Written:

Feb 2, 2026

Jupiter has become Solana's dominant DeFi protocol by building more than just a DEX aggregator. With a perpetual exchange that generates $46.

Jupiter has become Solana's dominant DeFi protocol by building more than just a DEX aggregator. With a perpetual exchange that generates $46.5M in monthly fees and a governance model that distributes $11.4M directly to active participants, Jupiter demonstrates how tokenomics can align protocol growth with holder rewards.

The key innovation is ASR (Active Staking Rewards), a mechanism that requires voting participation to earn protocol revenue. This isn't passive staking. To capture your share of Jupiter's fees, you must actively shape the protocol's future through governance votes.

This article breaks down JUP token distribution, explains how ASR works, analyzes Jupiter's product suite performance, and shows how the protocol has achieved over $200M in all-time holder revenue.

What is the JUP Token?

JUP is the governance and value accrual token for Jupiter, Solana's largest decentralized exchange aggregator and perpetual trading platform. Launched in January 2024, the token provides holders with voting rights in protocol governance and access to revenue through the Active Staking Rewards system.

The token launched with a 10 billion total supply, distributed across community airdrops, team allocation, and ecosystem grants. Unlike many DeFi tokens that function purely as governance tools, JUP captures and redistributes protocol fees directly to stakers who participate in voting.

Jupiter processes billions in weekly volume across its aggregator and perpetual exchange. The protocol splits fees between liquidity providers (JLP holders for perps) and JUP stakers who vote in governance proposals. This dual-revenue model creates value for both liquidity providers and governance participants.

The token's utility extends beyond governance. JUP stakers determine which projects launch on Jupiter's Launchpad For Governance (LFG) platform, vote on protocol parameter changes, and approve ecosystem spending proposals. Each locked JUP equals one vote, creating a direct connection between token holdings and governance influence.

JUP Token Distribution and Airdrops

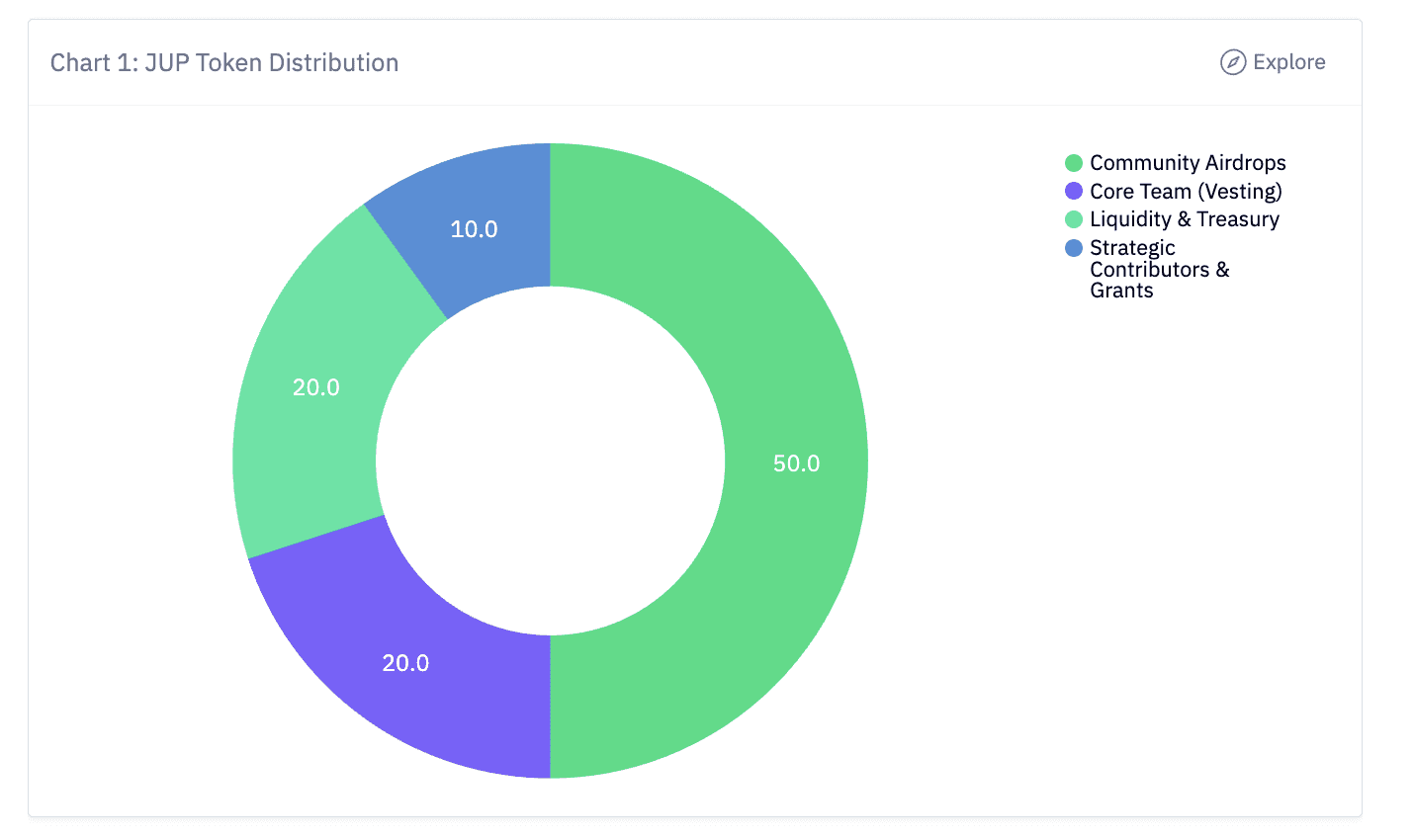

Jupiter allocated 50% of the 10 billion JUP supply to the community and 50% to team, contributors, and strategic reserves. The community portion focuses on rewarding users through multiple airdrop events called "Jupuary."

Community Allocation (50%)

The largest single distribution occurred in January 2024, when Jupiter airdropped 1 billion JUP tokens to 955,000 wallets. This marked one of the largest airdrops in Solana ecosystem history, worth approximately $700 million at distribution. The airdrop rewarded users based on trading volume, transaction count, and platform engagement between launch and November 2023.

A second Jupuary event followed in January 2025, distributing 700 million JUP tokens worth roughly $575 million. The allocation split into three categories: 440 million tokens for active traders, 60 million for existing stakers, and 200 million for growth initiatives called "carrots." The snapshot window covered November 2023 through November 2024.

Jupiter plans annual Jupuary distributions every January, with confirmed events scheduled through 2026. The remaining community allocation covers future airdrops, liquidity mining programs, and ecosystem grants designed to expand the protocol's user base.

Team and Strategic Allocation (50%)

The non-community portion distributes as follows: 20% to core team members with multi-year vesting schedules, 10% for strategic contributors and grants supporting protocol development, and 20% reserved for liquidity provision and treasury operations.

Team tokens remained locked until January 2025, when gradual unlocking began according to predetermined vesting schedules. This extended lockup period aligned team incentives with long-term protocol growth rather than short-term price movements.

The strategic reserve supports partnerships with other Solana protocols, provides liquidity for new markets, and funds development of additional Jupiter products. Treasury decisions require governance approval through JUP holder votes.

ASR: Active Staking Rewards Explained

Active Staking Rewards represent Jupiter's core value distribution mechanism. The system requires governance participation to earn protocol fees, creating incentive alignment between voting on proposals and capturing revenue.

How ASR Works

To participate in ASR, you must lock JUP tokens in the governance contract and vote on active proposals. Simply holding or passively staking JUP does not qualify you for rewards. Each locked JUP equals one vote, making the system proportional regardless of holding size.

The voting mechanism operates continuously. When proposals appear on Jupiter's governance forum, you allocate your locked JUP to support or oppose them. Your voting power remains active across all proposals during each quarterly epoch. At epoch end, the protocol calculates your participation and distributes rewards proportionally.

Locked tokens can be unstaked at any time, triggering a 30-day unlocking period. During this window, your voting power decreases linearly each day, reducing your share of ASR distributions. This gradual unlocking prevents immediate exits while maintaining user control over their tokens.

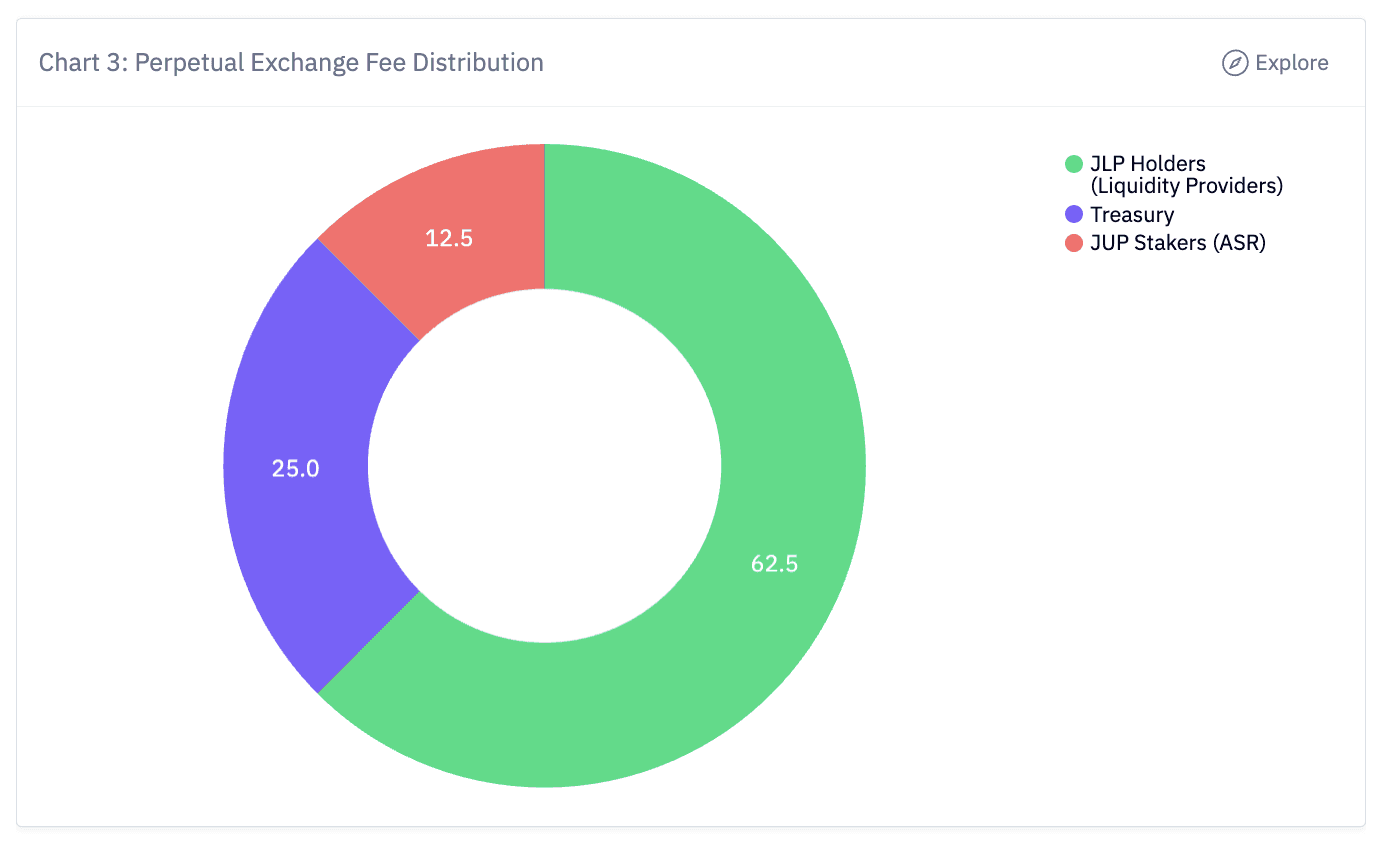

Fee Distribution Mechanics

Jupiter distributes 75% of protocol fees to ASR participants, while 25% flows to the protocol treasury. The fee sources include both the perpetual exchange and the DEX aggregator, creating dual revenue streams for stakers.

Perpetual Exchange Revenue: The perp platform generates the majority of protocol fees. Of the $46.5M in monthly perp fees, approximately 12.5% ($5.8M) flows to JUP stakers through ASR. The remaining 62.5% goes to JLP holders (the liquidity providers for perpetual contracts), and 25% to the protocol treasury.

Aggregator Revenue: Despite lower nominal fees of $602K monthly, the aggregator contributes $5.6M in holder revenue due to its different fee structure. The protocol captures value from routing optimization and MEV protection rather than traditional trading fees.

Total Monthly Distribution: Combining both revenue sources, ASR participants receive approximately $11.4M monthly. This figure fluctuates based on trading volume, market volatility, and overall protocol usage across Jupiter's product suite.

The all-time holder revenue has exceeded $200M since the token launched in January 2024, demonstrating consistent value distribution despite crypto market cycles. This revenue accrues from organic usage rather than token inflation or liquidity mining incentives.

Quarterly Distribution Epochs

ASR operates on quarterly cycles, with specific claim periods opening after each epoch concludes. The cycle structure provides predictable distribution timing while allowing flexibility in voting behavior throughout each quarter.

During July 2024's first ASR distribution, Jupiter allocated 50M JUP, 7.5B WEN, 7.5M ZEUS, 7.5M UPT, and 750K SHARK tokens to active voters from the March-June period. The second distribution in October 2024 provided 50M JUP and 7.5M CLOUD for voters active from July through September.

Reward amounts vary by epoch based on protocol revenue during that period. Higher trading volume and fees translate directly to larger reward pools. The quarterly cadence balances administrative efficiency with frequent enough distributions to maintain engagement.

Users can claim rewards during specified windows after each epoch. Unclaimed rewards accumulate but have expiration dates, requiring active monitoring. When claiming, JUP rewards automatically stake to your governance position, increasing your voting power for subsequent epochs.

Jupiter Product Suite Performance

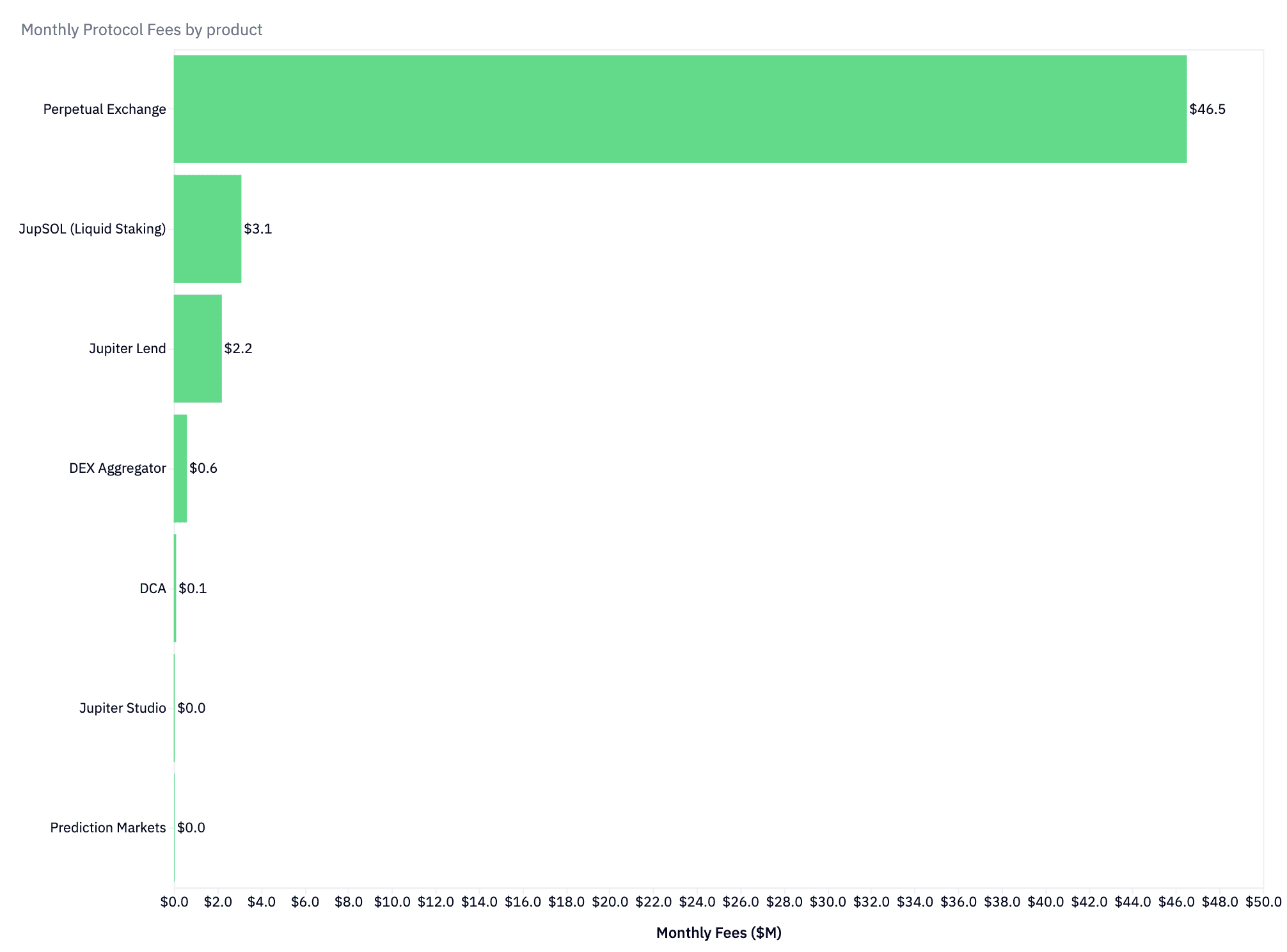

Jupiter operates five distinct products beyond the core aggregator, each contributing to the protocol's revenue and ecosystem value.

Perpetual Exchange

The perp platform dominates Jupiter's revenue generation, producing $46.5M in monthly fees. Built on an oracle-based model similar to GMX, the exchange offers leverage trading on SOL, ETH, BTC, and other major assets.

JLP holders provide the liquidity pool backing these perpetual contracts. They earn 70% of trading fees directly, creating a competitive yield opportunity that has generated over $137M for JLP holders in 2024. The remaining 30% splits between JUP stakers (12.5%) and the treasury (25%).

The perpetual exchange has become responsible for approximately 80% of Jupiter's total protocol fees, making it the primary revenue driver for ASR distributions. Trading volume consistently exceeds $10B weekly during active market periods, positioning Jupiter among the top decentralized perpetual exchanges across all chains.

DEX Aggregator

As Jupiter's founding product, the aggregator routes trades across Solana's entire DEX ecosystem to find optimal prices. The platform scans multiple liquidity sources including Orca, Raydium, Phoenix, and dozens of smaller venues.

Despite generating only $602K in direct monthly fees, the aggregator contributes $5.6M in holder revenue through its unique value capture mechanism. Jupiter monetizes routing efficiency, MEV protection, and transaction bundling rather than traditional swap fees.

The aggregator processes billions in weekly volume, serving as the primary interface for Solana traders. Its market dominance creates network effects that benefit Jupiter's other products, driving users toward the perp exchange and other protocol features.

Jupiter Lend

The lending protocol launched in 2024 as Jupiter's entry into isolated margin markets. The product generated $2.2M in monthly fees but does not currently distribute revenue to JUP holders. Instead, fees support JLP liquidity and protocol development.

Jupiter Lend focuses on margin trading integration with the perpetual exchange, allowing users to borrow against collateral for leveraged positions. This creates a lending market specifically designed for trader needs rather than general DeFi lending.

Future governance proposals may adjust fee distribution to include JUP holders, but current mechanics prioritize protocol growth over immediate holder revenue from this product line.

JupSOL (Liquid Staking)

JupSOL represents Jupiter's liquid staking token for Solana. Users deposit SOL and receive JupSOL, which accrues staking rewards while remaining liquid for use in DeFi protocols.

The product generates $3.1M in monthly fees from staking rewards and MEV capture. Like Jupiter Lend, these fees currently support protocol operations rather than flowing to JUP stakers. The team has indicated that future governance may propose revenue sharing for this product.

JupSOL competes with established Solana liquid staking derivatives like mSOL and stSOL. Jupiter leverages its existing user base and product integration to drive adoption, though it remains a smaller player in the liquid staking market.

Other Products

Jupiter Studio (Launchpad): Generates $45K in monthly fees from project launches. The LFG (Launchpad For Governance) platform requires JUP voting to approve new token launches, integrating governance with product usage.

DCA (Dollar Cost Averaging): Produces $106K in monthly fees from automated trading strategies. Users set up recurring buys that execute at specified intervals, capturing a small fee per transaction.

Prediction Markets: The newest product line generates $29K monthly from prediction market trading. This experimental feature explores information markets on the Solana ecosystem.

While these products contribute modest revenue individually, they expand Jupiter's utility beyond pure trading. Each product creates additional touch points with users and increases the protocol's overall engagement.

Protocol Performance and Metrics

Jupiter's financial performance demonstrates sustainable value creation through actual usage rather than token incentives. The protocol generates over $50M in monthly fees from organic trading activity, positioning it among DeFi's top revenue generators.

Revenue Breakdown by Source

30-Day Metrics:

Perpetual Exchange: $46.5M total fees

JLP holders: $29.1M (62.5%)

JUP stakers: $5.8M (12.5%)

Treasury: $11.6M (25%)

DEX Aggregator: $602K fees → $5.6M holder revenue

Jupiter Lend: $2.2M fees

JupSOL: $3.1M fees

Other products: $180K combined fees

The asymmetry between aggregator fees ($602K) and holder revenue ($5.6M) reflects Jupiter's sophisticated value capture from MEV, routing optimization, and bundled transactions. This demonstrates protocol economics beyond simple fee switching.

All-Time Performance

Since launching in January 2024, Jupiter has distributed over $200M to token holders through ASR. This represents genuine revenue sharing from protocol operations, not inflationary token emissions.

The protocol has processed over $300 billion in aggregate volume across all products in its first year. Trading volume concentrates on major pairs (SOL, ETH, BTC) but extends to long-tail Solana tokens through the aggregator's broad liquidity access.

Jupiter's perp exchange alone has generated over $500M in cumulative fees, with approximately $350M distributed to JLP holders. This makes JLP one of the highest-yielding liquidity provision opportunities in DeFi, competing with GMX and other major perp protocols.

Market Position

Jupiter dominates Solana DeFi across multiple categories:

#1 DEX aggregator by volume (>60% market share)

Top 3 decentralized perpetual exchange (all chains)

Largest Solana governance token by active voters

Highest revenue distribution to token holders on Solana

The protocol's market position creates network effects that reinforce its dominance. More users drive more volume, generating more fees, attracting more stakers, who have greater incentive to promote Jupiter products.

Comparing JUP to Other Aggregator Tokens

Jupiter's tokenomics differ significantly from other DEX aggregators, particularly in revenue distribution and governance requirements.

Revenue Sharing Models

1inch (1INCH): The leading Ethereum aggregator does not distribute protocol revenue to token holders. 1INCH functions purely as a governance token, with fee revenue retained by the protocol treasury. This model prioritizes protocol development over holder payouts.

0x (ZRX): Operates as a liquidity protocol rather than aggregator, with no revenue distribution to token holders. ZRX serves governance functions and staking requirements for market makers.

Kyber Network (KNC): Implemented a fee-sharing model where KNC stakers earn a portion of protocol fees. However, staking is passive and doesn't require governance participation, unlike Jupiter's active voting requirement.

Governance Mechanisms

Jupiter's ASR model uniquely combines revenue distribution with mandatory governance participation. This creates stronger incentive alignment than traditional governance tokens, where voting participation often remains below 10% of supply.

Other protocols have experimented with vote-escrowed tokens (veTokens) that increase rewards with longer lockup periods. Jupiter's approach differs by emphasizing active participation over lockup duration. The 30-day unlocking period provides flexibility while discouraging purely mercenary capital.

Fee Structure Comparison

Protocol | Revenue Share | Distribution Method | Governance Required |

Jupiter (JUP) | 75% to holders | Quarterly ASR | Yes - must vote |

1inch (1INCH) | 0% | None | No |

Kyber (KNC) | Variable | Epoch staking | No |

Uniswap (UNI) | 0% | None | No |

Jupiter's 75% revenue share to active stakers represents one of the highest percentages in DeFi. Most protocols retain 100% of fees for treasury operations or liquidity mining, making JUP's distribution model relatively unique.

Perp Exchange Comparison

When comparing Jupiter's perp platform to standalone perpetual exchanges, the revenue split becomes more complex:

GMX (GMX): Distributes 70% of fees to GLP liquidity providers, 30% to escrowed GMX stakers. This closely resembles Jupiter's model, with the difference being Jupiter's additional governance requirement for JUP stakers.

dYdX (DYDX): Moved to full appchain model with DYDX serving as a chain token. Revenue goes to validators and stakers rather than being distributed as fee sharing. This represents a different economic model focused on chain security.

Hyperliquid (HYPE): Distributes fees to HLP liquidity providers and HYPE stakers through a simplified model. The protocol launched with strong market performance but offers different mechanics than Jupiter's ASR system.

Jupiter's dual model—aggregator plus perps—creates complementary revenue streams that diversify protocol income beyond what pure aggregators or perp exchanges achieve individually.

Best Practices for JUP Staking

Maximizing ASR returns requires active engagement beyond simple token holding. These practices optimize your participation in Jupiter's governance and revenue distribution.

Voting Participation

Vote on every proposal during the quarter to maximize your ASR allocation. Missing votes reduces your proportional share relative to more active participants. Set reminders for governance proposal announcements or join Jupiter's Discord for voting notifications.

Review proposals thoroughly before voting. While voting is required for rewards, the decisions impact protocol direction and indirectly affect token value. Poor governance can reduce long-term returns even with short-term fee distribution.

Consider the implications of parameter changes, treasury spending proposals, and new product launches. Your votes shape Jupiter's strategic direction, making informed participation more valuable than automatic approval of all proposals.

Lock Amount Optimization

Each locked JUP equals one vote, creating linear scaling. However, consider the 30-day unlocking period when determining your lock amount. Only lock tokens you can commit for at least one full quarter plus unlocking time.

Large holders may benefit from splitting positions between locked (earning ASR) and liquid (maintaining exit flexibility). This balances reward maximization with risk management, particularly during volatile markets.

Monitor the effective APY from ASR distributions relative to other yield opportunities. During low-volume periods, ASR yields may not justify the lockup period compared to liquid alternatives. Adjust your locked position based on changing protocol revenue.

Claim Timing and Compounding

Claim ASR rewards promptly when distribution windows open. Unclaimed rewards have expiration dates, and late claims may forfeit accumulated distributions.

JUP rewards automatically stake to your governance position when claimed, increasing your voting power for subsequent epochs. This creates compounding effects where earlier participation generates larger shares of future distributions.

Consider the tax implications of frequent claims versus accumulated distributions. Depending on jurisdiction, each claim may represent a taxable event. Consult tax professionals familiar with DeFi revenue for optimal strategy.

Risk Considerations

ASR participation involves several distinct risks beyond standard token holding:

Smart Contract Risk: Locked tokens remain in Jupiter's governance contracts. While audited, these contracts represent additional smart contract exposure compared to cold storage.

Opportunity Cost: The 30-day unlocking period may prevent quick exits during market downturns. Locked JUP cannot be sold immediately if price action turns negative.

Governance Risk: Your votes impact protocol decisions. Poor collective governance could harm Jupiter's competitive position, reducing long-term token value despite short-term ASR distributions.

Regulatory Risk: Active governance participation may create different regulatory considerations than passive holding, particularly in jurisdictions with unclear DeFi regulations.

Common Mistakes to Avoid

Passive Staking Without Voting

The most common error is locking JUP but failing to vote on proposals. ASR requires active participation. Locked tokens without voting activity earn zero rewards, creating pure opportunity cost.

Set calendar reminders for each quarter's governance period. Even if proposals seem minor or administrative, voting qualifies you for the full distribution. Missing votes for "unimportant" proposals costs you the same as missing all votes.

Ignoring Unlock Timing

Beginning the unlock process late in a quarter wastes potential earnings. If you plan to exit, start unlocking immediately after claiming rewards to minimize the period where tokens are locked without earning.

Conversely, unlocking tokens mid-quarter reduces your voting power for that entire epoch. Time unlocking decisions around epoch boundaries to maximize captured rewards before exit.

Overlooking Claim Deadlines

ASR rewards have specific claim windows, typically lasting 2-4 weeks after epoch end. Missing these deadlines forfeits your earned distributions permanently.

Subscribe to Jupiter's official communication channels (Twitter, Discord, email) to receive claim notifications. Set multiple reminders for important deadlines rather than relying on memory during busy periods.

Neglecting Governance Quality

While voting is required for ASR, the content of your votes matters for protocol health. Consistently voting for proposals that harm Jupiter's competitive position reduces long-term token value.

This creates a balance between maximizing short-term ASR yields and protecting long-term protocol success. Read proposal summaries, consider implications, and vote according to what strengthens Jupiter's market position.

Overconcentration in Single Protocol

Locking significant capital in one protocol's governance token creates concentration risk. Diversify DeFi holdings across multiple protocols and chains to protect against protocol-specific failures.

Even strong protocols face unexpected competition, technical issues, or regulatory challenges. Jupiter's current market dominance doesn't guarantee future success. Size position accordingly within your broader portfolio risk tolerance.

Key Takeaways

Jupiter distributes $11.4M monthly to JUP stakers through ASR, totaling over $200M in all-time holder revenue from actual protocol fees rather than token inflation

ASR requires active voting participation, not passive staking—locked JUP without governance votes earns zero rewards despite the 30-day unlocking period

The perpetual exchange generates $46.5M in monthly fees (80% of total protocol revenue), while the aggregator contributes through MEV capture and routing optimization

Jupiter allocated 40% of supply to community airdrops (Jupuary), with annual distributions planned through 2026 and team tokens vesting gradually after January 2025 lockup

JUP's 75% revenue share to active stakers exceeds most DeFi protocols, which typically retain 100% of fees for treasury or distribute without governance requirements

Conclusion

Jupiter's tokenomics demonstrate how protocols can align token holder incentives with active governance participation. The ASR mechanism transforms JUP from a pure governance token into a productive asset that captures protocol revenue proportional to voting engagement.

The $11.4M in monthly distributions reflects genuine value creation from Jupiter's product suite, particularly the dominant perpetual exchange. With over $200M distributed to holders in the first year, the model has proven sustainable through multiple market cycles.

However, ASR requires active effort. Missing votes, ignoring claim deadlines, or treating JUP as a passive holding eliminates the primary value proposition. Success requires treating governance participation as essential to earning returns, not optional administrative overhead.

For Solana DeFi participants who want revenue exposure beyond liquidity provision, Jupiter offers compelling economics. The protocol's market dominance, product diversification, and consistent fee generation create a foundation for continued distributions. Whether these advantages persist as competition intensifies remains the key question for long-term holders.

Active governance, informed voting, and strategic position sizing maximize ASR benefits while managing the inherent risks of concentrated protocol exposure.

Jupiter Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Previously managing partner at a web3 venture fund (exit in 2021).

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.