Written:

Feb 1, 2026

In a crypto landscape where most protocols keep significant revenue for themselves, Hyperliquid stands apart.

In a crypto landscape where most protocols keep significant revenue for themselves, Hyperliquid stands apart. The decentralized perpetual exchange directs over $65 million monthly to its ecosystem participants, making it one of the highest holder revenue protocols in the industry. This article breaks down how HYPE token's unique value accrual mechanisms work and why they matter.

What is HYPE Token?

HYPE is the native token of Hyperliquid, a high-performance Layer 1 blockchain designed specifically for decentralized derivatives trading. Launched in November 2024, HYPE serves as both the gas token for the Hyperliquid L1 and the primary beneficiary of the platform's trading fee revenue.

Unlike traditional exchange tokens that simply offer fee discounts, HYPE captures value directly from protocol performance through an automated buyback mechanism. The Assistance Fund uses over 99% of trading fees to purchase HYPE tokens from the open market, creating constant buy pressure correlated with trading volume.

The token launched with a fully diluted valuation of $4.2 billion and has maintained strong performance due to its revenue-sharing model and community-first distribution approach.

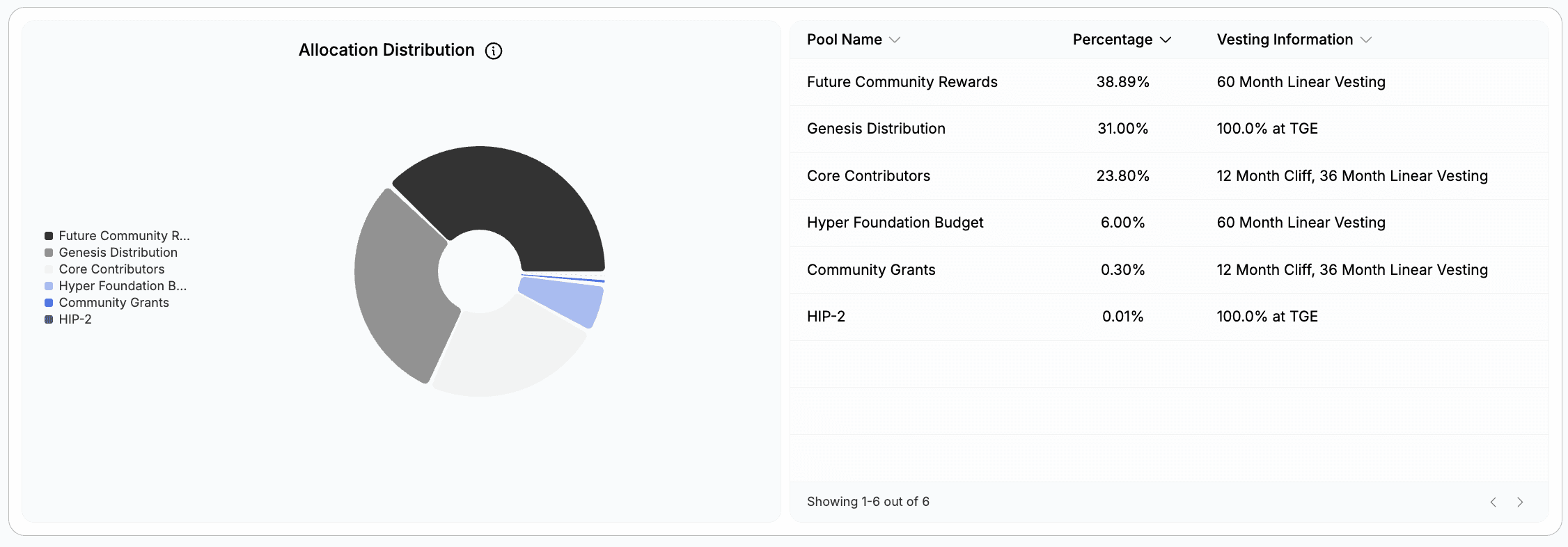

HYPE Token Distribution and Allocation

Hyperliquid's token distribution reflects a community-focused philosophy uncommon among major DeFi protocols. The allocation breakdown demonstrates this commitment to users over venture capital investors.

Genesis Airdrop: 31%

The largest single allocation went directly to users through the genesis airdrop on November 29, 2024. This distribution rewarded early traders, liquidity providers, and ecosystem participants based on their historical activity on the platform.

Industry analysis described it as "the biggest wealth creation event after the Arbitrum airdrop," with eligible users receiving allocations worth thousands to hundreds of thousands of dollars depending on their activity levels.

Community Rewards & Future Emissions: 38.88%

Nearly 39% of total supply remains allocated for future community incentives, including:

Season 2 and subsequent airdrop programs

Trading rewards and volume incentives

Liquidity provider rewards

Ecosystem development grants

With 428 million HYPE tokens still unclaimed in the community rewards wallet as of January 2026, future reward programs could significantly expand user adoption.

Core Contributors: 23.8%

The team allocation includes a one-year cliff with linear vesting extending until 2028. Monthly unlocks occur on the 6th of each month, starting with approximately 1.75 million tokens in the first distribution.

The next major unlock is scheduled for February 6, 2026, releasing 9.92 million HYPE tokens ($254.6 million at current prices) to core contributors.

Hyper Foundation: 6%

The foundation treasury supports protocol development, security audits, strategic partnerships, and long-term ecosystem sustainability.

Community Grants: 0.3%

A small allocation dedicated to supporting builders, researchers, and community initiatives that strengthen the Hyperliquid ecosystem.

Hyperliquid Detailed Tokenomics:

https://audit.tokenomics.com/tokenomics/hyperliquid

No VC Allocation: The Key Differentiator

Perhaps most notably, HYPE has zero venture capital allocation. No institutional investors received preferential access or discounted tokens. This stands in stark contrast to most DeFi protocols, where VC allocations often range from 15-40% of total supply.

This community-first approach has contributed to strong token holder alignment and reduced selling pressure from early investors seeking exits.

Value Accrual Mechanisms: The 99% Fee Share

Hyperliquid's tokenomics create direct value flow to HYPE holders through multiple mechanisms. Understanding how fees transform into holder value is essential to evaluating the token's economic model.

The Assistance Fund: Automated Buybacks

The Assistance Fund operates as an autonomous buyback engine, using protocol fees to repurchase HYPE tokens continuously. Here's how it works:

Fee Collection: Trading fees accumulate from perpetual and spot markets

Automated Purchases: The Assistance Fund uses 99% of collected fees to buy HYPE from the open market

No Manual Intervention: The buyback mechanism runs automatically based on protocol rules

Transparent Execution: All buyback transactions are visible on-chain

Recent data shows the Assistance Fund executing $1.7 million in buybacks weekly as of January 2026, with buyback volume accelerating 26% week-over-week during periods of high trading activity.

The protocol's fee structure channels almost all revenue to token holders, creating one of the most aggressive value accrual models in DeFi.

Revenue Breakdown by Product (January 2026)

Hyperliquid's ecosystem generates revenue across multiple products, with perpetual futures dominating the fee structure:

Hyperliquid Perps: The perpetual futures platform generated approximately $62.6 million in holder revenue over a recent 30-day period as of January 2026, representing 90.9% of the $68.9 million in total fees. Cumulative all-time holder revenue from perps alone exceeds $910 million.

Spot Orderbook: The spot trading market contributed approximately $1.9 million in holder revenue during the same period, providing diversified revenue beyond derivatives.

Hyperliquid L1: Gas fees from the Layer 1 blockchain added roughly $549,000 in holder revenue, creating an additional value stream as ecosystem activity expands.

HLP Vault: The Hyperliquid Liquidity Provider vault earned approximately $651,000 for liquidity providers during this period, compensating LPs for providing market-making services and absorbing liquidation risk.

Total ecosystem revenue flow exceeded $65 million monthly as of January 2026, positioning Hyperliquid among the top revenue-generating protocols across all of DeFi.

HLP Vault: Liquidity Provider Rewards

The HLP (Hyperliquid Liquidity Provider) vault operates as the platform's market maker, taking the opposite side of trader positions. Liquidity providers deposit assets into HLP and earn returns from:

Trading Fees: A portion of perpetual trading fees flows to HLP

Funding Rates: HLP collects funding payments when favorable

Liquidation Profits: Successful liquidations generate additional returns

HLP serves as the counterparty to traders, meaning its performance inversely correlates with trader profitability. During periods when traders lose money, HLP earns higher returns. When traders are profitable, HLP returns decrease.

The vault provides essential liquidity depth for the exchange while offering passive yield to depositors willing to accept the risks of being the "house" in derivatives trading.

L1 Staking and Gas Fees

As Hyperliquid operates its own Layer 1 blockchain, HYPE functions as the gas token for all on-chain transactions. This creates additional utility beyond the buyback mechanism:

Transaction Fees: Every trade, transfer, and smart contract interaction requires HYPE for gas

Validator Operations: Running validators and participating in consensus requires HYPE staking

Network Security: Staked HYPE secures the blockchain through proof-of-stake consensus

As ecosystem activity grows—with new applications launching on Hyperliquid L1—gas demand increases, creating organic buying pressure independent of the Assistance Fund.

Protocol Performance: Revenue at Scale

Hyperliquid's revenue metrics demonstrate product-market fit at a scale few DeFi protocols achieve. Comparing performance data reveals why HYPE has become one of the highest holder revenue tokens in crypto.

Trading Volume and Open Interest

Open interest on Hyperliquid spiked to $793 million on January 26-27, 2026, up from $260 million in December 2025. This 205% increase in open interest directly translates to higher fee generation and increased buyback activity.

Daily trading volume regularly exceeds $2 billion, with peak days reaching $3-4 billion during periods of high market volatility.

Fee Generation Trends

The protocol generated over $2.3 million in fees within a single 24-hour period during peak trading days in January 2026. Annualized fee projections based on recent activity suggest Hyperliquid could generate over $700 million in annual fees.

Unlike many protocols that retain a significant portion of fees as "protocol revenue," Hyperliquid channels nearly everything to ecosystem participants—either through Assistance Fund buybacks or HLP vault distributions.

Cumulative Metrics

Since launch, Hyperliquid has generated:

$869+ million in cumulative fees

$827+ million in cumulative revenue

$825+ million in cumulative holder revenue

$910+ million in all-time perpetual futures holder revenue

The close alignment between total fees, revenue, and holder revenue demonstrates the protocol's commitment to value distribution rather than extraction.

Comparing HYPE to Other Perps Tokens

Understanding Hyperliquid's position requires comparing it to competitors in the decentralized derivatives space. While protocols like GMX, dYdX, and Synthetix pioneered DeFi perpetual trading, Hyperliquid's approach differs significantly.

Revenue Distribution Models

GMX: Distributes 70% of fees to GMX and GLP stakers, retaining 30% for protocol development. GMX V2 introduced more complex fee structures with esGMX rewards.

dYdX: Initially retained significant protocol revenue but introduced DYDX token staking with fee sharing in later versions. The v4 chain launched with validators earning trading fees.

Synthetix: Uses SNX staking to collateralize synthetic assets, with stakers earning trading fees from perpetual futures on Kwenta and Polynomial.

Hyperliquid: Directs 99% of fees to buybacks, with only 1% to HLP, creating the most aggressive holder-focused model among major perps protocols.

Performance Comparison

Based on recent DeFiLlama data, Hyperliquid ranks among the top protocols by holder revenue, often competing with or exceeding established names like Uniswap, Aave, and Maker in monthly revenue distribution to token holders.

The combination of high trading volume, low fee leakage, and automated buybacks creates stronger value accrual than protocols that prioritize protocol treasury accumulation.

Trade-offs and Considerations

While Hyperliquid's model maximizes short-term holder value, it leaves minimal protocol revenue for development funding. The team relies on their token allocation and external resources rather than protocol fees.

This differs from protocols like Uniswap or Aave, which accumulate protocol treasuries to fund grants, development, and long-term sustainability. Whether Hyperliquid's approach proves superior long-term remains to be seen.

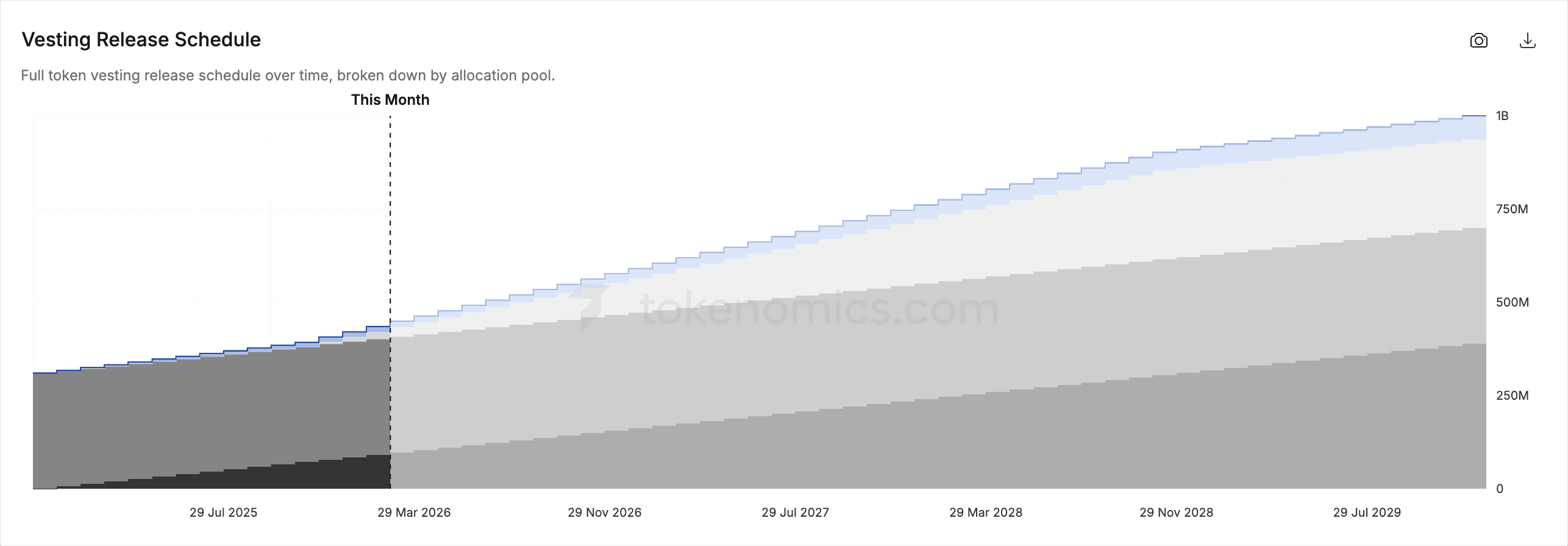

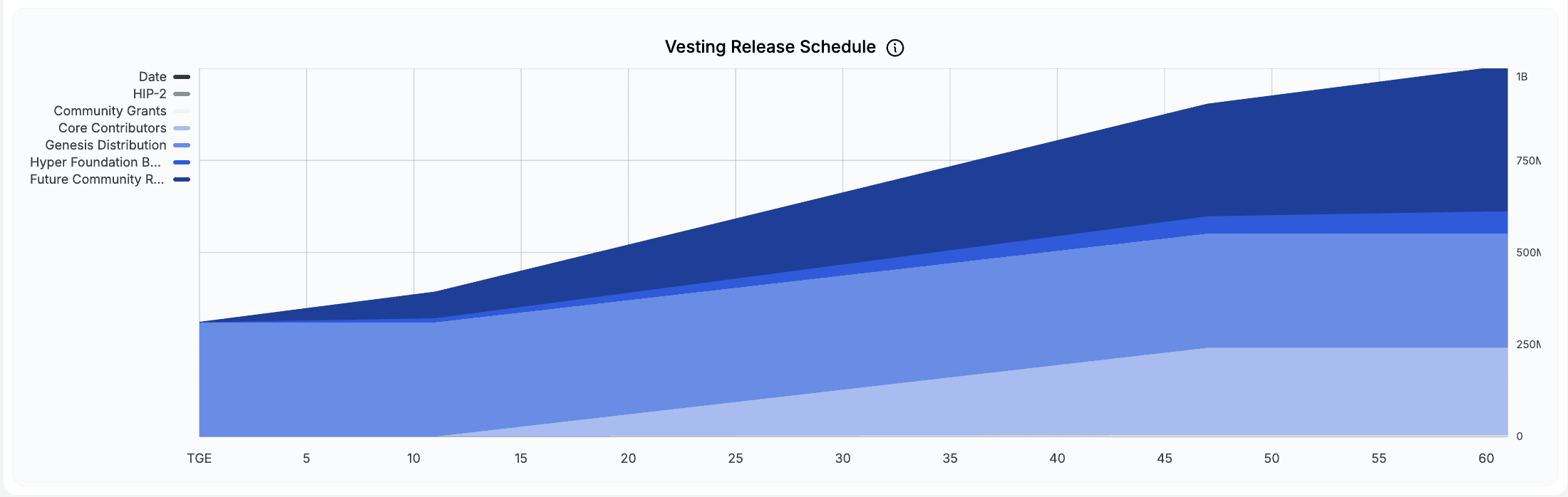

Token Vesting and Unlock Schedule

Understanding HYPE's supply dynamics requires examining the vesting schedule for locked tokens. The unlock calendar significantly impacts circulating supply and potential price pressure.

Unlock Timeline

Genesis: 31% immediately liquid (310 million HYPE)

Monthly Team Unlocks: Beginning November 29, 2024, approximately 1.75 million HYPE unlocks monthly

Major Cliff Unlock: February 6, 2026, releases 9.92 million HYPE ($254.6 million)

Linear Vesting Through 2028: Team allocation unlocks gradually over multiple years

The current circulating supply stands at approximately 395 million HYPE out of 962 million minted tokens, representing roughly 41% of total supply.

Future Emissions

The 38.88% allocated for community rewards will be distributed through:

Season 2 Airdrops: Rewarding trading activity, staking, and ecosystem participation

Liquidity Mining Programs: Incentivizing liquidity provision across trading pairs

Builder Grants: Supporting developers creating applications on Hyperliquid L1

The exact emission schedule for community rewards has not been fully disclosed, allowing the team flexibility in responding to market conditions and strategic priorities.

Price Impact Analysis

Industry analysts project HYPE trading between $19.94 and $59.61 during 2026, with some bullish forecasts suggesting potential highs around $78.56. These predictions factor in unlock schedules, buyback pressure, and overall market conditions.

The linear vesting model helps mitigate sudden supply shocks compared to cliff-heavy schedules, while the buyback mechanism creates offsetting demand pressure.

Buyback vs. Burn: The HIP-3 Proposal

In January 2026, the Hyperliquid community proposed burning a significant portion of the Assistance Fund's accumulated HYPE holdings—potentially valued at over $1 billion.

The Proposal

HIP-3 suggests burning approximately 13% of circulating supply currently held by the Assistance Fund. Instead of holding purchased HYPE indefinitely, the tokens would be permanently removed from circulation.

Arguments For Burning

Proponents argue that burning:

Reduces Supply: Permanently decreasing supply while demand remains constant should increase price

Demonstrates Commitment: Shows the protocol prioritizes long-term value over short-term treasury accumulation

Simplifies Tokenomics: Eliminates questions about future use of accumulated tokens

Industry research suggests buyback-and-burn models often outperform simple buybacks in traditional markets.

Arguments Against Burning

Critics counter that retaining purchased HYPE:

Provides Flexibility: Tokens could fund future development, grants, or emergency needs

Maintains Reserves: A protocol treasury offers financial resilience during market downturns

Already Creates Value: The buyback itself provides price support; burning is redundant

The debate reflects broader DeFi discussions about optimal value accrual mechanisms and the role of protocol treasuries.

Community Governance

As of early February 2026, the proposal remains under community discussion. HYPE holders will ultimately decide through governance votes whether to implement the burn mechanism.

The outcome could establish a precedent for how DeFi protocols manage buyback programs and balance short-term holder value against long-term protocol sustainability.

HYPE Staking and Future Utility

Beyond the buyback mechanism, HYPE offers additional utility through staking and participation in the Hyperliquid L1 ecosystem.

Current Staking Mechanics

HYPE holders can stake tokens to:

Validate Transactions: Run validator nodes securing the Hyperliquid L1

Earn Gas Fees: Validators receive a portion of transaction fees

Participate in Governance: Staked HYPE may grant voting rights on protocol upgrades

Staking rewards come from gas fees rather than inflationary emissions, aligning incentives with network usage.

Future Utility Expansion

The Hyperliquid team has outlined plans to expand HYPE utility:

USDH Stablecoin: Proposed collaborations with Paxos and Frax Finance suggest a native stablecoin where 95-100% of reserve interest flows to HYPE buybacks

DeFi Primitives: As more applications launch on Hyperliquid L1, HYPE could serve as collateral or liquidity in lending, options, and structured products

Ecosystem Incentives: HYPE rewards may incentivize liquidity provision, lending, and other ecosystem activities

These developments could create additional demand sources beyond speculative trading and buyback pressure.

Key Takeaways

Hyperliquid channels over $65 million monthly to its ecosystem, making HYPE one of the highest holder revenue tokens in crypto

The protocol directs 99% of trading fees to automated HYPE buybacks through the Assistance Fund, creating direct value accrual for token holders

HYPE's distribution included zero venture capital allocation, with 31% going to users through the genesis airdrop

Revenue streams span perpetual trading ($62.6M in recent monthly holder revenue), spot markets ($1.9M), L1 gas fees ($549K), and HLP vault returns ($651K)

Upcoming unlocks include 9.92 million HYPE tokens on February 6, 2026, as part of the linear team vesting schedule through 2028

A community proposal suggests burning the Assistance Fund's accumulated HYPE holdings: potentially 13% of circulating supply

HYPE serves as both the gas token for Hyperliquid L1 and the primary beneficiary of protocol fee revenue

Conclusion

Hyperliquid's tokenomics represent a bold experiment in maximizing holder value through aggressive fee sharing. By directing 99% of revenue to buybacks and launching without VC allocation, the protocol aligns incentives between users and token holders in ways few competitors match.

The model's sustainability depends on continued trading volume growth, effective management of token unlocks, and successful ecosystem expansion beyond derivatives. If Hyperliquid maintains its volume leadership while expanding into spot trading, stablecoins, and DeFi primitives, HYPE could establish a new standard for how exchange tokens accrue value.

For investors and participants, understanding these mechanisms matters. The combination of automated buybacks, predictable unlocks, and ecosystem revenue streams creates a unique value proposition—one that has already generated over $910 million in cumulative holder revenue since launch.

As the protocol evolves and the community decides on proposals like HIP-3, HYPE's tokenomics will continue adapting to balance short-term holder value against long-term protocol sustainability. That balance will ultimately determine whether Hyperliquid's model proves superior to more conservative approaches—or whether protocols need stronger treasuries to compete long-term.

HYPE Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.