Written:

Feb 7, 2026

dYdX tokenomics evolved from governance-only to 100% fee distribution. Learn how DYDX staking on dYdX Chain earns USDC from trading fees.

Few decentralized exchanges have undergone as dramatic a tokenomics transformation as dYdX. When the protocol migrated from Ethereum to its own sovereign blockchain in 2023, the DYDX token evolved from a governance-only asset to a Layer 1 staking token that captures 100% of protocol fees. This shift represents one of the most significant tokenomics upgrades in DeFi history, turning DYDX into a genuine revenue-sharing mechanism for dYdX validators and stakers.

Understanding dYdX tokenomics requires examining two distinct eras: the V3 period where token holders received no direct value capture, and the V4 dYdX Chain where stakers now earn all trading fees in USDC. This article explains how the protocol's migration to Cosmos SDK infrastructure enabled full fee distribution, how DYDX staking works, and what this means for DYDX token holders in the dYdX crypto ecosystem.

What is the DYDX Token?

The DYDX token sits at the center of dYdX tokenomics. DYDX is the native cryptocurrency of the dYdX protocol, a decentralized perpetual futures exchange. With a fixed total supply of 1 billion tokens minted on August 3, 2021, the DYDX token initially launched on Ethereum as a governance token for the protocol's V3 iteration.

The DYDX token utility has evolved significantly. On dYdX V3 (the Ethereum Layer 2 version), DYDX served three primary functions: protocol governance, trading fee discounts, and a safety staking module that was later deactivated in October 2022. Token holders could vote on protocol changes but received no share of trading fees generated by the exchange.

This changed entirely with dYdX V4. When the protocol launched its own blockchain using the Cosmos SDK in late 2023, the DYDX token transformed into a Layer 1 asset with expanded utility. The token now powers validator staking, secures the network through proof-of-stake consensus, and most importantly, entitles stakers to 100% of all trading fees collected by the protocol.

The migration process introduced two token standards: users can hold wethDYDX on Ethereum for V3 governance participation, or bridge their tokens to receive native DYDX on the dYdX Chain for DYDX staking and earning fee rewards. This dual-token model accommodates both legacy users and those participating in the new dYdX Chain economics.

V3 to V4: Why dYdX Built Its Own Chain

The architectural shift from dYdX V3 to V4 fundamentally changed how the protocol operates and distributes value. This transformation reshaped dYdX tokenomics from the ground up.

dYdX V3: Hybrid Layer 2 with No Fee Sharing

To understand the evolution of dYdX tokenomics, start with V3. On V3, dYdX operated as a hybrid system combining Ethereum smart contracts with StarkWare's StarkEx rollup technology. While this provided scaling benefits, the architecture had significant limitations. The order book and matching engine remained off-chain services managed by the dYdX team, making the system only partially decentralized.

More critically for DYDX token holders, trading fees generated by the protocol went to dYdX Trading Inc., not to token holders. The DYDX token functioned purely for governance voting, with no direct mechanism for value accrual beyond potential price appreciation from increased protocol adoption.

dYdX V4: Sovereign Chain with Full Fee Distribution

The V4 migration changed everything. By building an independent blockchain using the Cosmos SDK and Tendermint consensus, dYdX achieved full decentralization of the order book, matching engine, and settlement layer. All exchange logic now runs on-chain through a network of dYdX validators.

This sovereignty enabled the most significant dYdX tokenomics upgrade: 100% fee distribution to stakers. Unlike V3 where the company retained protocol revenue, V4 directs all trading fees (denominated in USDC), gas fees in USDC, and gas fees in DYDX directly to validators and their delegators. The dYdX team voluntarily gave up protocol fee revenue, aligning their incentives with DYDX token holders.

The decision to launch a sovereign chain rather than remain on Ethereum or use another Layer 1 gave dYdX complete control over its economics, governance, and technical roadmap. This independence allowed them to implement the 100% fee-sharing model without being constrained by the limitations of smart contract platforms.

Since launching the dYdX Chain, the protocol has processed over $316 billion in trading volume, generated more than $56 million in net protocol fees, and attracted over 71,000 DYDX token holders. More than 306 million DYDX is now staked, securing the network and earning continuous USDC rewards through DYDX staking.

DYDX Token Distribution and Allocation

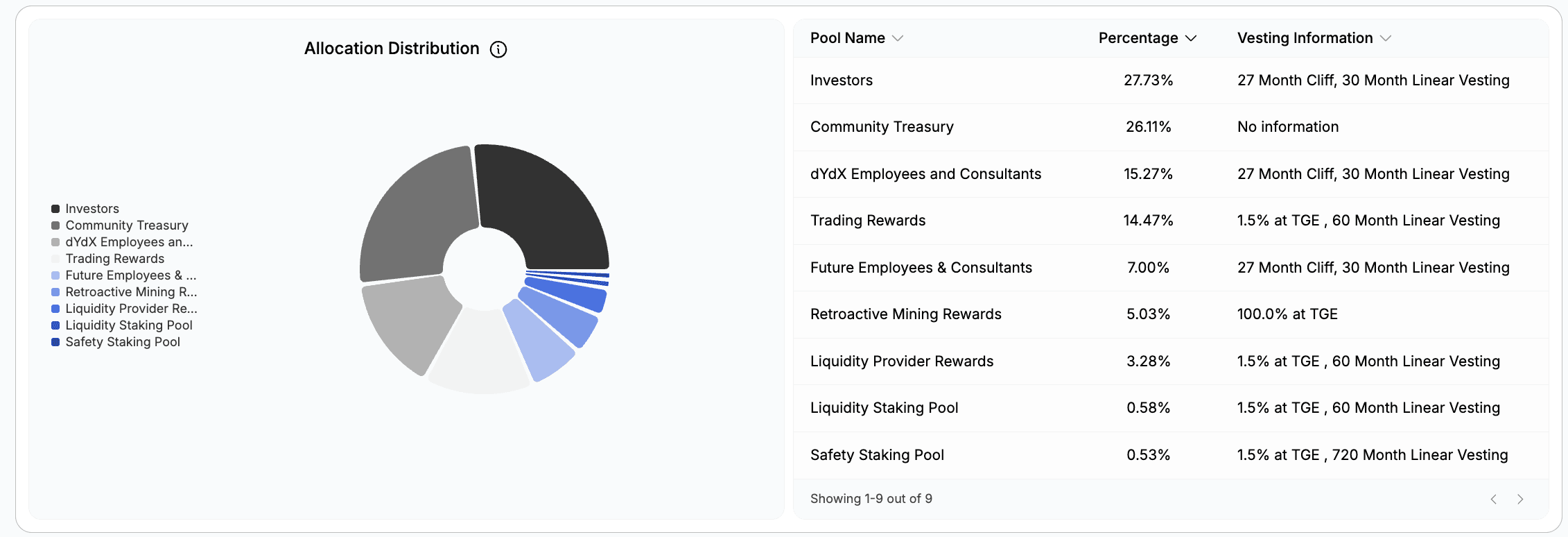

The 1 billion DYDX token supply follows a structured distribution designed to balance community incentives with team and investor interests. Understanding the DYDX token allocation is central to evaluating dYdX tokenomics.

Community Allocation: 50% (500 Million DYDX)

Half of the total supply was allocated to community-driven initiatives:

Community Treasury: 26.1% (261.1 million DYDX) controlled by governance for ecosystem development

Trading Rewards: 14.5% (144.7 million DYDX) distributed to active traders over time

Retroactive Mining Rewards: 5.0% (50.3 million DYDX) given to past users as recognition

Liquidity Provider Rewards: 3.3% (32.8 million DYDX) for market makers providing liquidity

USDC Liquidity Staking: 0.6% (5.8 million DYDX) for USDC staking participants

Safety Staking: 0.5% (5.3 million DYDX) for the now-deactivated safety module

Investors and Team: 50% (500 Million DYDX)

The other half was distributed to those who built and funded the protocol:

Past Investors: 27.7% (277.3 million DYDX) allocated to early backers of dYdX Trading Inc.

Founders, Employees, and Advisors: 15.3% (152.7 million DYDX) for team members and consultants

Future Employees: 7.0% (70 million DYDX) reserved for hiring and retention

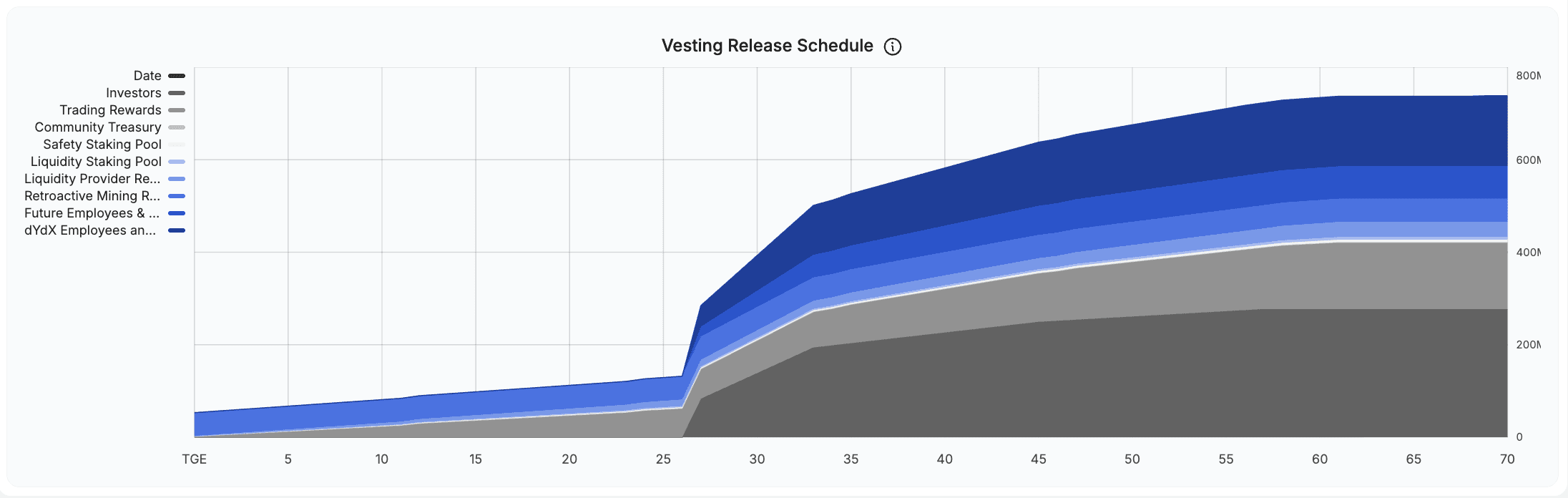

As of early 2026, approximately 813.3 million DYDX (81.33% of total supply) has been unlocked. The initial release date for investor tokens was postponed to December 1, 2023, extending the vesting timeline and reducing immediate selling pressure.

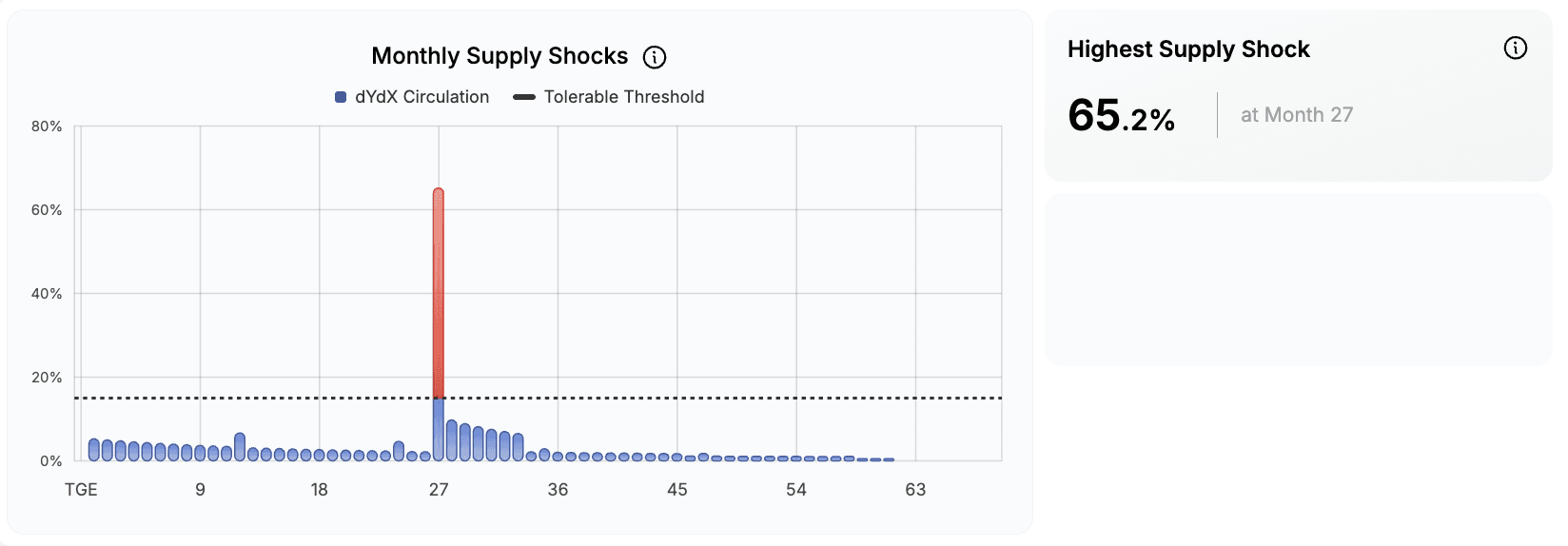

dYdX is known to be one of the projects with one of the worst economic models, because it generated huge "supply shocks" which means that after a specific unlock the supply increased +60% relative to the current circulation, and this tokens where allocated to investors, you can imagine what happened prior the unlock and after. Blood bath.

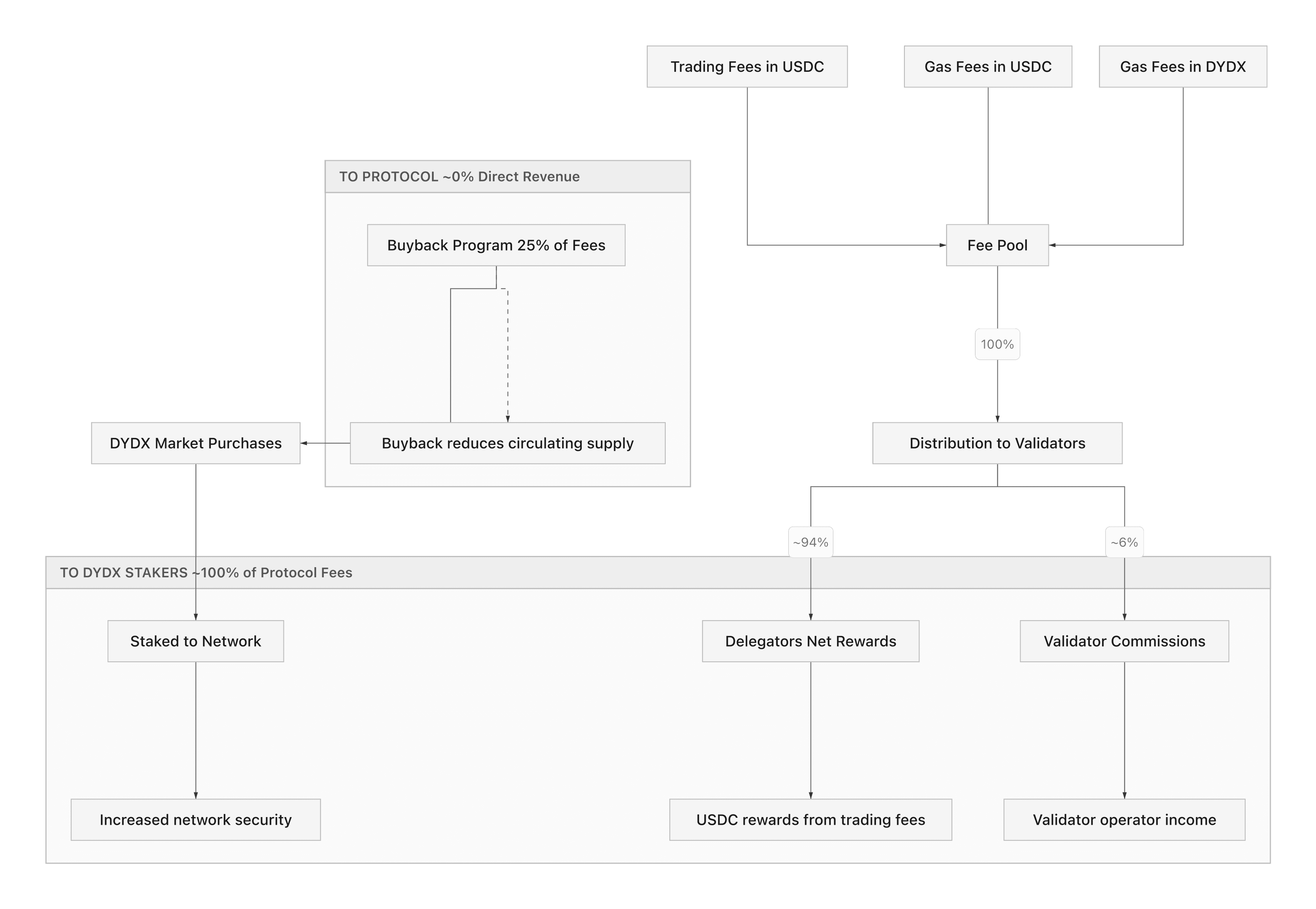

How dYdX Chain Fee Distribution Works

The fee distribution mechanism on dYdX V4 is straightforward: every fee collected goes directly to dYdX validators and their stakers. This is the core of dYdX tokenomics and what makes DYDX staking attractive.

Fee Sources

The protocol collects three types of fees:

Trading Fees in USDC: Maker and taker fees from perpetual futures trades, paid in USDC

Gas Fees in USDC: Transaction fees for on-chain operations, denominated in USDC

Gas Fees in DYDX: Alternative gas payment option in the native token

All three fee sources flow into a pool that gets distributed to stakers on a per-block basis. Notably, trading on the dYdX Chain itself is gas-less for users. Only maker and taker trading fees apply, making the dYdX crypto exchange experience similar to centralized platforms.

DYDX Staking Rewards Formula

Staking rewards follow a transparent calculation:

Reward = (Fee Pool x (Delegator's Stake / Total Stake)) x (1 - Community Tax) x (1 - Validator Commission)

Here is a breakdown of each component:

Fee Pool: Total fees collected in the current block

Delegator's Stake / Total Stake: Your proportional share of all staked DYDX

Community Tax: Percentage directed to community treasury (currently set to 0%)

Validator Commission: Fee charged by your chosen validator (averages 6.08%)

Since community tax is currently zero, the only reduction to your DYDX staking rewards is the validator's commission rate. This creates a competitive market where dYdX validators advertise lower commission rates to attract more delegators.

dYdX Validator Economics

dYdX validators secure the network by running nodes that validate transactions and produce blocks. They can set commission rates between 5% and 100%, though market dynamics push most toward the lower end, with the average sitting around 6.08%.

Stakers can delegate DYDX to multiple validators, spreading risk and optimizing for commission rates and validator reliability. When you delegate, your tokens remain in your custody but are locked with a 14-day unbonding period. During unbonding, you do not earn rewards and cannot transfer the tokens.

Rewards accumulate continuously and are manually claimable on a per-block basis, giving stakers control over when they realize income. Since most rewards come in USDC rather than DYDX, stakers receive a stablecoin income stream that does not depend on volatile token price movements.

The 100% Distribution Advantage

The 100% fee distribution is the defining feature of dYdX tokenomics. The decision to distribute 100% of protocol fees represents a bold alignment between the protocol and DYDX token holders. Unlike models where the protocol treasury or team captures a percentage, dYdX tokenomics mean every dollar of trading fee revenue flows directly to those securing the network.

This creates powerful incentives for long-term DYDX staking. As trading volume increases, staking yields improve proportionally. The protocol does not need to issue new tokens to incentivize security, because real fee revenue provides sustainable rewards.

dYdX Protocol Performance and Revenue Metrics

Real-world performance data shows the impact of dYdX tokenomics on staker returns.

According to current protocol metrics, dYdX V4 (dYdX Chain) generates approximately $307,000 in monthly holder revenue (30-day average). Since launch, the protocol has distributed over $62 million in cumulative holder revenue to stakers.

With more than 306 million DYDX staked and ongoing trading volume, the protocol demonstrates that fee-sharing tokenomics can create meaningful returns. The $56 million in net protocol fees since launch translates directly into staker compensation, with no protocol take reducing distributions.

Trading Volume and Activity

The dYdX Chain has processed over $316 billion in cumulative trading volume since its V4 launch. This positions the dYdX crypto exchange among the leading decentralized perpetual exchanges by volume, competing with centralized platforms while maintaining full decentralization.

Daily trading activity generates consistent fee revenue, though yields fluctuate based on market volatility and trader activity. During high-volume periods, DYDX staking yields increase correspondingly, while quieter markets produce lower returns.

DYDX Buyback Program

Adding another dimension to dYdX tokenomics, governance introduced a new mechanism in 2025 to support the DYDX token: the DYDX Buyback Program. Approved through on-chain proposals #225 and #231, this program allocates 25% of net protocol fees to monthly DYDX purchases from the open market.

Since its launch, the buyback program has:

Acquired 2.87 million DYDX from open markets

Spent over $1.88 million in cumulative protocol fees

Staked 100% of purchased tokens to secure the network

This creates a positive feedback loop. As trading fees increase, the protocol buys more DYDX, reducing circulating supply while simultaneously increasing the amount of staked tokens securing the network. The program demonstrates how dYdX tokenomics use revenue for sustainable token support beyond simple burns.

Trading Rewards

Beyond DYDX staking rewards, dYdX tokenomics include trading incentives. The dYdX Chain distributes 50,000 DYDX per day in trading rewards to active traders. These rewards are allocated in DYDX and distributed automatically each block based on trading volume and other factors.

This dual-incentive structure, with staking rewards in USDC plus trading rewards in DYDX, creates balanced incentives for both network security and trading activity.

Comparing dYdX to Hyperliquid and GMX

Understanding dYdX tokenomics requires context from competing perpetual exchanges. How does the 100% fee distribution model compare to alternatives?

Hyperliquid: Native Chain with Direct Rewards

Hyperliquid operates its own Layer 1 blockchain similar to dYdX, using a custom high-performance consensus mechanism. The HYPE token launched with a distribution model that includes staking rewards and potential fee sharing, though the exact fee distribution mechanism differs from the transparent 100% model in dYdX tokenomics.

Both protocols benefit from chain sovereignty, allowing complete control over tokenomics and performance optimization. The main difference lies in execution: the dYdX Chain uses Cosmos SDK's proven infrastructure, while Hyperliquid built custom technology optimized specifically for perpetual trading.

In terms of trading volume and liquidity, both protocols compete for the top decentralized perpetuals position. Hyperliquid emphasizes ultra-low latency and institutional-grade performance, while dYdX prioritizes decentralization through its dYdX validators network.

GMX: Multi-Chain with Liquidity Provider Model

GMX takes a fundamentally different approach. Rather than building its own chain, GMX operates on Arbitrum and Avalanche using smart contracts. The protocol's tokenomics centers around GLP (GMX Liquidity Provider) tokens, which represent a share of the protocol's liquidity pool.

Fee distribution on GMX is split:

30% of trading fees go to GMX stakers

70% go to GLP token holders who provide liquidity and take on the counterparty risk

This creates different incentives. GMX stakers receive consistent fee share without liquidity risk, while GLP holders earn higher yields but bear the risk of trader profits eating into their capital.

dYdX tokenomics differ by directing 100% of fees to stakers without requiring them to provide liquidity or take counterparty risk. The protocol's liquidity comes from professional market makers and traders rather than tokenized liquidity pools.

Tokenomics Model Comparison

The three protocols represent different philosophies:

dYdX: 100% fee distribution to stakers, sovereign chain, no liquidity pool risk

Hyperliquid: high-performance focus, constant buybacks daily.

GMX: Split fee model between stakers and liquidity providers, multi-chain deployment

For DYDX token holders seeking direct fee exposure, dYdX tokenomics offer the most straightforward value capture. For those willing to take counterparty risk, GMX's GLP provides potentially higher yields. Hyperliquid balances performance and token utility.

Each model has trade-offs. The dYdX tokenomics model with 100% distribution maximizes staker value but requires running validator infrastructure or trusting delegated validators. GMX's liquidity pool model is simpler to participate in but exposes participants to trader PnL risk. Hyperliquid's native architecture provides performance advantages but requires users to hold assets on a newer, less battle-tested chain.

Best Practices for DYDX Staking

Now that you understand dYdX tokenomics, here is how to maximize your returns. If you are considering DYDX staking, several factors influence your returns and risk.

Choosing dYdX Validators

Validator selection matters. Consider these criteria:

Commission Rate: Lower rates mean higher rewards, but extremely low rates may indicate insufficient validator margins for reliable operation

Uptime and Reliability: Check validator performance history and missed blocks

Delegation Amount: dYdX validators with more stake have higher voting power but are not necessarily better performers

Community Reputation: Established validators often have track records across multiple Cosmos chains

You can delegate to multiple dYdX validators to diversify risk. If one validator goes offline or acts maliciously, your other delegations continue earning rewards.

Understanding Unbonding

The 14-day unbonding period is important for every DYDX staking participant. When you unstake DYDX, your tokens are locked for two weeks during which you earn no rewards and cannot transfer them. This prevents certain attack vectors but reduces liquidity.

Plan ahead if you need access to your DYDX. The unbonding period means you cannot quickly react to market conditions once you initiate unstaking.

Reward Claiming Strategy

Since DYDX staking rewards are manually claimable, you control when to realize income. Some strategies:

Claim and Restake: Compound your USDC rewards by selling for more DYDX and restaking

Claim and Hold: Keep USDC rewards as stablecoin income

Claim Periodically: Balance gas costs (minimal on dYdX Chain) with the benefit of realized rewards

Gas fees on the dYdX Chain are low enough that claiming rewards frequently does not significantly impact returns.

Tax Considerations for dYdX Crypto Staking

DYDX staking rewards are generally taxable as ordinary income when received. The USDC rewards create clear taxable events with easily tracked dollar values, unlike rewards in volatile tokens where the taxable amount depends on market price at the moment of receipt.

Consult with tax professionals familiar with dYdX crypto staking, as regulations vary by jurisdiction and continue evolving.

Common Mistakes to Avoid

Even with favorable dYdX tokenomics, several pitfalls can reduce your DYDX staking returns or increase risk.

Choosing Validators Based Solely on Commission

The lowest commission rate does not always mean the best validator. A validator charging 5% but with 99.9% uptime may generate better returns than one at 4% with frequent downtime and slashing events.

Forgetting About Unbonding

A frequent mistake among dYdX crypto participants is initiating unbonding without remembering the 14-day lockup. If market conditions change and you want to quickly restake or sell, you are stuck waiting.

Not Monitoring Validator Performance

dYdX validators can change commission rates (within limits) or experience technical issues. Periodically review your delegated validators and consider rebalancing if performance degrades.

Overlooking the Migration Requirement

If you still hold DYDX on Ethereum, remember these are ethDYDX tokens that do not earn dYdX crypto staking rewards. You must bridge to the dYdX Chain to participate in fee distribution. The migration process requires gas fees on Ethereum and a bridge transaction.

Expecting Fixed Yields

A common misconception about dYdX tokenomics is that staking yields are fixed. DYDX staking yields fluctuate based on trading volume and total staked supply. Higher trading volume increases fees and yields, while more DYDX staked dilutes individual returns. Do not assume yields remain constant.

Key Takeaways

The dYdX Chain (V4) distributes 100% of trading fees to DYDX stakers, unlike V3 where token holders received no direct value capture from protocol revenue.

The DYDX token evolved from a governance-only token on Ethereum to a Layer 1 staking token on a sovereign Cosmos SDK blockchain with expanded utility.

With over $62 million in cumulative holder revenue distributed and $316 billion in trading volume processed, dYdX tokenomics demonstrate sustainable fee-sharing economics.

DYDX staking earns rewards predominantly in USDC rather than inflationary token emissions, providing stable income from real protocol fees.

The 1 billion DYDX token supply is split 50/50 between community allocations and investors/team, with approximately 81% unlocked as of early 2026.

Validator staking with dYdX validators involves a 14-day unbonding period and commission rates averaging 6.08%, with rewards claimable manually on a per-block basis.

dYdX tokenomics differ from competitors like GMX (split fee model with liquidity providers) and Hyperliquid (native chain with integrated rewards) by offering direct 100% fee distribution.

Conclusion

dYdX tokenomics represent a landmark case study in protocol evolution. The migration from a governance-only DYDX token with no value capture to a Layer 1 asset earning 100% of protocol fees demonstrates how sovereignty over blockchain infrastructure enables effective economic design.

For traders, the dYdX crypto platform offers a decentralized alternative to centralized perpetual exchanges with competitive liquidity and performance. For DYDX token holders, DYDX staking provides direct exposure to protocol revenue through staking yields paid in USDC, a sustainable model that does not rely on inflationary token emissions.

The decision to launch an independent blockchain using Cosmos SDK infrastructure gave dYdX complete control over its economic model, enabling the 100% fee distribution that defines V4 tokenomics. This architectural choice reflects a broader trend of major DeFi protocols seeking chain sovereignty to optimize for their specific needs.

As the protocol continues processing billions in trading volume and distributing millions in fee revenue to stakers, dYdX tokenomics stand as a strong example of how token economics can align incentives between protocols, users, and token holders. Whether the model proves sustainable long-term depends on maintaining competitive trading volume, but the fundamentals of real fee revenue distribution without token inflation offer a stronger foundation than many alternatives.

For those interested in decentralized perpetual trading or seeking exposure to DeFi protocol fees, understanding dYdX tokenomics provides valuable context on how modern token models can capture value while maintaining full decentralization.

dYdX Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Previously managing partner at a web3 venture fund (exit in 2021).

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.