Written:

Feb 7, 2026

Helium distributes 100% of network fees to operators through its burn-and-mint mechanism. Learn how HNT, IOT, and MOBILE tokens power DePIN.

Helium tokenomics revolve around a single principle: every dollar of network revenue flows back to the people who build and maintain the infrastructure. Unlike most crypto projects that split fees between treasuries, foundations, and insiders, Helium routes 100% of data transfer fees to hotspot operators through its burn-and-mint mechanism. This model has attracted over 990,000 active hotspots worldwide and positions HNT as one of the most direct value accrual tokens in the DePIN sector.

What Is Helium and How Does HNT Work?

Helium is a decentralized wireless network where individuals deploy hotspots to provide IoT and 5G mobile coverage. The HNT token sits at the center of this system, serving as the primary reward and governance asset for the entire network.

The network operates on Solana and uses a burn-and-mint equilibrium (BME) model. Users who need wireless connectivity purchase Data Credits (DCs) by burning HNT. Each Data Credit is pegged at $0.00001 USD, creating a stable pricing layer for network usage. When demand for data increases, more HNT gets burned, reducing circulating supply and creating upward pressure on the token price.

HNT has a hard supply cap of 223 million tokens, with emissions following a biannual halving schedule. After the August 2025 halving, daily emissions dropped to 20,548 HNT per day, down from 41,095 HNT previously. This predictable reduction in new supply mirrors Bitcoin's scarcity model while maintaining enough emissions to reward operators.

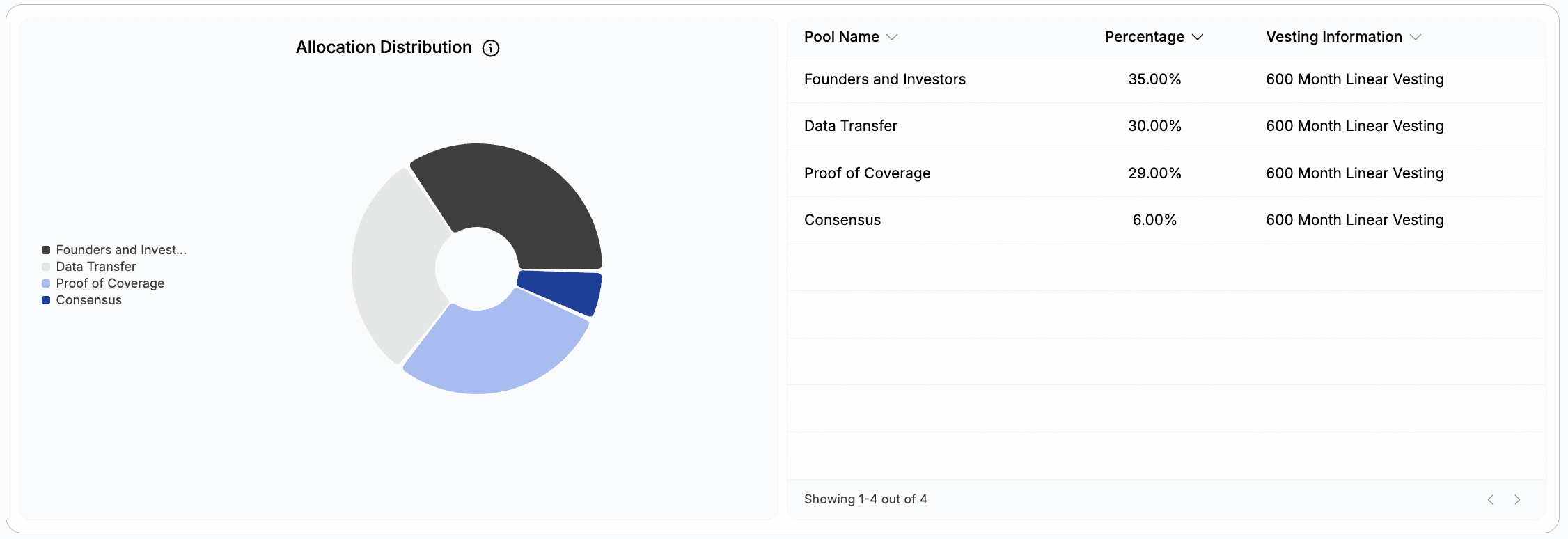

Helium Tokenomics Allocation

How Helium Tokenomics Distribute Value to Operators

The helium tokenomics model is built around what the team calls "HNT Returns," formalized through Helium Improvement Proposal 138 (HIP 138). This proposal, adopted in January 2025, consolidated all network rewards into a single HNT token, retiring the separate IOT and MOBILE subnetwork tokens.

The Burn-and-Mint Cycle

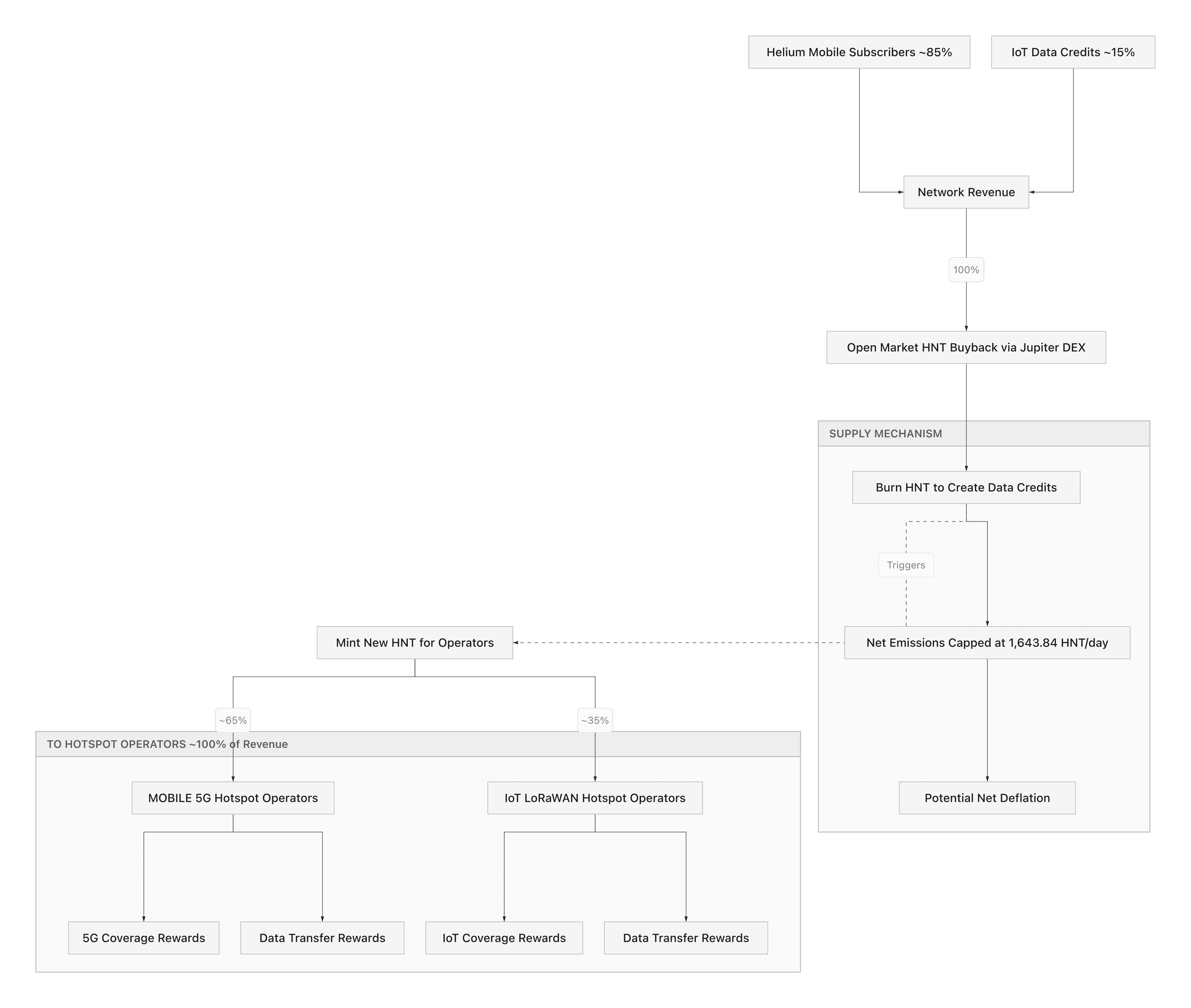

Here is how value flows through the Helium network:

Subscribers pay for data: Helium Mobile customers pay monthly fees in USD for wireless service.

Revenue converts to HNT: Those subscriber dollars are routed to purchase HNT on the open market, primarily through the Jupiter DEX using a dollar-cost averaging mechanism.

HNT burns create Data Credits: The purchased HNT is burned to generate Data Credits, permanently removing tokens from circulation.

Operators earn HNT rewards: Hotspot operators receive freshly minted HNT based on their contribution to network coverage and data transfer.

The critical insight is that network usage directly reduces HNT supply. Every megabyte of data transferred requires Data Credits, which requires burning HNT. As the network grows, burn rates accelerate while emission rates continue halving.

Reward Distribution by Network Type

After the HIP 138 consolidation, HNT rewards are distributed based on a Utility Score that weighs two factors:

Data Credits burned: How much actual demand each subnetwork generates

Active device count: How many operational hotspots serve each subnetwork

The IoT subnetwork covers long-range, low-power device connectivity using LoRaWAN technology. The MOBILE subnetwork provides 5G cellular coverage through citizen-deployed small cells. Both subnetworks now earn HNT directly rather than through intermediate tokens.

HNT Value Accrual

The HNT value accrual mechanism creates a direct relationship between network adoption and token scarcity. Three forces drive this:

Supply reduction through burns: Every data transfer burns HNT permanently. With Helium Mobile subscriber revenue flowing into daily buybacks, the protocol creates consistent buy pressure. In October 2025, the network allocated $3.4 million in revenue to open-market HNT purchases.

Halving schedule: The biannual halving reduces new supply predictably. Annual emissions fell from 15 million to 7.5 million HNT in August 2025. The next halving will cut this to 3.75 million HNT.

Net emissions cap: Even during periods of high burn, the protocol caps daily re-emissions at 1,643.84 HNT. This means if network usage burns more than the cap, the excess creates net deflation.

Together, these mechanisms mean that helium holder revenue grows proportionally with network demand. The helium value accrual model ensures that as more subscribers join and more data flows through the network, the token becomes scarcer while operator rewards remain funded by new emissions.

Helium Hotspot Rewards: What Operators Actually Earn

Helium hotspot rewards depend on several factors that operators should understand before deploying hardware.

Reward Factors

Factor | Impact on Rewards |

Location coverage | Higher rewards in areas with few existing hotspots |

Data transfer volume | More data relayed means higher earnings |

Uptime reliability | Consistent online presence increases reward share |

Network type (IoT vs. MOBILE) | 5G hotspots generally earn more per unit |

Proof of Coverage validation | Passing coverage challenges maintains eligibility |

Current Reward Economics

With daily emissions at 20,548 HNT split across the entire network, individual operator returns depend heavily on local demand density and competition. Urban 5G deployments with active data transfer tend to outperform rural IoT hotspots, though the Utility Score formula attempts to balance incentives across both subnetworks.

Operators should note that reward calculations update each epoch (approximately 24 hours), and the network adjusts distribution based on real-time coverage needs and data demand.

DePIN Tokenomics: How Helium Compares

Helium pioneered the DePIN tokenomics model that dozens of projects have since adopted. The core innovation is using token incentives to bootstrap physical infrastructure that would otherwise require massive capital expenditure.

Compared to other DePIN projects, Helium stands out in several areas:

Revenue maturity: Helium generates real subscriber revenue from its mobile service, not just speculative token demand

Supply discipline: The hard cap and halving schedule create scarcity without relying on manual governance votes

Unified token structure: After HIP 138, the single-token model reduces complexity and concentrates value accrual in HNT

Scale advantage: With nearly one million hotspots, Helium has more deployed hardware than any other DePIN network

The main challenge for helium tokenomics remains scaling demand-side revenue to match or exceed emissions. The helium value accrual thesis depends on sustained growth in actual wireless data usage across the network, and helium holder revenue will track this growth directly.

Key Takeaways

Helium tokenomics route 100% of network fees to operators through the burn-and-mint mechanism, with no value leaking to intermediaries

HNT has a 223 million token hard cap with biannual halvings, currently emitting 20,548 HNT daily after the August 2025 reduction

The HIP 138 consolidation retired IOT and MOBILE tokens, simplifying the system to a single HNT reward token

HNT value accrual is driven by three forces: usage-based burns, scheduled emission reductions, and a daily net emissions cap

Helium hotspot rewards depend on location, data transfer volume, uptime, and network type

As a DePIN tokenomics pioneer, Helium's model is distinguished by real subscriber revenue and a unified token structure

Helium Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Previously managing partner at a web3 venture fund (exit in 2021).

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.