Written:

Feb 7, 2026

Ethena generated $57M in December 2025 and launched an $890M buyback program. Learn how ENA tokenomics captures value from the synthetic dollar protocol.

Ethena tokenomics powers one of DeFi's fastest-growing protocols through a synthetic dollar system that generated $57M in December 2025. The ENA token serves as the governance and value accrual layer for USDe, a decentralized stablecoin backed by delta-neutral positions rather than traditional fiat reserves. With over $500M in cumulative revenue and an $890M buyback program, understanding how ethena tokenomics distributes value between the protocol treasury, sENA stakers, and sUSDe holders reveals why major institutions are allocating capital to this ecosystem.

The protocol achieved $230.8M in total revenue throughout 2025, marking it as one of the highest-earning DeFi applications. The fee switch activation in Q1 2026 transforms ENA from a pure governance token into a revenue-generating asset, directing protocol fees directly to sENA stakers. This article examines how ethena tokenomics captures value from funding rates, ETH staking yields, and the DAT buyback program.

What Is Ethena?

Ethena is a decentralized finance protocol that creates USDe, a synthetic dollar maintained through delta-neutral hedging rather than fiat backing. The protocol holds spot crypto assets while simultaneously opening offsetting short positions in derivatives markets, neutralizing price volatility to maintain a stable $1.00 peg.

USDe differs from traditional stablecoins like USDC or USDT because it does not rely on bank deposits or treasury bills. Instead, the protocol generates yield through two primary mechanisms: perpetual futures funding rates and ETH staking rewards. These revenue streams allow Ethena to offer sUSDe holders yields ranging from 4.72% to 10% APY without exposure to traditional financial system risks.

The protocol launched in 2024 and rapidly scaled to over $11.89B in total value locked by early 2026. Major exchanges including HTX announced USDe listings in January 2026, expanding global access to the synthetic dollar. The Converge Network, a purpose-built blockchain developed with Securitize, marks Ethena's evolution from a protocol layer to sovereign financial infrastructure designed for regulated institutional capital.

Ethena introduced iUSDe in 2026, an institutional-grade version with compliance wrappers, custody integrations, and reporting standards. This institutional focus successfully onboarded mid-sized hedge funds, family offices, and crypto-native asset managers seeking dollar-denominated yields without traditional banking intermediaries.

Ethena Tokenomics: ENA Supply and Distribution

The ENA token functions as the governance layer for Ethena protocol, enabling holders to vote on fee switch parameters, collateral additions, and protocol upgrades. Total supply caps at 15 billion ENA tokens, with approximately 7.96 billion tokens currently circulating as of early 2026.

Token utility extends beyond governance through the staking mechanism. Holders can stake ENA to receive sENA, which qualifies them for protocol revenue distributions once the fee switch activates. The staking rate determines the annual percentage yield sENA holders receive from protocol operations.

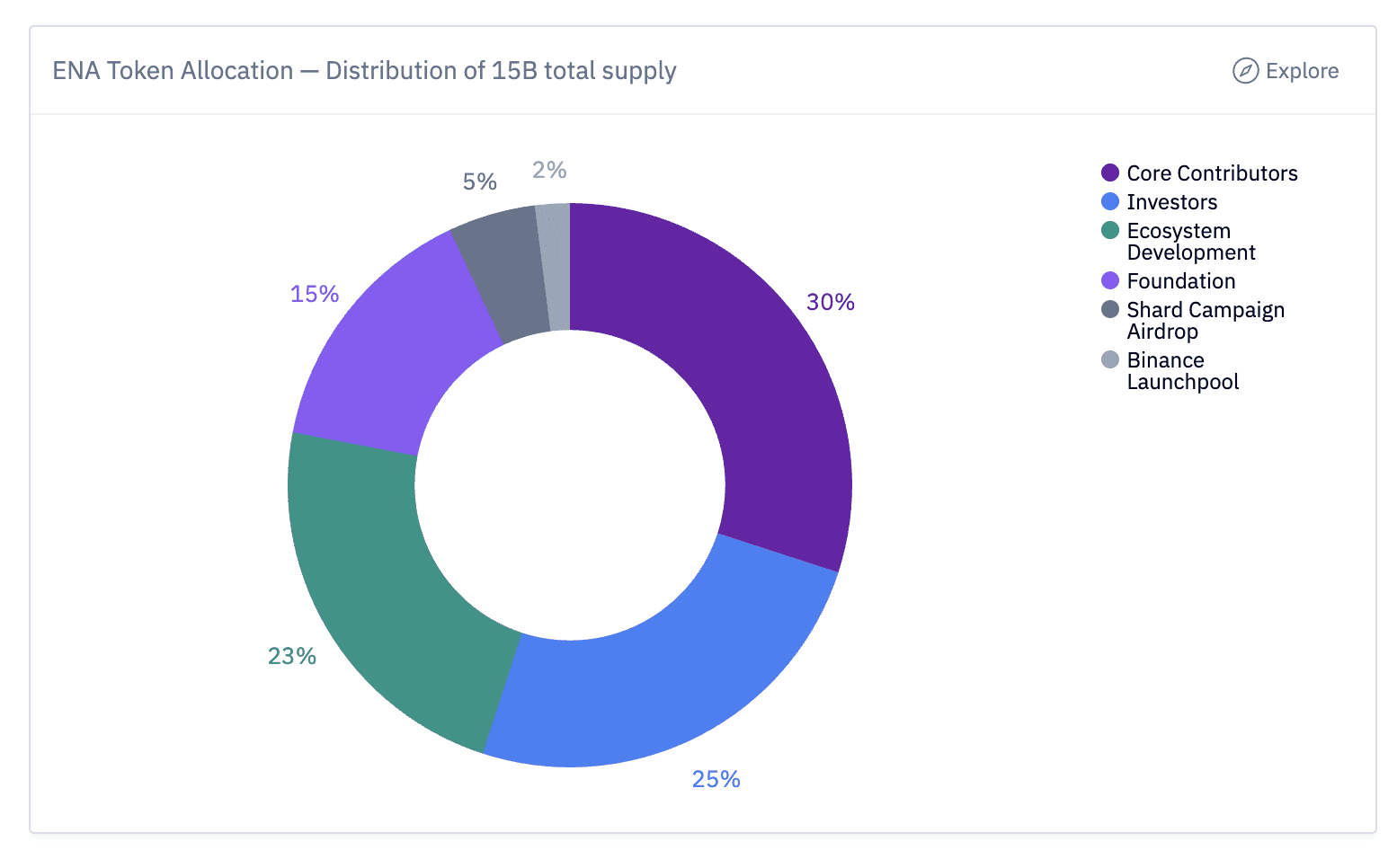

Token Allocation

Ethena's token distribution allocates supply across five major categories designed to balance protocol development, community incentives, and investor returns. Core Contributors received 30.00% of total supply, representing the largest single allocation. This allocation compensates the team building protocol infrastructure, smart contracts, and risk management systems.

Ecosystem Development accounts for 28.00% of supply, funding grants, liquidity incentives, and community growth initiatives. The Ethena Foundation manages these tokens to bootstrap adoption and reward early users. Investors received 25.00% through private funding rounds, providing capital for protocol development before the public launch.

The Foundation holds 15.00% for long-term protocol sustainability, governance operations, and emergency reserves. Binance Launchpool participants received 2.00% during the initial token distribution event, enabling immediate trading liquidity and price discovery. This allocation structure prioritizes long-term development over immediate circulating supply, with vesting schedules controlling token release rates.

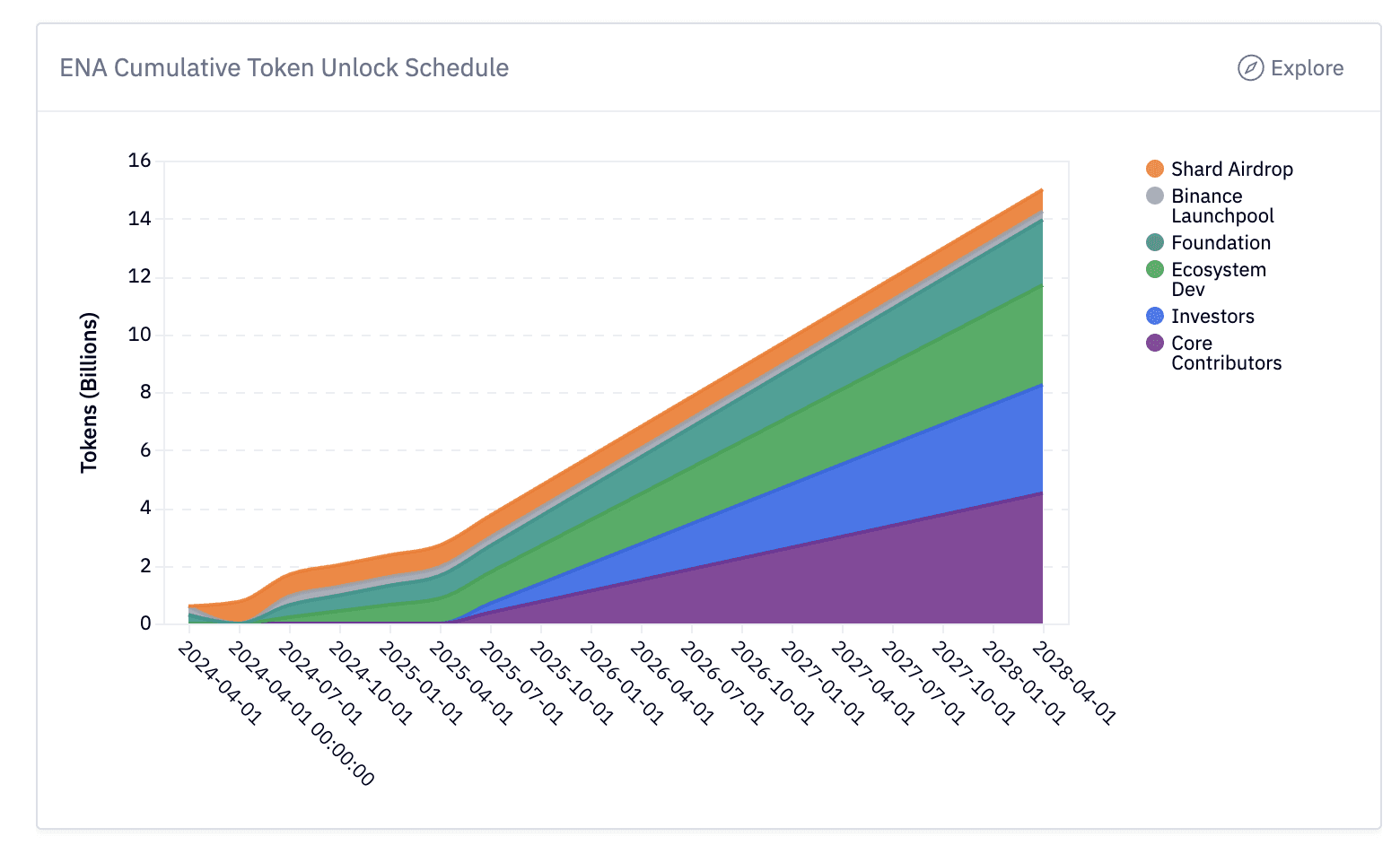

Vesting Schedule

Core Contributors and Investors face identical vesting terms to align incentives. Both categories include a 1-year cliff from token launch, meaning no tokens unlock during the first 12 months. After the cliff period, tokens vest linearly over 3 years with monthly distributions.

This 4-year total vesting period prevents immediate selling pressure while ensuring team and investor commitment. The 1-year cliff with 25% release followed by 36-month linear vesting creates a gradual supply increase rather than sudden unlocks. Recent unlock events show this schedule in action. In early 2026, Ethena released 212.50 million ENA tokens valued at $52.63 million, representing 3.04% of total supply entering circulation simultaneously.

Ecosystem Development tokens follow different vesting parameters controlled by the Ethena Foundation. These tokens unlock based on community incentive programs, liquidity mining campaigns, and partnership agreements. The Foundation releases tokens strategically to maximize protocol growth without flooding secondary markets.

Ethena Detailed Tokenomics Breakdown

https://audit.tokenomics.com/tokenomics/ethena

How Ethena Generates Revenue

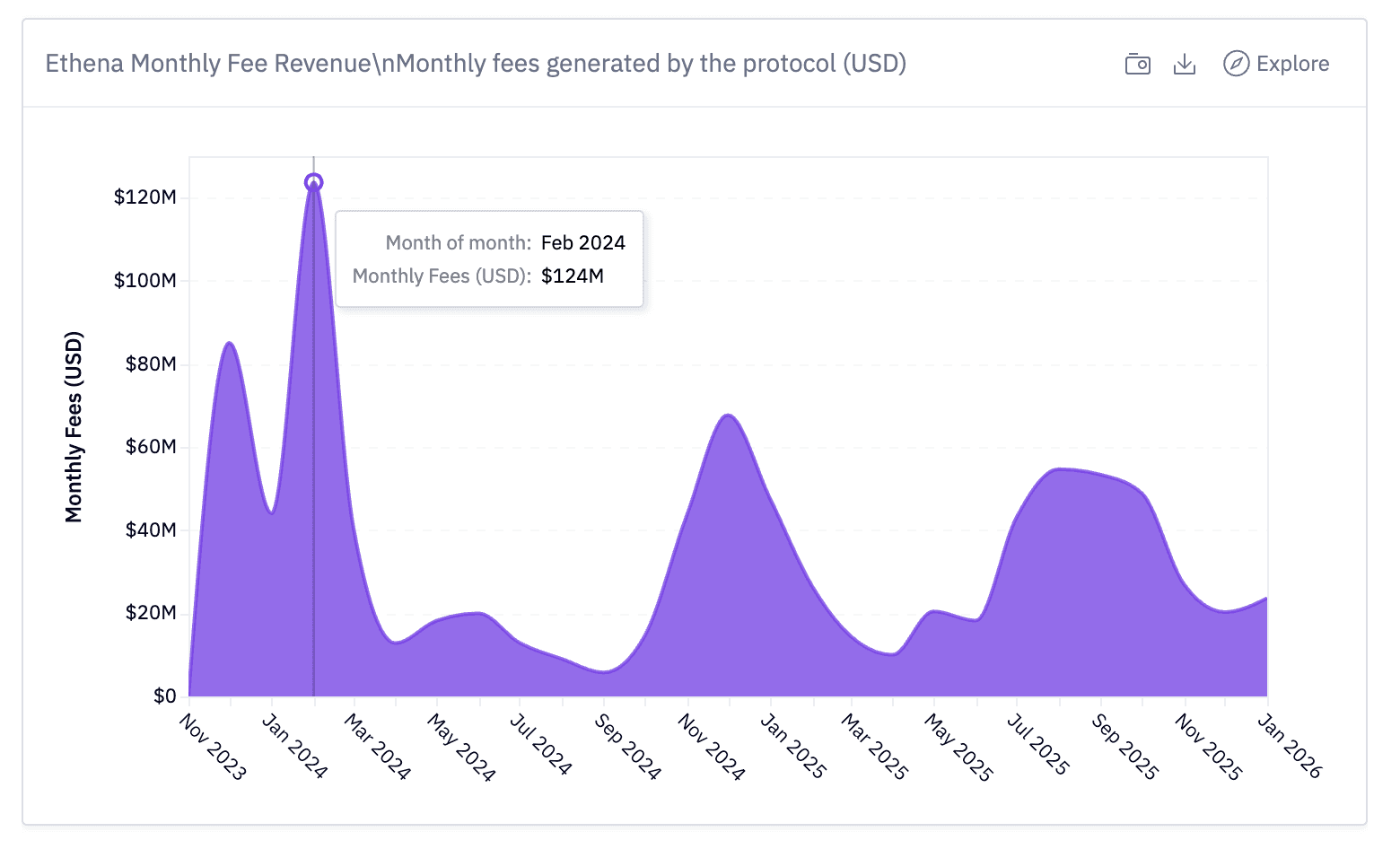

Ethena protocol operates as a revenue-generating machine through two core mechanisms: perpetual futures funding rates and Ethereum staking yields. Cumulative revenue exceeded $500 million by late 2025, positioning Ethena among the highest-earning DeFi protocols.

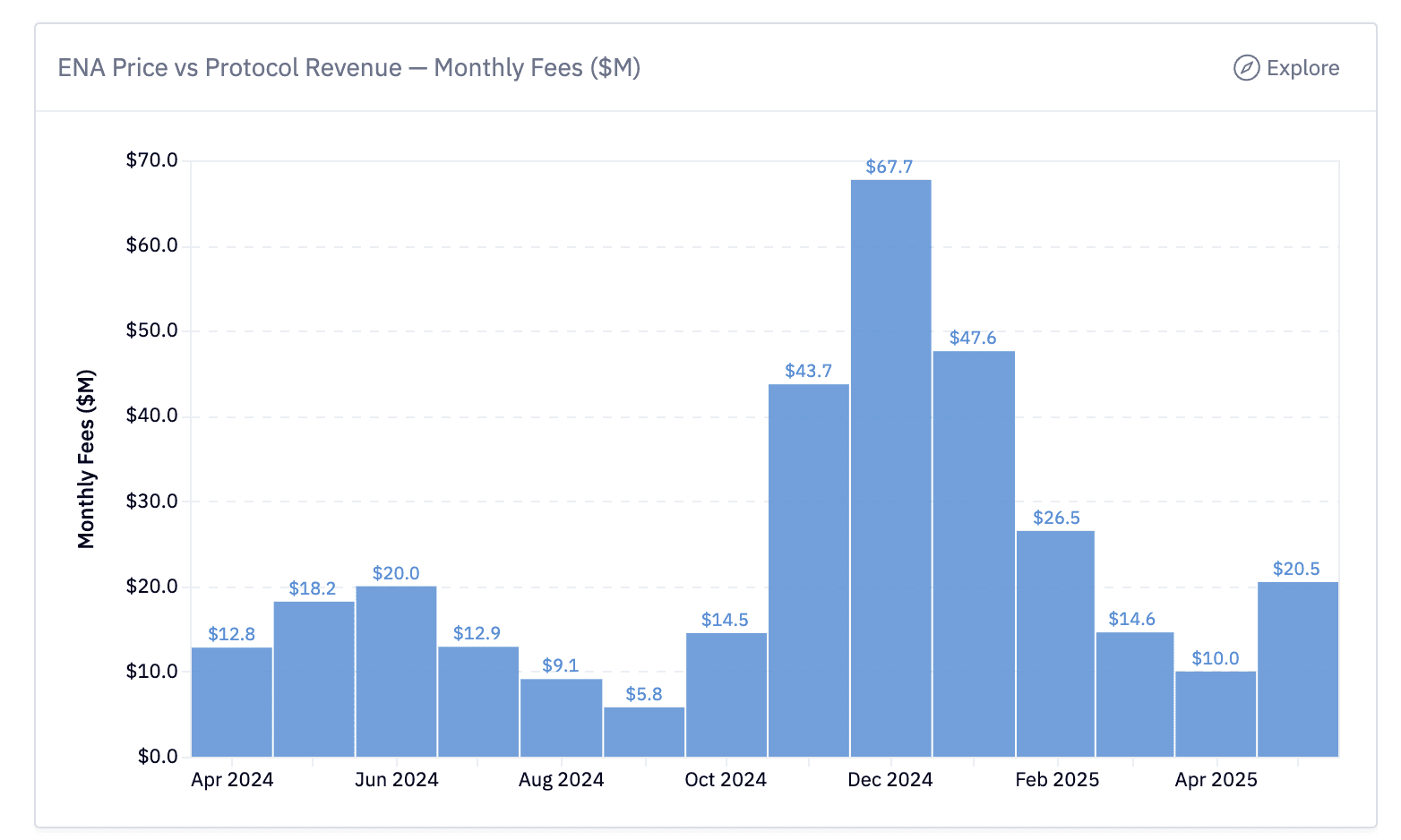

The chart clearly shows three distinct fee generation cycles:

Peak (Feb 2024): $124M — the all-time high, likely driven by the initial USDe launch and high funding rates

Year-end 2024 surge (Dec 2024): $68M

Mid-2025 plateau (Aug–Oct 2025): $49–55M range.

The trough in Sep 2024 ($5.8M) marks the cycle low before the recovery. Fees have moderated back to ~$24M in Jan 2026, roughly matching mid-2024 levels.

Revenue flows from delta-neutral positions that balance spot holdings against derivatives shorts. This strategy captures funding rate premiums paid by traders taking used long positions in perpetual futures markets. When funding rates turn positive, shorts receive payments from longs, creating passive income for the protocol.

Delta-Neutral Strategy Explained

Delta-neutral hedging forms the foundation of Ethena's revenue model and stablecoin stability. The protocol maintains equal but opposite positions in spot and derivatives markets. For every $1 of ETH held in spot wallets, Ethena opens a $1 short position in ETH perpetual futures.

This balanced positioning neutralizes price exposure. When ETH price increases 10%, spot holdings gain $0.10 per dollar while short positions lose $0.10 per dollar, resulting in net zero price change. The synthetic USD value remains stable regardless of underlying asset volatility.

The delta-neutral approach enables Ethena to hold volatile assets while maintaining stablecoin properties. Traditional stablecoins require fiat deposits or treasury bills, creating exposure to banking system risks and regulatory oversight. Ethena's purely on-chain collateral eliminates these dependencies.

Hedging occurs across multiple centralized exchanges and derivatives platforms to maximize capital efficiency and reduce counterparty risk. The protocol diversifies execution venues, ensuring no single exchange failure threatens the entire system. This multi-venue approach also captures better funding rates across different markets.

Funding Rate Income

Perpetual futures funding rates generate the majority of Ethena's protocol revenue. Funding rates represent periodic payments between traders holding long and short positions. When more capital flows into long positions, funding rates turn positive, and longs pay shorts every 8 hours.

Ethena's short positions receive these funding rate payments as passive income. During bull markets or periods of high use, funding rates can exceed 20-30% annually. The protocol collected substantial funding rate income throughout 2025 as perpetual futures open interest reached record levels.

Funding rates vary by asset and market conditions. ETH funding rates averaged 5-15% annually during 2025, while more volatile assets like SOL occasionally generated 30-40% rates. The protocol diversifies across multiple collateral types to smooth revenue fluctuations.

Revenue sustainability depends on persistently positive funding rates. Historical data shows funding rates remain positive 70-80% of the time across major cryptocurrencies. During negative funding rate periods, Ethena's reserve fund, representing 1.18% of total value locked, supplements returns to maintain yield stability for sUSDe holders.

ETH Staking Yield

Ethereum staking yields provide the second major revenue stream for Ethena protocol. The protocol stakes ETH collateral through validator infrastructure, earning the current 3.3% average annual staking yield. This yield accrues continuously regardless of market conditions or funding rate fluctuations.

Unlike funding rates, staking yields offer predictable, stable income that does not correlate with perpetual futures markets. The combination of staking yields and funding rates creates diversified revenue streams. When funding rates compress during bear markets, staking yields provide a minimum revenue floor. When funding rates surge during bull markets, total protocol revenue can exceed 20-30% annually on ETH collateral.

Ethena began expanding beyond ETH to include other stakeable assets. The protocol evaluates adding liquid staking derivatives and additional proof-of-stake tokens to maximize yield generation. This expansion strategy increases revenue potential while maintaining delta-neutral risk profiles.

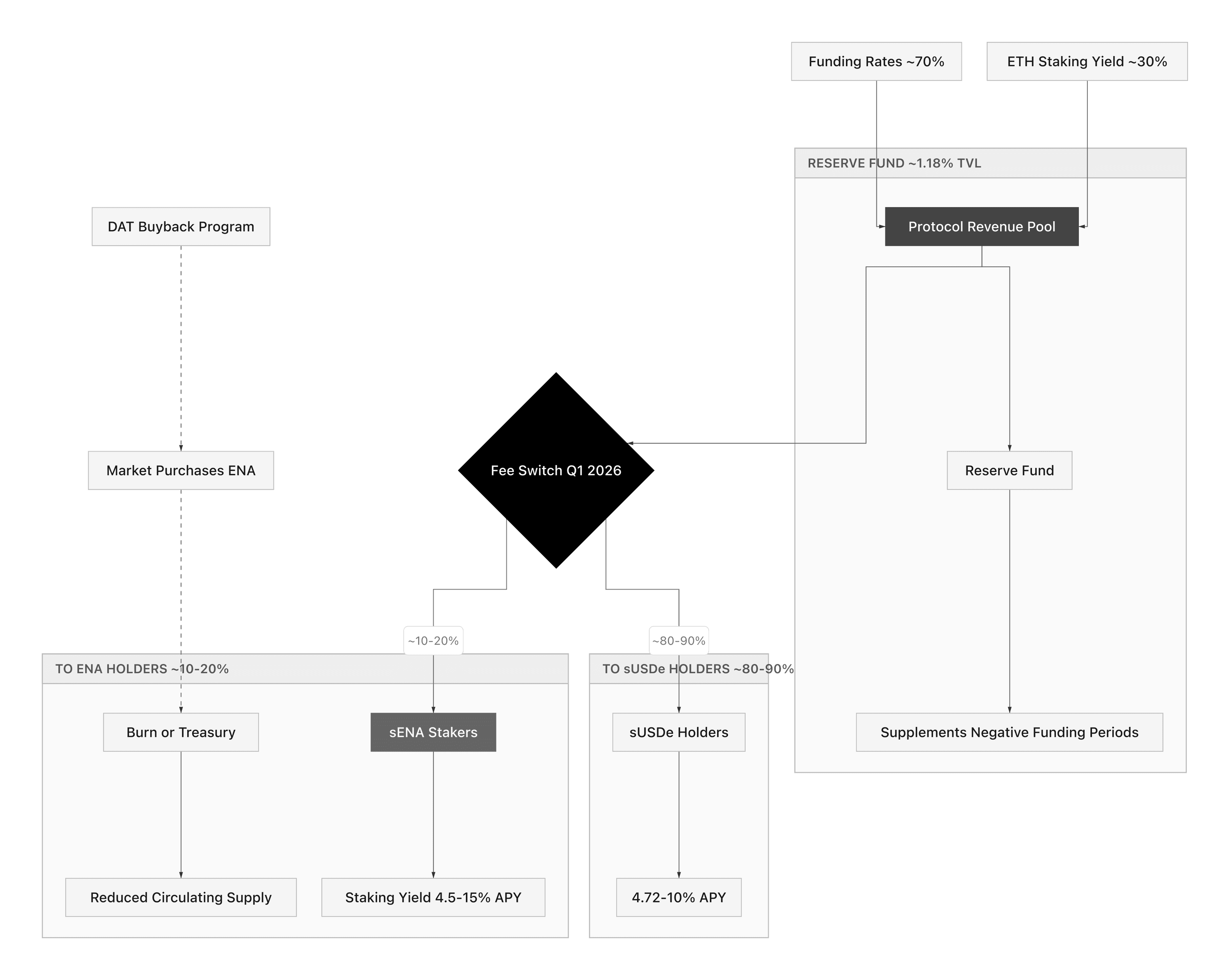

ENA Value Accrual: Fee Switch and Buybacks

The ENA token captures protocol value through two mechanisms: the fee switch directing revenue to sENA stakers and the DAT buyback program reducing circulating supply. These mechanisms transform ENA from a pure governance token into a revenue-generating asset. The fee switch activation in Q1 2026 marks a fundamental shift in ethena tokenomics.

Fee Switch (Pending Activation)

The fee switch represents a governance-controlled mechanism that redirects protocol revenue from the treasury to sENA stakers. Wintermute, a major trading firm, proposed the fee switch in November 2024. The Ethena Foundation announced in September 2025 that activation benchmarks had been met.

Activation requires USDe supply exceeding $6 billion and annual protocol revenue exceeding $250 million. Both thresholds were achieved by late 2025, with USDe supply reaching $11.89B and revenue surpassing $500M cumulatively. The final activation depends on a governance vote by ENA token holders.

Once activated, the fee switch directs between 10% and 20% of protocol fees directly to sENA holders. Based on monthly revenue of $50-60M, this allocation generates 4.5% to 15% annualized yield for stakers. Some analysts project potential yields reaching 34% annually depending on final allocation structures and protocol volume growth.

The fee switch aligns token holder incentives with protocol growth. Stakers benefit directly from increasing USDe adoption, funding rate income, and staking yields.

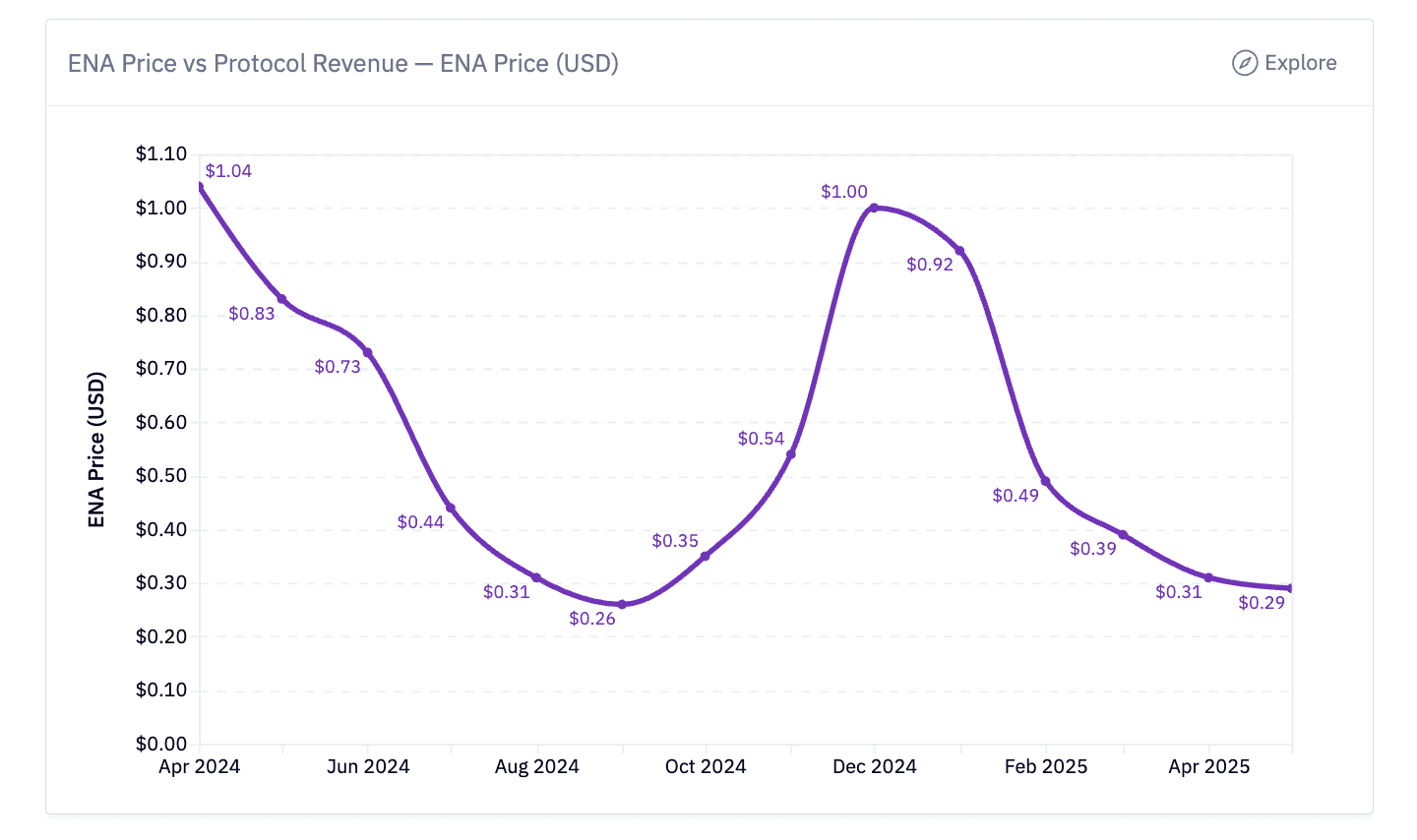

Key observations on the price-revenue correlation:

Strong co-movement Oct–Dec 2024: Both metrics surged together as fees exploded from $5.8M → $67.7M while price rallied from $0.26 → $1.00. This was the peak of Ethena's fee generation cycle.

Price leads on the way down: ENA price started declining from its $1.04 launch high in Apr 2024, while fees actually increased through June before following price lower. The market priced in the fee decline before it happened.

Divergence in May 2025: Fees doubled from $10M → $20.5M while price continued sliding to $0.29. Suggesting the market was not giving Ethena credit for the recent fee recovery, possibly due to token unlock concerns.

$890M DAT Buyback Program

Ethena launched the Decentralized Autonomous Trust buyback program in late 2025, committing $890 million to repurchase ENA tokens from secondary markets. The program executed in two phases: $360M in July 2025 and $530M in September 2025. This represents one of the largest token buyback programs in DeFi history.

The DAT functions similarly to corporate share buybacks, removing tokens from circulation to increase scarcity. Repurchased tokens either burn permanently or enter the protocol treasury for future ecosystem development. The buyback creates constant buy pressure, supporting token price during market downturns.

Buyback funding comes from protocol reserves accumulated before fee switch activation. The $890M allocation demonstrates confidence in long-term protocol sustainability while immediately rewarding existing holders. The program continues throughout 2026, with the Foundation announcing additional capital allocations if revenue targets exceed projections.

The combination of buybacks and fee switch activation creates dual value accrual. Buybacks reduce supply while fee switch distributions increase staking demand. This two-pronged approach maximizes price impact and holder returns compared to single-mechanism tokenomics models.

sENA Staker Rewards

Staking ENA tokens generates sENA, a rebasing token that accumulates protocol revenue distributions. The sENA staking guide explains that holders deposit ENA into staking contracts and receive sENA representing their share of the staking pool. Staked positions can be unstaked at any time without lock-up periods.

Fee switch activation transforms sENA into a yield-generating asset. Stakers receive revenue distributions based on their percentage of total staked supply. With approximately $750M in staked ENA as of late 2025, monthly protocol revenue of $50-60M translates to substantial annual percentage yields.

Staking rewards compound automatically through the rebasing mechanism. Unlike traditional staking where rewards appear as separate claimable balances, sENA holders see their token balance increase proportionally to fee distributions. This auto-compounding maximizes long-term returns without requiring manual claiming transactions.

sUSDe: How Holders Earn Yield

Staked USDe represents the yield-bearing version of Ethena's synthetic dollar. Holders deposit USDe into staking contracts and receive sUSDe tokens that accrue protocol revenue. Current APY ranges from 4.72% to 10%, attracting $11.89B in total value locked. This yield derives from the same funding rates and staking rewards that generate protocol revenue.

The staking mechanism operates through smart contracts that aggregate all USDe deposits into a single pool. Protocol revenue flows into this pool continuously, increasing the redemption value of each sUSDe token. Holders can unstake sUSDe at any time to redeem the underlying USDe plus accrued yield.

Risk factors affect sUSDe yield sustainability. Negative funding rates can compress yields, requiring the reserve fund to supplement returns. The reserve fund holds 1.18% of total value locked, providing a buffer during unfavorable market conditions. Historical data shows funding rates remain positive most of the time, but extended negative rate periods could pressure yields.

sUSDe competes with other yield-bearing stablecoins including Maker's sDAI and Frax's sFRAX. The key differentiator remains Ethena's synthetic collateral model, eliminating exposure to traditional banking systems while generating competitive yields. Institutional adoption of iUSDe further validates the protocol's approach to decentralized dollar alternatives.

Ethena vs Competitor Fee Comparison

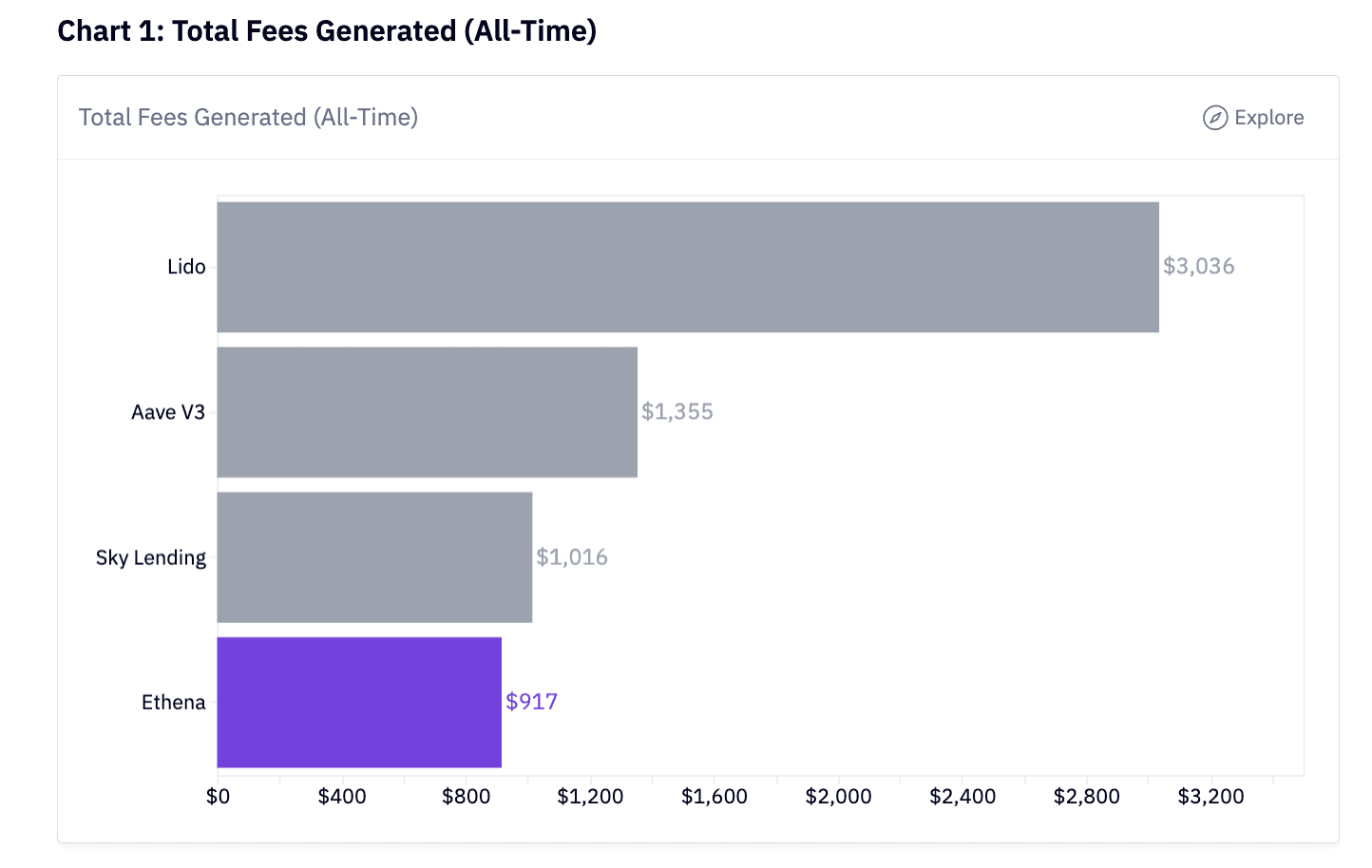

Lido leads at $3B, then Aave V3 ($1.4B), Sky Lending ($1B), Ethena ($917M). Shows Ethena is #4 in total fees but youngest protocol by far.

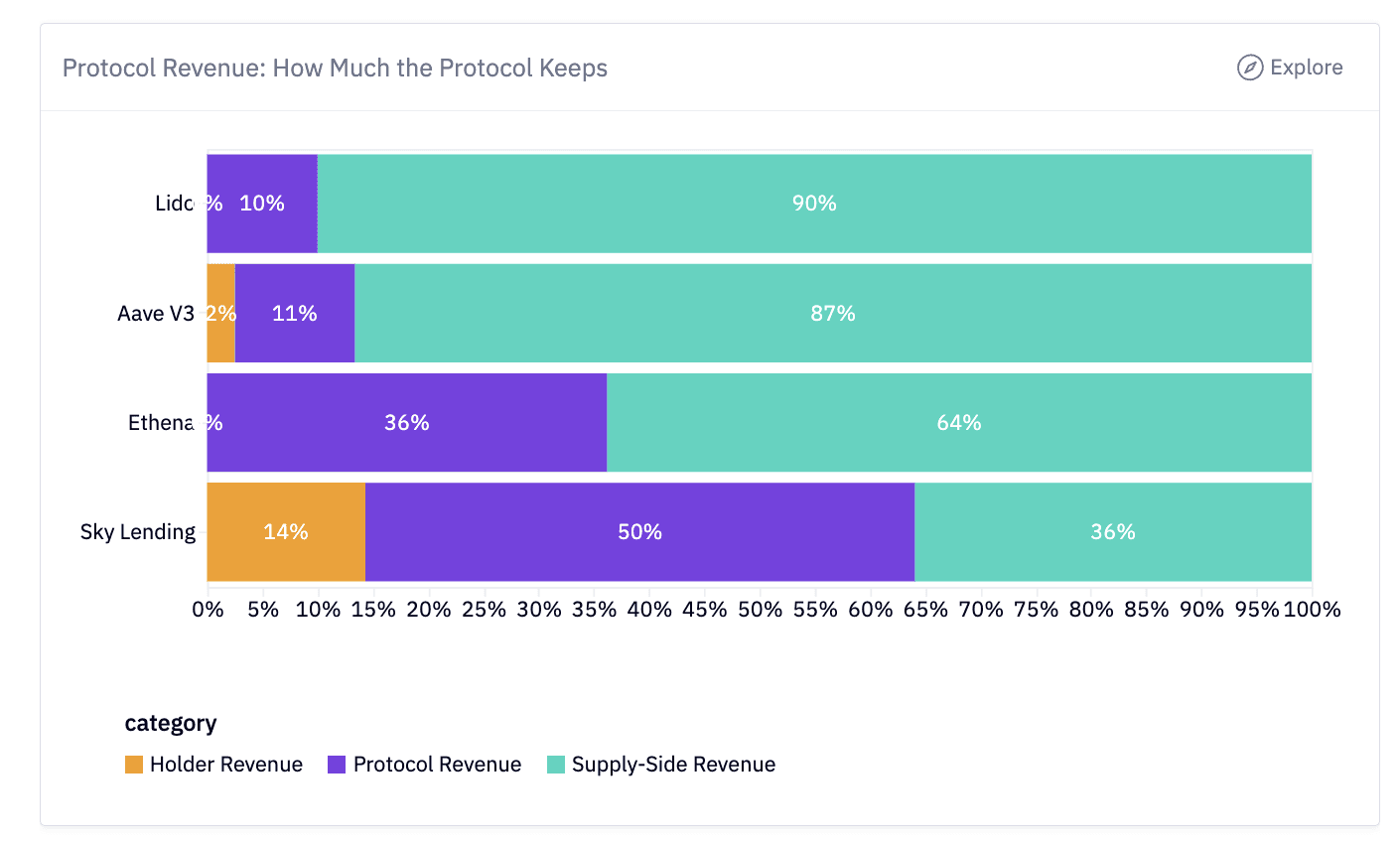

This is the key insight. The spectrum from "pass-through" to "value-capture" is stark:

Lido gives 90% back to stakers, keeping just 10% — classic infrastructure utility play

Aave V3 similarly passes 87% to depositors — lending protocol margin pressure

Ethena retains 36% (pre switch activation)

Sky Lending (MakerDAO) captures 64% between protocol (50%) and holders (14%)

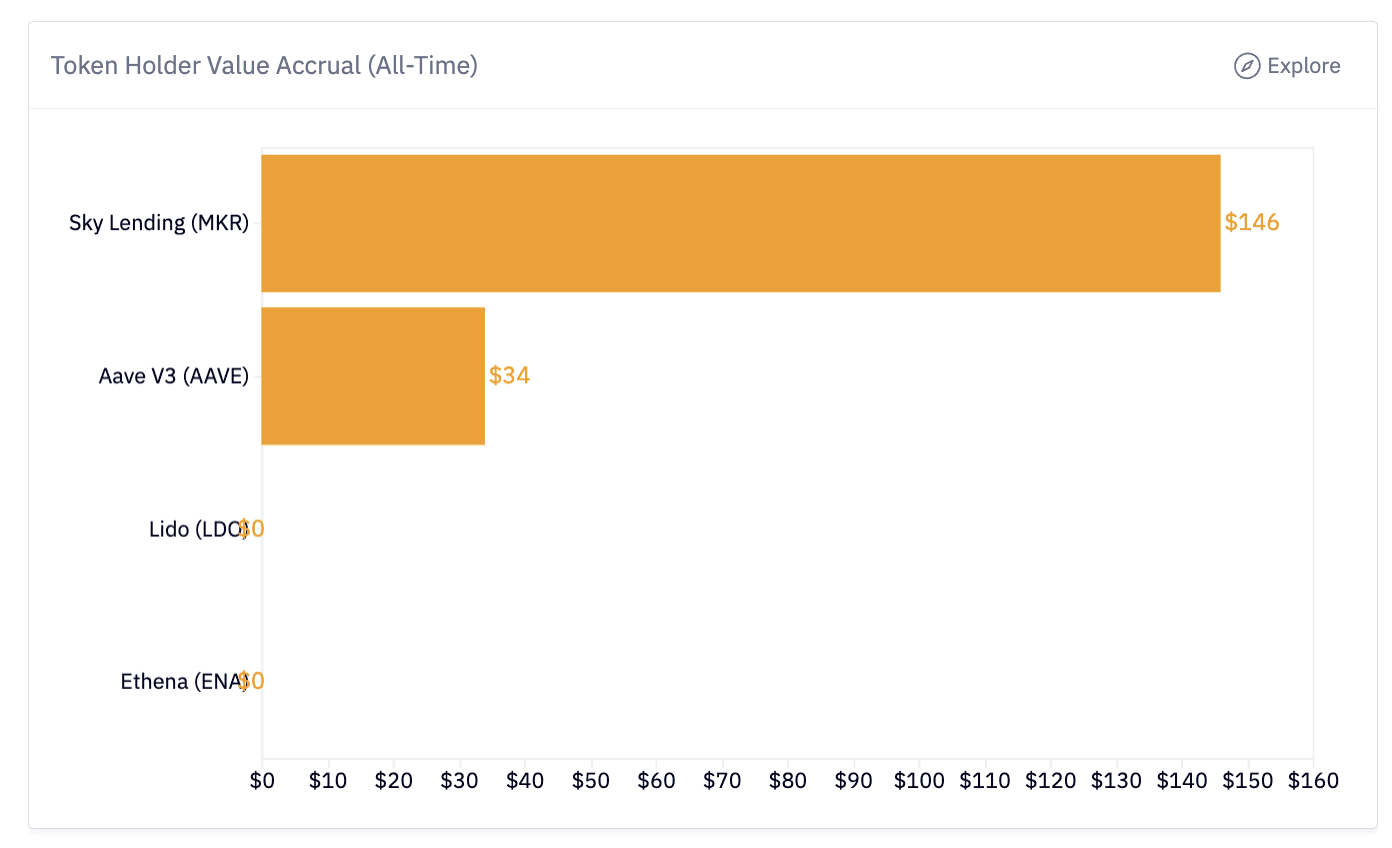

Sky Lending leads at $146M to MKR holders, with Aave at $34M. Both Ethena and Lido accrue $0 — but the context matters enormously: Ethena has $332M in protocol revenue accumulating in treasury. Once the fee switch activates (expected Q1 2026), directing even 10-20% of ongoing revenue to sENA stakers would immediately make it one of the largest holder accrual mechanisms in DeFi, potentially rivaling MKR's cumulative distribution within a single year given current run-rate.

Ethena's fee structure and yield generation compare favorably against established stablecoin protocols. The following table examines key metrics across major competitors:

Protocol | Stablecoin | Yield Rate | Backing Method | Fee Distribution |

Ethena | USDe/sUSDe | 4.72-10% | Delta-neutral crypto | 10-20% to sENA stakers |

MakerDAO/Sky | DAI/USDS | 0-8% (dynamic) | Crypto + RWA collateral | No token holder distribution |

Frax | FRAX/sFRAX | 6.5%+ | Algorithmic + collateral | Revenue to veFXS stakers |

Maker | sDAI | 5% | Same as DAI | Integrated savings rate |

Ethena generates higher absolute revenue than most competitors due to funding rate capture. The protocol earned $500M cumulatively while MakerDAO projected $611.5M gross revenue for 2026. However, Ethena's revenue growth rate exceeds Maker, with 2025 performance showing accelerating adoption.

Fee distribution mechanisms vary significantly. Ethena's fee switch directly rewards sENA stakers with 10-20% of protocol revenue. MakerDAO accumulates surplus in the treasury without direct distribution to MKR holders, though recent governance discussions explore similar mechanisms. Frax distributes revenue to veFXS stakers, creating comparable incentives to Ethena's model.

The $890M DAT buyback program distinguishes Ethena from competitors. No major stablecoin protocol has executed comparable repurchase programs, making this a unique value accrual mechanism. Combined with fee switch distributions, ethena tokenomics creates multiple value capture pathways unavailable in single-mechanism protocols.

Key Takeaways

Ethena tokenomics distributes value through fee switch activation and the $890M DAT buyback program, creating dual value accrual mechanisms for ENA holders.

The protocol generated $57M in December 2025 and exceeded $500M in cumulative revenue by mid-2025, positioning it among DeFi's highest-earning applications.

Fee switch activation in Q1 2026 directs 10-20% of protocol revenue to sENA stakers, generating projected annual yields between 4.5% and 15% based on current revenue rates.

sUSDe holders earn 4.72-10% annual yield from perpetual funding rates and ETH staking rewards, with the reserve fund providing stability during negative rate periods.

ENA token allocation includes 30% to core contributors, 28% to ecosystem development, 25% to investors, 15% to the foundation, and 2% to Binance Launchpool, with 4-year vesting schedules aligning incentives.

Delta-neutral hedging strategy generates revenue while maintaining stablecoin stability, eliminating exposure to traditional banking systems and regulatory dependencies.

The $890M buyback program represents one of DeFi's largest token repurchase initiatives, creating constant buy pressure while reducing circulating supply throughout 2026.

Ethena Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Previously managing partner at a web3 venture fund (exit in 2021).

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.