Written:

Feb 2, 2026

Pump.fun has emerged as Solana's dominant memecoin launchpad, generating over $800 million in cumulative revenue since launch. But what makes the pump.

Pump.fun has emerged as Solana's dominant memecoin launchpad, generating over $800 million in cumulative revenue since launch. But what makes the pump.fun tokenomics model unique is how the platform distributes value back to PUMP token holders through an aggressive buyback program that now allocates 100% of daily revenue to token repurchases. This article breaks down how Pump.fun's revenue model works, how PUMP tokens are distributed, and what risks investors should understand before participating.

What is Pump.fun?

Pump.fun is a decentralized application built on Solana that allows anyone to launch and trade memecoins using an automated bonding curve mechanism. The platform removes traditional barriers to token creation by eliminating the need for liquidity pools, LP tokens, or coding knowledge. Users can mint a new token with a single click and just 0.01 SOL.

Launched in early 2024, Pump.fun quickly captured 75-80% of the Solana memecoin launchpad market during peak periods. The platform's success led to the launch of its native PUMP token in July 2025, which introduced a revenue-sharing mechanism that directly rewards token holders.

The platform's core innovation lies in its bonding curve model, which provides instant liquidity by building it directly into the smart contract. Every token launched follows a linear pricing model where the price increases slightly with each purchase, rewarding early buyers while maintaining predictable pricing dynamics.

How Pump.fun Works

Pump.fun operates on a straightforward mechanism that makes memecoin creation accessible to anyone while maintaining fair price discovery.

Bonding Curve Mechanics

When a token launches on Pump.fun, 800 million tokens out of a 1 billion total supply are allocated to a bonding curve. As traders purchase tokens, the price increases according to a mathematical formula that ensures early participants receive lower prices. The bonding curve creates a predictable relationship between supply and demand without requiring external liquidity providers.

The platform charges a 1% fee on all trades conducted through the bonding curve. This fee structure generates revenue from both buying and selling activity, creating a consistent income stream regardless of market direction.

Token Graduation to Raydium

Once all 800 million tokens in the bonding curve are purchased (representing approximately $69,000 in market capitalization), the token "graduates" from Pump.fun. At this point, approximately 86 SOL has been collected through purchases, and the platform automatically deposits $12,000 worth of liquidity to decentralized exchanges.

Originally, graduated tokens transitioned exclusively to Raydium DEX. However, in March 2025, Pump.fun introduced its own decentralized exchange called PumpSwap, where graduated tokens now migrate by default. This vertical integration allows Pump.fun to capture more value across the entire token lifecycle.

The graduation mechanism serves multiple purposes. It validates market demand before creating permanent liquidity, prevents low-quality tokens from cluttering decentralized exchanges, and ensures sufficient initial liquidity for continued trading.

Platform Evolution

Pump.fun has evolved beyond its initial memecoin launchpad role. In January 2026, the platform introduced a Dynamic Fee Model that shifts to a market-driven approach where traders can influence creator fees based on token narratives. Fees now adjust dynamically based on trader activity and community sentiment rather than following a fixed rate.

This evolution reflects Pump.fun's strategy to build a sustainable ecosystem rather than remain a simple token launcher. The structured tokenomics, revenue sharing, and vertical integration through PumpSwap position the platform for long-term viability in the competitive Solana DeFi landscape.

PUMP Token Distribution

The PUMP token has a fixed maximum supply of 1 trillion tokens with no inflationary mechanism. This deflationary structure, combined with ongoing buybacks, creates potential scarcity over time.

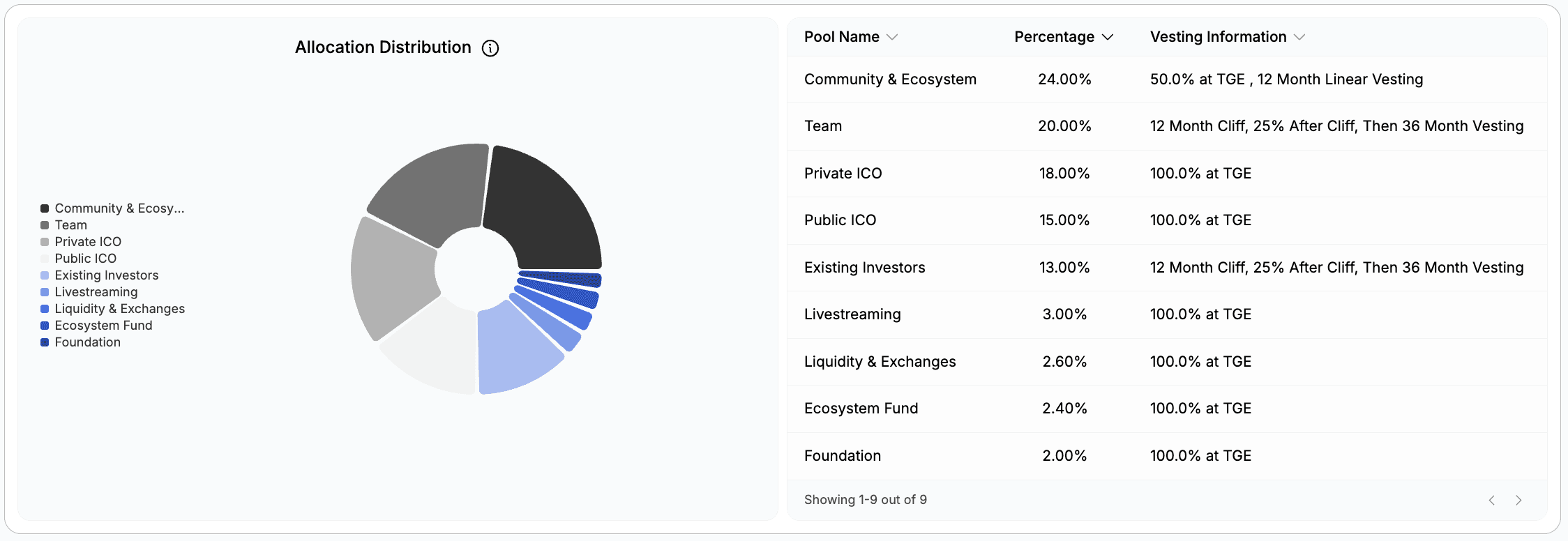

Allocation Breakdown

The token distribution reflects a balance between public participation, team incentives, and ecosystem development:

33% ICO (330 billion tokens): 18% allocated to private institutional investors and 15% to retail participants, both priced at $0.004 per token with full day-one unlocks

24% Community and Ecosystem (240 billion tokens): Reserved for community initiatives, partnerships, and ecosystem growth

20% Team (200 billion tokens): Allocated to Pump.fun's development team, subject to vesting schedules

13% Existing Investors (130 billion tokens): Pre-launch investors who funded platform development

3% Livestream Incentives (30 billion tokens): Rewards for content creators and community engagement

2.6% Liquidity and Exchanges (26 billion tokens): Ensures trading liquidity across centralized and decentralized venues

2.4% Ecosystem Fund (24 billion tokens): Strategic investments and ecosystem development

2% Foundation (20 billion tokens): Governance and long-term protocol development

Initial Coin Offering Details

The PUMP ICO launched on July 12, 2025, at 2 p.m. UTC with 150 billion tokens available across major exchanges including Bybit, Kraken, KuCoin, and Gate.io. The sale concluded on July 15 or upon sellout.

Notably, U.S. and U.K. citizens were completely excluded from participation due to regulatory restrictions. This geographic limitation reflects the complex regulatory environment surrounding token sales in major markets.

The ICO raised approximately $1 billion in the first 12 minutes, demonstrating strong market demand for exposure to Pump.fun's revenue stream. Within hours, the sale reached $500 million, valuing the platform at a $4 billion fully diluted valuation.

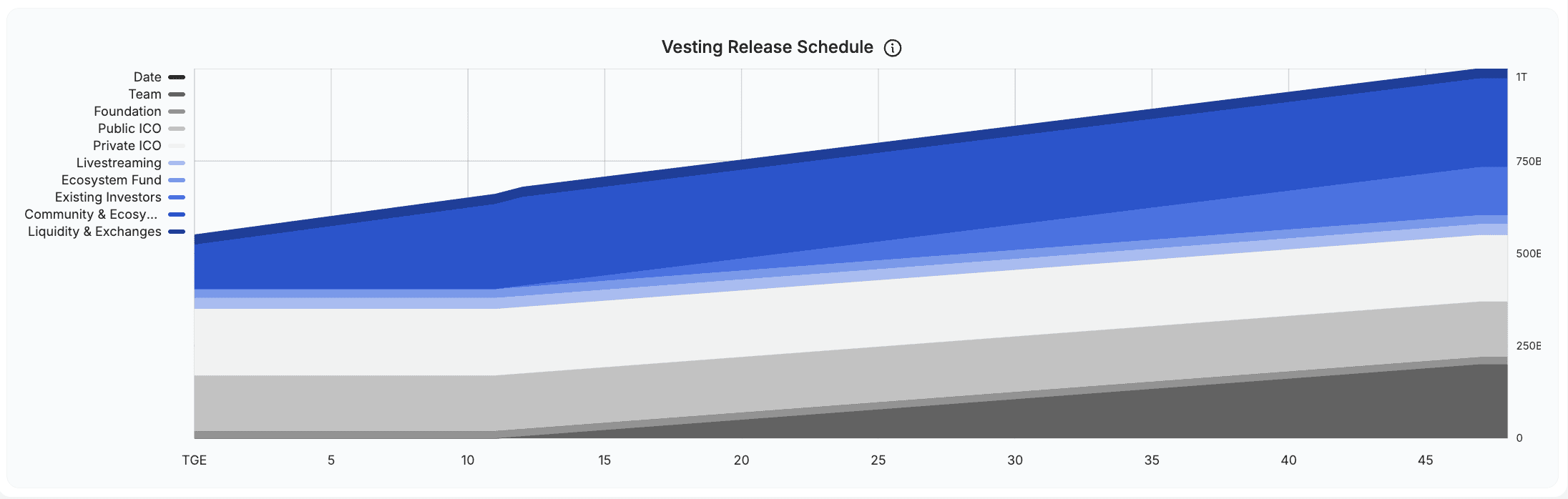

Circulating Supply and Vesting

As of early 2026, approximately 430 billion PUMP tokens are unlocked and circulating, representing about 43% of total supply. The remaining tokens follow vesting schedules that extend through 2029, with major unlock events scheduled periodically.

The next significant unlock is scheduled for July 12, 2026, exactly one year after the ICO. Most allocations are released through cliff mechanisms rather than linear vesting, meaning large quantities unlock at specific dates rather than gradually over time.

This vesting structure creates predictable unlock events that can impact token price through increased supply. Investors should monitor the vesting schedule to anticipate potential selling pressure from newly unlocked tokens.

Pump.fun Value Accrual

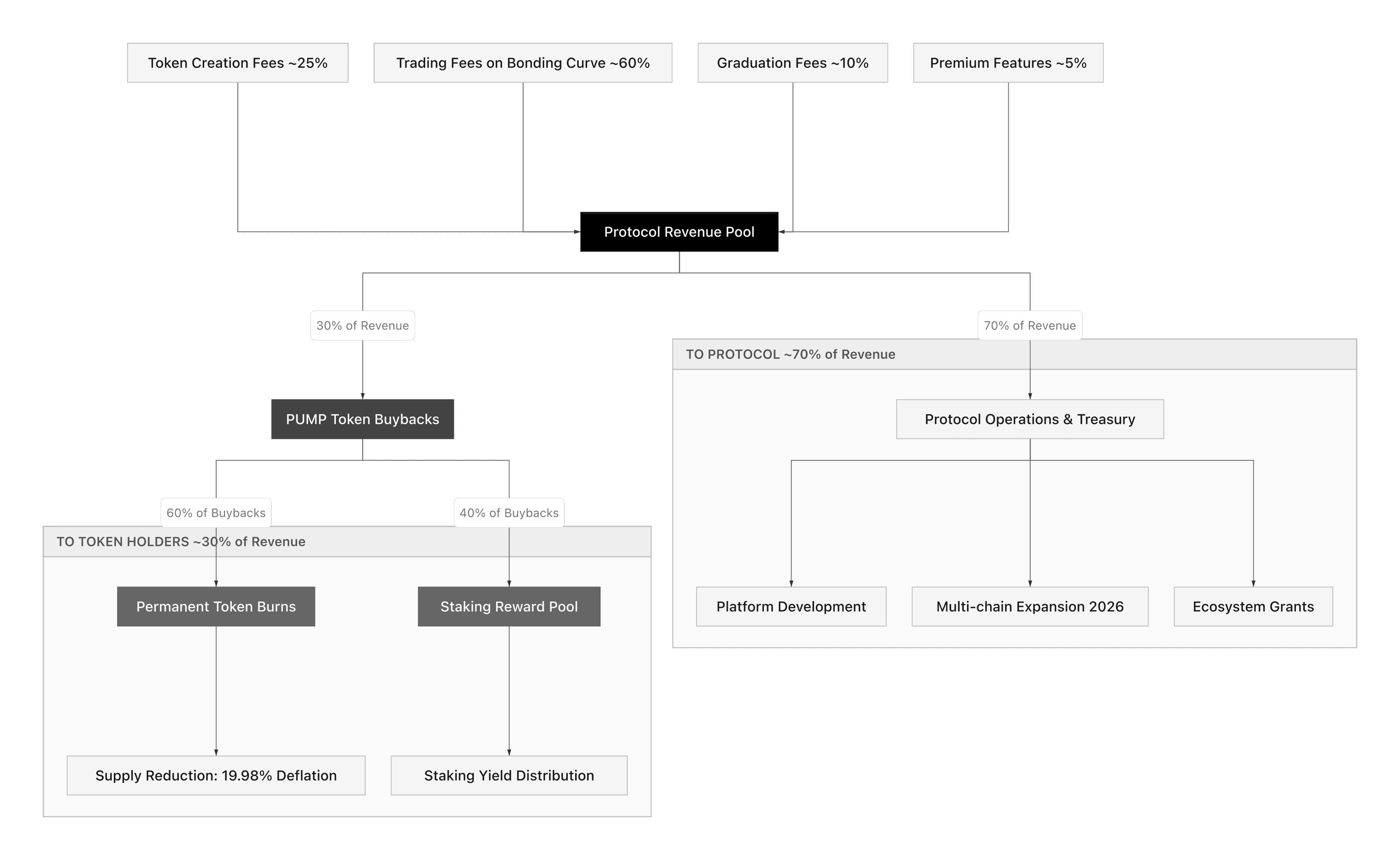

Pump.fun's economic model centers on capturing trading fees and redistributing them to PUMP token holders through a systematic buyback program. This PUMP value accrual mechanism converts platform revenue directly into token holder returns.

Fee Structure

The platform generates revenue through a simple 1% fee on all trades executed on its bonding curves. With billions in daily trading volume during peak memecoin cycles, this fee structure produces substantial income.

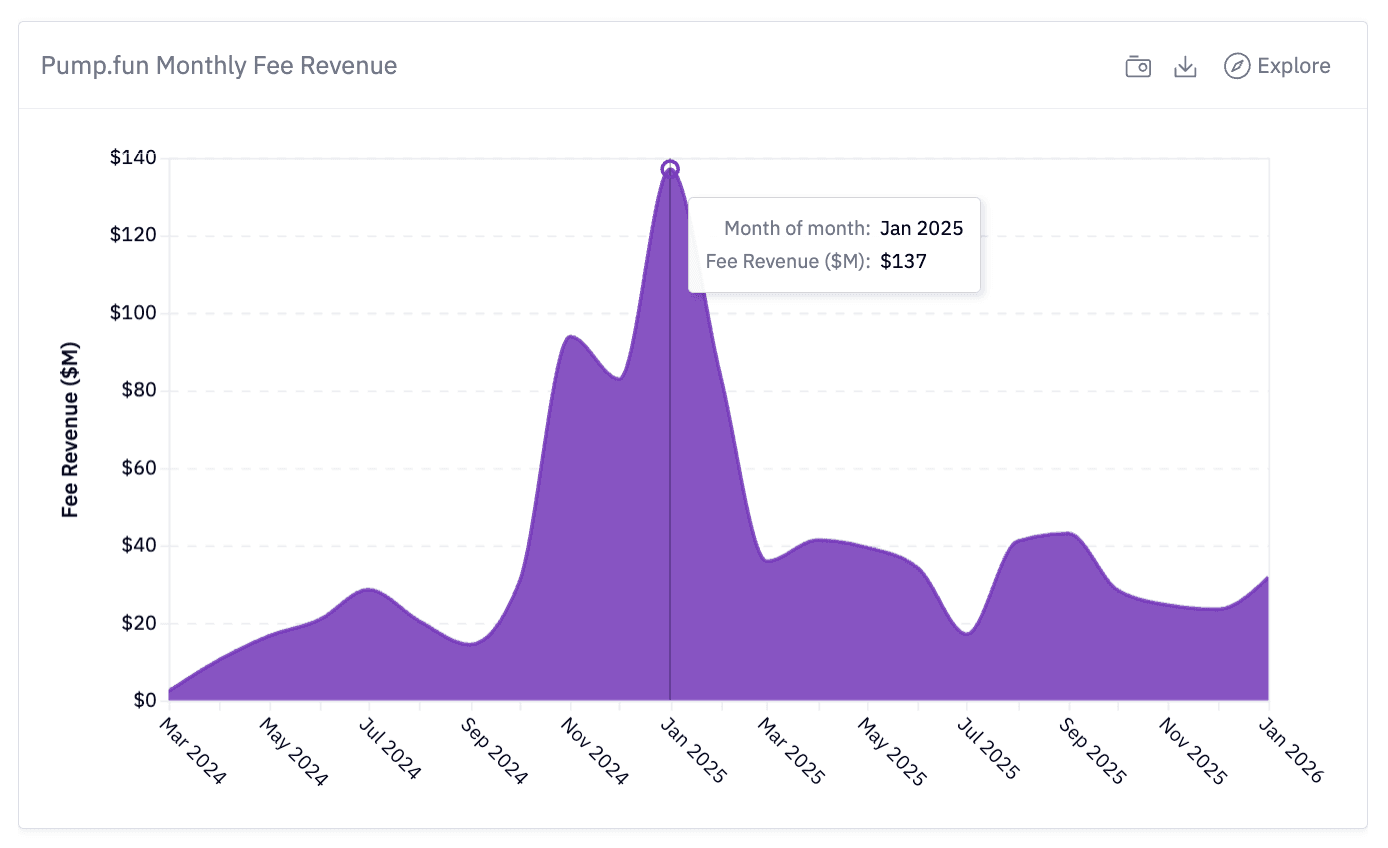

Since launch, Pump.fun has accumulated over $818 million in cumulative revenue. The platform reached its peak monthly performance in January 2025 with $137.12 million in revenue and fees. Even during quieter periods, the platform consistently generates millions in monthly revenue.

Daily revenue typically ranges from $800,000 to over $3 million depending on market conditions and memecoin activity. This consistent income stream supports the aggressive buyback program that defines pump.fun tokenomics.

Buyback Program

The PUMP token buyback program represents the primary mechanism for value distribution to token holders. Unlike dividend payments or staking rewards, Pump.fun repurchases tokens from the open market using platform revenue, then removes them from circulation.

The buyback strategy has evolved since launch. Initially, the platform allocated 25% of revenue to token repurchases. However, recognizing the program's importance to token value, Pump.fun increased this allocation to 100% of daily revenue, an unmatched commitment in the DeFi space.

Since the program launched in July 2025, Pump.fun has repurchased over $218 million worth of PUMP tokens. The program crossed the $150 million milestone within just three months, demonstrating the platform's substantial revenue generation.

Impact on Token Supply

The buyback program has measurably reduced circulating supply. As of late 2025, buybacks had eliminated 6.67% of circulating supply, effectively removing approximately 9.6% of total token supply from the market.

This supply reduction creates deflationary pressure on token price. Basic economics suggests that reducing supply while demand remains constant should increase per-unit price. The buyback program drove PUMP's price up 53.9% to $0.008354 in September 2025, though cryptocurrency prices remain volatile and influenced by many factors.

With nearly $1 million in daily buy pressure from the 100% revenue allocation, the buyback program provides consistent demand for PUMP tokens regardless of broader market conditions. This mechanism theoretically creates a price floor supported by platform revenue, though market dynamics can override this support during periods of heavy selling.

Sustainability Concerns

The 100% revenue allocation to buybacks raises questions about long-term sustainability. By directing all revenue to token repurchases, Pump.fun foregoes revenue that could fund development, marketing, security audits, or operational expenses.

This aggressive allocation suggests the platform either maintains substantial reserves from the ICO and pre-launch period, or believes token price appreciation serves as the most effective way to attract and retain users. It may also indicate confidence that trading volume will remain high enough to sustain both buybacks and operational needs.

Industry analysis suggests this subsidy model (where holders receive more than 100% of platform fees through the buyback program) works when the platform captures value through other mechanisms such as token appreciation, ecosystem expansion, or future revenue streams not currently active.

Protocol Performance

Pump.fun's financial performance demonstrates the platform's market dominance and the sustainability of its revenue model.

Revenue Statistics

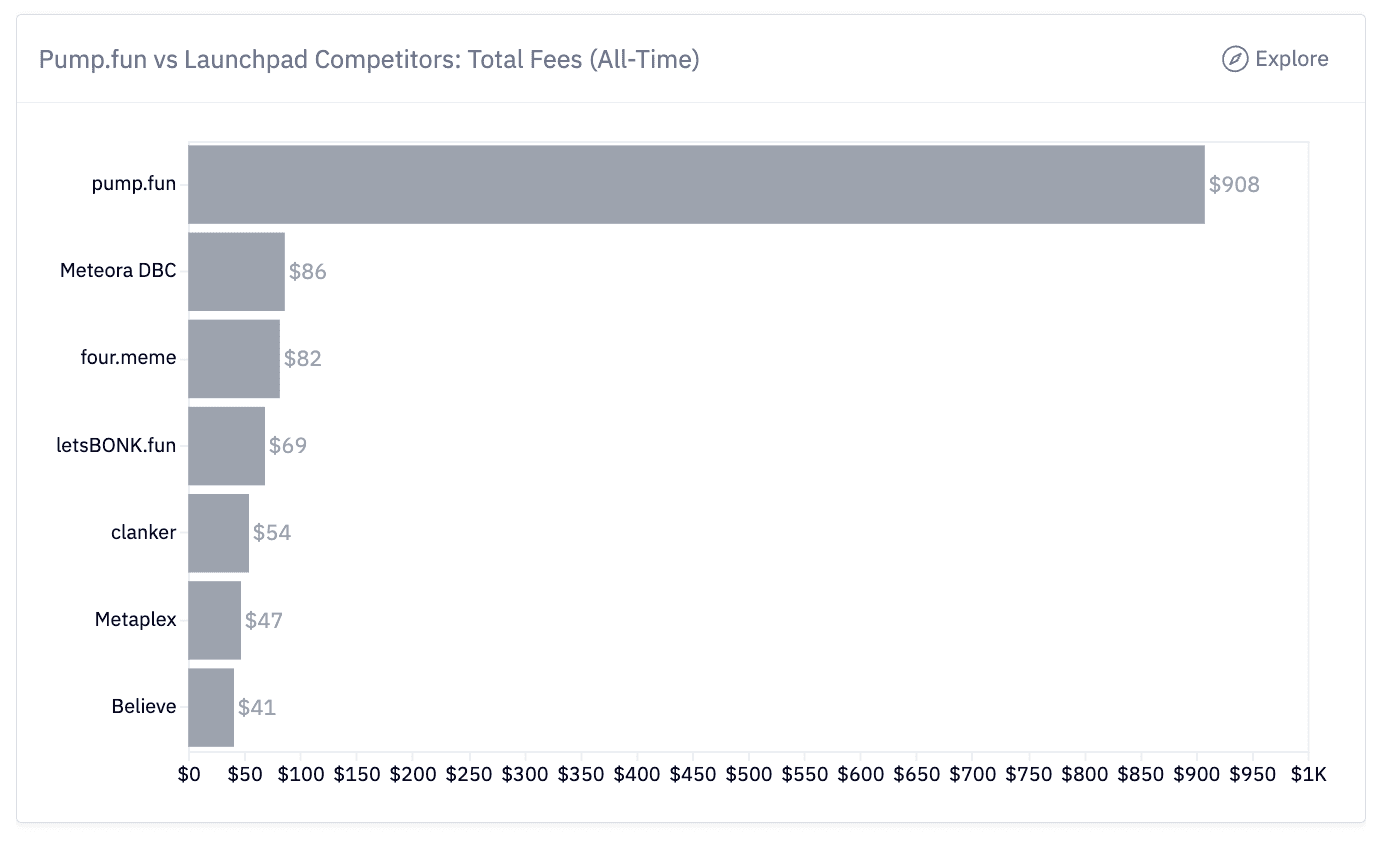

The purple area chart clearly shows the Jan 2025 peak at $137M during the memecoin supercycle, with revenue normalizing to ~$24-43M/month through 2025 and a $908M all-time total.

The platform's revenue trajectory shows impressive growth from launch through late 2025:

Cumulative Revenue: Over $818 million since launch

Peak Monthly Revenue: $137.12 million (January 2025)

Recent Monthly Performance: $25.56 million (30-day average in early 2026)

Daily Revenue Range: $800,000 to $3.38 million depending on market conditions

These figures position Pump.fun as one of the highest-earning protocols in decentralized finance. The platform frequently ranks in the top three DeFi protocols by daily revenue, competing with established players like Tether and Circle.

Trading Volume

Pump.fun has facilitated over $150 billion in cumulative trading volume since launch. This massive volume reflects both the platform's market dominance and the speculative nature of memecoin trading.

Daily volume fluctuates significantly based on memecoin market cycles. During peak periods, the platform processes hundreds of millions in daily volume. Even during quieter periods, consistent trading activity generates steady fee revenue.

Market Position

Throughout 2025, external trackers consistently showed Pump.fun holding approximately 75-80% market share of "graduated" Solana launchpad tokens during market upswings. This dominant position provides competitive advantages including network effects, liquidity concentration, and brand recognition.

pump.fun at $908M absolutely dwarfs the field. 10.5x the next largest (Meteora DBC at $86M). The gray bars make the competitive gap impossible to miss.

The platform successfully defended its market position against competitors like LetsBonk and other Solana launchpads. This defensibility stems from Pump.fun's first-mover advantage, superior user experience, and established community trust.

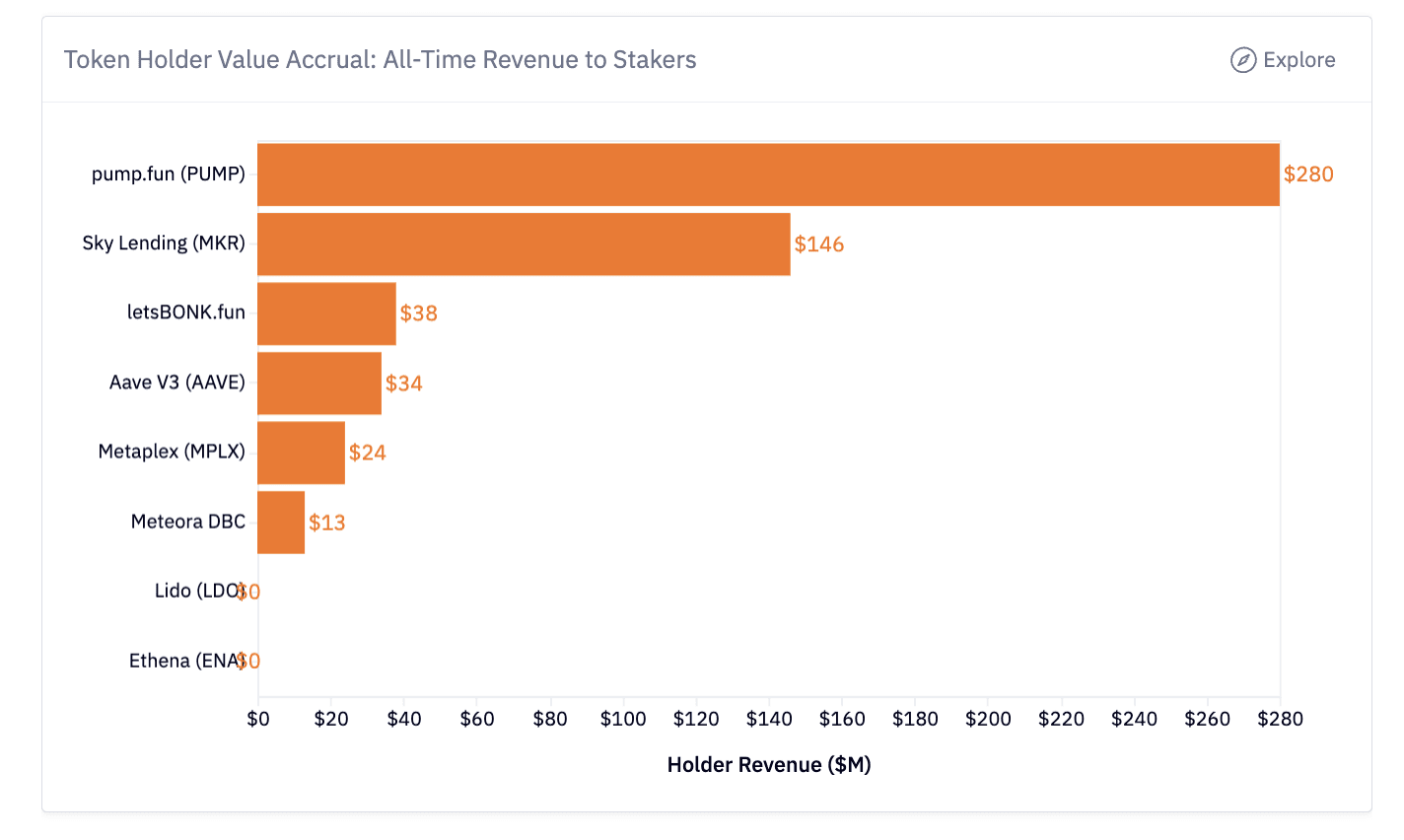

Holder Revenue Distribution

This is the key insight: pump.fun returns 30.8% directly to holders — one of the the highest value accrual mechanism in the web3 space as of Feb 2026.

pump.fun leads at $280M in holder revenue after just 7 months of distributions, nearly 2x Sky Lending's $146M accumulated over years

The holders revenue metric (representing buyback spending) shows the direct value flowing to PUMP token holders:

Cumulative Holders Revenue: over $280.1 million

Annualized Holders Revenue: $448.18 million (projected based on current rates)

30-Day Holders Revenue: $36.74 million

Daily Holders Revenue: $1.27 million average

These figures demonstrate that PUMP token holders receive substantial value from the buyback program.

Risks and Considerations

While pump.fun tokenomics offers compelling value distribution through buybacks, investors should understand several significant risks before purchasing PUMP tokens.

Memecoin Market Volatility

Pump.fun's revenue directly correlates with memecoin trading activity. Memecoins are among the most volatile and speculative crypto assets, characterized by rapid price swings, short attention spans, and frequent complete value losses.

When memecoin interest wanes (as it inevitably does during broader market downturns), Pump.fun's trading volume and revenue decline sharply. The platform's revenue dropped 92% from peak levels during quieter market periods, demonstrating this cyclical dependency.

This revenue volatility directly impacts the buyback program's effectiveness. During low-revenue periods, buyback pressure weakens, potentially leading to PUMP price declines. Investors should expect significant price volatility correlated with broader memecoin market cycles.

Regulatory Uncertainty

The exclusion of U.S. and U.K. participants from the PUMP ICO highlights regulatory concerns surrounding the platform and token. Memecoin launchpads occupy a gray area in securities regulation, particularly when platform tokens claim revenue-sharing characteristics.

Regulatory actions against similar platforms could impact Pump.fun's operations, token price, or ability to serve certain markets. The revenue-sharing mechanism through buybacks may attract regulatory scrutiny as securities regulators worldwide increase focus on crypto assets.

Platform Competition

While Pump.fun currently dominates Solana memecoin launches, this position isn't guaranteed. Competitors can easily replicate the bonding curve mechanism, and user preferences in the memecoin space shift rapidly based on trends, features, and community sentiment.

The introduction of PumpSwap and dynamic fee models represents Pump.fun's attempt to build defensible moats beyond simple token launching. However, these features don't guarantee sustained market dominance in a space characterized by rapid innovation and user fickleness.

Token Unlock Risk

The vesting schedule extending through 2029 means substantial PUMP tokens remain locked. When these tokens unlock (particularly large cliff unlocks), they create significant selling pressure as team members, investors, and ecosystem allocations become liquid.

The next major unlock on July 12, 2026, could introduce substantial supply to the market. If selling pressure from newly unlocked tokens exceeds buying pressure from the buyback program, token price may decline regardless of the platform's operational success.

Sustainability of 100% Buyback Allocation

Allocating 100% of revenue to buybacks rather than protocol development, security, or operations presents long-term sustainability questions. While this allocation maximizes short-term holder value, it may limit the platform's ability to invest in improvements, security audits, marketing, or competitive responses.

This strategy suggests Pump.fun raised sufficient capital during the ICO to fund operations for an extended period, or the team believes token price performance serves as the most effective growth mechanism. However, if the platform encounters unexpected costs, security incidents, or competitive pressures requiring capital investment, the 100% buyback allocation may prove unsustainable.

Key Takeaways

Pump.fun dominates Solana memecoin launches with 75-80% market share and over $818 million in cumulative revenue since launch.

The platform allocates 100% of daily revenue to PUMP token buybacks, distributing approximately $1 million daily in buy pressure and over $218 million in total buybacks since July 2025.

PUMP token has a 1 trillion fixed supply with 33% distributed through ICO, 24% for community and ecosystem, 20% to team, and remaining allocations for investors, incentives, and liquidity.

The bonding curve model allows anyone to launch tokens with 0.01 SOL and no coding, with automatic graduation to DEXs at $69,000 market cap.

Revenue depends heavily on memecoin trading activity, creating significant volatility with monthly revenue ranging from $25 million in quiet periods to $137 million at peak.

Major risks include memecoin market cyclicality, regulatory uncertainty, upcoming token unlocks through 2029, and sustainability questions around the 100% buyback allocation.

Conclusion

Pump.fun tokenomics demonstrates an aggressive approach to value distribution in DeFi protocols. By allocating 100% of revenue to token buybacks, the platform creates direct, measurable value flow to PUMP token holders. The $218 million in buybacks since July 2025 and consistent $1 million daily buy pressure provide tangible evidence of this value transfer.

However, this model's sustainability depends on continued memecoin market activity. The platform's revenue concentration in speculative memecoin trading creates cyclical performance that investors must accept. During peak periods, the pump.fun tokenomics model generates impressive holder returns. During downturns, reduced revenue weakens buyback support and token prices typically decline.

For investors bullish on Solana's memecoin ecosystem and comfortable with significant volatility, PUMP token offers direct exposure to the largest launchpad's revenue stream. The aggressive buyback program and dominant market position create compelling value propositions. However, the risks are substantial and include memecoin market cyclicality, token unlock selling pressure, regulatory uncertainty, and long-term sustainability questions.

Understanding these trade-offs allows investors to make informed decisions about whether pump.fun tokenomics aligns with their investment goals, risk tolerance, and market outlook. The model succeeds when memecoin activity thrives but faces challenges during inevitable market downturns.

Pump.fun Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.