Written:

Feb 7, 2026

EigenLayer secures $11.6B in restaked ETH across 27 AVS operators. Learn how EIGEN tokenomics captures value through universal intersubjective staking and sl...

EigenLayer dominates the Ethereum restaking market with over $15 billion in total value locked (TVL), representing 93.9% market share across 4.36 million ETH. The protocol recently proposed a transformative tokenomics overhaul through ELIP-12, introducing a 20% fee on subsidized AVS rewards and channeling 100% of EigenCloud infrastructure revenue into EIGEN buybacks. This article examines how eigenlayer tokenomics creates value accrual mechanisms across the restaking ecosystem, analyzing token distribution, revenue models, and competitive positioning against Symbiotic and Karak.

What Is EigenLayer?

EigenLayer is a protocol built on Ethereum that introduces restaking, a new onchain primitive allowing either natively staked ETH or Liquid Staking Tokens (LSTs) to be restaked in return for additional yield. The protocol enables users to redeploy already staked ETH or tokens representing staked ETH to secure additional decentralized protocols and services, often called Actively Validated Services (AVS), creating new sources of yield.

The core innovation addresses a fundamental problem in blockchain infrastructure: each new decentralized service traditionally requires its own validator set and security model. EigenLayer solves this through pooled security, allowing Ethereum validators to opt into validating additional services without deploying new capital. This approach significantly increases the cost of corruption for potential attackers as it shifts from the security of individual protocols to the sum of all staked assets.

AVSs specify their security needs and hire operators via EigenLayer, compensating operators who share rewards with their delegators (the restakers). The Ethereum restaking ecosystem has reached a total value locked of $16.257 billion as of early 2026, with EigenLayer commanding $15.258 billion USD in TVL and 4,364,467 ETH. Operators select which AVSs to validate for, earning yield and subjecting themselves to the slashing conditions associated with each AVS.

The protocol integrates three core infrastructure components through EigenCloud: EigenDA (data availability), EigenCompute (off-chain compute), and EigenVerify (dispute resolution). EigenDA offers a flexible cost model for both variable and fixed fees, allowing payment in ETH, EIGEN or your own native token, with fixed pricing and bandwidth reservations as opposed to competing with other activity on the network.

EigenLayer Tokenomics: EIGEN Supply and Distribution

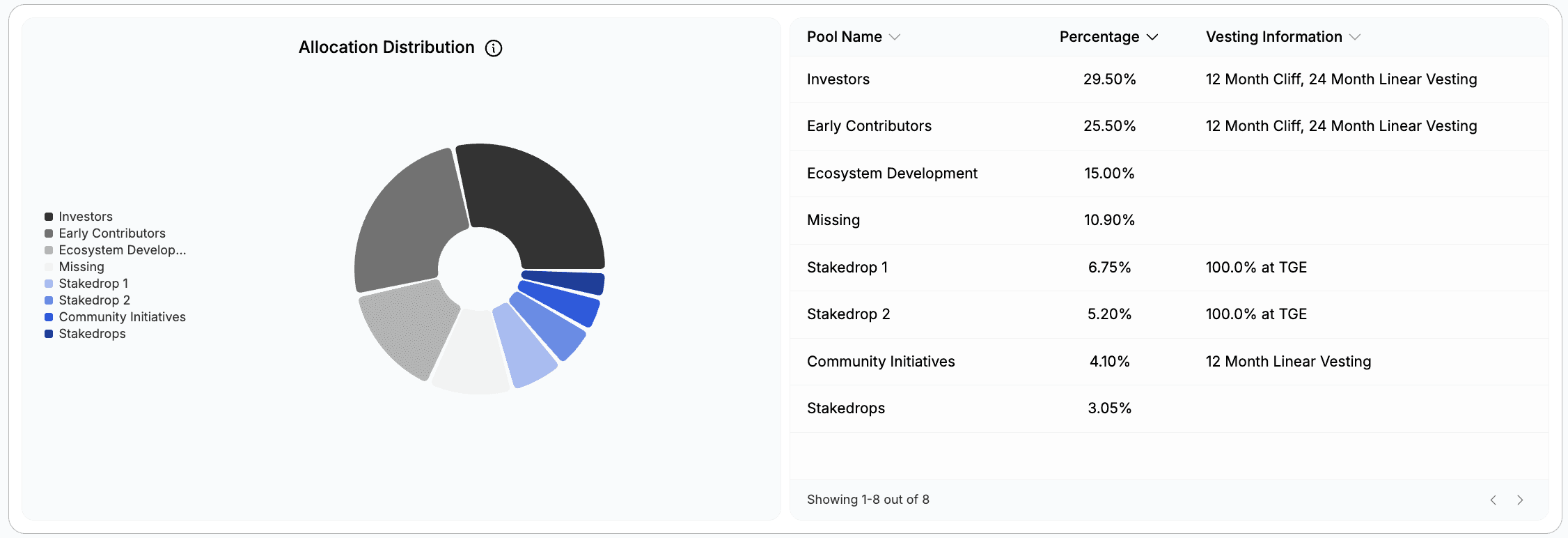

The eigenlayer tokenomics model centers on the EIGEN token, which has a total supply of 1,793,689,817 EIGEN tokens. The initial allocation at launch included 1.67 billion tokens distributed across five categories. Early contributors received 25.50%, investors obtained 29.50%, while 15.00% was allocated to stakedrops, 15.00% to research and development with ecosystem development, and 15.00% to future community initiatives.

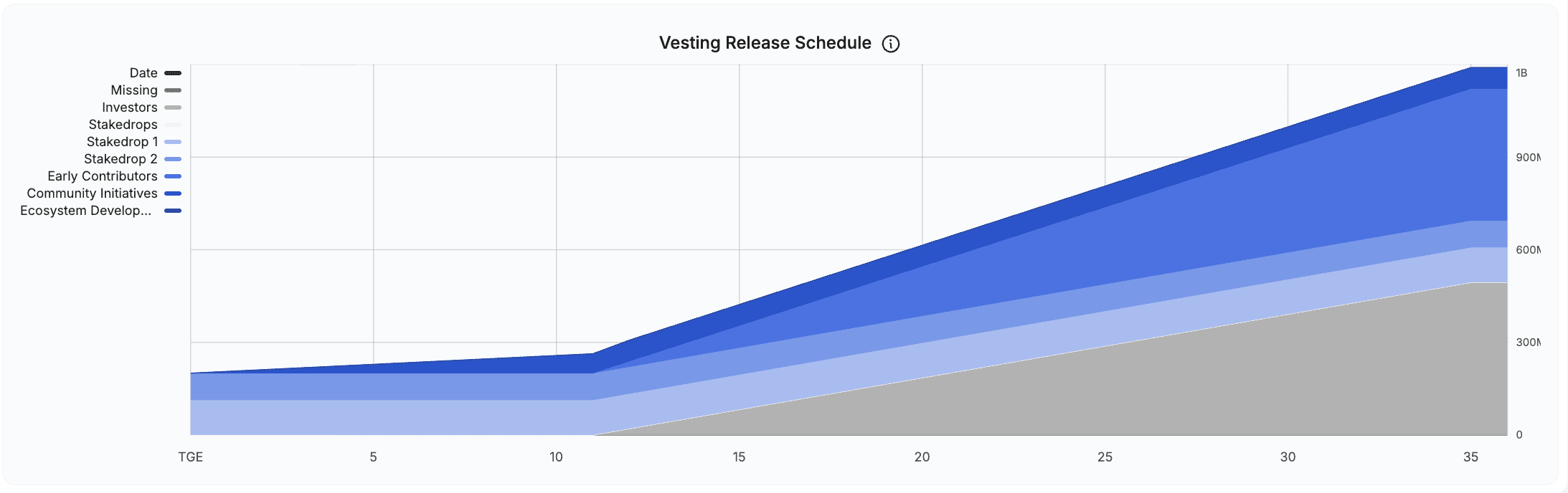

As of early 2026, all 451,570,867 EIGEN are currently unlocked and in circulation. The token has infinite supply, meaning the full unlock schedule extends indefinitely with ongoing emissions. Investors and early contributors are subject to a total lockup period of three years for their allocations, with the first year involving a complete lock, followed by a gradual release of their total holdings at a rate of 4% per month over the subsequent two years.

Token Allocation

The EIGEN token allocation reflects a balanced distribution between early stakeholders, ecosystem development, and community participation. The 29.50% investor allocation represents the highest single category, supporting the capital raised to develop the protocol infrastructure. The 25.50% early contributor allocation compensates the team and early builders who established the technical foundation.

The allocation strategy dedicates 45.00% of total supply to ecosystem growth and community initiatives. The 15.00% stakedrop allocation rewards participants who restake assets through the protocol, creating direct alignment between token holders and network security providers. The 15.00% research and development allocation funds ongoing protocol improvements, security audits, and technical innovation. The final 15.00% for future community initiatives provides flexibility for governance-directed programs and ecosystem expansion.

Stakedrop and Airdrop History

EigenLayer implemented a multi-season stakedrop program distributing 15% of EIGEN tokens linearly over multiple seasons to contributors. Season 1 distributed approximately 113 million EIGEN tokens, representing 6.75% of the initial supply, with claims open from May 10 to September 7, 2024. On March 15, 2024, the project captured a snapshot of those who had restaked ETH or LSTs, either directly or through liquid restaking protocols.

In Season 1, 90% of tokens went to those who staked directly in EigenLayer or via Liquid Restaking Tokens (LRTs). The protocol airdropped around 28 million additional EIGEN tokens to over 280,000 wallets just days after the first airdrop announcement to address community concerns. Season 1 claimants received a minimum of 110 EIGEN, while Season 2 claimants who interacted with the protocol between March 15 and April 29 received a minimum of 100 EIGEN.

Season 2 claims began on September 16, 2024, and ran until March 16, 2025. The allocation included 70 million EIGEN (4.2% of fully diluted valuation) for stakers and operators, with up to 10 million EIGEN (0.6% FDV) allocated for ecosystem partners. The protocol initially made tokens non-transferable, with transferability and trading enabled on September 30, 2024, creating a controlled launch period.

The next token unlock is scheduled for March 1, 2026 (22 days away), which will release 36.82 million EIGEN tokens ($8.24 million), representing 2.1% of total supply. On February 1, 2026, 36.8 million EIGEN tokens (worth approximately $12.3 million) were unlocked, representing over 2% of total token supply and a significant 6.75% of circulating market cap at the time.

How EigenLayer Generates Revenue

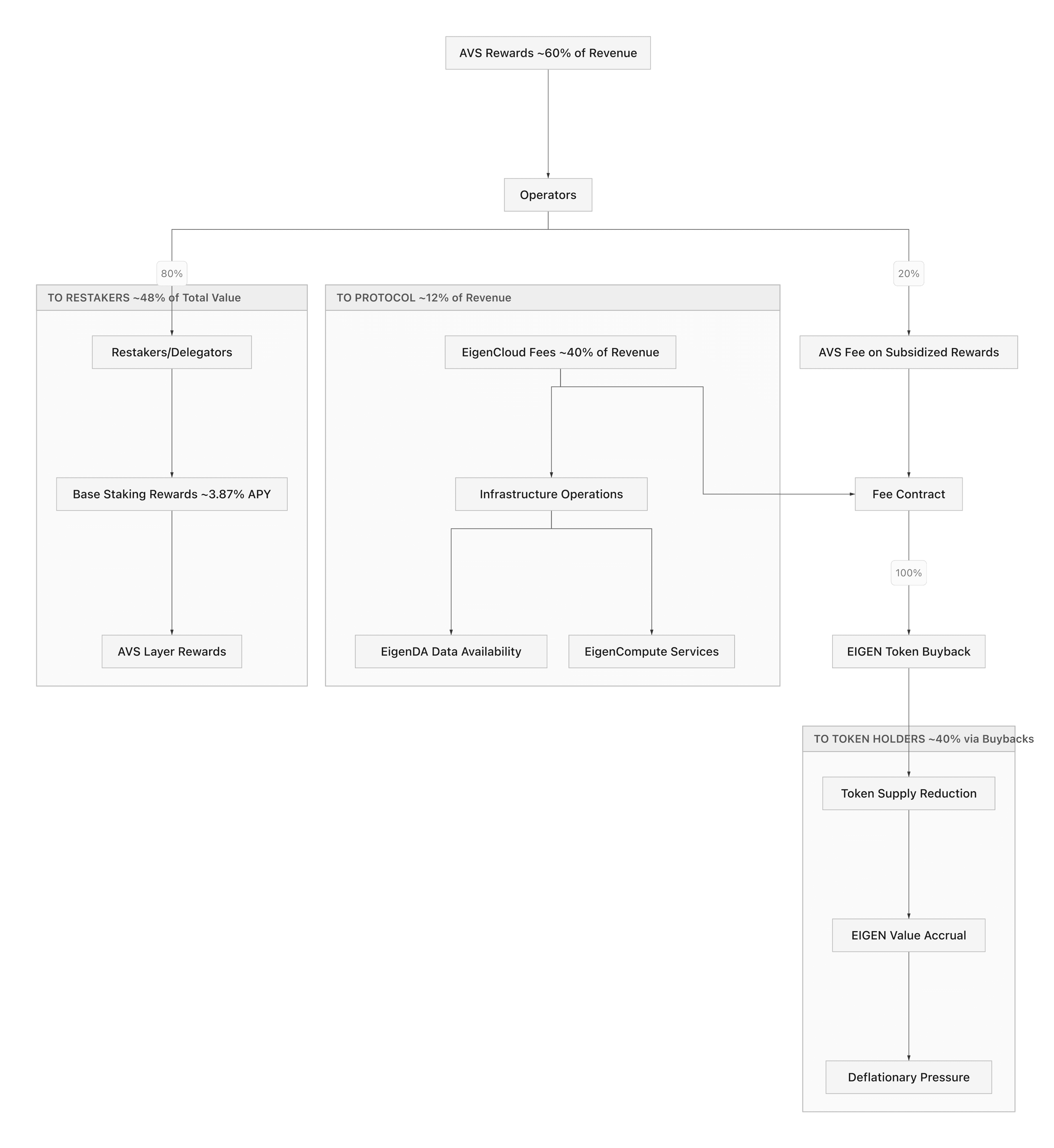

EigenLayer generates revenue through three primary mechanisms: AVS fee models, EigenCloud infrastructure fees, and slashing insurance premiums. The protocol recently proposed ELIP-12, a governance proposal to establish an Incentives Committee that would direct revenue from these sources toward EIGEN buybacks, creating deflationary pressure as the ecosystem grows.

AVS Fee Model

The AVS fee model operates through a two-sided marketplace where AVSs choose how much yield to offer operators, who in turn share rewards with delegators. AVSs specify their security needs and hire operators via EigenLayer, compensating them for validation services. Operators select which AVSs to validate for, earning yield and subjecting themselves to the slashing conditions associated with each service.

ELIP-12 proposes a 20% fee on subsidized AVS rewards, with these fees directed to a fee contract that can be used for buybacks. On stake that is subsidized by EIGEN incentives, the committee will implement this fee structure. Moving forward, only fee-paying AVSs will be eligible for staker and ecosystem incentives, creating a direct value-accrual loop that ties token emissions to actual ecosystem usage and fee generation.

The Incentives Committee will focus allocations on participants who actively secure AVS and expand the broader EigenCloud ecosystem. Staffed by representatives from the Eigen Foundation and Eigen Labs, and subject to ratification by the Protocol Council, the committee would have the authority to adjust emissions policies without resorting to lengthy contract upgrades. This aims to make EIGEN emissions more efficient by directing them toward Actively Validated Services that generate real fees and secure the network.

EigenCloud Infrastructure Fees

EigenCloud integrates EigenDA (data availability), EigenCompute (off-chain compute), and EigenVerify (dispute resolution) into a unified, modular infrastructure. The fee structure channels revenue from cloud-based services directly toward EIGEN buybacks after operational costs. As revenue grows on EigenAI, EigenCompute and EigenDA, 100% of cloud fees after operator expenses will be directed to the same fee contract for buybacks.

EigenDA offers a flexible cost model for both variable and fixed fees, allowing payment in ETH, EIGEN or your own native token. The service provides fixed pricing and bandwidth reservations as opposed to competing with other activity on the network. This pricing model creates predictable revenue streams for the protocol while offering developers stable cost structures for data availability services.

The infrastructure fee mechanisms are being developed and implemented as part of ongoing governance proposals, with ELIP-12 establishing the framework for channeling service revenue back to EIGEN token holders. The protocol aims to create direct deflationary pressure through these infrastructure fees, with 100% of EigenCloud fees after operator expenses funneled into a buyback contract.

Slashing Insurance Premiums

EigenLayer implements a sophisticated slashing mechanism that creates insurance-like revenue opportunities. If operators are proven to be malicious according to an onchain Ethereum contract, then they may lose their stake or a portion of their stake. The slashing feature arrived on mainnet April 17, 2025, enabling AVSs to set custom conditions, manage operators through Operator Sets, and implement Unique Stake Allocation with targeted accountability.

AVSs can set the slashing conditions that operators comply with to support and run their AVSs. Conditions are tied to specific Operator Sets, but sit outside of the EigenLayer protocol. AVSs can select these conditions based on their business needs, risk profile, and security requirements. The Unique Stake model allows operators to allocate a percentage of their ETH that an Operator Set is permitted to slash, meaning a unit of ETH can only be slashed by a single Operator Set at any given time.

To prevent unwarranted slashing, especially on newer or less-established AVSs, a veto committee within EigenLayer investigates and may overturn any slashing incidents. This multi-tiered method makes it harder for bad actors while protecting ethical validators by ensuring safety nets that enhance overall security and trustworthiness on the network. Attributable security works like insurance, and in principle, a new actuarial market will spring up with pricing for each of the AVSs, ostensibly linked to their perceived risk.

The slashing mechanism creates potential revenue streams through insurance premiums as AVSs and operators seek protection against slashing events. The risk-based pricing model mirrors traditional insurance markets, where higher-risk AVSs command higher premiums for security guarantees.

EIGEN Value Accrual: Proposed Buyback Model

The EIGEN value accrual mechanism operates through a proposed buyback model that channels protocol revenue directly into token purchases. ELIP-12 establishes the framework for this value capture, directing fees from AVS rewards and EigenCloud services toward EIGEN buybacks to create deflationary pressure as the ecosystem scales.

20% of AVS Rewards to Buybacks

The proposed fee model implements a 20% fee on AVS reward-related fees, once subsidized by EIGEN incentives, funneled into a fee contract designed for token buybacks. This mechanism applies specifically to stake that is subsidized by EIGEN incentives, creating a direct link between protocol emissions and fee generation. The 20% fee structure ensures that as AVS activity increases, the protocol captures value proportional to the subsidies provided.

Moving forward, only fee-paying AVSs will be eligible for staker and ecosystem incentives. This requirement creates a minimum threshold for AVS participation, ensuring that EIGEN emissions support services that generate actual protocol revenue. The fee contract accumulates these revenues for potential EIGEN buybacks, creating a programmatic value accrual loop independent of governance intervention.

The 20% fee applies after AVSs compensate operators, who then share rewards with delegators. This structure preserves yield for restakers while capturing protocol value at the infrastructure layer. As the AVS ecosystem matures and fee generation increases, the buyback contract accumulates larger revenue streams, potentially creating sustained deflationary pressure on EIGEN supply.

Incentives Committee (Q1 2026)

ELIP-12 is a live governance proposal to establish an Incentives Committee, with the goal of making EIGEN emissions more efficient by directing them toward Actively Validated Services that generate real fees and secure the network. The committee represents a new governance body to better manage and direct token emissions approved by the Protocol Council.

Staffed by the Eigen Foundation and Eigen Labs, the Incentives Committee would be tasked with setting policy for allocating token emissions to participants actually securing the AVSs, building on EigenCloud, and generating real fees. The committee structure creates administrative efficiency, allowing emissions adjustments without lengthy contract upgrades or full governance votes for routine policy changes.

The Incentives Committee launches in Q1 2026, providing oversight for the transition from initial token distribution to sustainable value accrual. The committee will focus allocations on participants who actively secure AVS and expand the broader EigenCloud ecosystem, moving away from passive yield farming toward productive participation. This shift aims to align token emissions with network security and revenue generation.

The committee has authority to adjust emissions policies, determining which AVSs receive EIGEN subsidies based on fee generation, security contributions, and ecosystem value. This discretionary power enables rapid response to market conditions while maintaining alignment with protocol goals through Protocol Council oversight.

Productive Stake Rewards

Productive stake rewards form the foundation of eigenlayer value accrual, compensating users who earn extra yield by validating selected AVSs in return for accepting increased slashing risks. The current estimated reward rate of EigenCloud is 3.87%, meaning that on average, stakers earn about 3.87% if they hold an asset for 365 days. This baseline yield comes from Ethereum staking rewards, with additional AVS rewards layered on top.

Restaking allows users to redeploy already staked ETH or tokens representing staked ETH to secure additional decentralized protocols and services, creating new sources of yield. Key benefits of eigenlayer restaking include improved capital efficiency and potentially higher staking rewards, as ETH stakers earn additional staking rewards by securing more networks without needing to stake more tokens.

When users opt in to restake their ETH, they are exposed to increased slashing risk, and as a result, restakers are compensated with higher staking rewards for undertaking more risk. AVSs specify their security needs and hire operators via EigenLayer, and in return, they compensate operators who share rewards with their delegators. The productive stake model creates direct economic alignment between security providers and protocol revenue.

The productive stake framework distinguishes between passive token holding and active network participation. Only users who actively secure AVSs through restaking receive the enhanced yield, creating incentives for capital deployment into productive uses. This structure ensures that staking rewards flow to participants who contribute to network security rather than passive speculators.

The Restaking Ecosystem: TVL and Growth

The restaking ecosystem has experienced explosive growth, with the Ethereum restaking market reaching a total value locked of $16.257 billion as of early 2026. EigenLayer dominates this market with $15.258 billion USD in TVL and 4,364,467 ETH, commanding a 93.9% market share. The protocol reached an all-time high TVL of $19.7 billion, demonstrating substantial demand for restaking services.

The asset composition shows 4,650,055 ETH currently being utilized within restaking frameworks to provide cryptoeconomic security for Actively Validated Services. This represents a significant portion of total Ethereum staking, indicating that many validators view the additional yield from eigenlayer restaking as compelling despite increased slashing risks. The TVL concentration in EigenLayer reflects both first-mover advantage and network effects from AVS integrations.

The protocol foundation proposed ELIP-12 Incentives Committee governance proposal for Q1 2026 and the EigenCompute Mainnet Release for Q1 2026, indicating continued ecosystem development. The growth trajectory from initial launch through $19.7 billion TVL occurred within approximately two years, representing one of the fastest capital accumulations in decentralized finance history.

The restaking TVL demonstrates capital efficiency improvements, as the same ETH secures both Ethereum consensus and additional AVS services. This capital reuse creates use for security budgets, allowing AVSs to bootstrap cryptoeconomic security without proportional capital raises. The TVL growth correlates with AVS launches, as each new service creates additional yield opportunities for restakers.

EigenLayer vs Competitor Revenue Comparison

EigenLayer maintains its position as the established leader with $15 billion in pooled funds and 1,500 operators. The protocol architecture centers on Ethereum existing validator infrastructure, allowing stakers to opt into additional validation duties through Active Validation Services. Symbiotic ranks second with $897 million USD in TVL and 256,533 ETH, representing a 5.5% share of the restaking market, while Karak manages $102 million USD in TVL and 29,055 ETH, capturing approximately 0.6% of total restaked asset volume.

The supported assets differentiate the three protocols. EigenLayer current focus is on restaking staked ETH assets and Lido liquid staked tokens (LSTs) with plans to expand the network reach in the future. Symbiotic has a modular design that supports restaking of various ERC-20 tokens, including stETH, and empowers developers with complete control of the entire restaking process. Karak supports various assets such as EigenLayer core offerings like ETH and LST but goes further to add LP tokens, stablecoins, WBTC, StaFi liquid staking tokens (LRT), and more.

Architecture and design differences create distinct value propositions. EigenLayer focuses on pooled security and flexibility through an open market governance structure, allowing validators to secure multiple modules with the same staked assets. Symbiotic emphasizes modularity and customization, providing network builders with full control over their restaking processes, particularly focusing on immutability and stability. Karak differentiates itself by supporting multi-asset restaking and offering cross-blockchain compatibility, making it a universal security solution with a developer-centric approach.

The competitive landscape shows EigenLayer dominance through network effects and first-mover advantage. Symbiotic reached $200 million in deposits within a day of launch, demonstrating substantial demand for alternative restaking solutions. Karak multi-asset support creates differentiation, though both competitors remain in early stages with significant room for development. The restaking landscape has evolved from EigenLayer early monopoly into a three-way competition that reshapes how decentralized networks secure themselves.

Revenue comparison shows EigenLayer ahead in absolute terms due to TVL dominance and AVS integrations. The proposed ELIP-12 fee mechanisms (20% of subsidized AVS rewards and 100% of EigenCloud fees) create direct revenue capture for EIGEN holders. Symbiotic and Karak are still establishing their fee structures and token economics, making direct revenue comparisons premature. The competitive dynamics suggest restaking will support multiple protocols with differentiated strategies for asset support, architecture, and value accrual.

Key Takeaways

EigenLayer tokenomics creates value accrual through a proposed buyback model that channels 20% of subsidized AVS rewards and 100% of EigenCloud infrastructure fees into EIGEN token purchases. The ELIP-12 governance proposal establishes an Incentives Committee launching Q1 2026 to direct emissions toward fee-generating AVSs, creating deflationary pressure as the restaking ecosystem scales beyond $15 billion in current TVL.

The EIGEN token has a total supply of 1,793,689,817 tokens with 451,570,867 currently in circulation. The allocation distributed 29.50% to investors, 25.50% to early contributors, and 45.00% to ecosystem development through stakedrops, research and development, and future community initiatives. Investors and early contributors face a three-year vesting with 4% monthly releases after the first year complete lock.

EigenLayer generates revenue through three mechanisms: AVS fee models charging 20% on subsidized rewards, EigenCloud infrastructure fees from EigenDA, EigenCompute, and EigenVerify services, and slashing insurance premiums from the attributable security model. The protocol dominates the restaking market with $15.258 billion TVL and 93.9% market share, compared to Symbiotic at $897 million (5.5%) and Karak at $102 million (0.6%).

The productive stake model delivers a current estimated reward rate of 3.87%, with additional AVS yields layered on top for users who accept increased slashing risk. The slashing mechanism launched on mainnet April 17, 2025, enabling AVSs to set custom conditions with Unique Stake allocation where ETH can only be slashed by a single Operator Set at any given time.

The Incentives Committee will focus allocations on participants who actively secure AVSs and expand the EigenCloud ecosystem, moving away from passive yield farming toward productive participation. Only fee-paying AVSs will be eligible for staker and ecosystem incentives going forward, ensuring EIGEN emissions support services that generate protocol revenue and contribute to the buyback contract funding.

Eigenlayer Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Previously managing partner at a web3 venture fund (exit in 2021).

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.