Written:

Feb 2, 2026

Raydium generates over $1.8 million per month in revenue for RAY token holders through an aggressive buyback program funded by trading fees.

Raydium generates over $1.8 million per month in revenue for RAY token holders through an aggressive buyback program funded by trading fees. As Solana's largest automated market maker (AMM) by trading volume, Raydium has repurchased $196 million worth of RAY tokens, representing 26% of circulating supply, using protocol fees collected from traders. This article breaks down how Raydium's tokenomics convert Solana's trading activity into sustained value for RAY holders.

What is Raydium?

Raydium is a decentralized exchange (DEX) and automated market maker built on Solana that enables fast, low-cost token swaps and liquidity provision. Launched in February 2021, Raydium pioneered the integration of on-chain order books with AMM pools by connecting to Serum (now OpenBook), giving traders access to deeper liquidity than standalone AMM protocols.

The platform operates three pool types: Standard AMM pools for basic liquidity provision, Constant Product Market Maker (CPMM) pools with customizable fee tiers, and Concentrated Liquidity Market Maker (CLMM) pools that allow liquidity providers to concentrate capital within specific price ranges. This multi-pool architecture makes Raydium the backbone of Solana DeFi, handling over 55% of all trades routed through Jupiter, Solana's leading DEX aggregator.

Raydium's dominance stems from several competitive advantages. The protocol processes trades with minimal slippage due to concentrated liquidity around active trading pairs. Integration with popular launchpads like Pump.fun drives continuous trading volume. Most importantly, Raydium's buyback mechanism and staking rewards create direct financial incentives for holding RAY tokens, a value accrual model that distinguishes it from competitors.

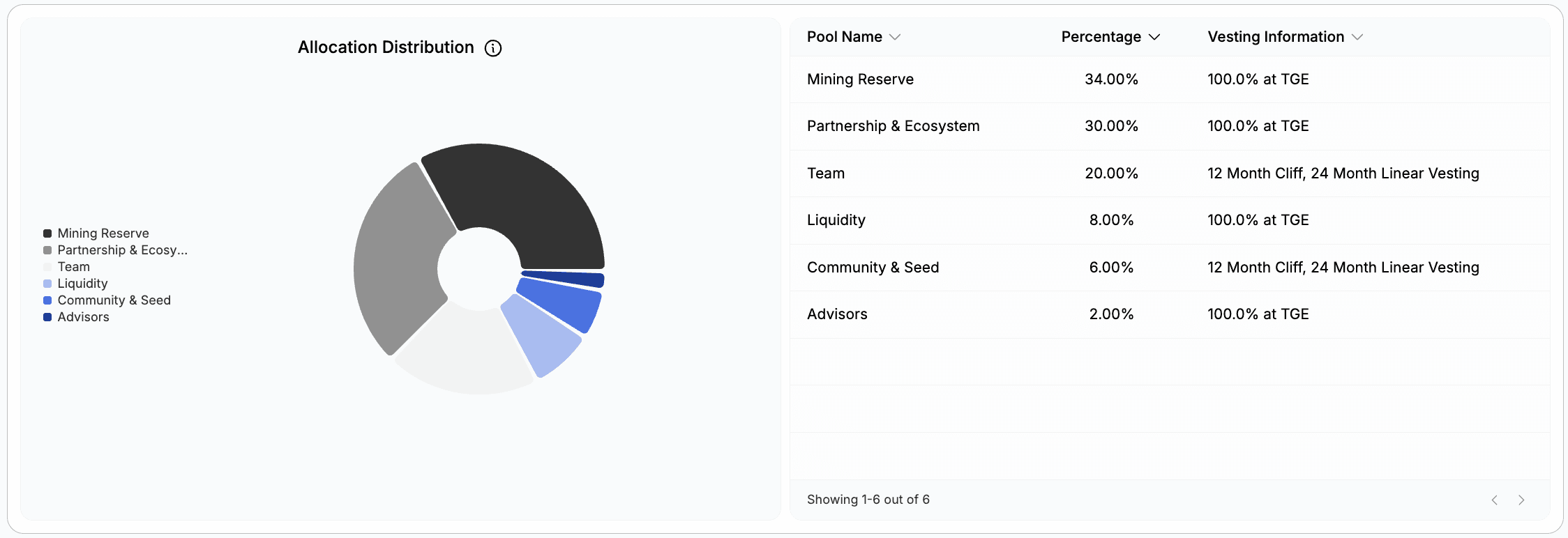

The RAY Token: Distribution and Supply

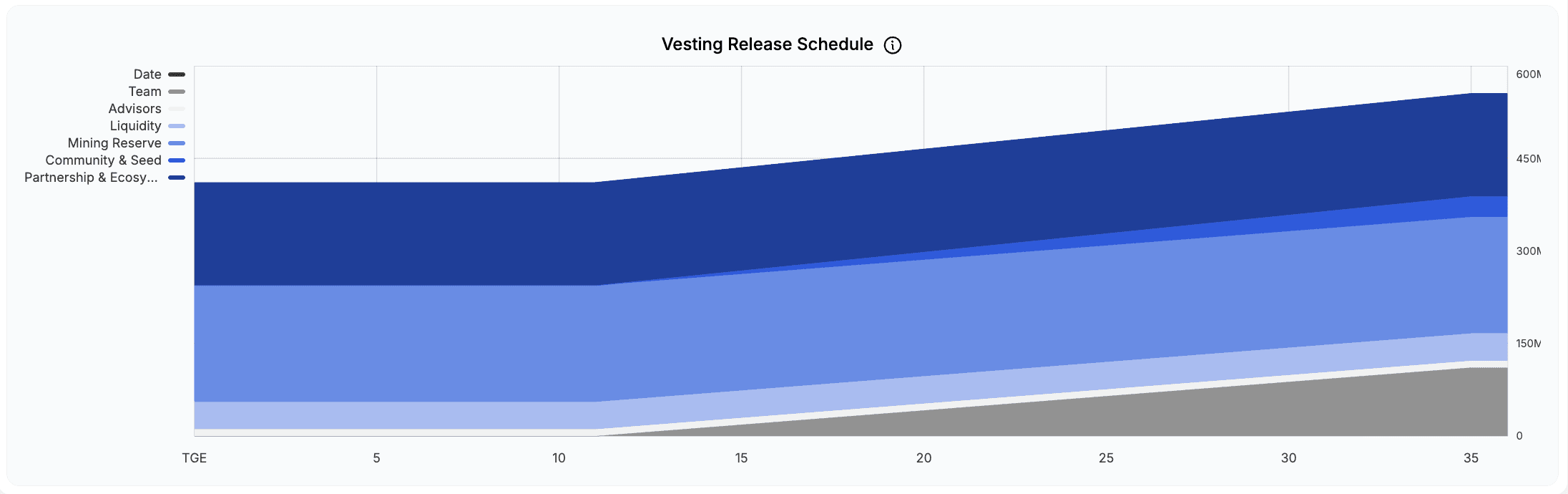

RAY has a maximum supply of 555 million tokens, with 550 million minted at genesis and 5 million reserved for future ecosystem needs. Token distribution follows a structured allocation designed to balance community incentives, team compensation, and protocol sustainability.

The initial token allocation distributed RAY across seven key categories. Community and ecosystem initiatives received 34% (188.1 million RAY), with these tokens airdropped to early liquidity providers over three years. The team and advisors received 20% (110 million RAY) with vesting schedules extending through 2024. Strategic partners and investors received 22.5% (123.75 million RAY) through private sales. Liquidity provision incentives claimed 10% (55 million RAY) to bootstrap initial pools. A partnership liquidity fund received 5.5% (30.25 million RAY), while the platform operations budget received 5% (27.5 million RAY). Finally, 2% (11 million RAY) went to AcceleRaytor launchpad participants, and 1% (5.5 million RAY) supported the DropZone NFT marketplace.

As of January 2025, approximately 270 million RAY tokens circulate in the market, representing 49% of total supply. The remaining tokens vest gradually through 2026, with most major unlock events completed. This controlled release schedule prevented sudden supply shocks that plague many DeFi protocols during cliff unlocks.

Raydium's buyback program has substantially reduced effective circulating supply. Since launching in 2022, the protocol has repurchased roughly 71 million RAY tokens using $196 million in protocol revenue. These buybacks retire 26.4% of circulating supply, creating deflationary pressure that benefits remaining token holders. This aggressive capital return strategy distinguishes RAY from inflationary governance tokens that continuously dilute holders.

How Raydium Generates Revenue

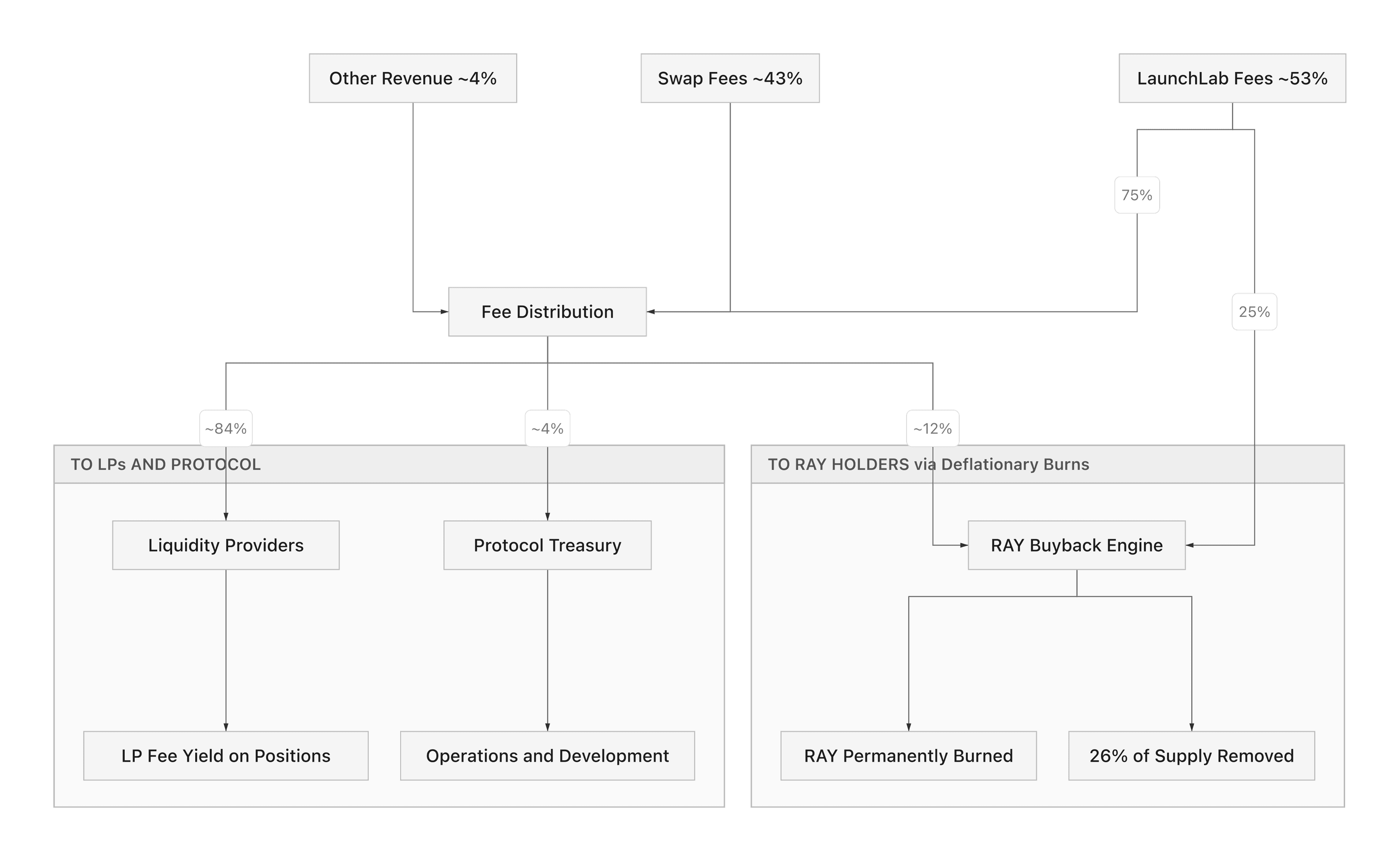

Raydium collects trading fees from every swap executed on the platform, with fee structures varying by pool type to optimize for different trading pairs and liquidity strategies.

Standard AMM pools (v4) charge a 0.25% fee on all trades. Of this amount, 0.22% (88%) goes to liquidity providers who supply capital to the pools. The remaining 0.03% (12%) funds RAY token buybacks, directly benefiting token holders through supply reduction.

CPMM and CLMM pools implement a more flexible fee structure with multiple tiers. CPMM pools offer four fee options: 0.25%, 1%, 2%, and 4%, allowing pool creators to match fees to asset volatility. CLMM pools provide eight fee tiers ranging from 0.01% to 2%, optimized for everything from stablecoin pairs to exotic assets. Across all CPMM and CLMM pools, revenue splits 84% to liquidity providers, 12% to RAY buybacks, and 4% to the Raydium treasury.

This fee distribution accomplishes three objectives simultaneously. Liquidity providers earn competitive yields, incentivizing them to supply capital and maintain deep liquidity. The buyback allocation creates consistent buy pressure for RAY tokens. Treasury funds support protocol development, security audits, and ecosystem grants.

Beyond trading fees, Raydium expanded its revenue streams in April 2025 with the launch of AcceleRaytor LaunchLab. This token launch platform charges a 1% trading fee on newly launched tokens, with 25% directed to additional RAY buybacks. LaunchLab has quickly become a significant revenue contributor, with popular token launches generating millions in additional protocol income.

The cumulative result is substantial. Raydium has generated over $663 million in all-time fees, with approximately $80 million allocated to buybacks and treasury operations. Monthly revenue averages $15 million, though this fluctuates with Solana ecosystem activity and overall crypto market conditions.

Raydium Value Accrual: Staking and Buybacks

RAY value accrual occurs through two primary mechanisms: staking rewards and programmatic buybacks. These complementary systems ensure that protocol growth translates directly to token holder benefits.

Staking RAY for Protocol Fees

RAY holders can stake their tokens on Raydium to earn a share of the 0.03% protocol fee collected from standard AMM pool trades. Staking requires locking RAY tokens for a minimum period, with rewards distributed proportionally based on each staker's share of the total staked supply.

Current staking yields fluctuate between 5% and 15% APY depending on the total amount staked and trading volume. When trading activity surges during bull markets, staking rewards increase correspondingly. Conversely, lower volume periods produce more modest yields. Approximately 20-30% of RAY supply remains staked at any given time, suggesting strong holder confidence in long-term value accrual.

The staking mechanism serves a dual purpose. It provides immediate yield to token holders while simultaneously reducing liquid circulating supply. Locked tokens cannot be sold, decreasing selling pressure and supporting price stability during volatile periods.

The RAY Buyback Program

Raydium's buyback program represents the most aggressive value return mechanism in DeFi. The protocol uses 12% of all trading fees (plus 25% of LaunchLab fees) to programmatically purchase RAY tokens from the open market at frequent intervals.

Since inception, buybacks have consumed approximately $196 million in protocol revenue to retire 71 million RAY tokens. This represents 26.4% of circulating supply, effectively removing more than one-quarter of tradable tokens from circulation. The pace of buybacks accelerated significantly in 2024-2025 as trading volumes surged during the Solana memecoin boom.

Purchased tokens are permanently removed from circulation, creating deflationary tokenomics that contrast sharply with the inflationary models common in DeFi. While many protocols continuously mint new tokens for incentives and dilute existing holders, Raydium does the opposite: systematically reducing supply as usage grows.

The buyback program also experimented with new approaches. In late 2024, Raydium allocated 33,000 SOL (approximately $7 million) from LaunchLab revenue to provide single-sided RAY liquidity. This approach purchased 2.06 million RAY while simultaneously deepening protocol-owned liquidity, demonstrating how buybacks can serve multiple strategic objectives.

The economic impact is substantial. At current trading volumes averaging $15 million in monthly fees, Raydium allocates approximately $1.8 million monthly to buybacks. This consistent buy pressure supports RAY price appreciation during growth periods and provides a floor during market downturns. Token holders benefit from both the supply reduction and the signaling effect of the protocol demonstrating confidence in its own token.

Raydium vs Jupiter vs Orca: Tokenomics Comparison

Understanding Raydium's position requires examining how its tokenomics compare to Solana's other major DEX protocols: Jupiter and Orca. Each platform takes a different approach to token value accrual and holder incentives.

Raydium: The Liquidity Backbone

Raydium processes the highest actual trading volume among native Solana AMMs, handling over 55% of trades routed through Jupiter's aggregator. This dominant liquidity position generates substantial fee revenue ($663 million all-time) with 12% allocated directly to RAY buybacks.

The buyback program has removed 26% of circulating supply, creating deflationary pressure unmatched by competitors. RAY staking offers 5-15% APY from protocol fees, providing immediate yield while locking supply. Raydium's fully diluted valuation (FDV) remains substantially lower than competitors despite higher revenue generation, suggesting relative undervaluation.

Strategic partnerships amplify Raydium's position. The Pump.fun integration brings continuous new token launches and trading volume. LaunchLab provides an additional revenue stream with 25% of fees funding supplemental buybacks. These sticky partnerships create network effects that compound Raydium's liquidity advantages.

Jupiter: The Aggregator King

Jupiter operates as a DEX aggregator rather than a native AMM, scanning multiple Solana DEXs to route trades through the most efficient path. This aggregator model makes Jupiter the most-used interface for Solana trading, but it generates less direct fee revenue than Raydium since it primarily routes through other protocols.

Jupiter launched its JUP governance token in January 2024 via airdrop, distributing 40% of supply to users. The token grants voting rights on protocol decisions but currently offers no staking rewards or fee sharing. This pure governance model leaves JUP without direct value accrual mechanisms.

The major concern for JUP holders is token inflation. The current unlock schedule will increase circulating supply by 127% over the next 24 months, creating substantial dilution pressure. Without fee-sharing or buybacks to offset this inflation, JUP relies entirely on demand growth to maintain token value.

Despite these tokenomics headwinds, Jupiter's dominant market position as the primary Solana trading interface provides strong network effects. The protocol's zero-fee aggregation model maximizes user experience, driving consistent usage that could eventually translate to fee switches or alternative revenue mechanisms.

Orca: Efficiency Without Retention

Orca pioneered concentrated liquidity on Solana with its Whirlpools product, offering capital-efficient trading similar to Uniswap v3. The protocol emphasizes user experience with a clean interface that appeals to DeFi newcomers.

However, Orca struggles with liquidity retention. Despite strong features, Orca's total value locked (TVL) represents only a fraction of Raydium's, resulting in higher slippage for large trades. The lack of a competitive liquidity mining program means liquidity providers often migrate to higher-yield opportunities on competing platforms.

ORCA token holders can stake for governance rights and a share of protocol fees, but yields remain modest compared to Raydium. The protocol has not implemented a buyback program, relying instead on traditional staking rewards to incentivize holding.

Orca's friendly interface and technical efficiency make it a solid choice for smaller trades and DeFi newcomers, but its inability to capture and retain liquidity limits its competitive position against Raydium's dominant pools.

Performance Comparison

Comparing the three protocols across key metrics reveals Raydium's structural advantages:

Revenue Generation: Raydium generates approximately $15 million in monthly fees at peak activity, substantially exceeding Orca while capturing value from trades routed through Jupiter.

Value Accrual: RAY offers dual value capture through staking yields (5-15% APY) and buybacks ($1.8M monthly). JUP provides governance rights only. ORCA offers modest staking yields without buybacks.

Supply Dynamics: RAY supply has contracted 26% through buybacks. JUP faces 127% inflation over 24 months. ORCA maintains stable but non-deflationary supply.

Liquidity Depth: Raydium commands over 55% of trades routed by Jupiter aggregator, indicating deepest liquidity. Orca maintains smaller but efficient pools.

Strategic Moat: Raydium's partnerships with Pump.fun and AcceleRaytor create sticky volume sources. Jupiter's aggregator dominance provides strong network effects. Orca lacks comparable moat.

For token holders prioritizing direct value capture and proven value accrual mechanisms, Raydium's tokenomics offer the clearest path to benefiting from Solana DeFi growth. Jupiter's aggregator position provides optionality despite current tokenomics headwinds. Orca remains a technically sound but competitively challenged alternative.

Concentrated Liquidity Innovation (CLMM)

Raydium launched Concentrated Liquidity Market Maker (CLMM) pools in October 2022, bringing Uniswap v3-style capital efficiency to Solana. This innovation allows liquidity providers to concentrate their capital within specific price ranges rather than spreading it across the entire price curve from zero to infinity.

How CLMM Works

Traditional AMM pools distribute liquidity uniformly across all possible prices. For a SOL/USDC pool, this means capital sits idle at prices far from the current market rate, which is wasted capital that earns no fees. Concentrated liquidity solves this inefficiency by letting providers choose a price range where their capital actively facilitates trades.

For example, a liquidity provider might concentrate capital in the $120-$180 range for a SOL/USDC pair trading at $150. As long as the price remains within this range, the provider's capital earns fees at a much higher rate than it would in a traditional pool. If the price moves outside the range, the capital stops earning until price returns, similar to a limit order.

This design benefits both liquidity providers and traders. Providers earn higher yields per dollar of capital deployed, often 2-5x compared to traditional pools. Traders benefit from deeper liquidity around the current price, resulting in lower slippage and better execution on large orders.

CLMM Features and Flexibility

Raydium's CLMM implementation includes sophisticated features that optimize performance:

Customizable Fee Tiers: Pool creators select from eight fee tiers (0.01%, 0.02%, 0.03%, 0.04%, 0.05%, 0.25%, 1%, 2%) to match asset characteristics. Stablecoin pairs use 0.01% fees to stay competitive. Volatile altcoin pairs use 0.25-1% to compensate providers for impermanent loss risk. Exotic pairs use 2% to account for extreme volatility.

Position NFTs: Each concentrated liquidity position generates a unique NFT representing the specific price range and liquidity amount. Providers can hold multiple positions across different ranges, allowing sophisticated strategies. These NFTs are tradable, creating a secondary market for LP positions.

Permissionless Pool Creation: Any user can create a CLMM pool for any token pair and establish farms (yield incentives) to attract liquidity. This permissionless design has made Raydium the default choice for new Solana token launches.

Dynamic Rebalancing: Advanced providers can adjust positions as market conditions change, moving capital to maintain optimal fee generation. While this requires active management, the increased yields often justify the effort for larger liquidity positions.

CLMM Adoption and Impact

CLMM pools have become increasingly dominant on Raydium, especially for high-volume pairs. Major SOL pairs like SOL/USDC now primarily trade on CLMM pools due to superior capital efficiency. New token launches almost exclusively use CLMM architecture to maximize liquidity depth with limited initial capital.

The shift to concentrated liquidity has improved the overall trading experience on Raydium. Slippage has decreased on major pairs despite relatively stable TVL, as capital concentrates more efficiently around active price levels. This efficiency attracts additional volume, creating a virtuous cycle where better execution brings more trades, which generate more fees, which attract more liquidity providers.

For the broader Solana ecosystem, Raydium's CLMM implementation demonstrates that Solana can support sophisticated DeFi primitives at scale. The technical complexity of managing thousands of concentrated positions would overwhelm Ethereum's limited throughput, but Solana's high transaction capacity handles it seamlessly at minimal cost.

Raydium Protocol Performance

Raydium's tokenomics succeed because they're backed by strong fundamental protocol performance. Revenue generation, liquidity retention, and ecosystem integration all contribute to sustained value accrual for RAY holders.

Trading Volume and Market Share

Raydium consistently processes $20-50 billion in monthly trading volume depending on overall Solana ecosystem activity. During the 2024 memecoin surge, monthly volumes peaked above $70 billion as retail traders flocked to new token launches hosted on Raydium pools.

Market share data reveals Raydium's dominance. Over 55% of all trades routed through Jupiter (which itself handles the majority of Solana DEX volume) execute on Raydium pools. This position as the primary liquidity source for Solana's most-used trading interface creates durable competitive advantages.

Volume concentration in specific pools drives fee generation efficiency. The SOL/USDC pool alone generates millions in monthly fees, with other major pairs like RAY/USDC, USDC/USDT, and various memecoin pools contributing substantially. This concentrated volume in high-activity pools maximizes fee revenue relative to total TVL.

Total Value Locked (TVL)

Raydium maintains approximately $1-2 billion in TVL across all pool types, with significant fluctuation based on crypto market conditions. During bull markets, TVL expands as liquidity providers chase yields. During bear markets, TVL contracts as capital moves to safer assets.

Despite TVL volatility, Raydium's fee generation remains strong due to high trading velocity. The protocol generates more fees per dollar of TVL than most competitors because its deep liquidity attracts high-frequency traders and arbitrageurs who execute large volumes regardless of market conditions.

The TVL composition has evolved as CLMM pools gained adoption. Standard AMM pools still hold substantial value in major pairs, but CLMM pools increasingly dominate new token launches and volatile altcoin pairs where capital efficiency matters most.

Revenue Metrics

Cumulative protocol revenue has surpassed $663 million since launch, placing Raydium among the highest-earning DeFi protocols across all blockchains. Of this total, approximately $196 million has funded RAY buybacks, with the remainder split between liquidity provider rewards, treasury operations, and staking distributions.

Monthly revenue averages $15 million during normal market conditions, with peaks exceeding $30 million during high-volatility periods. This revenue scales directly with trading activity, creating a growth model where increased Solana adoption automatically benefits RAY holders through larger buybacks and higher staking yields.

The revenue-to-FDV ratio for Raydium compares favorably to traditional finance benchmarks. At times, Raydium has generated annualized revenue exceeding 20% of its fully diluted market cap, multiples higher than most DeFi protocols and competitive with profitable Web2 technology companies.

Ecosystem Integration

Strategic partnerships amplify Raydium's protocol performance. The Pump.fun integration brings continuous new token launches that trade exclusively on Raydium pools initially, generating substantial fee revenue from high-volatility early trading. AcceleRaytor LaunchLab provides curated token launches that combine initial liquidity provision with ongoing trading incentives.

Integration with Jupiter's aggregator creates a symbiotic relationship. Jupiter routes trades to Raydium when it offers the best prices, which happens frequently due to Raydium's deep liquidity. This routing drives volume to Raydium, which generates fees, which fund buybacks and staking rewards, which attract more liquidity, which improves prices, which attracts more Jupiter routing. It's a self-reinforcing cycle.

OpenBook integration provides additional liquidity from the on-chain order book, allowing Raydium AMM pools to tap into limit order liquidity. This hybrid model gives Raydium an edge over pure AMM competitors that cannot access order book depth.

Common Questions About Raydium Tokenomics

What makes Raydium's buyback program unique?

Raydium's buyback program stands out for its scale and consistency. With $196 million spent to retire 26% of circulating supply, it represents one of the most aggressive capital return strategies in DeFi. Unlike one-time buybacks or sporadic repurchase efforts, Raydium's program runs continuously, purchasing RAY at frequent intervals using protocol fees. The program also innovated with single-sided liquidity provision, using buyback capital to simultaneously acquire RAY and deepen protocol-owned liquidity. This dual-purpose approach maximizes capital efficiency while supporting token price.

How does RAY staking work?

RAY staking allows token holders to lock their tokens in exchange for a proportional share of protocol fees from standard AMM pools. Stakers earn from the 0.03% protocol fee (12% of the total 0.25% trading fee) collected on trades. Rewards accrue automatically and can be claimed at any time. Staking requires a minimum lock period, though exact duration depends on the specific staking pool chosen. Current yields range from 5-15% APY depending on total staked amount and trading volume. Approximately 20-30% of RAY supply remains staked, indicating strong long-term holder conviction.

Is Raydium better than Jupiter for trading?

Raydium and Jupiter serve different purposes in the Solana ecosystem. Jupiter operates as a DEX aggregator, scanning multiple platforms (including Raydium) to find the best trade execution. Raydium functions as a native AMM providing the underlying liquidity. For users, Jupiter often provides the best interface since it automatically routes to Raydium when it offers optimal prices. However, users who want to provide liquidity and earn fees must interact directly with Raydium pools. From a token holder perspective, RAY offers clearer value accrual through staking and buybacks, while JUP currently provides governance rights without direct fee sharing.

What are the risks of providing liquidity on Raydium?

Liquidity providers on Raydium face several risks. Impermanent loss occurs when token prices diverge significantly from the ratio at which liquidity was provided, potentially resulting in less value than simply holding tokens. This risk increases with CLMM positions since concentrated ranges can lead to positions becoming entirely one asset if price moves beyond the range. Smart contract risk exists despite multiple audits, and bugs or exploits could potentially drain liquidity pools. Token risk applies when providing liquidity for newer or less established tokens that may lose value or become illiquid. Market volatility can create temporary situations where withdrawing liquidity results in losses. However, Raydium's track record of security, combined with competitive fee yields, has attracted substantial long-term liquidity despite these inherent risks.

How does Raydium compare to Ethereum DEXs like Uniswap?

Raydium and Uniswap share similar AMM mechanics, with Raydium's CLMM pools closely resembling Uniswap v3's concentrated liquidity design. The key differences stem from underlying blockchain capabilities. Raydium benefits from Solana's high throughput and low fees, enabling trades that cost pennies in fees and settle in seconds. Ethereum-based Uniswap trades can cost $5-50 in gas fees during network congestion, making small trades economically unviable. This efficiency advantage helped Raydium capture significant market share in retail-oriented trading, especially for memecoins and smaller tokens where Ethereum's costs are prohibitive. However, Uniswap's deeper absolute liquidity and more mature ecosystem make it preferable for very large trades or institutional activity. Both protocols demonstrate successful AMM models adapted to their respective blockchain capabilities.

Key Takeaways

Raydium generates $1.8 million monthly in RAY token holder value through an aggressive buyback program funded by 12% of all protocol trading fees.

The protocol has spent $196 million to repurchase 71 million RAY tokens (26% of circulating supply), creating deflationary tokenomics that contrast with inflationary competitor models.

RAY holders capture value through dual mechanisms: staking yields of 5-15% APY and continuous buyback-driven supply reduction.

Raydium processes over 55% of trades routed through Jupiter aggregator, making it Solana's dominant native AMM by liquidity depth and trading volume.

Concentrated liquidity (CLMM) pools allow capital-efficient liquidity provision, generating 2-5x higher yields for providers while reducing slippage for traders.

Strategic partnerships with Pump.fun and AcceleRaytor LaunchLab create sticky volume sources that compound Raydium's liquidity advantages and fee generation.

Compared to Jupiter and Orca, Raydium offers the clearest path for token holders to capture value from Solana DeFi growth through proven revenue-sharing mechanisms.

Conclusion

Raydium's tokenomics demonstrate how protocol revenue can translate directly into token holder value through systematic buybacks and staking rewards. By allocating 12% of trading fees to RAY repurchases, the protocol has retired over one-quarter of circulating supply while generating $663 million in total revenue. This deflationary approach, combined with Raydium's position as Solana's liquidity backbone, creates sustained demand for RAY tokens independent of speculative narratives.

The concentrated liquidity design positions Raydium to maintain its dominance as Solana DeFi matures. Capital efficiency improvements allow liquidity providers to earn higher yields while traders enjoy lower slippage, benefits that reinforce Raydium's network effects. Strategic integrations with Jupiter, Pump.fun, and AcceleRaytor ensure continuous trading volume regardless of broader market conditions.

For token holders evaluating Solana DeFi opportunities, RAY offers tangible value accrual through proven mechanisms backed by strong protocol fundamentals. The combination of buyback-driven supply reduction, staking yields, and dominant market position makes Raydium's tokenomics a model for how DeFi protocols can create sustainable value for token holders beyond pure governance rights.

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Previously managing partner at a web3 venture fund (exit in 2021).

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.