Written:

Feb 7, 2026

Orca allocates 20% of protocol fees to buy back and burn ORCA tokens from $77M in annualized revenue. Learn how Orca tokenomics captures Solana DEX value.

Orca tokenomics center on a systematic buyback-and-burn model that allocates 20% of all protocol fees to purchasing and destroying ORCA tokens. The protocol operates as one of Solana's top decentralized exchanges, processing over $500 million in daily trading volume and generating $77 million in annualized revenue. This article breaks down how orca tokenomics turn trading activity into direct value for ORCA holders.

What Is Orca?

Orca is a decentralized exchange built on Solana that enables users to trade tokens through automated market maker pools. The platform launched in February 2021 and has established itself as one of the top three DEXs on Solana, processing billions in monthly volume. Orca uses the Whirlpool architecture to provide concentrated liquidity markets, allowing liquidity providers to earn fees within specific price ranges.

The exchange offers multiple trading pairs with varying fee tiers, ranging from 0.01% to 2% per swap. Traders benefit from fast transaction speeds and low costs inherent to the Solana blockchain. The platform also launched Wavebreak, a launchpad for new token projects seeking to bootstrap liquidity.

Orca's technology focuses on capital efficiency. The Whirlpool concentrated liquidity system allows liquidity providers to concentrate capital within price ranges where trading occurs most frequently. This results in higher fee earnings compared to traditional full-range liquidity pools.

Orca Tokenomics: ORCA Supply and Distribution

The ORCA token serves as the governance and value accrual mechanism for the protocol. Token holders participate in governance decisions and benefit from fee-based buyback programs.

Fixed Supply of 100M ORCA

Orca has a maximum supply cap of 100 million ORCA tokens. According to official documentation, the total supply was reduced to 75 million ORCA after a 25 million token burn in 2025. This 25% token burn represented a significant orca tokenomics restructuring approved by the Orca DAO.

The burn reduced the available supply and aligned incentives toward value accrual for remaining token holders. The fixed cap prevents inflation and establishes scarcity as the protocol grows. No additional ORCA tokens can be minted beyond the original 100 million maximum.

Circulating vs Total Supply

Approximately 60.16 million ORCA tokens currently circulate in the market. The remaining tokens are allocated across treasury reserves, team vesting schedules, and future distribution programs. The original distribution plan allocated tokens as follows:

50% to treasury for ecosystem development

22% to core team with vesting

12% to future team members

10% to early investors

6% to advisors

The team and investor allocations vest over 3 years, preventing sudden supply shocks. The treasury allocation funds liquidity mining incentives, grants, and the systematic buyback program. As vested tokens unlock, the circulating supply increases, though the buyback mechanism counteracts this by removing tokens from circulation permanently.

How Orca Generates Revenue

Orca earns protocol revenue from swap fees charged on every trade executed through its liquidity pools. The fee structure varies based on pool type and volatility.

Concentrated Liquidity Fee Tiers

Orca implements multiple fee tiers for Whirlpool pools: 0.01%, 0.05%, 0.3%, 1%, and 2%. The fee tier selection depends on asset volatility and trading behavior. Stablecoin pairs typically use the 0.01% tier due to minimal price movement, while volatile token pairs require higher fees to compensate liquidity providers for impermanent loss risk.

Each fee tier creates separate pools for the same trading pair. Traders route through the most capital-efficient pool for their trade size. Larger trades may split across multiple pools to minimize price impact.

Orca also introduced Adaptive Fee Pools that combine a base fee with a dynamic component that increases during high volatility. When prices move rapidly, the adaptive fee rises to protect liquidity providers. This mechanism helps maintain liquidity during market stress while maximizing orca DEX fees during active trading periods.

Whirlpool Architecture

Whirlpools represent Orca's implementation of concentrated liquidity automated market makers. Liquidity providers choose specific price ranges to deploy capital rather than providing liquidity across the entire price curve. When trading occurs within a provider's chosen range, that provider earns a proportionally larger share of fees.

The concentrated liquidity model improves capital efficiency by 100x or more compared to traditional constant product market makers. A liquidity provider can earn the same fees with significantly less capital at risk. This efficiency attracts more liquidity to Orca, which in turn reduces slippage and improves execution for traders.

Whirlpool positions are represented as non-fungible tokens. Each position NFT contains the price range, liquidity amount, and accumulated fees for that deposit. Providers can modify positions by adding liquidity, removing liquidity, or closing positions entirely.

ORCA Value Accrual: Buyback and Burn

The core of orca tokenomics is the systematic value return to ORCA holders through buybacks and burns rather than direct fee distribution.

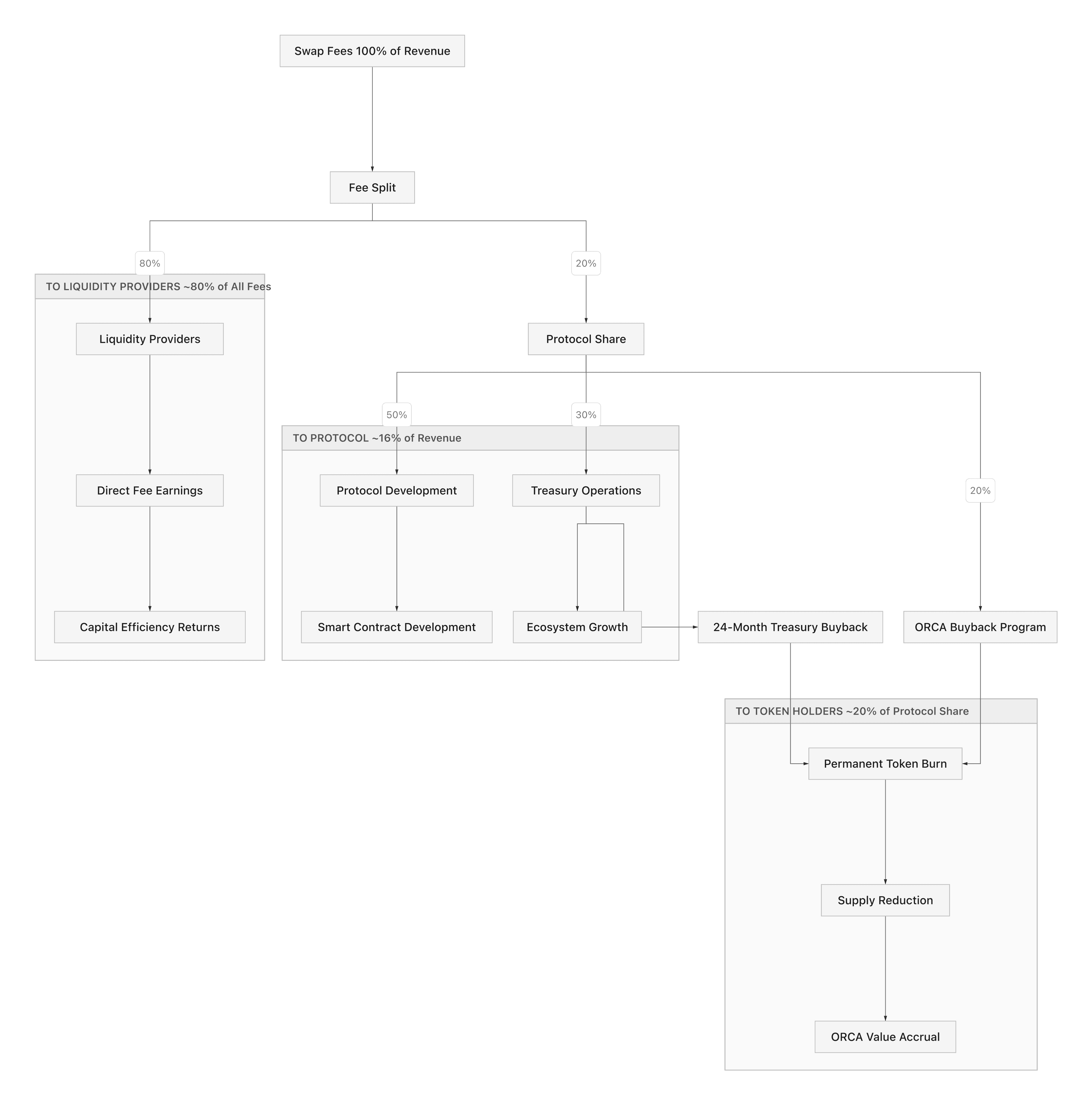

20% Fee Allocation to Burns

The protocol allocates 20% of all trading fees to a dedicated ORCA buyback program. These fees accumulate in various tokens (SOL, USDC, and other trading pairs) and are periodically used to purchase ORCA from the open market. The purchased tokens are then permanently removed from circulation through burning.

This mechanism creates constant buying pressure on the ORCA token as protocol volume increases. The remaining 80% of fees split between liquidity providers (who earn the majority), protocol development (50% of the protocol share), and treasury operations (30% of the protocol share). The fee split balances sustainable liquidity incentives with orca value accrual for token holders.

24-Month Treasury Buyback Program

In August 2025, the Orca DAO approved a complementary treasury buyback program. This initiative deploys up to 55,000 SOL and $400,000 USDC from the treasury over 24 months to purchase ORCA tokens from the market. The program caps daily purchases at 2% of the 30-day average trading volume to prevent excessive market impact.

The treasury buyback supplements the ongoing 20% fee buyback. Together, these programs create dual mechanisms for reducing supply. The treasury program also includes validator staking to generate additional SOL revenue that further funds buybacks.

The 24-month timeline provides predictable support for orca tokenomics while the DAO evaluates long-term value accrual strategies. The program includes governance checkpoints to adjust parameters based on market conditions and treasury needs.

xORCA Staking Rewards

Orca developed the xORCA staking contract to provide utility beyond governance. Users who participate in orca staking receive xORCA tokens, which represent their staked position. The staking contract accumulates a portion of buyback tokens and distributes them as rewards to xORCA holders.

The xORCA staking mechanism creates an incentive to lock ORCA, reducing liquid supply and increasing scarcity. xORCA can be transferred while staked, providing liquidity for staked positions. The contract underwent a full security audit by Sec3 and uses the same 3-of-5 multisig governance as Whirlpool contracts.

Staking rewards come from buyback allocations and potential future fee-sharing mechanisms. The xORCA model aligns long-term holder interests with protocol success, as increased trading volume leads to higher buyback amounts and larger staking distributions.

Orca Revenue: $77M Annualized

Orca generates approximately $77.3 million in annualized fees based on recent trading activity. This positions the protocol among the highest revenue-generating DEXs on Solana.

Volume and Fee Trends

The platform processes over $500 million in daily trading volume across thousands of token pairs. Volume surged 107% in recent periods despite relatively flat total value locked, demonstrating improved capital efficiency from the Whirlpool architecture.

The SOL/USDC pair represents the highest volume trading pair at approximately $349 million in 24-hour volume. Other major pairs include SOL/USDT, BONK/SOL, and various Solana ecosystem tokens. The platform currently supports 425 tokens across 4,157 trading pairs.

Fee revenue scales directly with volume. The $77 million annualized figure represents approximately 0.04% of total trading volume, reflecting the predominance of lower-fee stablecoin and major pair trading. Higher fee tier pools generate proportionally more revenue per dollar traded.

Orca captures nearly 30% of Solana's total DeFi activity, establishing it as a dominant liquidity venue within the solana DEX tokenomics landscape. This market share positions the protocol to benefit from broader Solana ecosystem growth.

Orca vs Competitor Fee Comparison

Understanding orca tokenomics requires context within the broader Solana DEX landscape. The following table compares key fee and value accrual metrics.

Metric | Orca | Raydium | Jupiter |

Fee Tiers | 0.01% - 2% | 0.01% - 2% | 0% platform fee |

Annualized Revenue | $77M | $65M+ | $54M+ (aggregator) |

Value Accrual | 20% buyback/burn | Buyback + staking | ASR distributions |

Concentrated Liquidity | Yes (Whirlpools) | Yes (CLMM) | Routes to both |

Max Token Supply | 100M (75M post-burn) | 555M | 10B |

Raydium operates as both an automated market maker and concentrated liquidity provider. Raydium allocates fees differently, with portions directed to RAY token buybacks, staking rewards, and treasury operations. Raydium also integrates with order book systems, providing additional liquidity sources.

Jupiter functions as a DEX aggregator rather than a liquidity provider. Jupiter charges 0% platform fees and routes trades through underlying DEXs like Orca and Raydium to find the best execution. Jupiter and Orca operate complementarily rather than as direct competitors, as Jupiter routes order flow to Orca pools when they offer the best price.

The key differentiator in orca tokenomics versus Raydium lies in the buyback allocation structure. Orca's 20% fee allocation to systematic buybacks provides clear value accrual to token holders. The transparency of this mechanism makes it easier to model ORCA token value relative to protocol revenue.

FAQ

What is the total supply of ORCA tokens?

ORCA has a maximum supply of 100 million tokens. Following a 25 million token burn in 2025, the total supply stands at 75 million ORCA. The circulating supply is approximately 60.16 million tokens, with the remainder held in treasury reserves and vesting schedules.

How does the ORCA buyback program work?

Orca allocates 20% of all protocol fees to a systematic buyback program. These fees accumulate in various tokens and are used to purchase ORCA from the open market. Purchased tokens are permanently burned, reducing circulating supply. A complementary treasury buyback program deploys up to 55,000 SOL and $400,000 USDC over 24 months for additional purchases.

What is xORCA staking?

xORCA is a staking token received when users stake ORCA. The xORCA staking contract accumulates buyback tokens and distributes them as rewards to stakers. Staking reduces liquid ORCA supply while providing utility beyond governance. The contract is fully audited and allows transfers of staked positions.

How much does Orca earn annually?

Orca generates approximately $77.3 million in annualized fees based on current trading volume. The platform processes over $500 million in daily volume across 4,157 trading pairs. Fee revenue scales with trading activity as the protocol captures nearly 30% of Solana's DeFi volume.

How do orca DEX fees compare to other Solana exchanges?

Orca uses fee tiers ranging from 0.01% to 2%, similar to Raydium's structure. The key difference is that orca tokenomics allocate 20% of all fees directly to buyback and burn, creating a transparent value accrual mechanism. Raydium splits fees across buybacks, staking, and treasury with different proportions.

Key Takeaways

Orca allocates 20% of all protocol fees to a systematic ORCA buyback-and-burn program, creating direct value accrual tied to trading activity.

The protocol generates $77 million in annualized revenue from over $500 million in daily trading volume across 4,157 pairs.

ORCA has a 100 million token maximum supply, reduced to 75 million after a 25 million token burn in 2025.

The 24-month treasury buyback program deploys up to 55,000 SOL and $400,000 USDC for additional market purchases.

xORCA staking provides holders with buyback-funded rewards while reducing liquid supply.

Orca captures approximately 30% of Solana DeFi activity, positioning it to benefit from ecosystem growth.

Understanding orca tokenomics reveals a protocol that converts trading volume into measurable value for token holders. The combination of fee-funded buybacks, treasury purchases, and xORCA staking rewards creates multiple pathways for value accrual. As the Solana DEX landscape continues to grow, Orca's transparent fee allocation model and concentrated liquidity architecture provide a clear framework for assessing ORCA token fundamentals.

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Previously managing partner at a web3 venture fund (exit in 2021).

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.