Written:

Feb 7, 2026

Jito processes $4.2B daily on Solana through liquid staking and MEV extraction. Learn how JTO tokenomics captures value from tips, commissions, and restaking...

Jito tokenomics represents a fundamental shift in how Solana protocols align value capture with governance token holders. Unlike traditional liquid staking protocols that retain revenue, Jito sends 100% of Block Engine and Bundle Auction Marketplace (BAM) fees directly to the DAO treasury while JitoSOL stakers earn MEV-boosted yields that outperform native staking. This article examines how JTO token economics work, where revenue flows, and why Jito's model creates sustainable value accrual for both governance participants and liquid stakers.

What Is Jito?

Jito is a liquid staking protocol and MEV infrastructure provider on Solana that pioneered the integration of Maximal Extractable Value (MEV) capture into staking rewards. The protocol operates three core products: JitoSOL liquid staking tokens, the Jito Block Engine for transaction ordering, and the Block Assembly Marketplace (BAM) for decentralized block building.

At its foundation, Jito allows users to stake any quantity of SOL and receive JitoSOL, a liquid staking derivative that represents staked SOL plus accumulated MEV rewards. Unlike native Solana staking, which locks capital for multi-day unbonding periods, JitoSOL remains liquid and can be deployed across DeFi protocols while continuing to earn staking yields.

The Jito Block Engine processes transaction bundles submitted by searchers and validators, extracting MEV from transaction ordering. By early 2026, over 95% of Solana's active stake was delegated to validators running the Jito-Solana client, making it the dominant MEV infrastructure on the network. The Block Engine captures priority fees and MEV tips that would otherwise be lost, redistributing these proceeds to JitoSOL holders and, following JIP-24, to the DAO treasury.

BAM launched in July 2025 as Jito's decentralized block assembly marketplace. This system enables a network of nodes running within Trusted Execution Environments (TEEs) to order transactions and send them to validators running Jito's upgraded client. The transaction flow remains private until execution, preventing front-running while allowing customizable plugins for specialized transaction processing. BAM generated an estimated $15 million in annual revenue projections by late 2025, supplementing the Block Engine's existing fee streams.

Jito staking dominates Solana's liquid staking market with over 14.5 million SOL staked and approximately $2.92 billion in total value locked (TVL) as of early 2026. This positions JitoSOL as the largest liquid staking token on Solana, surpassing competitors like Marinade Finance and representing the primary gateway for retail and institutional participants seeking MEV-enhanced staking yields.

Jito Tokenomics: JTO Supply and Distribution

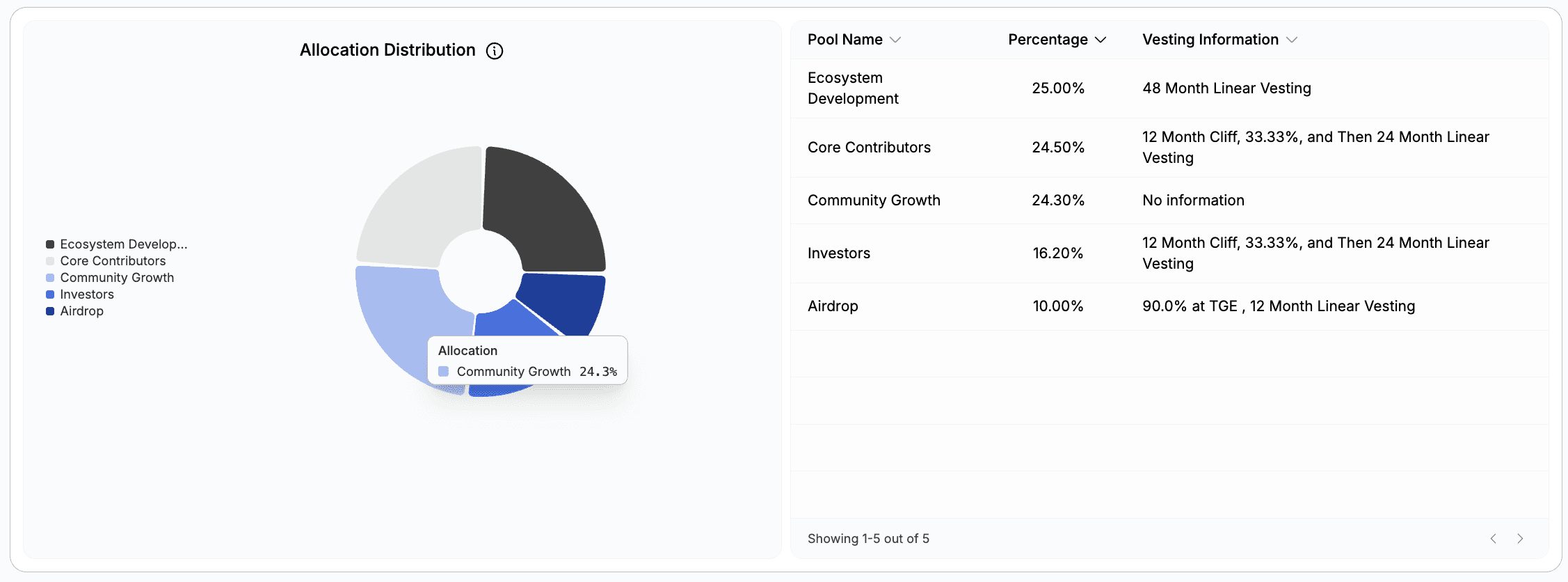

Jito tokenomics begins with a maximum supply of 1 billion JTO tokens, though the token has an infinite supply ceiling to accommodate future emissions if governance decides to implement them. The initial distribution allocated tokens across four primary categories: Community Growth (34.29%), Ecosystem Development (25%), Core Contributors (24.5%), and Investors (16.21%).

The remaining 5% distribution includes allocations for the DAO treasury, foundation reserves, and initial liquidity. This structure prioritizes community and ecosystem alignment over investor concentration, a design decision that distinguishes Jito from protocols where venture capital allocations exceed 30%.

As of February 2026, the circulating supply stands at approximately 433.5 million JTO tokens, representing 43.35% of the total supply. The remaining tokens remain locked under various vesting schedules, with significant unlock events scheduled throughout 2026 that will gradually increase circulating supply.

Token Allocation

The Community Growth allocation (34.29% or 342.9 million JTO) supports airdrop recipients, community incentives, and ongoing participation rewards. The initial JTO airdrop distributed tokens to eligible Jito users, with 50% available at genesis and the remaining 50% unlocking linearly over 12 months. This allocation follows an estimated six-year linear vesting schedule designed to sustain long-term community engagement without creating excessive selling pressure.

Ecosystem Development receives 25% (250 million JTO) under a 48-month linear vesting schedule. These tokens fund protocol partnerships, developer grants, liquidity mining programs, and strategic integrations across Solana DeFi. The extended vesting period ensures consistent capital availability for ecosystem expansion while preventing concentrated unlocks that could destabilize JTO price action.

Core Contributors hold 24.5% (245 million JTO) subject to a three-year vesting schedule with a one-year cliff. This structure ensures team alignment with long-term protocol success, preventing early token sales by insiders. The cliff mechanism means no contributor tokens became liquid until December 2024, one year after the token generation event.

Investors received 16.21% (162.1 million JTO) from venture capital firms that supported Jito's development. These allocations also vest over multiple years, with the first significant unlock occurring in January 2026. Jito Labs raised $50 million in October 2025, bringing total funding to $62 million, though this latest round involved equity investment rather than additional token allocations.

Vesting and Unlock Schedule

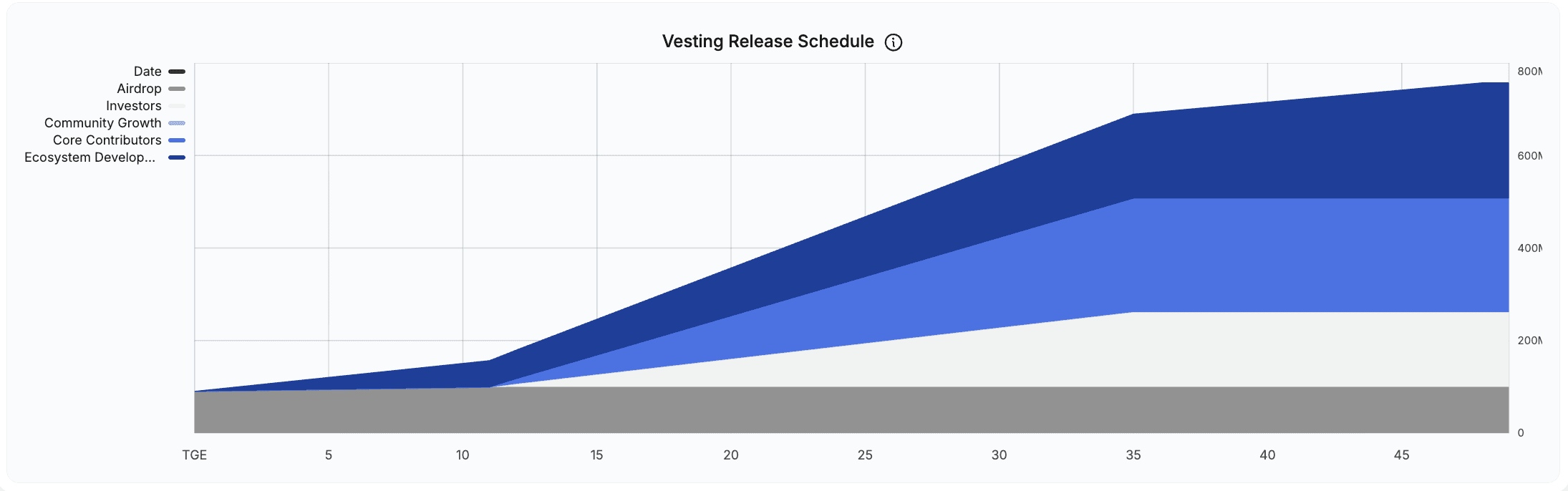

Jito vesting schedules create predictable token unlock patterns that impact circulating supply and potential selling pressure. January 7, 2026 marked a significant unlock event, releasing 2.5% from investors (4.05 million tokens), 2.71% from the team (6.64 million tokens), and 1.88% from development (4.69 million tokens). Similar monthly unlocks continue throughout 2026, gradually increasing liquid JTO supply.

The airdrop vesting concluded in December 2024, fully unlocking all community distribution tokens from the genesis event. This milestone meant early adopters gained complete access to their allocations, though many recipients chose to stake JTO in governance rather than sell.

The prolonged vesting periods for core contributors and ecosystem development create downward pressure on immediate sell-side liquidity. Because these allocations unlock linearly rather than in cliff events, the protocol avoids sudden supply shocks. However, the cumulative effect of ongoing unlocks means circulating supply will nearly double by late 2027, potentially diluting per-token value unless demand growth matches or exceeds emission rates.

Understanding Jito tokenomics requires recognizing that JTO functions primarily as a governance token rather than a direct claim on protocol cash flows. The token grants voting rights in Jito DAO decisions, including critical proposals like JIP-24 that restructured fee distribution. While JTO holders do not receive automatic dividends or staking rewards from protocol revenue, governance control over a treasury receiving 100% of protocol fees creates indirect value accrual mechanisms that the DAO can activate through buybacks, fee switches, or other value distribution programs.

How Jito Generates Revenue

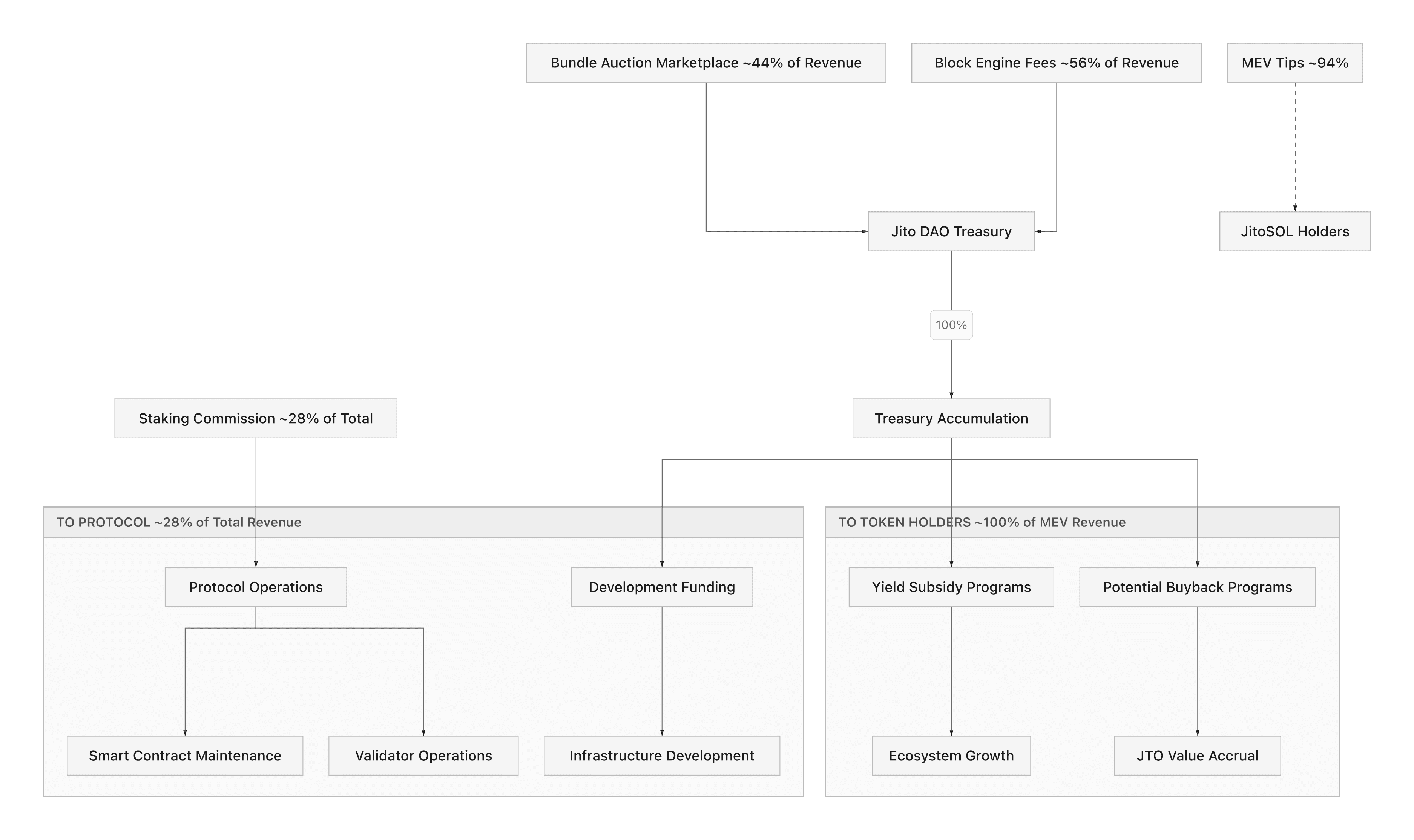

Jito generates revenue through three distinct mechanisms: Block Engine fees from MEV extraction, Bundle Auction Marketplace fees from decentralized block building, and liquid staking commission from JitoSOL. Each revenue stream contributes to different stakeholders, creating a multi-layered economic model that serves JTO governance participants, JitoSOL holders, and protocol sustainability.

Block Engine Fees

The Jito Block Engine charges a 6% fee on all MEV rewards captured through transaction ordering and bundle processing. Before JIP-24, this 6% fee split equally between Jito Labs (3%) and the Jito DAO treasury (3%). Following the passage of JIP-24 in August 2025, the entire 6% now flows directly to the DAO treasury, eliminating protocol founder revenue sharing.

Block Engine fees derive from searchers who submit transaction bundles containing MEV opportunities like arbitrage trades, liquidations, and sandwich attacks. Validators running the Jito-Solana client accept these bundles and pay tips to block producers for inclusion. The Block Engine extracts a percentage of these tips before distributing the remainder to validators and ultimately to JitoSOL stakers.

Revenue projections for the Block Engine reached approximately $4.7 million in Q3 2025 alone. When annualized, this suggests nearly $19 million in annual Block Engine revenue flowing to the DAO treasury under the post-JIP-24 structure. However, actual revenue fluctuates with network activity, MEV opportunity density, and competition from alternative transaction ordering systems.

The Block Engine achieved 94% market share among Solana validators by Q2 2025, demonstrating near-universal adoption. This dominance creates a strong moat for Jito revenue generation because searchers must use Jito infrastructure to access the vast majority of Solana's block production. Even if competing MEV infrastructure emerges, Jito's first-mover advantage and established validator relationships provide sustained revenue capture.

Bundle Auction Marketplace (BAM)

BAM launched on July 21, 2025, introducing a decentralized alternative to the centralized Block Engine model. Rather than relying on Jito Labs-operated infrastructure, BAM operates as a permissionless network where independent nodes compete to assemble transaction bundles within Trusted Execution Environments.

The marketplace charges fees for plugin usage and specialized bundle processing. These plugins allow customizable transaction ordering logic, enabling searchers to implement complex MEV strategies without revealing their methods to competitors. Early revenue estimates suggested BAM could generate an additional $15 million annually beyond existing Block Engine fees, though actual adoption depends on searcher migration from the centralized engine to the decentralized marketplace.

BAM fees follow the same 100% DAO treasury allocation established under JIP-24. This means all future BAM revenue accrues to JTO governance participants rather than splitting with Jito Labs. The protocol launched a Validator Subsidy Program in Q1 2026 through JIP-31 to incentivize validators to adopt BAM-compatible clients. This subsidy phases out over 12 weeks, creating a transition period where validators earn guaranteed income while building familiarity with the new system.

The strategic importance of BAM extends beyond immediate revenue. By decentralizing block assembly, Jito reduces reliance on centralized infrastructure that could become regulatory targets or single points of failure. The TEE-based architecture also enables more sophisticated MEV strategies while preserving transaction privacy, potentially attracting institutional searchers who require confidentiality guarantees.

Liquid Staking Commission

JitoSOL liquid staking generates revenue through a commission structure separate from Block Engine and BAM fees. The protocol charges stakers a percentage of earned staking rewards, which historically followed industry-standard rates between 5-8% of total yield.

Unlike Block Engine and BAM fees that flow to the DAO treasury, liquid staking commissions support operational costs including validator set management, smart contract maintenance, and protocol security. JitoSOL delegates staked SOL across over 200 validators through Jito StakeNet, creating decentralization benefits while requiring ongoing coordination and performance monitoring.

Stakers receive the remaining 92-95% of earned yields automatically through JitoSOL price appreciation. Rather than distributing new tokens, the liquid staking derivative increases in value relative to native SOL as rewards accumulate. This auto-compounding mechanism simplifies tax accounting and eliminates the need for manual reward claiming.

With over 14.5 million SOL staked in JitoSOL and base Solana staking yields averaging 5.9-6.6% APY, the protocol generates substantial commission revenue even before MEV contributions. Assuming a 6% average APY and 6% commission rate, JitoSOL produces approximately 52,200 SOL in annual commission revenue, worth roughly $9.4 million at $180 SOL prices. This revenue stream remains stable regardless of MEV market conditions, providing baseline protocol sustainability.

The combination of Block Engine fees, BAM marketplace revenue, and liquid staking commission creates a diversified income model where Jito captures value from both MEV extraction and traditional staking. Total protocol revenue likely exceeds $30 million annually under current network conditions, with growth potential as BAM adoption increases and total value locked expands.

JTO Value Accrual: MEV-Powered Treasury

JTO value accrual fundamentally changed in August 2025 when the Jito DAO passed JIP-24, redirecting 100% of protocol fees to the DAO treasury. This governance proposal transformed JTO from a token with indirect value capture to one with direct treasury backing that grows proportionally to protocol revenue.

JIP-24: 100% of Fees to DAO

JIP-24 restructured Jito's fee distribution by eliminating the previous 50/50 split between Jito Labs and the DAO treasury. Under the new model, all Block Engine fees and all future BAM fees flow entirely to the DAO, creating a treasury that accumulates protocol revenue without sharing with protocol founders or team members.

The proposal passed through community governance, demonstrating that JTO holders recognized the value of consolidating revenue under DAO control. By eliminating Jito Labs' revenue share, the protocol ensured that value generated by community-supported infrastructure benefits token holders rather than enriching insiders who already profited from token allocations.

The immediate impact was a treasury receiving approximately $19 million annually from Block Engine fees plus an estimated $15 million from BAM, totaling roughly $34 million in yearly DAO income. This creates a treasury growth rate that exceeds most Solana protocols and rivals the treasuries of established DeFi protocols on Ethereum.

JIP-24 also established the Cryptoeconomics SubDAO (CSD), a specialized governance body created under JIP-17 to manage value accrual programs. The CSD holds responsibility for designing and implementing mechanisms that activate accumulated treasury capital, including potential buyback programs, fee switch vaults, or yield subsidy initiatives. Within one to two quarters of JIP-24's passage, the CSD began deploying programs to utilize treasury funds for JTO holder benefit.

The strategic importance of 100% fee capture lies in creating sustainable token value that does not depend on speculative narratives or token price appreciation. Instead, JTO backing grows mathematically with protocol usage. If Block Engine and BAM revenue doubles, treasury accumulation doubles. If Jito captures additional MEV market share from competing protocols, fee income increases proportionally. This direct linkage between protocol success and token value distinguishes Jito tokenomics from governance tokens that lack clear value accrual mechanisms.

MEV Tip Distribution

MEV tip distribution creates the yield advantage that makes JitoSOL more attractive than native Solana staking. When validators running the Jito-Solana client accept transaction bundles from searchers, they receive MEV tips that supplement base staking rewards. These tips flow through the protocol's distribution system, ultimately benefiting JitoSOL holders.

The distribution process begins when a searcher submits a bundle containing MEV opportunities. The searcher includes a tip to incentivize validators to prioritize their bundle over competing transactions. Jito's Block Engine collects these tips, extracts the 6% protocol fee, and distributes the remaining 94% to the validator that included the bundle in their block.

Validators then distribute these MEV proceeds to their delegators, including the stake delegated through JitoSOL. Because JitoSOL pools stake across over 200 validators, the protocol captures MEV tips from diverse sources, averaging returns across the entire validator set rather than depending on a single operator's MEV extraction efficiency.

Research indicates that MEV-based staking increases yields by approximately 20-30% compared to traditional staking alone. On a base APY of 6%, this MEV boost translates to an additional 1.2-1.8% APY, bringing total JitoSOL yields to roughly 7.2-7.8% depending on network conditions. By Q2 2025, Jito MEV infrastructure contributed 13-15% of total staking rewards across the Solana network, demonstrating the material impact of MEV capture on staker returns.

The consistency of MEV rewards depends on network activity and searcher competition. During periods of high DeFi usage, arbitrage opportunities increase, driving higher MEV tips. Conversely, during market downturns, reduced trading volume decreases MEV extraction potential. However, because Jito captures such a dominant share of Solana's MEV market, the protocol benefits from nearly all available extraction opportunities, smoothing returns across market cycles.

JitoSOL Yield Boost

JitoSOL yield boost refers to the total return advantage liquid stakers achieve over native Solana staking. This advantage comes from three sources: base staking rewards, MEV tips, and auto-compounding mechanics that eliminate reward claim delays.

Base staking rewards for Solana average 5.9-6.6% APY under current inflation schedules. JitoSOL captures these same rewards through delegation to high-performing validators selected for uptime reliability and commission competitiveness. The protocol's 200+ validator diversification ensures that temporary outages or poor-performing nodes do not significantly impact overall yield.

MEV tips add the differentiated yield component that makes Jito staking superior to alternatives. As discussed, this MEV capture generates an estimated 1.2-1.8% APY premium over native staking. Unlike protocols that extract MEV but retain proceeds as protocol revenue, Jito distributes MEV value directly to stakers, creating immediate yield enhancement rather than relying on future governance decisions to activate value distribution.

Auto-compounding further amplifies returns by eliminating the delay between earning rewards and restaking them. Native Solana staking requires validators to distribute rewards each epoch, and stakers must manually restake to benefit from compound interest. JitoSOL automatically incorporates all earned rewards into the token's exchange rate, meaning every epoch's yield immediately begins earning additional returns without user intervention.

The cumulative effect creates total APY ranges for JitoSOL of approximately 7.2-7.8%, compared to 5.9-6.6% for native staking. Over a one-year period with a 10,000 SOL position, this difference generates an additional 130-180 SOL in returns, worth roughly $23,400-$32,400 at $180 SOL prices. For institutional stakers with millions in capital, this yield advantage translates to hundreds of thousands of dollars in incremental annual revenue.

JitoSOL's MEV-powered yield boost positions the token as the preferred liquid staking option for yield-focused participants. While competitors like Marinade Finance offer liquid staking with base rewards, none match Jito's MEV capture infrastructure and distribution efficiency. This moat sustains JitoSOL's market leadership and creates compounding network effects where increased TVL leads to greater validator participation, which enables more efficient MEV extraction, which attracts additional stakers.

JitoSOL vs Traditional Staking

Comparing JitoSOL to traditional Solana staking reveals fundamental tradeoffs between liquidity, yield, and security. Native staking locks capital for multi-day unbonding periods while offering base rewards without MEV capture. JitoSOL provides immediate liquidity and enhanced yields but introduces smart contract risk and liquid token price volatility.

Native Solana staking requires users to delegate SOL to a validator for a minimum of one epoch before earning rewards. Unstaking requires a cooldown period where capital remains locked and does not earn yields. During this unbonding window, stakers cannot access funds even in emergency scenarios, creating opportunity cost when attractive trading or investment opportunities emerge.

JitoSOL eliminates unbonding delays by representing staked positions as liquid tokens tradeable across Solana DeFi. Users can stake SOL and immediately receive JitoSOL at the current exchange rate. If they need liquidity, they can sell JitoSOL on decentralized exchanges like Orca or Raydium without waiting for unstaking. This liquidity premium attracts participants who want staking exposure without sacrificing capital flexibility.

Yield comparisons favor JitoSOL through MEV capture. Native staking generates 5.9-6.6% APY from base inflation rewards. JitoSOL earns the same base rewards plus MEV tips, producing total yields of 7.2-7.8% APY. Over a one-year period, a 10,000 SOL position earns 590-660 SOL with native staking versus 720-780 SOL with JitoSOL, a difference of 130-180 SOL worth approximately $23,400-$32,400.

The yield advantage extends to operational efficiency. Native staking requires users to select validators, monitor performance, and potentially redelegate if their chosen validator underperforms. JitoSOL abstracts this complexity by managing a diversified validator set, automatically optimizing delegation to maintain maximum yield. Stakers receive professional validator management without active monitoring.

Security tradeoffs distinguish the two approaches. Native staking involves only Solana's core protocol, eliminating smart contract risk from liquid staking derivatives. Users trust only the base layer blockchain, which has been battle-tested through years of network operation. JitoSOL introduces smart contract risk through the liquid staking pool contracts that manage delegation and token minting. While these contracts have undergone extensive audits, any smart contract carries inherent vulnerability risk.

JitoSOL also creates price volatility risk separate from SOL itself. The liquid staking token trades on secondary markets where supply and demand dynamics can cause temporary price dislocations. During periods of high unstaking demand, JitoSOL may trade at a discount to its intrinsic value, meaning sellers realize less than the underlying SOL value. Conversely, during high demand periods, JitoSOL can trade at a premium, making purchases more expensive than direct staking.

Decentralization considerations favor JitoSOL's multi-validator approach over users manually selecting single validators. By delegating across 200+ validators, JitoSOL prevents stake concentration that could threaten network security. Native stakers often select high-commission validators with strong marketing rather than optimizing for decentralization, inadvertently centralizing stake among a few operators. Jito StakeNet actively balances delegation to support long-tail validators while maintaining performance standards.

Tax treatment differs between the two staking methods. Native staking generates taxable events each epoch when rewards are distributed. Stakers must track these micro-payments for accurate tax reporting, creating accounting complexity. JitoSOL appreciation does not generate taxable events until sale, simplifying tax obligations to a single capital gains calculation when users exit their position.

The choice between JitoSOL and traditional staking depends on user priorities. Yield maximizers benefit from JitoSOL's MEV capture and liquidity that enables capital deployment across additional yield sources like lending protocols. Security-focused participants who prioritize minimizing smart contract exposure may prefer native staking despite lower yields. Institutional participants often choose JitoSOL for the combination of enhanced returns, professional validator management, and integration with DeFi strategies that require liquid collateral.

Jito vs Competitor Revenue Comparison

Jito's revenue model and market position significantly surpass competing Solana liquid staking protocols in both total fees collected and value distribution mechanisms. Comparing Jito to Marinade Finance reveals how MEV infrastructure integration creates sustainable competitive advantages that extend beyond simple yield differences.

Marinade Finance represents Jito's primary competitor with over $2 billion in TVL as of early 2026. The protocol charges a 6% fee on staking rewards, with 50% of revenue used for MNDE buybacks since September 2025. Marinade offers native SOL staking with APY exceeding 10% during peak periods and liquid staking through mSOL at approximately 11.8% APY.

However, Marinade's revenue model lacks MEV integration. The protocol earns exclusively from staking commission without capturing MEV tips or operating block building infrastructure. This limits Marinade to approximately $7-8 million in annual revenue assuming 6% commission on $2 billion TVL with 6% base APY. While substantial, this pales compared to Jito's combined Block Engine, BAM, and staking revenue exceeding $30 million annually.

Jito's dominant market position stems from first-mover advantage in MEV capture. By launching the Block Engine when Solana MEV infrastructure was nascent, Jito established relationships with validators and searchers before competitors entered the market. This network effect created a flywheel where validator adoption attracted searcher activity, which generated MEV tips that attracted more stakers, which funded development of advanced features like BAM.

The protocol's 94% market share among Solana validators running MEV-compatible clients demonstrates this moat. Even if Marinade or other competitors launch MEV infrastructure, they would need to convince validators to switch from established Jito systems. Validators face switching costs including technical integration, searcher relationship rebuilding, and potential reward disruption. These friction points protect Jito's position even if competitors offer marginally better economics.

TVL comparisons show Jito's market leadership. JitoSOL holds over 14.5 million SOL ($2.6 billion at $180 prices) compared to Marinade's roughly 11 million SOL. While both protocols command substantial market share, Jito's growth trajectory exceeds Marinade's, particularly among institutional participants. The launch of 21Shares' Jito Staked SOL ETP in January 2026 provides European institutional investors regulated exposure to JitoSOL, creating demand channels unavailable to competitors.

Revenue distribution mechanisms further differentiate the protocols. Marinade's 50% MNDE buyback program returns value to token holders through reduced supply rather than direct yield. This benefits long-term holders who see token appreciation from buybacks but provides no immediate cash flow. Jito's DAO treasury accumulation under JIP-24 creates optionality for governance to implement buybacks, direct distributions, or yield subsidies based on community preferences.

Governance control over revenue deployment gives Jito flexibility that Marinade lacks. The Cryptoeconomics SubDAO can adjust value accrual programs as market conditions change, implementing buybacks during favorable market conditions or accumulating reserves during uncertainty. Marinade's fixed buyback structure provides predictability but limits adaptive response to changing circumstances.

Yield competitiveness ultimately determines market share in liquid staking. JitoSOL's 7.2-7.8% APY outperforms most alternatives including Marinade's mSOL at 6.1% APY. While Marinade's native staking reaches 11.8% APY, this requires capital lockup without the liquidity benefits liquid staking provides. The yield spread between JitoSOL and Marinade's liquid product exceeds 1-1.7%, translating to substantial annual return differences for large stakers.

Network effects surrounding JitoSOL create additional competitive advantages. The token maintains the deepest liquidity pools across Solana DEXs, enabling large position entries and exits without excessive slippage. DeFi protocols preferentially integrate JitoSOL over alternatives because of this liquidity and the protocol's established track record. These integrations make JitoSOL more useful as collateral, liquidity provisioning assets, and yield farming instruments, creating use cases beyond simple staking.

The competitive landscape will likely consolidate around Jito as the dominant MEV-integrated liquid staking solution with Marinade serving participants who prefer a more conservative approach without MEV exposure. Alternative protocols may capture niche segments like institutional staking through Marinade Select or specialized validator strategies, but Jito's combination of MEV infrastructure, liquidity depth, and governance-controlled revenue positions it as the market leader for general liquid staking demand.

Key Takeaways

Jito tokenomics represents a sophisticated value capture model where governance token holders control a treasury receiving 100% of protocol fees while liquid stakers earn MEV-boosted yields that outperform traditional Solana staking. The passage of JIP-24 fundamentally aligned protocol economics with JTO holder interests by eliminating revenue sharing with Jito Labs and establishing the Cryptoeconomics SubDAO to deploy value accrual programs.

The protocol generates over $30 million in annual revenue through three streams: Block Engine fees from MEV extraction, Bundle Auction Marketplace charges from decentralized block building, and liquid staking commission from JitoSOL management. This diversified revenue model creates stability even as individual components fluctuate with network conditions.

JitoSOL dominates Solana liquid staking with over 14.5 million SOL staked and approximately $2.92 billion in TVL, exceeding competitors like Marinade Finance in both market share and yield generation. The protocol's 94% validator market share creates a defensible moat that protects revenue streams from competitive threats.

MEV capture distinguishes Jito from alternative liquid staking protocols, delivering an estimated 20-30% yield boost over base staking rewards. This translates to total JitoSOL APY of 7.2-7.8% compared to 5.9-6.6% for native Solana staking, creating meaningful return advantages for capital-efficient participants.

Token vesting schedules gradually increase circulating JTO supply throughout 2026 and beyond, with monthly unlocks from investor, team, and ecosystem allocations. While this creates potential selling pressure, treasury accumulation from protocol fees generates fundamental value backing that can support long-term price appreciation regardless of circulating supply expansion.

The strategic importance of Jito extends beyond immediate financial metrics to infrastructure control over Solana's MEV landscape. By operating the dominant transaction ordering system and transitioning to decentralized block assembly through BAM, Jito positions itself as critical infrastructure for the network's economic security and validator economics.

Understanding Jito tokenomics requires recognizing the distinction between JTO governance participation and JitoSOL staking yields. The governance token captures value through treasury accumulation and control over value distribution mechanisms, while the liquid staking token provides direct yield from MEV-enhanced staking. Both assets serve distinct purposes within the broader Solana ecosystem, offering participants multiple pathways to gain exposure to Jito's market position and revenue generation.