Written:

Feb 7, 2026

PancakeSwap burns more CAKE than it emits, achieving 8.19% deflation in 2025. Learn how Tokenomics 3.0 transformed CAKE's value accrual model.

PancakeSwap tokenomics have undergone a dramatic transformation. In April 2025, the protocol launched Tokenomics 3.0, cutting daily emissions by 44% and establishing a target of at least 4% annual deflation. The results so far: over 31 million CAKE tokens burned in 2025 alone, an 8.19% net supply reduction, and a 23-month streak of burns exceeding new emissions. This article explains how CAKE captures value across BNB Chain and what Tokenomics 3.0 means for holders.

What Is PancakeSwap and How Does CAKE Work?

PancakeSwap is a decentralized exchange (DEX) built primarily on BNB Chain, with additional deployments across multiple EVM-compatible networks. It is the dominant DEX on BNB Chain, capturing 64% of protocol revenue on the network.

The CAKE token functions as both a governance and utility asset within the PancakeSwap ecosystem. Holders can stake CAKE to participate in protocol decisions, earn a share of trading fees, and access priority features across the platform's product suite, which includes swaps, liquidity pools, a prediction market, and a lottery.

In January 2026, the community passed a proposal to reduce CAKE's maximum supply cap from 450 million to 400 million tokens. With a circulating supply of approximately 350 million CAKE, this cap reduction limits future dilution and signals the protocol's commitment to a deflationary trajectory.

PancakeSwap Tokenomics 3.0

The tokenomics 3.0 upgrade, implemented in April 2025, represented the most significant structural change in CAKE's history. Here is what changed and why it matters for pancakeswap value accrual.

Before Tokenomics 3.0

The previous model relied on veCAKE (vote-escrowed CAKE), where holders locked their tokens for up to four years to earn boosted rewards and voting power. While this approach reduced selling pressure by locking supply, it created several problems:

Locked tokens could not be used productively elsewhere

The system rewarded long lockups but penalized flexibility

Revenue sharing was complex and difficult for casual holders to access

veCAKE governance concentrated voting power among a small group of large stakers

What Tokenomics 3.0 Introduced

The upgrade addressed these issues through four major changes:

Emission reduction: Daily CAKE emissions dropped from 40,000 to 22,500 tokens, a 44% cut that immediately reduced sell pressure from farming rewards

veCAKE retirement: The vote-escrow staking system was retired, unlocking approximately 79 million staked CAKE tokens and returning them to a liquid state

Enhanced burn mechanisms: 15% of fees from high-volume trading pools are now burned, adding a demand-driven destruction layer on top of existing burn sources

Simplified ownership: Instead of locking tokens for years, CAKE holders now benefit directly from supply reduction without complex staking commitments

The result is a simpler model where CAKE value accrual comes primarily from supply reduction rather than yield farming incentives.

CAKE Value Accrual: How Burns Drive Deflation

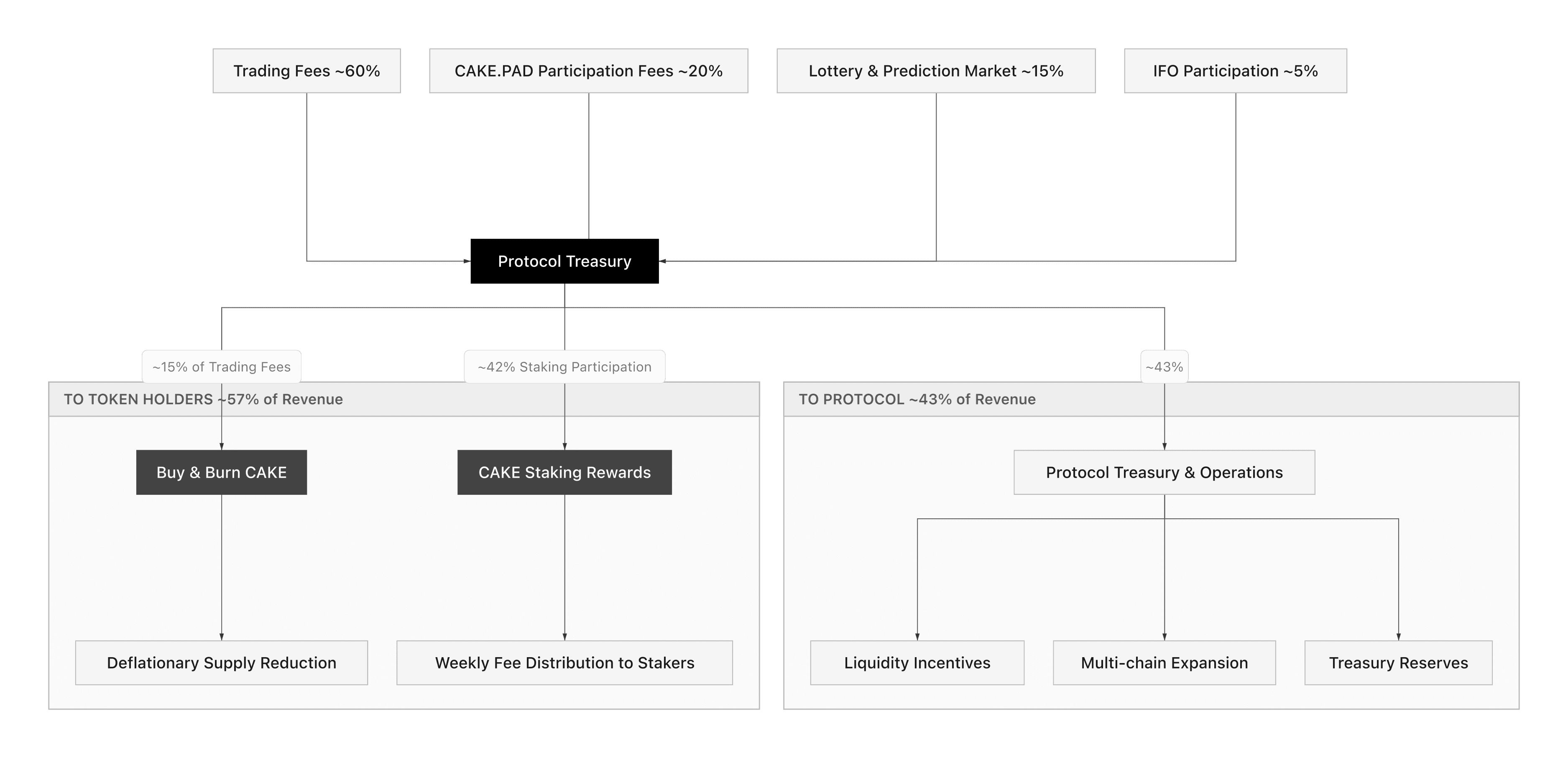

The CAKE value accrual model depends on burns consistently exceeding emissions. PancakeSwap try to achieve this through multiple burn sources operating simultaneously.

Burn Sources

Burn Source | How It Works |

Trading fee burns | 15% of fees from designated high-volume pools are used to buy and burn CAKE |

Lottery burns | CAKE spent on lottery tickets is partially burned |

Prediction market burns | A portion of prediction market fees goes to burns |

CAKE.PAD participation | 100% of participation fees on the CAKE.PAD launchpad are permanently burned |

IFO (Initial Farm Offering) burns | CAKE committed to IFO token sales is burned |

Burn Performance

The numbers tell a clear story of pancakeswap burns accelerating:

2025 full year: Over 31 million CAKE tokens burned, achieving 8.19% net deflation

January 2026: 3.2 million CAKE burned ($4.9 million in value), reducing total supply by 0.805%

Cumulative since March 2025: 43.4 million CAKE removed from circulation

Consecutive deflationary months: 23 and counting

With daily emissions now at 22,500 CAKE and pancakeswap burns regularly exceeding that amount, the protocol has achieved sustained deflation without relying on manual intervention or governance votes to trigger additional pancakeswap burns.

PancakeSwap Holder Revenue: Staking and Fee Distribution

PancakeSwap holder revenue flows through several channels, though the model shifted significantly with Tokenomics 3.0.

Current Revenue Channels

Trading fee share: CAKE stakers receive a portion of trading fees collected across PancakeSwap's pools. Distribution occurs weekly, proportional to each staker's share of the total staked pool.

Deflationary appreciation: With burns exceeding emissions, the effective supply of CAKE decreases over time. Holders benefit from this scarcity effect without needing to actively stake or lock their tokens.

Syrup Pool rewards: PancakeSwap's Syrup Pools offer staking yields in CAKE and partner tokens, though emission rates have been reduced under Tokenomics 3.0.

Revenue Scale

PancakeSwap generates annualized revenue of approximately $27 million, with about 42% of CAKE staked across various pools. The protocol processed $2.36 trillion in trading volume during 2025, a 619% increase year over year. Monthly revenue flows of approximately $2.8 million support both staking rewards and buy-and-burn programs.

PancakeSwap on BNB Chain: Market Position

PancakeSwap's dominance on BNB Chain gives it a structural advantage in the pancakeswap tokenomics model. The protocol captures 64% of DEX revenue on BNB Chain, making it the default trading venue for the network's most active pairs.

Multi-Chain Expansion

While BNB Chain remains the core market, PancakeSwap has expanded to Ethereum, Arbitrum, Base, zkSync, Polygon, and several other networks. This multi-chain presence diversifies revenue sources and increases the total addressable volume for fee generation.

The expansion follows a consistent pattern: deploy on a new chain, incentivize early liquidity with CAKE emissions, then gradually shift to fee-funded sustainability as volume grows. Each chain adds incremental revenue that feeds into the unified burn mechanism.

CAKE.PAD and New Revenue Streams

CAKE.PAD, launched as part of the Tokenomics 3.0 ecosystem, allows users to participate in early token launches by committing CAKE. The innovation here is that 100% of participation fees are permanently burned, creating a direct link between launchpad activity and CAKE deflation.

This model mirrors the pump fun buyback approach in concept but applies it differently: instead of buying back tokens, PancakeSwap simply burns the CAKE that users spend to participate, achieving the same deflationary effect with fewer steps.

Key Takeaways

PancakeSwap tokenomics 3.0 cut daily CAKE emissions by 44% and retired the veCAKE locking system, simplifying the holder experience

CAKE has achieved 23 consecutive months of net deflation, with over 43.4 million tokens burned since March 2025

The maximum supply cap was reduced from 450 million to 400 million CAKE in January 2026, limiting future dilution

PancakeSwap captures 64% of DEX revenue on BNB Chain and processed $2.36 trillion in trading volume during 2025

Multiple burn sources operate simultaneously: trading fees, lottery, prediction market, CAKE.PAD participation, and IFO burns

Pancakeswap holder revenue comes from trading fee distributions, staking rewards, and the passive value appreciation driven by sustained supply deflation

CAKE Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Previously managing partner at a web3 venture fund (exit in 2021).

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.