Written:

Feb 1, 2026

Learn how Aave tokenomics work with the Safety Module, GHO stablecoin revenue, and buyback programs. Complete guide to AAVE value accrual mechanisms.

Aave has evolved from a simple governance token into a multi-layered value accrual mechanism. With the Safety Module, GHO stablecoin revenue, and recent buyback programs, AAVE now offers staking rewards, protocol revenue sharing, and deflationary tokenomics. This guide explains how Aave tokenomics work, where value comes from, and how the protocol's design compares to other DeFi platforms. Understanding Aave tokenomics is essential for evaluating the protocol's investment potential.

What is AAVE Token?

AAVE is the native token of Aave Protocol, the largest decentralized lending platform in DeFi. Originally launched as ETHLend in 2017 and rebranded to Aave in 2020, the AAVE token serves three primary functions: governance rights, protocol security through the Safety Module, and value accrual from protocol revenue.

The token has a capped supply of 16 million AAVE, with approximately 94.88% of tokens now fully unlocked and circulating. Unlike many DeFi governance tokens that provide voting rights without direct financial benefits, AAVE has developed multiple mechanisms to capture and distribute protocol value to token holders.

Key AAVE Token Stats

Total Supply: 16,000,000 AAVE (capped)

Circulating Supply: ~15,181,444 AAVE (94.88% unlocked)

Primary Use Cases: Governance voting, Safety Module staking, GHO borrowing collateral

Annual Protocol Revenue: $100-120 million (2025-2026 estimates)

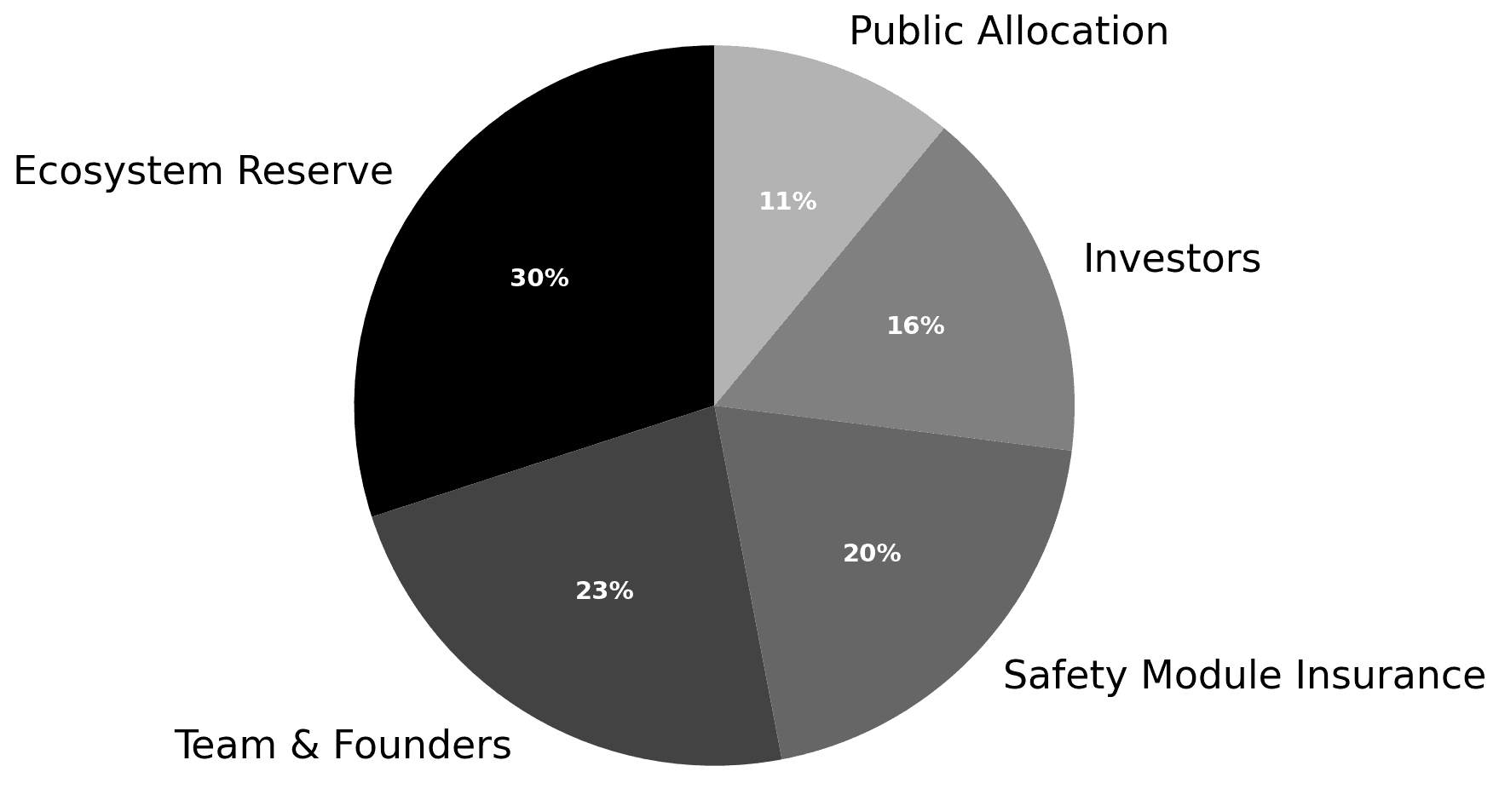

AAVE Token Distribution and Allocation

The initial AAVE token distribution was designed to balance ecosystem development, team alignment, and decentralized governance. The allocation breakdown reflects a typical venture-backed DeFi protocol structure:

Ecosystem Reserve (30%): Allocated for liquidity mining programs, protocol incentives, and ecosystem grants. This reserve funds ongoing development and user acquisition.

Team & Founders (23%): Distributed to the core team with multi-year vesting schedules to ensure long-term commitment and alignment with protocol success.

Investors (16%): Allocated across seed rounds, early-stage investors, and strategic partners who supported development before the mainnet launch.

Safety Module Insurance (20%): Reserved for backstopping protocol risks through the Safety Module, where tokens are staked to cover potential shortfall events.

Public Allocation (11%): Distributed during the 2020 token migration from LEND to AAVE and through secondary market activity.

As of early 2026, nearly all AAVE tokens have completed their unlock schedules, meaning there is minimal future selling pressure from vesting schedules. This full unlock status reduces the risk of dilution and allows Aave tokenomics to focus on value accrual mechanisms rather than emission schedules.

Value Accrual Mechanisms in Aave Tokenomics

Aave has built one of the most comprehensive value accrual systems in DeFi. Unlike pure governance tokens that offer voting rights without direct revenue sharing, AAVE captures value through three primary mechanisms: the Safety Module staking system, GHO stablecoin revenue, and the recently introduced buyback program.

Safety Module: stkAAVE Staking

The Safety Module is Aave's first line of defense against protocol insolvency. Users stake AAVE tokens to earn rewards while accepting slashing risk if the protocol experiences a shortfall event. When you stake AAVE in the Safety Module, you receive stkAAVE, a tokenized representation of your staked position.

How Safety Module Staking Works:

Deposit AAVE: Lock AAVE tokens in the Safety Module smart contract

Receive stkAAVE: Get a staking receipt token representing your position

Earn Rewards: Accrue AAVE token rewards from protocol emissions

Accept Slashing Risk: Up to 20% of staked tokens can be slashed in a shortfall event

The Safety Module originally offered the primary source of yield for AAVE holders, with annual percentage yields ranging from 5-10% depending on total staked amount and reward emissions. However, the introduction of the Umbrella system in June 2025 fundamentally changed the Safety Module dynamics.

Legacy stkAAVE vs. Umbrella:

The legacy stkAAVE system now operates with slashing temporarily disabled during the Umbrella transition period. Stakers continue to receive governance power and some residual yield, but the main safety mechanism has shifted to the Umbrella system, which allows users to stake specific protocol assets like aUSDC, aUSDT, aWETH, and GHO.

Under Umbrella, slashing occurs autonomously when bad debt in a staked asset exceeds preset thresholds, eliminating the governance delay that characterized the original Safety Module. This creates a more capital-efficient system where risk is segmented by asset rather than pooled across the entire protocol.

Current Slashing Risk:

With Umbrella active, the maximum slashing for stkAAVE is 20%, down from the previous 30% cap. However, slashing remains disabled for legacy stkAAVE positions as the system transitions to Umbrella as the primary safety mechanism. This temporary protection gives existing stakers time to evaluate the new system before risking capital loss.

GHO Stablecoin Revenue

GHO is Aave's native overcollateralized stablecoin, launched to create a new revenue stream for the protocol. Unlike traditional Aave markets where interest is split between lenders and the protocol, 100% of GHO interest payments flow directly to the Aave DAO treasury.

This creates a highly profitable revenue model. Every dollar of GHO minted generates roughly the same revenue as $10 borrowed through traditional Aave markets, making GHO approximately 10x more profitable per unit of capital. Despite representing only around $200 million in total borrows, GHO already contributes approximately 10% of total protocol revenue.

GHO Revenue Distribution:

The protocol has allocated 50% of GHO revenue (approximately $6 million annually as of late 2025) to the revenue redistribution program, with the following split:

80% to AAVE Stakers: Distributed to stkAAVE holders as additional yield

20% to StkBPT Holders: Shared with Balancer pool token stakers who provide liquidity

GHO achieved a 10x supply increase in 2024, growing from minimal adoption to over $200 million in circulation. The protocol targets a 5x growth in 2025, aiming for $1 billion in GHO supply. If achieved, this would significantly increase revenue flowing to AAVE stakers.

stkGHO and Aave V4 Integration:

The upcoming Aave V4 introduces stkGHO, a yield-bearing version of the stablecoin. Users can stake GHO in the Umbrella safety module to earn approximately 8.4% APY, creating a positive carry for GHO holders while simultaneously backstopping protocol risk. This innovation turns GHO into both a revenue generator and a safety asset, improving capital efficiency across the protocol.

Buyback Program and Deflationary Pressure

In 2025, Aave governance approved a $1 million per week AAVE buyback program, running for an initial six-month period. This initiative uses protocol treasury funds to repurchase AAVE from secondary markets, creating consistent buy pressure and reducing circulating supply.

Buyback Program Details:

Repurchase Rate: $1 million per week ($4.3 million per month)

Initial Duration: Six months with potential extension

Funding Source: Aave DAO treasury (funded by protocol revenue)

Distribution: Governance can allocate to permanent burns, staker rewards, or treasury reserves

The buyback program effectively introduces a deflationary mechanism to AAVE tokenomics. With $50 million in annual buybacks against $100-120 million in total protocol revenue, approximately 40-50% of revenue flows toward token buybacks. This represents a significant value transfer from protocol treasury to token holders.

Combined with the revenue redistribution to stakers, AAVE now captures value through both direct yield (staking rewards) and indirect value accrual (buybacks reducing supply). This dual approach within Aave tokenomics mirrors traditional equity finance, where companies return capital through both dividends and share buybacks.

Comparing AAVE to Other Lending Tokens

Most DeFi governance tokens launched in 2020-2021 provided voting rights without direct revenue sharing. Uniswap (UNI), Compound (COMP), and others distributed tokens primarily as governance and incentive instruments, explicitly avoiding securities classification by not sharing protocol revenues with token holders.

Aave diverged from this model early by introducing the Safety Module, creating a direct economic relationship between AAVE token holders and protocol risk. This approach to Aave tokenomics positioned AAVE as a productive asset rather than a pure governance token.

Governance-Only vs. Value Accrual Models:

Feature | Pure Governance (UNI, COMP) | Value Accrual (AAVE) |

Voting Rights | Yes | Yes |

Direct Revenue Share | No (until recent changes) | Yes (via Safety Module, GHO) |

Staking Yield | No | Yes (5-10% APY) |

Deflationary Mechanism | No | Yes (buybacks) |

Slashing Risk | No | Yes (up to 20%) |

Recent developments suggest convergence toward the value accrual model. Uniswap activated its fee switch in late 2024, beginning to distribute protocol revenue to UNI stakers. This shift indicates growing recognition that governance-only tokens struggle to capture value even when underlying protocols generate significant revenue.

The Value Accrual Challenge:

A 2025 governance dispute within Aave highlighted the fundamental tension between protocol value and token value accrual. When Aave Labs switched the swap provider on the protocol frontend from ParaSwap to CoW Swap, it was revealed that swap fee revenues (estimated at over $10 million annually) were flowing to Aave Labs rather than the DAO treasury.

This incident exposed a structural issue common across DeFi: strong protocol fundamentals do not automatically translate into token value if governance lacks clear mechanisms for value capture. The controversy led to renewed focus on AAVEnomics updates and clearer delineation between company equity value and token holder value.

Lessons from the Governance Crisis:

The Aave Labs controversy demonstrates that even well-designed tokenomics can fail if operational control and revenue rights diverge from token governance. Value accrual requires not just revenue-sharing mechanisms but also clear protocol ownership and transparent revenue routing.

Protocols that maintain ambiguity about who controls revenue streams risk repeating Aave's governance conflict, where community members discovered that millions in annual fees bypassed the DAO entirely.

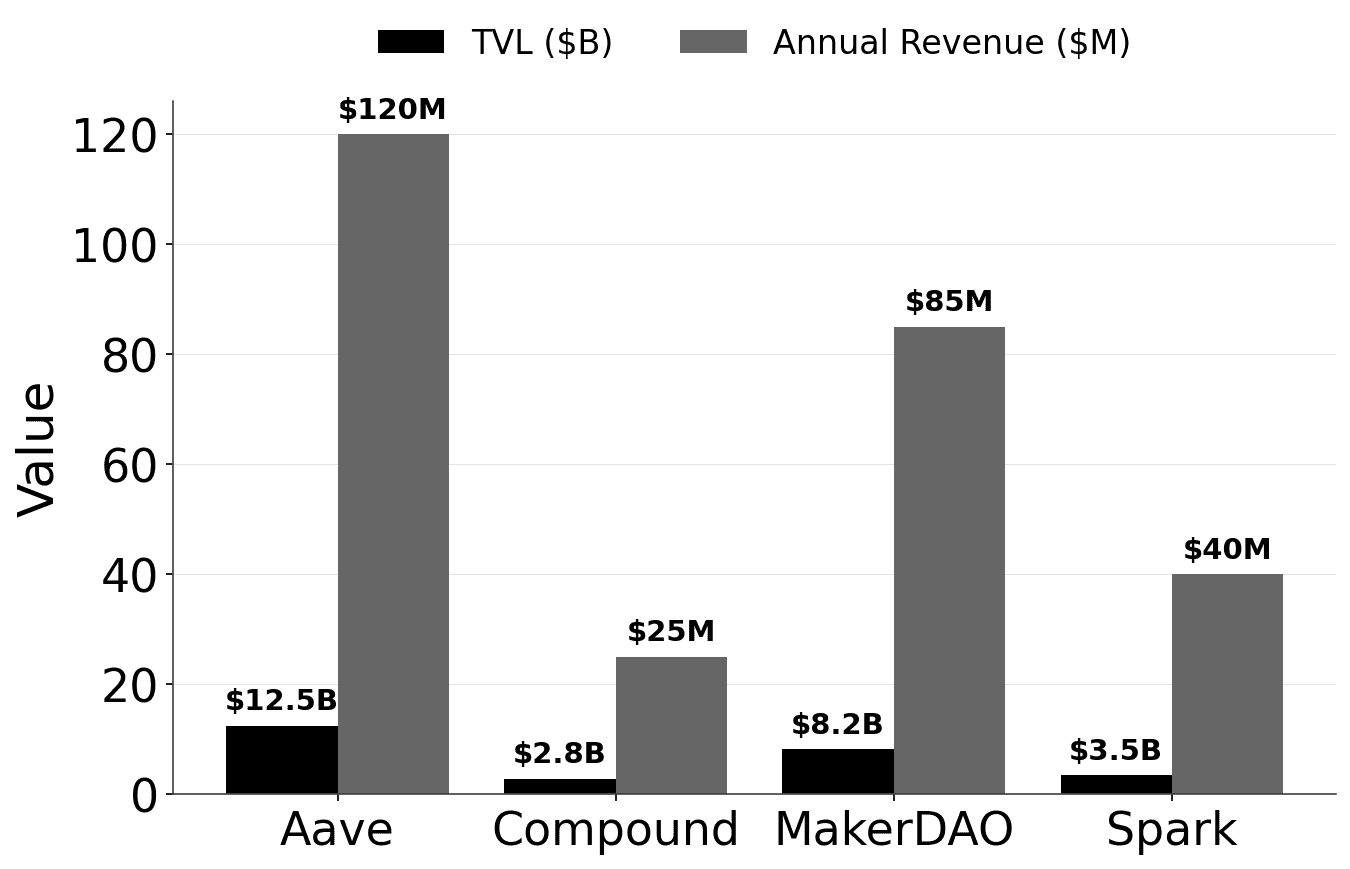

Protocol Performance and Financial Metrics

Aave's financial performance underpins the value of its tokenomics. As the largest DeFi lending protocol by total value locked (TVL), Aave generates consistent revenue from borrowing interest across multiple blockchain networks.

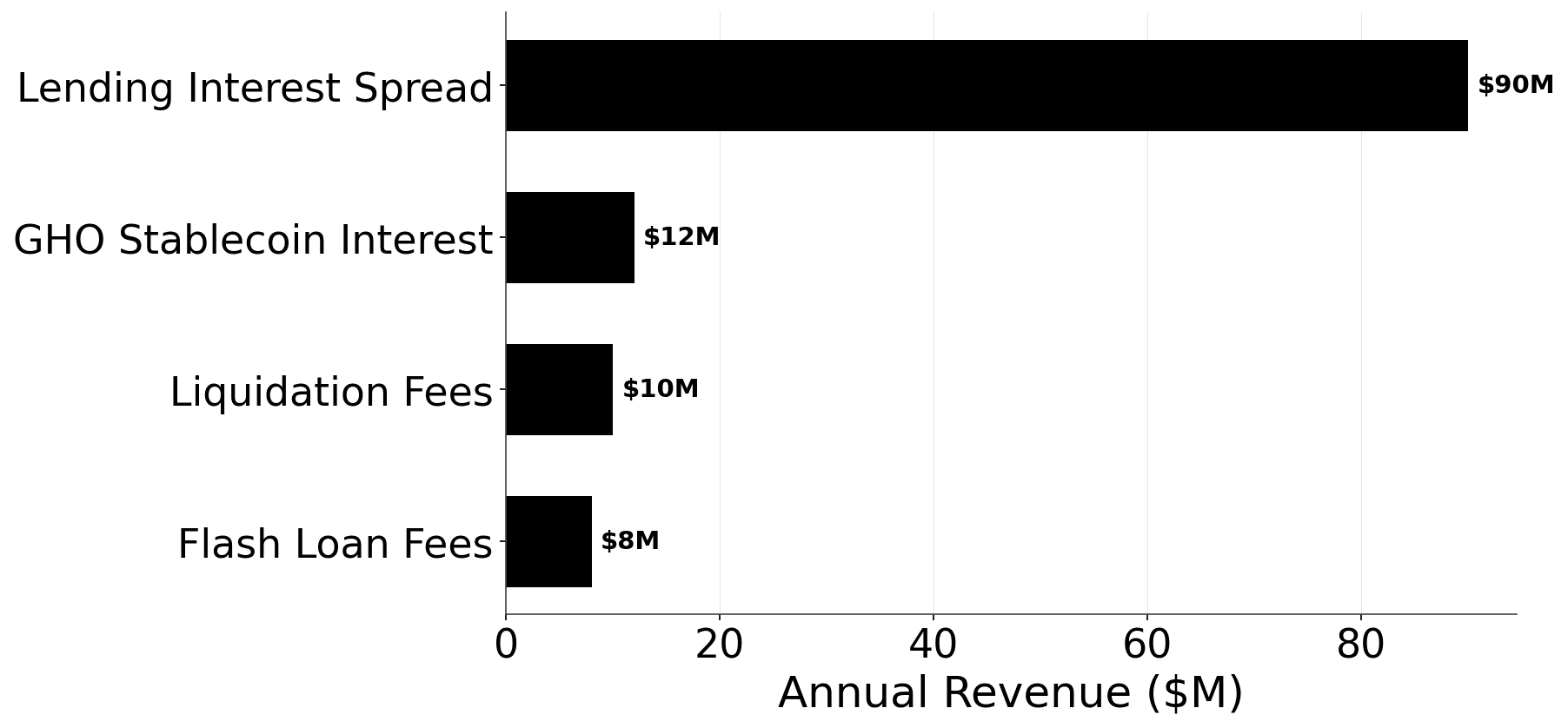

Revenue and Growth Metrics:

Annual Protocol Revenue: $100-120 million (2025-2026 estimates)

GHO Contribution: ~10% of total revenue ($10-12 million)

Target GHO Growth: 5x in 2025 (from $200M to $1B supply)

Buyback Budget: $50 million annually (permanent allocation)

The protocol's revenue comes from the interest rate spread between borrowers and lenders. Aave takes a small percentage of each loan's interest as protocol revenue, which accumulates in the DAO treasury. This revenue model scales with borrowing demand, making Aave's value proposition tied to overall DeFi adoption and lending activity.

Multi-Chain Expansion:

Aave operates across Ethereum, Polygon, Avalanche, Arbitrum, Optimism, and other Layer 2 networks. This multi-chain presence diversifies revenue sources and reduces dependency on Ethereum gas fees, though Ethereum mainnet still represents the largest share of protocol activity and revenue.

Competitive Position:

Compared to other lending protocols, Aave maintains the highest TVL and most liquid markets. Compound and other competitors have struggled to match Aave's scale, partially because Aave's tokenomics incentivize liquidity provision and protocol security through the Safety Module and liquidity mining programs.

The GHO stablecoin represents a significant competitive advantage. While MakerDAO's DAI dominates decentralized stablecoins by market cap, GHO's 100% revenue retention makes it far more profitable per dollar of supply. If GHO achieves the targeted $1 billion supply, it could contribute $50-60 million in annual revenue, rivaling the rest of the protocol's lending markets.

Key Takeaways

AAVE token captures value through the Safety Module staking system, GHO stablecoin revenue distribution, and a $50 million annual buyback program, creating multiple layers of value accrual beyond pure governance rights.

The Safety Module offers 5-10% APY for staking AAVE but carries up to 20% slashing risk in protocol shortfall events, creating a risk-return tradeoff that distinguishes AAVE from governance-only tokens.

GHO stablecoin generates approximately 10% of protocol revenue despite representing only $200 million in borrows, with 50% of GHO interest distributed to AAVE stakers, making it roughly 10x more profitable than traditional lending markets.

The 2025 governance crisis revealed that protocol revenue control matters as much as tokenomics design, with Aave Labs routing an estimated $10 million annually in swap fees outside the DAO treasury, highlighting structural risks in DeFi governance.

Unlike pure governance tokens that struggled to capture value despite strong protocol fundamentals, AAVE's revenue-sharing mechanisms have positioned it as a productive asset, though this approach may carry higher regulatory risk.

Conclusion

Aave tokenomics represent one of the most mature value accrual systems in DeFi, combining staking rewards, revenue redistribution, and deflationary buybacks to create multiple pathways for token holders to capture protocol value. The Safety Module addresses the fundamental challenge of DeFi lending, specifically who bears the risk of protocol insolvency, by compensating stakers for accepting slashing exposure.

GHO's rapid growth and exceptional profitability could transform AAVE's value proposition if the stablecoin achieves meaningful scale. The upcoming V4 integration with stkGHO creates positive feedback loops where GHO holders simultaneously earn yield and backstop protocol risk, potentially accelerating adoption.

However, the 2025 governance crisis demonstrates that even sophisticated tokenomics cannot fully solve the principal-agent problem between protocol developers and token holders. Clear revenue routing, transparent operational control, and alignment between equity value and token value remain ongoing challenges for decentralized governance.

For token holders evaluating Aave tokenomics, the core question is whether the protocol's revenue growth, GHO adoption, and buyback program outweigh the governance risks and potential regulatory scrutiny of revenue-sharing tokens. The shift from governance-only to value-accrual models across DeFi suggests the industry is converging on AAVE's approach, but implementation details will determine which protocols successfully translate revenue into sustainable token value.

AAVE Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Previously managing partner at a web3 venture fund (exit in 2021).

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.