Written:

Feb 7, 2026

Balancer generates $23M in annualized fees from customizable liquidity pools. Learn how BAL tokenomics captures value through veBAL governance, protocol fees...

Balancer distributes 75% of all protocol fees to veBAL holders through its vote-escrowed governance model. This article examines how BAL tokenomics captures AMM value in v3.

What Is Balancer?

Balancer is a decentralized automated market maker (AMM) protocol that enables customizable liquidity pools with up to eight different tokens per pool. Unlike traditional AMMs that require equal token weights, Balancer allows pool creators to set custom weight distributions, providing greater flexibility for liquidity providers and traders.

The protocol launched in March 2020 and has processed over $39.93 million in cumulative revenue since inception. Balancer operates across multiple Ethereum Virtual Machine (EVM) compatible chains, offering lower trading fees compared to major competitors. The average trading fee on Balancer is 6 basis points (bps), significantly lower than Uniswap's 24 bps average.

Balancer v3 launched with partnership integration with Aave, introducing 100% boosted pools that automatically deploy idle liquidity into external lending markets. This architecture overhaul combines swap fees with lending yields, creating multiple revenue streams for liquidity providers while maintaining capital efficiency.

The protocol's core innovation lies in its weighted pool design and flexible fee structure. Each Balancer pool can set its own trading fee based on strategy requirements, with protocol fees taken as a percentage of total swap fees. This model allows Balancer to serve diverse use cases, from stablecoin trading to balanced portfolio management.

Balancer Tokenomics: BAL Supply and Distribution

The BAL token serves as both a governance token and the foundation for Balancer tokenomics value accrual mechanisms. Understanding the supply structure and emission schedule is essential for evaluating long-term token holder incentives.

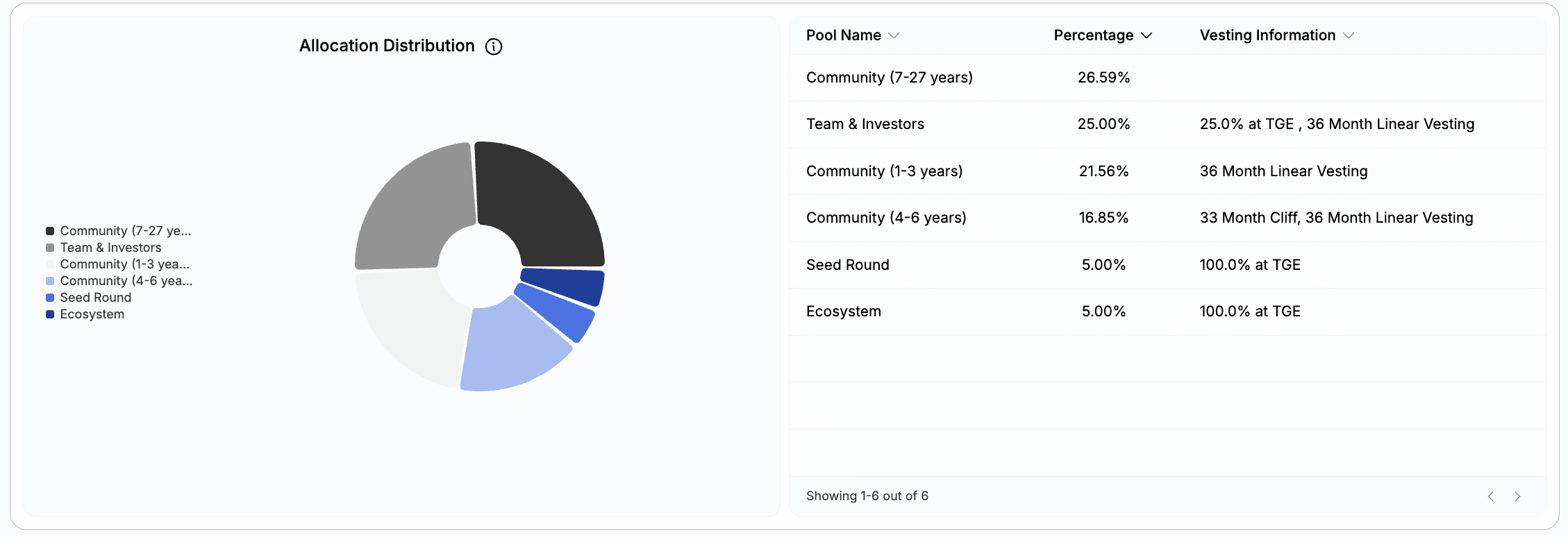

Token Allocation

The maximum supply of BAL is capped at 100 million tokens, distributed across four primary categories. This allocation structure balances team incentives, ecosystem growth, and community distribution.

The initial token allocation breakdown:

Liquidity Mining: 65 million BAL (65% of total supply) allocated to liquidity providers through a long-term emission program designed to run until approximately 2050

Founders, Options, Advisors, and Investors: 25 million BAL (25%) with vesting schedules where 25% unlocked immediately and 75% vested continuously over three years

Ecosystem Fund: 5 million BAL (5%) deployed to attract strategic partners and grow the Balancer ecosystem

Fundraising Fund: 5 million BAL (5%) reserved for initial and future fundraising rounds at a seed price of $0.60 per BAL

The allocation prioritizes long-term liquidity provider rewards, with 65% of all tokens dedicated to liquidity mining. This heavy emphasis on LP rewards differentiates Balancer tokenomics from other AMM protocols that allocate larger portions to early investors and team members.

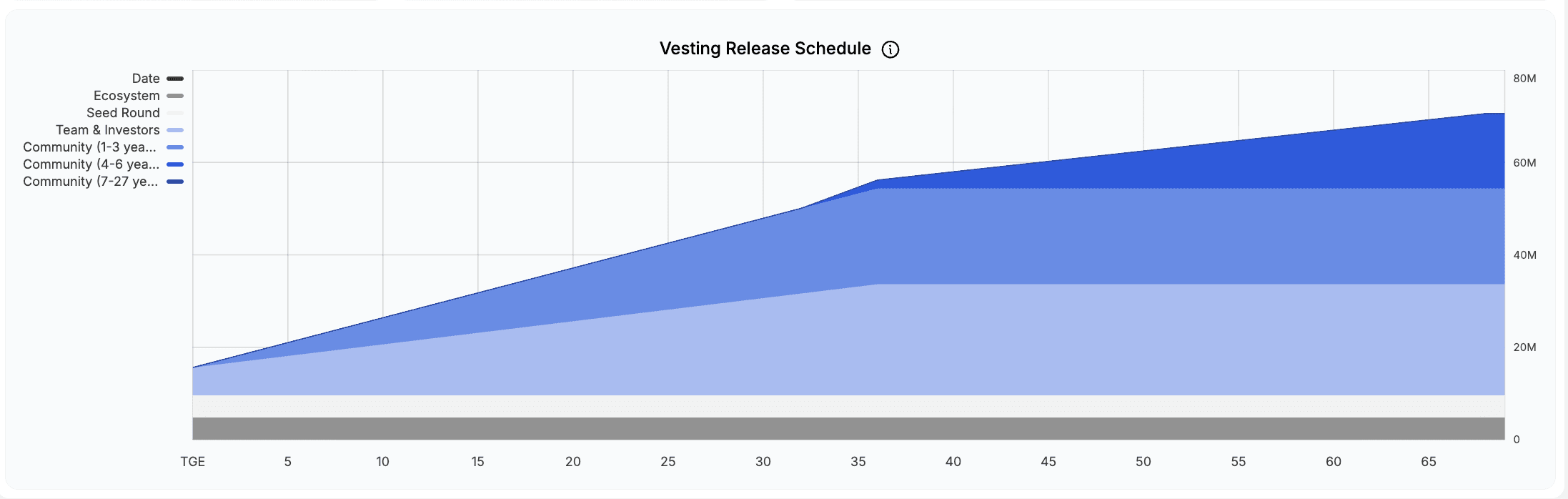

Emission Schedule

BAL emissions follow a decreasing schedule designed to sustain liquidity incentives while gradually reducing inflation. The emission model halves every four years, similar to Bitcoin's supply reduction mechanism.

Current emission metrics as of 2026:

Weekly emissions: 145,000 BAL distributed to liquidity providers through gauge voting

Annual emissions: 7.5 million BAL per year under the current schedule

Next halving: 2026 (four years after veBAL tokenomics launch in early 2022)

Expected final supply: 96 million BAL when emissions conclude around 2050

The veBAL migration in early 2022 introduced gradual annual reductions in addition to the four-year halving schedule. Each year following the tokenomics launch includes incremental decreases in BAL inflation, creating a smooth downward curve rather than abrupt halvings.

This emission schedule ensures Balancer maintains adequate liquidity mining incentives through 2050 while preventing excessive token dilution. The gradual reduction allows the protocol to adjust fee revenue targets as emissions decrease, transitioning from inflation-based rewards to fee-based sustainable revenue.

How Balancer Generates Revenue

Balancer generates revenue through trading fees and yield capture mechanisms. The v3 architecture expanded revenue sources beyond traditional swap fees, introducing new value streams from integrated lending protocols.

v3 Fee Model: Trade Fees + Yield Capture

Balancer v3 implements a dual revenue model that combines traditional swap fees with automated yield generation. This structure increases capital efficiency while creating multiple income sources for both liquidity providers and the protocol.

The v3 fee model operates through two primary mechanisms:

Swap fee revenue comes from traders exchanging tokens within Balancer pools. Each pool sets its own swap fee rate, typically ranging from 0.01% to 10% depending on the asset pair and volatility. The protocol takes a governance-adjustable percentage of these swap fees as protocol fees.

Yield capture revenue originates from Boosted Pools, which automatically deploy idle liquidity into external lending markets like Aave. When assets sit in a Balancer pool waiting for trades, they generate lending interest rather than remaining unproductive. The protocol takes a portion of this yield as additional revenue.

As of BIP-371 implemented in August 2023, the fee split structure is:

50% of swap fees go to the protocol

50% of wrapped token yield fees go to the protocol (on non-exempt pools with rate providers)

100% of collected BAL fees are distributed to veBAL holders

This dual-revenue architecture positions Balancer v3 ahead of traditional AMMs that only capture swap fee revenue. The integration of automated yield strategies through Boosted Pools adds a passive income layer that continues generating returns even during periods of low trading volume.

The protocol's flexible hooks framework also enables developers to create custom fee structures for specialized pools. These hooks allow for dynamic fee adjustments based on market conditions, MEV tax implementation for high-priority transactions, and other revenue optimization strategies.

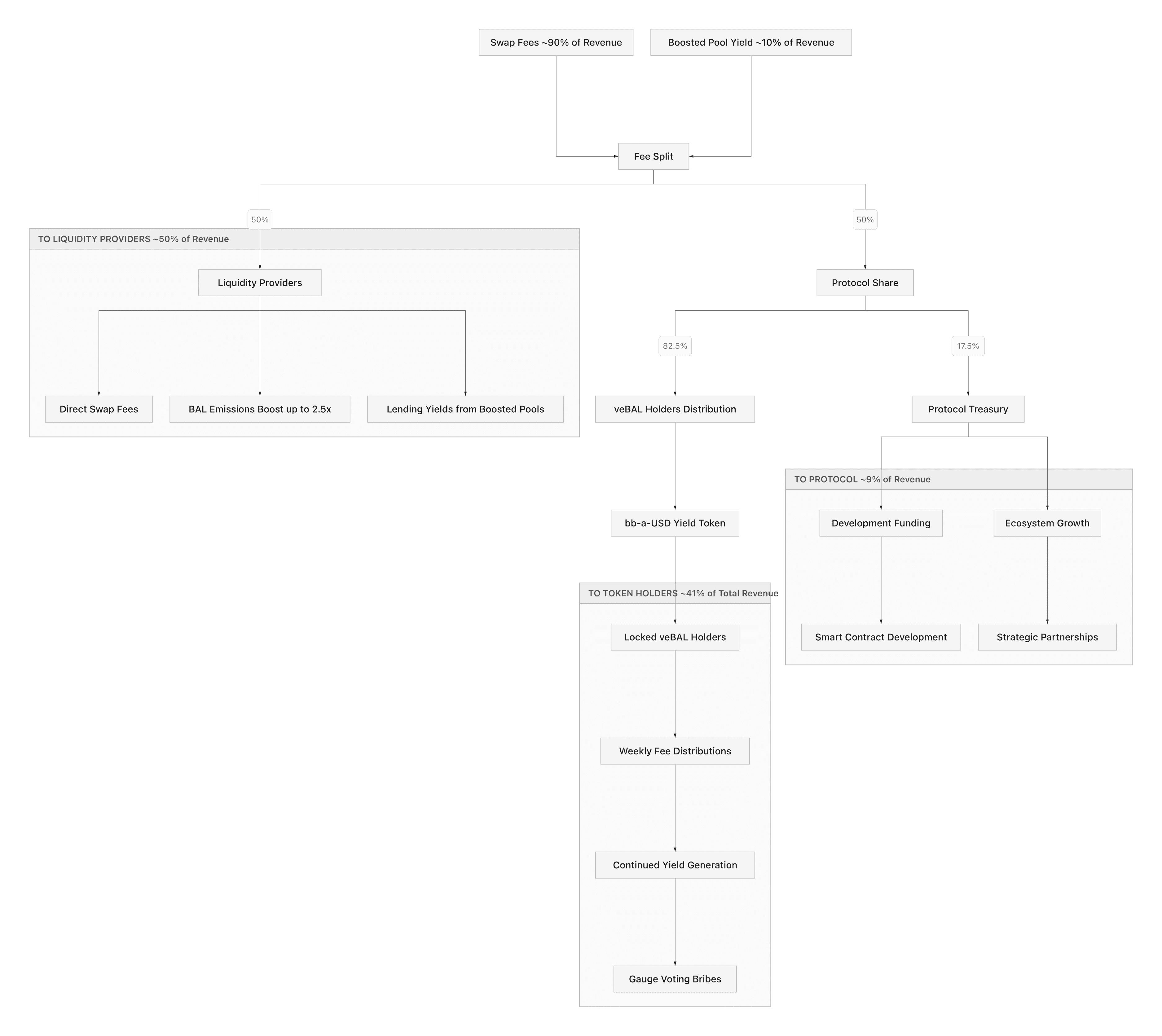

Protocol Fee Split

Balancer protocol fees flow through a defined distribution mechanism that allocates revenue between the protocol treasury and token holders. This split determines how value accrues to different stakeholders within the ecosystem.

The current protocol fee distribution following BIP-371:

50% protocol take rate on all swap fees from trading activity

50% protocol take rate on yield fees from Boosted Pools

82.5% distribution to veBAL holders (updated from original 75% following BIP-457)

17.5% to protocol treasury for ecosystem development and operations

The increase from 75% to 82.5% for veBAL holders reflects governance decisions to enhance value accrual for locked token holders. This adjustment provides stronger incentives for long-term BAL staking through the veBAL mechanism.

Protocol fees are collected and distributed weekly. veBAL holders receive their share in bb-a-USD (Balancer Boosted Aave V3 USD Composable Stable Pool), a yield-bearing stablecoin basket that continues generating returns even after distribution. This fee token selection came from community governance in May 2023.

As of February 2026, Balancer generates approximately $189,000 in monthly revenue, with an annualized run rate of $2.31 million. The protocol targets $250,000+ in monthly revenue by Q2 2026, with at least 50% coming from sustainable sources (non-incentivized or fee-positive pools).

The protocol fee split balances immediate value distribution to veBAL holders with long-term treasury funding for ecosystem growth. This structure aligns with sustainable tokenomics principles where protocol revenue eventually exceeds token emission costs.

veBAL Value Accrual

The veBAL (vote-escrowed BAL) system forms the core value accrual mechanism for Balancer tokenomics. Token holders who lock their BAL receive enhanced governance rights, protocol fee distributions, and liquidity mining boosts.

Vote-Escrowed Locking Mechanism

The veBAL locking mechanism adapts Curve's pioneering veCRV model to create time-weighted voting power and fee distribution rights. Users lock 80/20 BAL/WETH Balancer Pool Tokens (BPT) for up to one year to receive veBAL.

The veBAL calculation formula is:

veBAL balance = (amount of BPT locked) × (weeks remaining in lock / 52)

For example:

Locking 1 BPT for 52 weeks (1 year) = 1 veBAL

Locking 1 BPT for 26 weeks (6 months) = 0.5 veBAL

Locking 2 BPT for 26 weeks = 1 veBAL

The veBAL balance decays linearly as the lock period approaches expiration. A user who locked tokens for one year will see their veBAL balance decrease proportionally each week. This decay mechanism ensures voting power reflects current commitment rather than past decisions.

Key characteristics of the veBAL system:

Non-transferable: veBAL tokens cannot be transferred or traded. They represent a locked position rather than a liquid asset.

Time-weighted power: Longer lock durations grant proportionally more veBAL per BPT locked, incentivizing long-term commitment.

Flexible relocking: Users can extend their lock period or add more BPT to their existing lock position at any time.

Maximum duration: The one-year maximum lock period is shorter than Curve's four-year maximum, making Balancer staking more accessible to shorter-term holders.

The 80/20 BAL/WETH pool requirement (rather than pure BAL) provides liquidity and price stability. This structure ensures the governance token maintains tradable depth while encouraging long-term locking behavior.

veBAL holders receive three primary benefits: protocol fee distributions (82.5% of all fees), gauge voting power to direct BAL emissions, and boosted liquidity mining rewards on their provided liquidity.

Gauge Voting and Bribes

Gauge voting enables veBAL holders to direct BAL emissions toward specific liquidity pools each epoch. This mechanism determines which pools receive liquidity mining incentives, creating a marketplace for vote influence.

The gauge voting system operates on weekly epochs:

veBAL holders vote to allocate their voting power across different pool gauges

BAL emissions for the next week distribute proportionally based on gauge vote weights

Liquidity providers in pools with more gauge votes receive higher BAL rewards

The voting cycle resets each week with a new allocation round

For example, if a pool receives 10% of total gauge votes, it will receive approximately 10% of the weekly 145,000 BAL emission. This direct correlation between votes and emissions creates strong incentives for projects to influence veBAL voting.

Vote incentives (bribes) emerged as a natural byproduct of gauge voting power. External projects offer token rewards to veBAL holders who vote for their pools, creating additional yield streams for governance participants.

The Balancer bribe ecosystem includes:

Hidden Hand: A vote incentive marketplace where projects deposit token bribes for specific gauges

Warden: A platform connecting bribe offerers with veBAL holders

Votemarket: Another bribe aggregation service for gauge voting

Projects typically offer bribes when they want to:

Bootstrap new pool liquidity quickly

Maintain competitive emissions for existing pools

Attract long-term liquidity without permanent token spending

For veBAL holders, bribes represent supplementary income beyond protocol fees. Large veBAL positions can earn substantial returns by strategically voting for high-bribe pools each week. This creates a market-driven system where capital naturally flows toward pools offering the best combined returns (BAL emissions + bribes).

The bribe model increases total veBAL value accrual beyond the stated 82.5% protocol fee share. When factoring in bribe income, effective returns for active veBAL voters often exceed protocol fee distributions alone.

Liquidity Mining Boosts

veBAL provides liquidity mining boosts that multiply the base BAL rewards earned by liquidity providers. This boost mechanism rewards users who both provide liquidity and lock tokens for governance.

The boost calculation considers two factors:

Staked liquidity amount: How much liquidity a user provides to gauged pools

veBAL balance: The user's vote-escrowed token holdings

A user's boost multiplies their base BAL emissions up to 2.5x. The exact multiplier depends on the ratio between their veBAL holdings and their share of total pool liquidity.

Minimum boost: 1x (no boost) for liquidity providers with zero veBAL Maximum boost: 2.5x for liquidity providers with sufficient veBAL relative to their LP share

The boost formula incentivizes balanced behavior. A user providing $100,000 in liquidity needs proportionally more veBAL to achieve maximum boost than someone providing $10,000. This prevents large LPs from farming emissions without governance commitment.

For example, achieving 2.5x boost on $100,000 of provided liquidity requires significantly more locked BAL than boosting $10,000. The relationship is not linear, meaning smaller LPs can achieve maximum boost more easily than larger ones.

This structure benefits several stakeholder groups:

Small liquidity providers can achieve high boosts with modest veBAL holdings, improving their competitive position against larger LPs.

Large liquidity providers must accumulate substantial veBAL positions to maintain maximum boost, creating buying pressure on BAL tokens.

veBAL accumulators who provide liquidity can enhance their locked tokens for enhanced mining rewards beyond fee distributions.

The liquidity mining boost adds a third value accrual stream for veBAL holders alongside protocol fees and gauge bribes. Combined, these mechanisms create strong economic incentives for long-term BAL holding and active governance participation.

Balancer v3: Architecture Overhaul

Balancer v3 represents a fundamental redesign of the protocol's core infrastructure. The architecture introduces native support for yield-bearing tokens, a flexible hooks framework, and improved capital efficiency through boosted pool designs.

Boosted Pools and Hooks

Boosted Pools solve the capital efficiency problem that plagues traditional AMMs. Most liquidity in standard pools sits idle waiting for trades. Balancer v3 automatically deploys this idle capital into external lending markets, generating continuous yield.

The Boosted Pool mechanism works through token wrapping:

Users deposit regular tokens (USDC, DAI, USDT) into a Balancer pool

The pool automatically wraps these into yield-bearing versions (aUSDC, aDAI, aUSDT from Aave)

Wrapped tokens earn lending interest while simultaneously providing swap liquidity

When trades occur, the pool unwraps necessary amounts for settlement

Idle balances remain wrapped and continue earning lending yields

This design creates a layered revenue structure for liquidity providers:

Base layer: Lending yields from protocols like Aave (typically 2-8% APR)

Second layer: Swap fees from trading activity

Third layer: BAL token emissions from liquidity mining

Fourth layer: Additional yield from boosted position optimization

The v3 launch in partnership with Aave enables 100% boosted pools where all deposited assets immediately begin generating lending returns. This positions Balancer as a superior yield venue compared to standard AMMs that offer only swap fee income.

The hooks framework extends pool functionality beyond standard trading mechanics. Hooks are customizable smart contract extensions that trigger at specific points in the pool lifecycle:

Before swap: Adjust fees dynamically based on market conditions

After swap: Implement MEV taxes or routing optimizations

Before join/exit: Apply custom entry/exit logic

After join/exit: Trigger rebalancing or yield harvesting

Hook use cases in the Balancer ecosystem include:

Dynamic fee adjustment: Pools can increase fees during high volatility and decrease during stable periods, optimizing revenue capture.

MEV tax implementation: High-priority transactions (typically MEV-related) pay additional fees that redistribute to LPs rather than being captured by searchers.

Automated rebalancing: Pools can maintain target weight ratios by triggering swaps when allocations drift beyond thresholds.

Yield optimization: Hooks can redirect liquidity to higher-yielding lending markets when opportunities arise.

The hooks framework enables developers to build custom pool behaviors without forking the core protocol. This extensibility positions Balancer v3 as a flexible infrastructure layer for DeFi innovation rather than a rigid AMM implementation.

Transient accounting (EIP-1153) enables secure vault reentrancy, allowing hooks to interact with external protocols during pool operations. This technical foundation makes complex strategies like cascading yield optimization and cross-protocol arbitrage possible within single transactions.

Sustainable Revenue Targets

Balancer's 2026 roadmap prioritizes transitioning from emission-dependent liquidity to fee-sustainable pools. The protocol targets $250,000+ monthly revenue by Q2 2026, with at least 50% derived from sustainable sources.

Sustainable revenue is defined as income from:

Non-incentivized pools (no BAL emissions)

Fee-positive pools (where fee revenue exceeds emission costs)

Yield-generating boosted pools (lending income)

Current revenue metrics as of February 2026:

Monthly revenue: $189,000

Annualized revenue: $2.31 million

Cumulative protocol revenue: $39.93 million

Gap to target: $61,000 additional monthly revenue needed

The path to sustainable revenue focuses on:

Boosted Pool expansion: Integrating additional lending protocols beyond Aave to capture higher yields and attract more TVL. Expanding boosted pool offerings across different asset types and risk profiles.

MEV revenue capture: Implementing MEV taxes through hooks to redirect searcher profits to LPs. This converts extracted value into protocol revenue rather than allowing external capture.

Premium pool features: Launching specialized pools with advanced features that justify higher fee rates. Examples include options-embedded pools, automated portfolio managers, and dynamic rebalancing vaults.

Cross-chain deployment: Expanding to additional EVM chains where fees and yields may be higher due to less competition. The v3 launch on Base demonstrates this multi-chain strategy.

The sustainable revenue model addresses a fundamental challenge in DeFi tokenomics: many protocols subsidize liquidity through token emissions that create selling pressure without building self-sustaining economics. Balancer tokenomics aims to flip this model where protocol revenue exceeds emission costs, enabling true value accrual.

The DAO governance structure allows veBAL holders to adjust protocol fee rates (currently 50%) if needed to accelerate revenue growth. However, excessively high fees risk losing market share to competitors, creating a balancing act between revenue maximization and competitive positioning.

Balancer vs Competitor Fee Comparison

Balancer competes with other major AMM protocols for liquidity and trading volume. Fee structures and value accrual mechanisms differ significantly across platforms, impacting trader costs and LP returns.

Average trading fees by protocol:

Curve: 5 basis points (0.05%) average

Balancer: 6 basis points (0.06%) average

Uniswap: 24 basis points (0.24%) average

Balancer maintains competitive fee rates close to Curve while offering greater pool customization flexibility. Each Balancer pool sets its own fee rate based on strategy, while Curve fees remain more standardized across pools.

Protocol fee take rates:

Balancer: 50% of swap fees + 50% of yield fees

Curve: Variable governance-adjusted rates (historically 50%)

Uniswap: 10-25% governance-adjustable (currently inactive)

Balancer's 50% protocol take is relatively high compared to competitors, but the dual revenue streams from swap fees and yield capture provide higher total income potential. Uniswap v3 technically enables protocol fees but has not activated this mechanism as of 2026.

Value accrual to token holders:

Balancer: 82.5% of protocol fees to veBAL holders (updated from 75%)

Curve: 50% of protocol fees to veCRV holders (plus additional gauge voting bribes)

Uniswap: No fee sharing mechanism implemented (governance discusses but has not activated)

The Balancer fee distribution model provides among the highest direct value accrual rates in DeFi. The 82.5% distribution to veBAL holders exceeds Curve's 50% rate, though Curve's longer four-year lock periods may command higher bribe premiums in vote markets.

Capital efficiency and yields:

Balancer v3 boosted pools offer combined income from swap fees, BAL emissions, lending yields, and potential MEV redistribution. This multi-layer yield structure can generate higher total returns than single-source fee income from traditional AMMs.

Curve maintains an advantage in stablecoin trading due to its specialized bonding curve algorithm that minimizes slippage for like-kind asset swaps. However, Balancer's flexibility with weighted pools and custom ratios serves different use cases like index funds and balanced portfolios.

Uniswap v3 concentrated liquidity provides superior capital efficiency for active LPs who actively manage positions, but requires ongoing monitoring and rebalancing. Balancer's passive strategies through boosted pools offer hands-off yield generation suitable for longer-term LPs.

Market positioning in 2026:

Uniswap remains the dominant DEX by volume across most chains, serving as the default venue for long-tail token trading and new listings. Curve maintains leadership in stablecoin swaps and like-kind asset pairs where low slippage is paramount.

Balancer occupies a specialized niche for weighted pools, boosted yield strategies, and custom pool designs. The protocol serves teams wanting specific token ratios, basket products, or vault-style automated strategies. The v3 architecture positions Balancer as infrastructure for building custom DeFi applications rather than a simple swap venue.

Key Takeaways

Balancer tokenomics centers on the veBAL vote-escrowed model that distributes 82.5% of protocol fees to locked token holders. This represents one of the highest value accrual rates among major DeFi protocols, updated from the original 75% allocation through governance voting.

The BAL token has a 100 million maximum supply with 65% allocated to long-term liquidity mining. Current emissions distribute 145,000 BAL weekly, halving every four years with the next reduction in 2026. The emission schedule extends until approximately 2050, balancing inflation with sustained LP incentives.

Balancer v3 architecture introduces dual revenue streams from swap fees and yield capture. Boosted pools automatically deploy idle liquidity into lending protocols like Aave, generating continuous returns beyond traditional AMM fee income. The flexible hooks framework enables custom pool behaviors like dynamic fees and MEV redistribution.

veBAL holders benefit from multiple value accrual mechanisms: direct fee distributions in yield-bearing stablecoins, liquidity mining boosts up to 2.5x base rates, and vote incentive payments from gauge voting. The one-year maximum lock duration makes Balancer staking more accessible compared to longer lock periods on competing platforms.

The protocol generates $189,000 monthly as of February 2026, targeting $250,000+ by Q2 2026 with focus on sustainable non-emission-dependent revenue. Balancer competes with 6 basis point average fees compared to Curve's 5 bps and Uniswap's 24 bps, serving specialized use cases for weighted pools and automated yield strategies.

Balancer Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Previously managing partner at a web3 venture fund (exit in 2021).

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.