Written:

Feb 2, 2026

GMX has distributed over $134 million to token stakers since launch, making it one of the most successful real yield protocols in DeFi.

GMX has distributed over $134 million to token stakers since launch, making it one of the most successful real yield protocols in DeFi. Unlike protocols that pay rewards through inflationary token emissions, GMX shares actual revenue generated from trading fees with GMX token holders. This article explains how GMX tokenomics works, from staking mechanics to fee distribution, and why it's become a model for sustainable protocol economics.

What is GMX Token?

GMX is the native governance and utility token of GMX, a decentralized perpetual exchange built on Arbitrum and Avalanche. The GMX token serves three primary functions: governance rights for protocol decisions, fee-earning through staking, and boosted rewards via the Multiplier Points system.

The protocol enables traders to open leveraged positions up to 100x on major crypto assets without relying on order books. Instead, GMX uses a unique liquidity pool model where liquidity providers (LPs) act as the counterparty to traders. This design creates sustainable revenue that flows directly to GMX stakers and liquidity providers.

With a fixed maximum supply of 13.25 million tokens and no planned inflation, GMX tokenomics prioritizes value accrual over token dilution. As of February 2026, approximately 10.36 million GMX tokens (78.2% of total supply) have been unlocked and are circulating in the market.

GMX Token Distribution and Supply

GMX launched with a carefully structured token allocation designed to reward early supporters while maintaining long-term protocol sustainability. The 13.25 million GMX token supply breaks down across six key categories.

Token Allocation Breakdown:

XVIX/Gambit Migration (6M tokens, 45.3%) - Reserved for users who migrated from GMX's predecessor protocols

Uniswap Liquidity (2M tokens, 15.1%) - Paired with ETH to provide initial DEX liquidity

esGMX Vesting Reserves (2M tokens, 15.1%) - Set aside for future vesting rewards

Floor Price Fund (2M tokens, 15.1%) - Treasury allocation to support token value

Marketing & Community (1M tokens, 7.5%) - Funding for partnerships and developer incentives

Team Allocation (250K tokens, 1.9%) - Linear vesting over 2 years for core contributors

This allocation model ensured that nearly half of all tokens rewarded early community members who participated in GMX's development journey. The relatively small team allocation (under 2%) demonstrates the protocol's community-first approach to tokenomics.

The fixed supply cap means GMX cannot inflate its way out of economic challenges. New GMX tokens only enter circulation through the vesting of esGMX rewards earned by stakers, creating a balanced emission schedule tied directly to protocol usage.

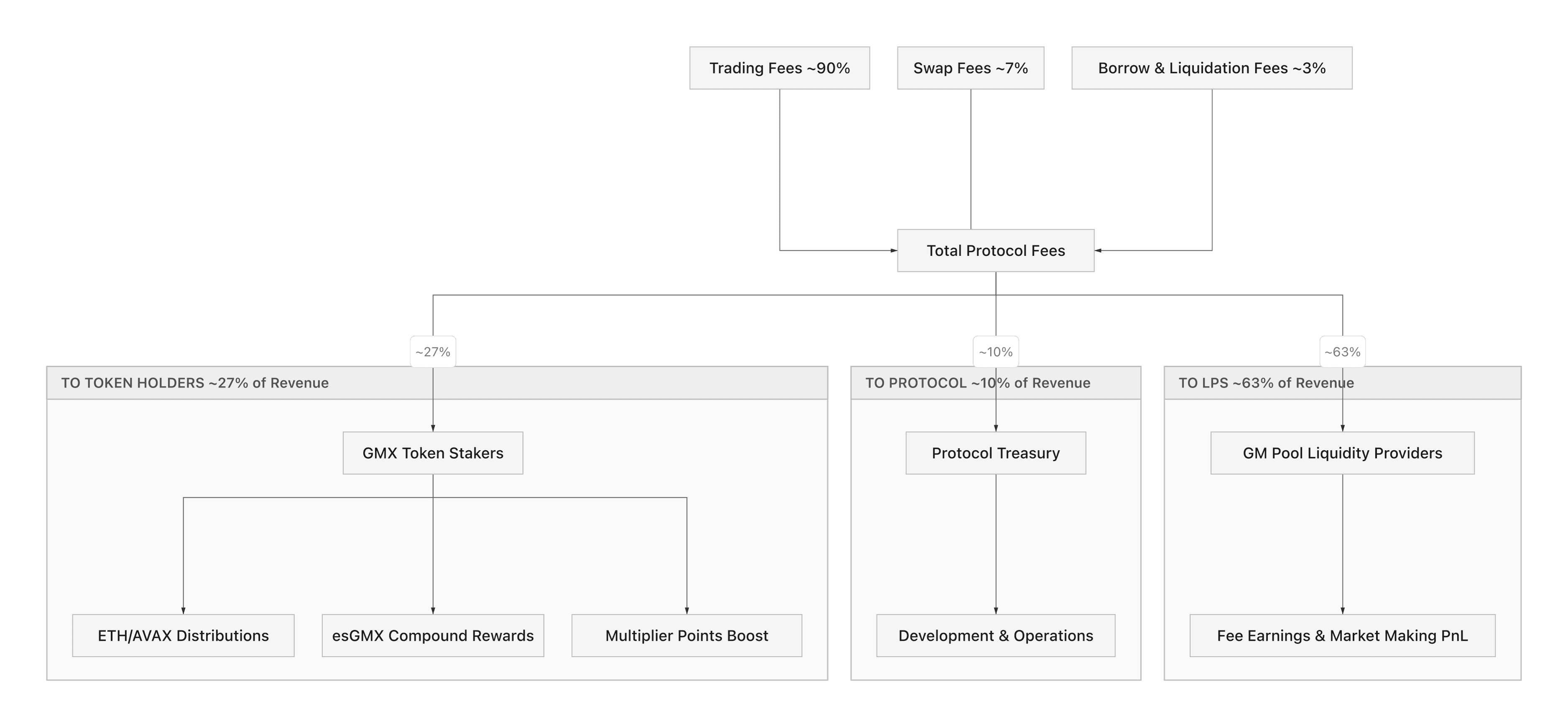

How GMX Fee Distribution Works

GMX generates revenue through four main sources: opening and closing fees for leveraged positions (0.1% each), swap fees when traders exchange tokens (0.2%-0.8%), borrowing fees for holding leveraged positions (varies by utilization), and liquidation fees when positions fall below maintenance margin.

These fees are collected in the assets being traded—primarily ETH, WBTC, USDC, and other supported tokens. The protocol then distributes this revenue to three stakeholder groups based on a fixed percentage split.

GMX V2 Fee Distribution (30-Day Period):

GM Pool LPs: $2.6M (63%) - Liquidity providers who supply capital to GM pools

GMX Stakers: $1.1M (27%) - Users who stake GMX tokens

Protocol Treasury: $420K (10%) - Reserved for protocol development and sustainability

In the past 30 days, GMX generated approximately $4.2 million in total fees. The majority (63%) flows to GM pool liquidity providers, who take on the risk of being the counterparty to traders. GMX stakers receive 27% of fees for locking their tokens, while 10% goes to the protocol treasury for ongoing development.

This fee-sharing model creates alignment between traders, liquidity providers, and token holders. When trading volume increases, all three groups benefit proportionally. The real yield is paid in blue-chip assets like ETH and AVAX rather than newly minted tokens, making GMX rewards more stable than inflationary reward systems.

GMX Staking Performance

GMX stakers have collectively earned over $134 million since the protocol launched in September 2021, making it one of the highest-paying DeFi protocols by cumulative holder revenue. This figure represents actual fees distributed to token holders, not the notional value of inflationary rewards.

Cumulative Revenue to GMX Stakers:

GMX V1: $90.8M - Earned from September 2021 to August 2023

GMX V2: $43.3M - Earned from August 2023 to February 2026

Total: $134.1M - All-time distributions to GMX token holders

GMX V1 initially generated higher absolute revenue as it captured significant market share in the early DeFi perpetuals market. The V2 upgrade in August 2023 introduced GM pools to replace the single GLP pool, allowing for more granular liquidity provision and improved capital efficiency.

The transition from V1 to V2 temporarily reduced staker revenue as the protocol implemented a new fee distribution model. Under the updated system, GMX stakers now receive protocol revenue primarily through GMX token buybacks rather than direct ETH/AVAX distributions. This shift occurred in late 2024 to create sustained buying pressure for GMX tokens.

Real-world staking returns vary based on GMX price, total staked supply, and trading volume. During periods of high volatility and trading activity, APRs for GMX stakers have exceeded 20% in ETH/AVAX terms. During quieter markets, yields typically range between 5-12%.

GMX Staking Mechanics

Staking GMX is straightforward but includes several reward layers designed to benefit long-term holders. When you stake GMX tokens, you immediately begin earning three types of rewards: base fee distributions, esGMX (Escrowed GMX), and Multiplier Points.

Base Rewards: ETH and AVAX

The primary reward for GMX stakers comes from protocol fees distributed in ETH (on Arbitrum) or AVAX (on Avalanche). These rewards accumulate every second and can be claimed at any time without unstaking your GMX. The amount you earn depends on your share of total staked GMX and the protocol's trading volume.

For example, if you stake 1,000 GMX when 5 million GMX are staked total, you own 0.02% of the staking pool. If the protocol generates $1.1 million in staker fees per month (as in recent periods), you would earn approximately $220 monthly in ETH or AVAX.

esGMX: Compound or Vest

Escrowed GMX (esGMX) is a non-transferable version of GMX that you earn as a bonus reward when staking. esGMX functions identically to regular GMX when staked—it earns the same fee distributions and continues generating more esGMX. However, you cannot sell or transfer esGMX until you vest it into regular GMX.

Vesting esGMX into GMX takes exactly one year and requires you to reserve an equivalent amount of GMX or GLP that you used to earn those rewards. For instance, if you earned 100 esGMX by staking 1,000 GMX for several months, you must reserve 1,000 GMX tokens to vest those 100 esGMX over 12 months.

During vesting, your reserved GMX continues earning rewards, but the esGMX being vested does not. The vested GMX accumulates linearly and can be claimed at any time—you don't need to wait the full year to claim partial amounts.

Most long-term stakers choose to stake their esGMX immediately rather than vesting it, effectively compounding their rewards and increasing their share of fee distributions.

Multiplier Points: Loyalty Rewards

Multiplier Points (MPs) reward long-term stakers without diluting the token supply. When you stake GMX or esGMX, you earn Multiplier Points at a fixed rate of 100% APR. Staking 1,000 GMX for one year generates 1,000 Multiplier Points.

Multiplier Points don't represent tokens—they're purely a boost to your fee earnings. Each MP earns the same amount of ETH/AVAX as one GMX token. If you have 1,000 GMX staked and 200 MPs accumulated, you earn fees as if you had 1,200 GMX staked (a 20% boost).

The catch: Multiplier Points are burned proportionally when you unstake GMX or esGMX. If you unstake 50% of your GMX, you lose 50% of your MPs. This creates a strong incentive to maintain your staked position rather than frequently entering and exiting.

Combined, these three reward mechanisms create a staking system that increasingly favors long-term holders. New stakers earn competitive base yields, while long-term participants benefit from compounding esGMX and accumulating Multiplier Points.

GLP vs GM Pools: The Evolution

GMX originally used a single liquidity pool called GLP (GMX Liquidity Provider) that served as the counterparty for all trades across all markets. GLP holders provided multi-asset liquidity and earned fees from trading activity, but they also absorbed losses when traders were profitable.

The GLP model proved successful but had limitations. Since all markets shared one pool, a surge of profitable traders in Bitcoin could negatively impact returns for liquidity providers, even if Ethereum or other markets generated fees. The pooled risk also made it difficult for LPs to manage exposure to specific assets.

GMX V2 introduced GM pools as an evolution of the GLP concept. Instead of one universal pool, GMX V2 creates separate pools for each market. Each GM pool is specific to one trading pair—for example, there's a GM pool for ETH/USD, another for BTC/USD, and individual pools for each supported market.

Key Differences:

Feature | GLP (V1) | GM Pools (V2) |

Pool Structure | Single multi-asset pool | Individual market-specific pools |

Risk Exposure | All markets combined | Isolated per market |

LP Control | Accept all exposure | Choose specific markets |

Fee Sharing | 63% of protocol fees | 63% of protocol fees |

Capital Efficiency | Lower (broad exposure) | Higher (targeted exposure) |

GM pool liquidity providers earn 63% of fees generated in their specific market, identical to the GLP revenue share. However, GM pools allow LPs to manage risk more precisely by selecting which markets to provide liquidity for based on their outlook and risk tolerance.

For example, an LP bullish on Ethereum but neutral on Bitcoin might provide liquidity only to the ETH/USD GM pool. If ETH traders are unprofitable and pay significant fees, the LP captures those returns without exposure to BTC market movements.

The transition from GLP to GM pools represented GMX's shift toward more sophisticated capital markets infrastructure while maintaining the core revenue-sharing principle that made the protocol successful.

GMX vs Other Perpetual DEXs

GMX pioneered the liquidity pool model for perpetual futures, but several competitors have since emerged with different approaches to decentralized leverage trading. Understanding how GMX tokenomics compares to dYdX and Hyperliquid reveals the trade-offs between different perpetual DEX designs.

GMX: Liquidity Pool Model

GMX uses isolated liquidity pools (GM pools) where LPs provide the capital that traders trade against. The protocol generates revenue from trading fees and distributes it to LPs (63%) and GMX stakers (27%). With over $470 million in cumulative fees, GMX has proven the sustainability of this model over multiple market cycles.

The GMX token has a fixed supply of 13.25 million with no inflation. Stakers earn real yield in ETH and AVAX, not newly minted governance tokens. This design makes GMX attractive for yield-focused investors who want exposure to trading volume without taking directional risk.

GMX's main limitation is capital efficiency. Because LPs must provide significant capital to support large positions, the protocol requires higher fees (around 0.1% per trade) compared to order book models. However, these fees directly translate to staker revenue.

dYdX: Order Book with Token Incentives

dYdX operates as a traditional order book exchange built on its own Cosmos SDK-based chain. Traders pay lower fees (0.05% taker, 0.01% maker) because there's no LP counterparty—trades match between buyers and sellers directly.

The dYdX token initially served primarily as a governance token, with most trading rewards coming from token emissions rather than fee sharing. This created significant sell pressure as traders immediately sold earned DYDX tokens. Recent governance proposals have shifted toward using protocol revenue for token buybacks, moving closer to GMX's model.

dYdX has generated approximately $380 million in cumulative fees and offers over 200 perpetual markets with up to 100x leverage. The protocol excels at providing deep liquidity for major pairs and competitive fees for high-volume traders.

Hyperliquid: On-Chain Order Book

Hyperliquid launched in late 2024 with a fully on-chain order book running on its custom L1 blockchain. The protocol achieved rapid growth by offering near-instant trade execution, competitive fees (0.045% taker, 0.015% maker), and comprehensive market coverage.

The HYPE token distribution allocated 31% directly to users through an airdrop with zero venture capital allocation. The protocol commits to using 97% of daily trading revenue for token buybacks, creating continuous buying pressure. This model mirrors GMX's real yield approach but applies it more aggressively.

Hyperliquid has processed over $10 billion in daily volume and captured roughly 70% market share among perpetual DEXs. However, with only ~$95 million in cumulative fees (as a newer protocol), it hasn't yet proven long-term sustainability through multiple market cycles like GMX.

Cumulative Revenue Comparison:

GMX: $470M - Proven model since September 2021

dYdX: $380M - Established exchange with deep liquidity

Hyperliquid: $95M - Rapid growth but newer protocol

Each protocol serves different trader needs. GMX prioritizes decentralization and real yield, dYdX offers the most markets and institutional-grade infrastructure, and Hyperliquid provides CEX-like performance with aggressive tokenomics. For stakers seeking passive income from trading fees, GMX remains the clearest value accrual mechanism.

How to Stake GMX

Staking GMX requires connecting a Web3 wallet to the GMX platform and depositing tokens into the staking contract. The process takes just a few minutes and immediately begins earning rewards.

Step-by-step staking process:

Acquire GMX tokens - Purchase GMX on Arbitrum or Avalanche from exchanges like Uniswap, Camelot, or centralized exchanges

Bridge to Arbitrum/Avalanche - If you bought GMX on Ethereum or another chain, bridge to Arbitrum or Avalanche where GMX staking contracts are deployed

Connect wallet - Visit gmx.io and connect your wallet (MetaMask, Rabby, or WalletConnect supported)

Navigate to Earn page - Click "Earn" in the top navigation to access the staking interface

Stake GMX - Enter the amount of GMX you want to stake and confirm the transaction

Claim rewards - Return anytime to claim accumulated ETH/AVAX rewards and esGMX

Once staked, your GMX earns three simultaneous rewards: ETH or AVAX from trading fees (claimable anytime), esGMX that can be staked for compound returns or vested to regular GMX, and Multiplier Points that boost your fee earnings by 100% APR.

You can unstake GMX at any time without lockup periods, but unstaking burns your Multiplier Points proportionally. If you unstake 30% of your GMX, you lose 30% of accumulated MPs. This encourages long-term staking but doesn't force it.

The staking interface displays real-time APR calculations based on recent trading volume, your current boost from Multiplier Points, and total staked GMX. Keep in mind that APRs fluctuate with trading activity—volatile markets generate higher fees and better yields for stakers.

Risks and Considerations

While GMX offers attractive real yield opportunities, staking involves several risks that potential participants should understand before committing capital.

Smart Contract Risk

GMX staking requires depositing tokens into smart contracts that could contain undiscovered vulnerabilities. Although GMX has undergone multiple audits and has been live since September 2021 without major exploits, smart contract risk can never be fully eliminated. Consider the protocol's track record and only stake amounts you can afford to lose.

GMX Price Volatility

Staking rewards are denominated in ETH and AVAX, but your principal is held in GMX tokens. If GMX price declines significantly, your total portfolio value (principal plus rewards) could decrease even as you earn consistent ETH/AVAX yield. This makes GMX staking suitable for those who are long-term bullish on the token, not just seeking yield.

For example, earning 15% APR in ETH while GMX drops 30% in price results in a net loss despite positive yield. Conversely, GMX price appreciation can amplify returns beyond the base staking yield.

Trading Volume Dependency

Staking rewards directly correlate with GMX trading volume. During bear markets or periods of low volatility, trading activity declines and so do fee distributions. APRs can fluctuate between 5-25% depending on market conditions, making returns unpredictable.

The protocol has demonstrated resilience through the 2022 bear market and the 2023-2024 recovery, suggesting sustainable baseline activity. However, future regulatory changes or competing DEXs could impact GMX's market share and fee generation.

esGMX Vesting Requirements

Vesting esGMX into sellable GMX requires reserving an equivalent amount of GMX or GLP tokens. If you earned substantial esGMX but no longer have the original GMX used to earn it, you cannot vest without buying additional GMX. This creates a capital lock-up that may be inconvenient for some users.

Many stakers simply continue staking esGMX rather than vesting it, which compounds returns but also increases exposure to GMX token price.

LP Counterparty Risk

Although GMX stakers don't directly provide liquidity, their returns depend on GM pool LPs continuing to supply capital. If LPs experience sustained losses from profitable traders, they may withdraw liquidity, reducing trading capacity and fee generation. The GMX model requires balanced markets where LPs earn net positive returns over time.

Historically, GMX LPs have been profitable in aggregate, but individual market pools can experience temporary losses. The 63% fee share to LPs helps offset this risk, but it's not guaranteed.

Key Takeaways

GMX has distributed over $134 million to token stakers since September 2021, making it one of the highest-paying DeFi protocols by cumulative holder revenue

GMX stakers earn 27% of protocol fees in ETH or AVAX, while GM pool liquidity providers receive 63%, creating a sustainable real yield model without token inflation

The GMX token has a fixed maximum supply of 13.25 million with no planned inflation, prioritizing value accrual over dilution

Staking GMX generates three simultaneous rewards: base ETH/AVAX fees (claimable anytime), esGMX that compounds when staked, and Multiplier Points that boost yields by up to 100% APR

GMX V2 introduced isolated GM pools that replaced the universal GLP pool, allowing liquidity providers to choose specific markets and manage risk more precisely

Compared to dYdX's order book model and Hyperliquid's aggressive buybacks, GMX offers the most established real yield tokenomics with $470M in cumulative fees

Staking carries risks including GMX price volatility, trading volume dependency, and smart contract exposure that potential stakers should carefully consider

Conclusion

GMX tokenomics demonstrate that sustainable DeFi protocols can generate real revenue and share it with token holders without relying on infinite inflation. By distributing 27% of trading fees to GMX stakers in ETH and AVAX, the protocol has paid out over $134 million since launch—an impressive figure that reflects genuine value accrual rather than artificial emissions.

The combination of fixed token supply, esGMX compounding, and Multiplier Points creates a staking system that rewards long-term believers while remaining accessible to new participants. Whether GMX maintains its position as a leading perpetual DEX depends on continued trading volume, but the tokenomics model has proven resilient through multiple market cycles.

For crypto investors seeking yield backed by protocol revenue rather than token emissions, GMX staking offers one of the most battle-tested models in DeFi. The mechanics are straightforward, the rewards are tangible, and the track record speaks for itself.

GMX Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Previously managing partner at a web3 venture fund (exit in 2021).

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.