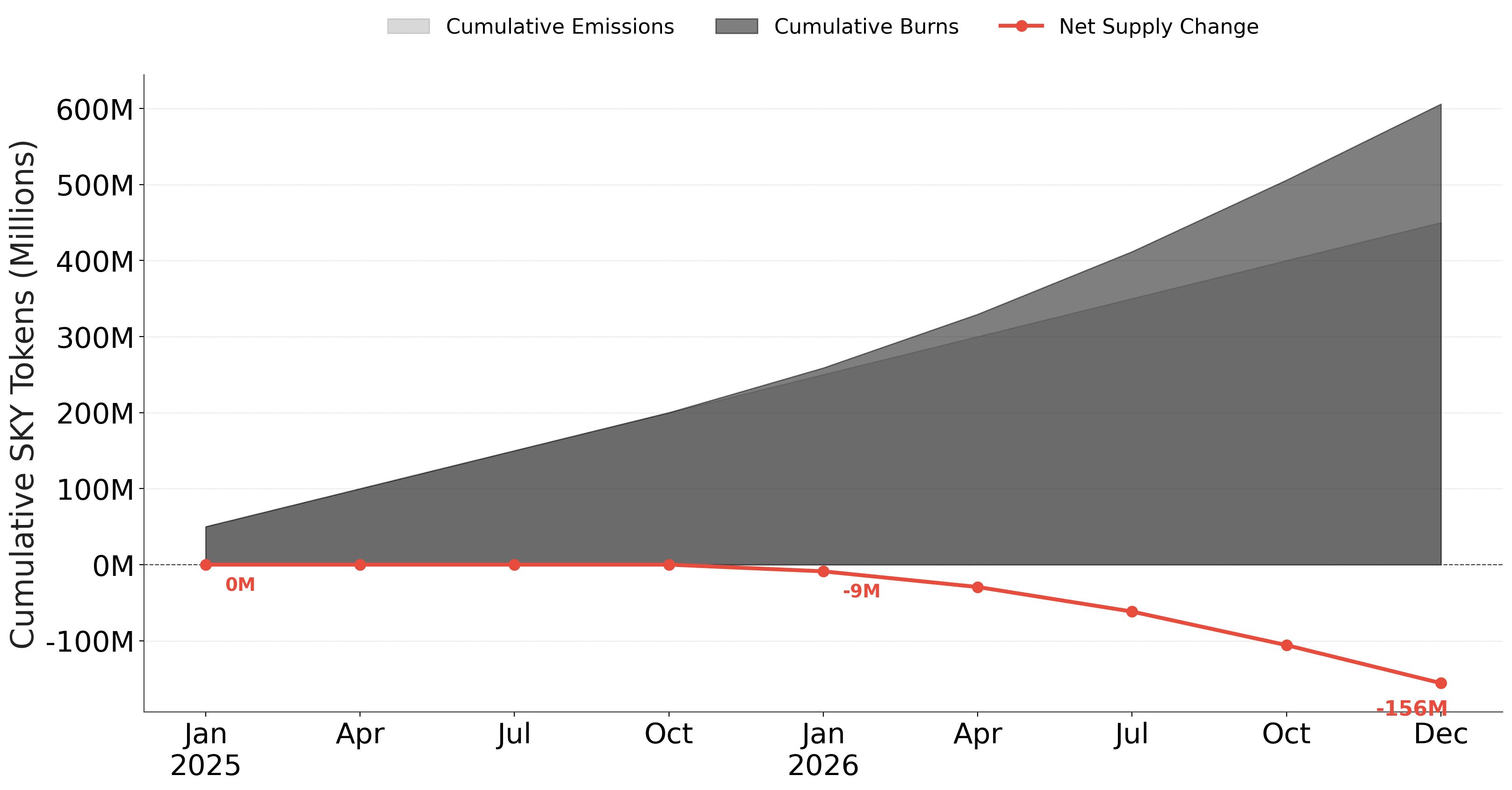

Supply Dynamics: Emissions vs Burns

Sky tokenomics creates a dynamic supply model where annual emissions compete against systematic burns. The protocol distributes 600 million SKY per year as rewards to USDS holders who participate in the Sky Token Rewards program. This emission creates inflationary pressure on the token supply.

The Smart Burn Engine counteracts this inflation by purchasing and destroying SKY from the open market. In 2025, the engine deployed $102.2 million toward buybacks. At a SKY price of approximately $0.17, this removes roughly 600 million tokens annually, approximately offsetting the emission rate.

The net supply effect depends on SKY price. When SKY trades below $0.17, the burn engine removes more tokens than emissions create, producing net deflation. When SKY trades above $0.17, emissions exceed burns, creating net inflation. This dynamic creates a self-balancing mechanism where lower prices accelerate supply reduction.

How Sky Generates Revenue

Sky earns protocol revenue through four primary channels: real-world asset yields, stability fees on vault loans, liquidation penalties, and Peg Stability Module fees. The protocol generated $435 million in annualized revenue during 2025 with a 38.6% profit margin, producing $168 million in annualized protocol profits.

Real-World Asset Yields

Real-world asset investments represent the largest and most stable revenue source for Sky. The protocol allocates portions of its reserves to Treasury bills, structured credit products, and tokenized real-world assets. These investments generate predictable yields that correlate with macro interest rates rather than crypto market conditions.

The Sky Frontier Foundation projects $611.5 million in gross ecosystem revenue for 2026, an 81% increase over 2025. Much of this growth stems from expanded RWA strategies. The protocol plans to launch up to 10 new Sky Agents in 2026, with the first focused on structured credit in Q1. The Keel Initiative includes a $500 million Tokenization Regatta campaign designed to attract additional RWA capital.

RWA yields provide revenue stability that purely DeFi-native protocols cannot match. While funding rates and trading fees fluctuate with market sentiment, Treasury bill yields remain relatively predictable across market cycles. This diversification distinguishes sky tokenomics from competitors that depend entirely on crypto-native revenue.

Stability Fees and Liquidations

Stability fees represent interest rates charged on USDS and DAI loans issued through Sky vaults. Users deposit collateral assets such as ETH or WBTC, borrow stablecoins against that collateral, and pay ongoing stability fees. Governance adjusts these rates based on market conditions and protocol objectives.

In Q4 2025, the protocol maintained $3.36 billion in USDS loan balances and collected $28.6 million in stability fees. These fees scale directly with stablecoin demand. As more users borrow USDS, stability fee revenue increases proportionally.

Liquidation penalties generate additional revenue when vault collateral ratios fall below required thresholds. During market downturns, collateral auctions produce liquidation fees that flow to the protocol surplus. This revenue source is counter-cyclical, generating more income during periods of high volatility when other revenue sources may compress.

The Peg Stability Module charges small fees on direct USDC-to-DAI and USDC-to-USDS conversions, helping maintain the stablecoin peg while generating transaction revenue. PSM fees represent a smaller but consistent revenue stream.

How SKY Captures Value

The core of sky tokenomics is the Smart Burn Engine, a systematic mechanism that converts protocol surplus into permanent SKY supply reduction. Launched in February 2025, the engine represents one of the largest sustained buyback programs in decentralized finance.

How the Smart Burn Engine Works

The Smart Burn Engine operates through an automated process that executes daily. Protocol revenue accumulates as surplus from stability fees, RWA yields, liquidation income, and PSM fees. Once this surplus exceeds operational requirements, the engine deploys capital to purchase SKY tokens from the open market.

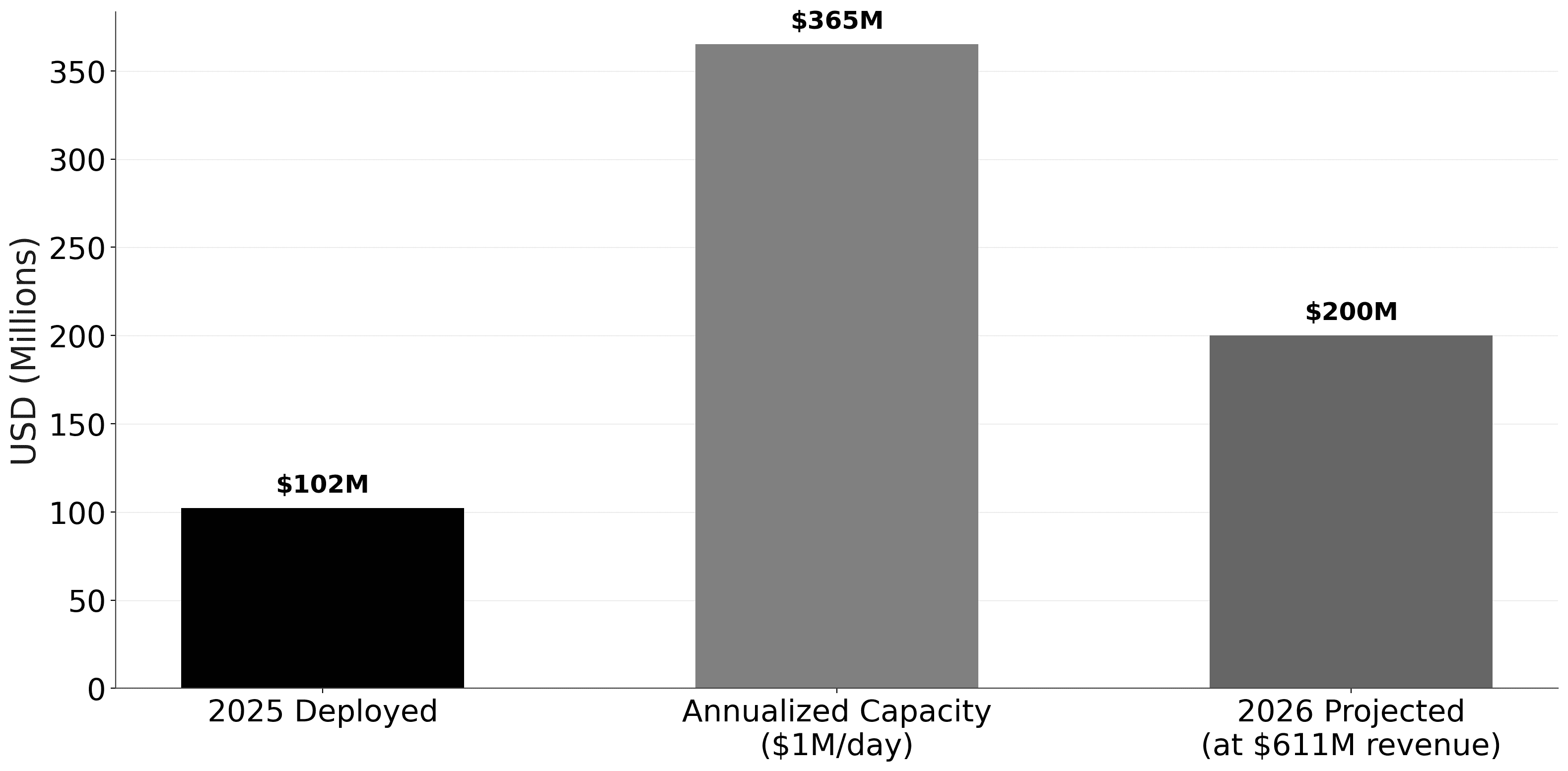

The engine currently operates at a rate of $1 million USDS per day, translating to $365 million in annualized purchasing capacity. In 2025, the engine deployed $102.2 million, meaning actual execution varies based on surplus availability and market conditions. Purchased SKY tokens are permanently removed from circulation through burning, not redistributed or recycled.

This mechanism benefits all SKY holders equally without requiring staking or active participation. As the total supply decreases, each remaining token represents a larger proportional share of the protocol. Unlike staking rewards that require lockups and active management, the burn mechanism creates passive value accrual for every token holder.

$611M Revenue Fueling Burns in 2026

The Sky Frontier Foundation projects $611.5 million in gross revenue and $157.8 million in protocol profits for 2026. This 81% revenue increase and projected 198% profit growth provide significantly more surplus to fuel the Smart Burn Engine.

Revenue growth comes from multiple drivers. USDS supply is projected to nearly double to $20.6 billion in 2026, increasing stability fee income proportionally. New Sky Agent launches expand RWA diversification beyond Treasury bills into structured credit and other yield-generating instruments. Institutional adoption of USDS as a savings vehicle continues to accelerate.

Higher protocol revenue directly increases Smart Burn Engine capacity. If the engine scales from $102 million to $200 million or more in annual buybacks, the deflationary impact on SKY supply intensifies. At current prices, doubling the burn rate would remove over 1.2 billion tokens annually, significantly exceeding the 600 million token emission rate and creating net deflation.

USDS Staking: Sky Savings Rate and Token Rewards

Sky offers USDS holders two distinct staking options: the Sky Savings Rate for stable yield and Sky Token Rewards for SKY token exposure. Both programs drive demand for USDS and support sky tokenomics through different mechanisms.

Sky Savings Rate

The Sky Savings Rate provides USDS holders with a variable annual percentage yield, currently set at 4.5% APY as of February 2026. Governance votes determine this rate, balancing the need to attract deposits with protocol profitability. A higher savings rate draws more USDS into the savings platform but reduces protocol margin.

The Sky Savings platform reached $4 billion in total value locked by December 2025, representing a 60% increase in 30 days. This growth demonstrates strong demand for decentralized yield on stablecoins. The protocol funds the savings rate from the spread between revenue earned on assets and the rate paid to depositors.

USDS holders who choose the savings rate receive predictable, stable returns denominated in USDS. This option suits holders who want consistent income without exposure to SKY price volatility.

Sky Token Rewards

Sky Token Rewards provide an alternative staking path that distributes 600 million SKY per year to participating USDS holders. Rather than earning stablecoin yield, participants receive SKY governance tokens proportional to their share of the total rewards pool.

The choice between savings rate and token rewards creates an interesting dynamic within sky tokenomics. Risk-averse holders select the stable 4.5% APY. Holders who are bullish on SKY price appreciation choose token rewards for governance exposure. The split between these two pools reflects market sentiment toward the SKY token.

Governance recently proposed shifting staking rewards from USDS-denominated to SKY-denominated distributions. This change would increase SKY utility and align incentives more directly with protocol governance participation. The proposal includes allocating 500 million SKY to the treasury for buyback adjustments during the transition period.

Sky vs Competitor Revenue Comparison

Sky tokenomics operates within a competitive stablecoin landscape where protocols differentiate through revenue models and value accrual mechanisms. The following table compares key metrics across major stablecoin protocols.

Metric | Sky | Ethena | Aave (GHO) | Frax |

Stablecoin Supply | $26B (DAI+USDS) | $7.6B (USDe) | $500M (GHO) | $600M (FRAX) |

Annual Revenue | $435M (2025) | $656M (peak) | $100-120M | Data limited |

Revenue Model | RWA + stability fees | Funding rates + basis | Lending fees + GHO | AMOs + RWA |

Value Accrual | Buyback-burn ($102M/yr) | Fee switch + $890M buyback | Revenue sharing (planned) | 50/50 veFXS/buybacks |

Revenue Stability | High (RWA-backed) | Low (market-dependent) | Medium (usage-driven) | Medium (hybrid) |

Profit Margin | 38.6% | Variable | Data varies | Data limited |

Ethena generated higher absolute revenue during bull market conditions in 2025, reaching $656 million annualized at peak. However, Ethena's revenue depends on perpetual futures funding rates, which compressed significantly during market downturns. The protocol's TVL declined 49% from $14.8 billion to $7.6 billion in late 2025, demonstrating this volatility risk.

Sky's RWA-backed revenue model provides greater stability across market cycles. While Ethena earns more during periods of high crypto use, Sky generates consistent income from Treasury bill yields regardless of market direction. This predictability supports more reliable Smart Burn Engine operations and sustainable staking rewards.

Aave introduced GHO as a competing stablecoin with remarkable capital efficiency. Each dollar of GHO minted generates 10 times the revenue of a typical borrowed dollar. GHO supply grew 245% in 2025, though it remains far smaller than Sky's ecosystem at $500 million versus $26 billion. Aave plans to share protocol revenue with AAVE stakers once its fee switch activates.

Frax operates a hybrid model combining algorithmic mechanisms with RWA yields. The protocol proposes splitting revenue 50% to veFXS holders and 50% to FXS buybacks. Frax targets $100 billion in TVL on its Layer 2 network, though current scale remains modest at $600 million in FRAX supply.

Key Takeaways

Sky tokenomics deploys $1 million daily through the Smart Burn Engine to purchase and permanently destroy SKY tokens, with $102.2 million deployed in 2025.

The protocol generated $435 million in annualized revenue during 2025 and projects $611.5 million for 2026, an 81% year-over-year increase.

Combined DAI and USDS stablecoin supply reaches $26 billion, making Sky the largest decentralized stablecoin ecosystem.

USDS holders choose between 4.5% APY savings rate or 600 million SKY annual token rewards for governance exposure.

MKR converts to SKY at 1:24,000 with escalating quarterly penalties, with 81% of holders migrated as of late 2025.

Revenue stability from real-world asset yields differentiates sky tokenomics from funding-rate-dependent competitors like Ethena.

USDS supply is projected to nearly double to $20.6 billion in 2026, directly increasing stability fee revenue and Smart Burn Engine capacity.

Sky tokenomics demonstrates how a mature DeFi protocol transitions from pure governance utility to systematic value accrual. The Smart Burn Engine converts protocol revenue into permanent supply reduction, while dual staking options give USDS holders flexibility between stable yield and token exposure. As the largest decentralized stablecoin protocol scales its RWA strategy and launches new Sky Agents, the growing revenue base feeds directly into increased burn capacity and staking rewards for sky tokenomics participants.

SKY Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.