Written:

Feb 7, 2026

Lido controls 28% of staked ETH with $18B TVL. Learn how LDO tokenomics captures value through staking fees, dual governance, and protocol revenue distribution.

Lido has become the dominant force in liquid staking, managing over $32 billion in total value locked and commanding more than 28% of the Ethereum staking market. With a 10% fee on all staking rewards from billions in staked ETH, the protocol generates substantial revenue annually. But how does the LDO token capture this value, and what role does it play in the ecosystem?

This complete analysis explores lido tokenomics, examining how the protocol generates revenue, distributes value, and uses governance to control critical parameters. Understanding lido tokenomics is essential for anyone evaluating the long-term value proposition of liquid staking protocols.

What Is Lido?

Lido is a decentralized liquid staking protocol that allows users to stake Ethereum without locking assets or maintaining validator infrastructure. Instead of requiring the standard 32 ETH minimum for solo staking, Lido accepts deposits of any size and issues stETH (staked Ether) tokens on a 1:1 basis with the amount deposited.

The protocol operates through a decentralized network of over 297,000 active validators, securing 28.27% of the Ethereum network. This extensive validator set provides redundancy and reduces centralization risks compared to solo staking or centralized exchange offerings.

Unlike traditional staking where assets remain locked, Lido provides immediate liquidity through stETH. Users can trade, use as collateral, or integrate stETH into DeFi protocols while continuing to earn staking rewards. This liquidity advantage has made Lido the largest liquid staking platform, with more than $38 billion in assets staked through the protocol.

The protocol recently underwent its V3 upgrade in 2026, transforming from a pure staking infrastructure provider into a multi-product DeFi platform. The V3 upgrade introduces stVaults, a framework that decouples validator selection from liquidity provision, enabling users to customize staking strategies while retaining exposure to stETH.

Lido Tokenomics: LDO Supply and Distribution

The LDO token serves as the governance token for the Lido DAO, controlling protocol parameters, fee structures, and treasury allocation. Understanding lido tokenomics starts with examining the token supply and distribution mechanics.

Token Allocation

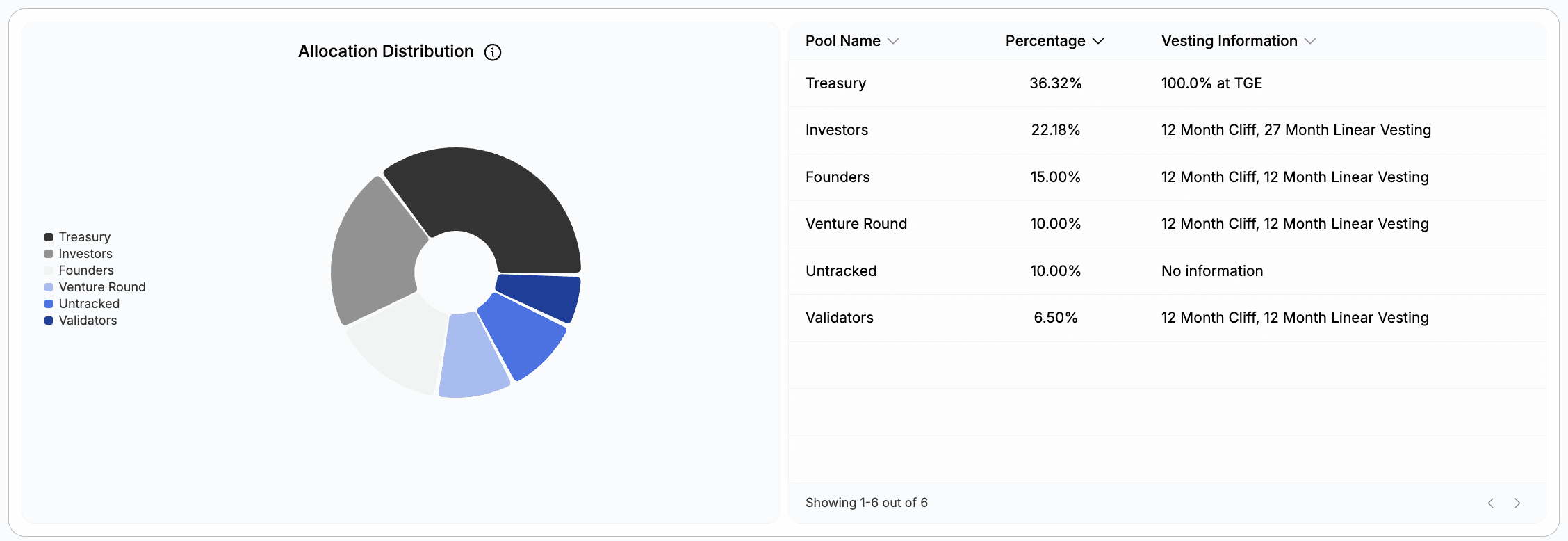

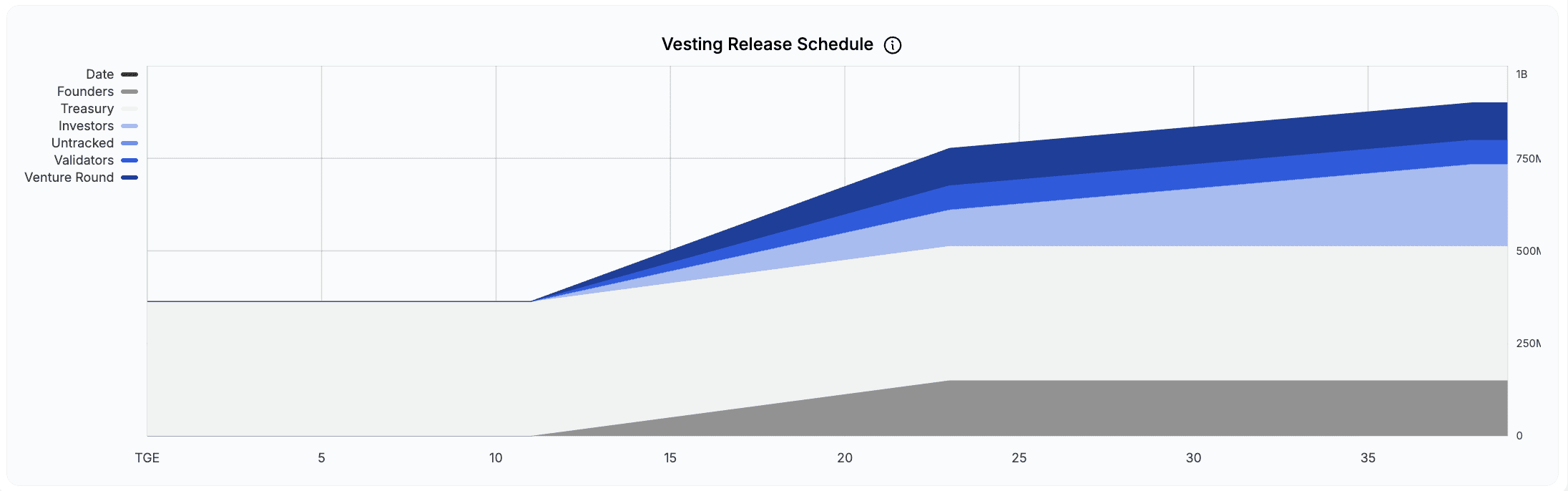

LDO launched with a total supply of 1 billion tokens. The initial allocation distributed tokens across five main categories to balance development needs, investor alignment, and community governance.

The DAO treasury received the largest allocation at 36.32%, providing long-term runway for protocol development and ecosystem growth. This substantial treasury allocation ensures the DAO can fund development, grant programs, and strategic initiatives without requiring additional token emissions.

Investors received 22.18% of the total supply, locked for 1 year and then vested over 1 year. Initial developers received 20%, subject to the same vesting schedule. Founders and future employees received 15%, while validators and signature holders received 6.5%.

The vesting schedule has successfully completed across all major allocation categories, including Team and Validators (40.04%), Investors (34.61%), and DAO Treasury (25.35%). This completed vesting reduces sell pressure from early participants and provides more stability for long-term holders.

Current Supply Dynamics

As of 2026, approximately 896 million LDO tokens (89.6% of the total supply) are in circulation. The remaining tokens reside primarily in the DAO treasury, which currently holds around 350 million LDO, representing roughly 35% of the total supply.

Unlike many DeFi protocols with aggressive emission schedules, lido tokenomics does not feature a concrete release schedule for treasury tokens. Instead, emissions are voted on by the Lido DAO through governance proposals. This approach provides flexibility to align token distribution with protocol needs rather than following a predetermined schedule.

The LDO token has a market capitalization of approximately $1.88 billion. Anyone can make a proposal on how treasury tokens should be used, creating a community-driven approach to token distribution and protocol development.

The circulating supply represents the maximum amount of LDO that will ever exist, as there is no inflation mechanism built into lido tokenomics. This fixed supply model differs from protocols with perpetual inflation and creates potential scarcity dynamics as the protocol grows.

How Lido Generates Revenue

Lido generates revenue through a straightforward fee model applied to all staking rewards earned by deposited ETH. Understanding this revenue mechanism is critical to evaluating lido tokenomics and the protocol's long-term sustainability.

The 10% Fee Model

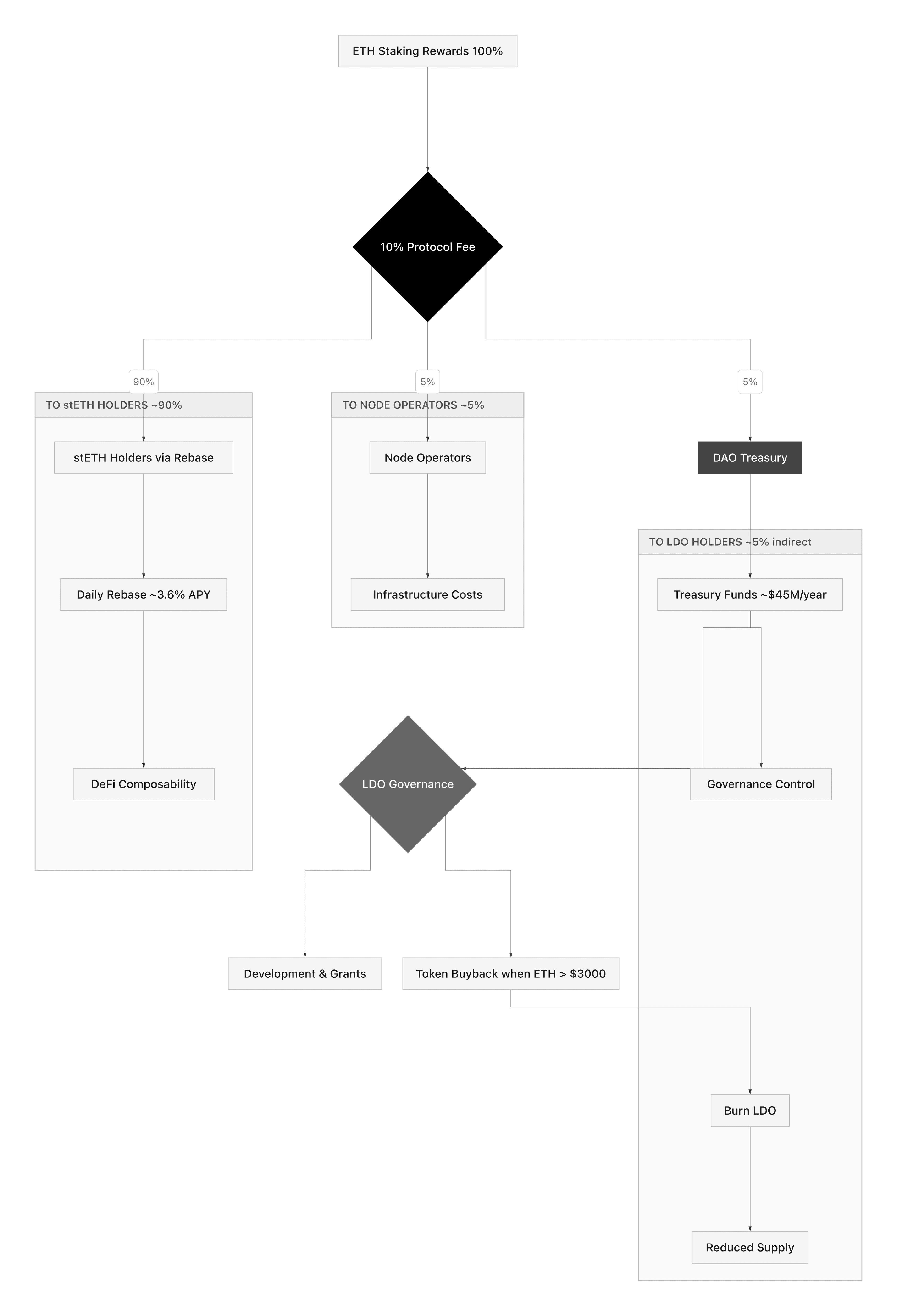

Lido applies a 10% fee on staking rewards that are split between node operators and the DAO Treasury. When stakers deposit ETH and receive stETH, their stETH balance increases daily through rebasing to reflect accumulated staking rewards. However, Lido takes a 10% cut before these rewards are distributed.

For example, if the Ethereum network provides a 4% annual staking yield, stETH holders effectively receive 3.6% (4% minus the 10% protocol fee). The remaining 0.4% is split between node operators and the DAO treasury.

This fee structure applies universally across all staked ETH in the protocol. With more than $32.5 billion in total value locked, even a small percentage generates substantial revenue. Lido has earned $44.68 million in revenue this year, exceeding its budget by 147 percent, and maintains around $90 million in annualized revenue.

The 10% fee rate is set by the Lido DAO through on-chain governance, subject to alignment with the protocol's needs and user interests. This governance control over fee parameters represents a key value driver for lido tokenomics, as LDO holders can adjust fees to balance protocol revenue with user competitiveness.

Revenue Split: Node Operators vs DAO Treasury

Lido's 10% fee is evenly divided between node operators and the DAO treasury, resulting in a 50/50 split. This allocation serves two distinct purposes within the protocol architecture.

Node operators receive 5% of staking rewards as compensation for managing validators and maintaining network reliability. These operators handle the technical complexity of running Ethereum validators, including hardware maintenance, software updates, and monitoring. The fee compensates them for capital requirements, operational costs, and the technical expertise needed to maintain high validator performance.

The DAO treasury receives the remaining 5% to support Lido DAO operations, infrastructure costs, and long-term research and development efforts. This steady revenue stream funds protocol development, security audits, grant programs, and ecosystem growth initiatives.

With approximately $90 million in annualized revenue and a 50/50 split, the DAO treasury receives roughly $45 million per year. This substantial income provides significant runway for protocol development without requiring token sales or additional fundraising.

The fee allocation structure remains subject to governance, allowing the DAO to adjust the split based on changing protocol needs. For instance, if node operator costs increase or the DAO requires more funding for development, LDO holders can propose and vote on fee structure changes.

stETH: How Liquid Staking Creates Value

The stETH token represents the core innovation that differentiates Lido from traditional staking services. Understanding how stETH works and creates value is essential to comprehending the full scope of lido tokenomics.

stETH Rebasing Mechanism

stETH is a transferable rebasing utility token representing a share of the total ETH staked through the protocol, which consists of user deposits and staking rewards. The token rebases daily to accurately reflect the amount of ETH staked through the Lido middleware and any accrued rewards or slashing events that might have occurred.

The rebasing mechanism works automatically without requiring any user action. Staking rewards are reflected in your stETH balance through a daily rebase, with your stETH balance increasing proportionally to the staking rewards earned by the protocol. Because stETH rebases daily, it communicates the position of the share daily, providing transparent and immediate reward distribution.

For example, if you stake 10 ETH and receive 10 stETH, and the protocol earns 4% annually (minus the 10% protocol fee for a net 3.6%), your stETH balance will gradually increase to reflect these rewards. After one year, you would hold approximately 10.36 stETH, representing your original 10 ETH plus accumulated staking rewards.

This rebasing approach differs from wrapped staking derivatives like wstETH or rETH, which maintain a constant token balance but increase in value relative to ETH. The rebasing mechanism provides immediate visibility into reward accumulation, making it easier for users to track performance.

The supply of stETH is adjusted on a daily basis to accurately reflect the amount of ETH staked through the Lido middleware. This adjustment accounts not only for positive rewards but also potential slashing events, ensuring the token supply always represents the true underlying ETH position.

DeFi Composability and Yield Stacking

The liquid nature of stETH enables yield stacking strategies that multiply returns beyond base staking rewards. Users can stake ETH with Lido to receive stETH tokens, then deploy those tokens into other yield strategies while continuing to earn staking rewards.

Common yield stacking strategies involve using stETH as collateral on lending platforms like Aave. Users can borrow assets against their stETH while still earning staking rewards on Aave. The borrowed assets can then be deployed into additional yield opportunities, effectively using the initial ETH position.

Another popular strategy involves adding stETH to liquidity pools on Curve Finance. By pairing stETH with ETH in Curve's low-slippage pools, users earn trading fees and Curve LP token rewards on top of their base staking yield. These LP tokens can then be deposited into Convex Finance for additional boosted rewards.

DeFi composability creates substantial value through these stacked yield opportunities. A practical example involves lido staking to receive stETH tokens, then adding stETH to a liquidity pool on Curve Finance to receive trading fees and Curve LP token rewards. These strategies can potentially generate total returns significantly higher than simple staking.

The V3 upgrade further enhances composability by introducing stVaults, which allow users to customize staking strategies while retaining exposure to stETH. This framework enables more sophisticated yield optimization strategies and expands the use cases for lido staking.

Liquid staking tokens like stETH will become standard collateral, boosting composability across ecosystems by 2026. Protocols can integrate with each other permissionlessly, assets can be rehypothecated across venues, and new financial primitives can be built by stacking existing ones.

LDO Value Accrual: Treasury and Governance

The LDO token captures value through two primary mechanisms: direct treasury revenue from protocol fees and governance control over critical protocol parameters. Understanding these mechanisms is essential for evaluating lido value accrual.

DAO Treasury Revenue

The DAO treasury receives 5% of all staking rewards as part of the 10% protocol fee, generating approximately $45 million annually based on current protocol metrics. This revenue flows directly to the treasury controlled by LDO token holders through governance.

The treasury holds approximately 350 million LDO tokens (35% of total supply) plus accumulated revenue from protocol operations. This dual asset base provides substantial resources for protocol development and creates optionality for value return to token holders.

LDO holders control how treasury funds are deployed through governance proposals. The DAO can allocate funds to development grants, security audits, marketing initiatives, strategic partnerships, or other activities that benefit the protocol. This control over substantial resources represents a significant value accrual mechanism for lido tokenomics.

The buyback mechanism activates only when Ethereum's price exceeds $3,000 and Lido's annualized revenue surpasses $40 million, indicating the protocol has surpassed this revenue threshold. When active, the DAO can use treasury funds to purchase and burn LDO tokens, directly reducing circulating supply and potentially increasing value for remaining holders.

The treasury revenue stream provides a sustainable funding model that does not rely on token sales or external fundraising. As the protocol grows and total value locked increases, treasury revenue scales proportionally, ensuring long-term financial sustainability.

Governance Power Over Fee Parameters

LDO holders exercise governance control over critical protocol parameters, including fee rates, fee distribution, node operator selection, and protocol upgrades. This governance power represents a key component of lido value accrual.

The protocol fee rate is currently set at 10%, but LDO holders can adjust this rate through on-chain governance. If competitive pressure requires lower fees, the DAO can reduce the rate to maintain market share. If the protocol has sufficient competitive advantages, the DAO can maintain or increase fees to maximize revenue.

Similarly, the 50/50 split between node operators and treasury is subject to governance control. LDO holders can adjust this allocation based on changing needs, such as increasing node operator compensation to attract high-quality validators or increasing treasury allocation to fund development.

Node operator selection represents another critical governance function. The Lido DAO approves which entities can operate validators for the protocol, controlling validator quality and decentralization. This power ensures the protocol maintains high performance and reduces centralization risks.

Protocol upgrades like the V3 transition to stVaults require governance approval. LDO holders vote on major changes to protocol architecture, ensuring upgrades align with community interests. This control over protocol evolution protects token holder interests and ensures sustainable development.

The governance framework provides LDO holders with direct control over value accrual mechanisms. By adjusting fees, treasury allocation, and protocol features, token holders can optimize lido tokenomics for long-term sustainability and value capture.

Lido vs Competitor Revenue Comparison

Evaluating lido tokenomics requires comparing the protocol to alternative liquid staking platforms. Market share, revenue generation, and fee structures reveal competitive positioning and sustainability.

Lido commands 76% market share in the Ethereum staking ecosystem, followed by Coinbase at 17% and Rocket Pool at 3.5%. This dominant position reflects network effects, liquidity depth, and DeFi integration advantages that reinforce market leadership.

Revenue generation scales with market share. Lido maintains around $90 million in annualized revenue, substantially higher than smaller competitors. This revenue advantage funds superior development resources, security audits, and ecosystem growth initiatives.

Fee structures vary across platforms, impacting user returns and protocol revenue. Lido offers 3% APR after fees, Rocket Pool offers 2.8% for stake-only or 6.3% for running a node, and Coinbase offers comparable rates through its centralized platform. The narrow spread suggests fee competition limits pricing power.

Rocket Pool provides up to 3.27% APY for liquid ETH staking with a more decentralized node operation model. The rETH token suits users comfortable with validator duties or multi-protocol risk, offering an alternative value proposition focused on decentralization over liquidity.

Coinbase represents the centralized exchange approach, offering one-click setup, automated rewards, and minimal decisions that suit first-time stakers who prioritize simplicity over control. The cbETH token provides liquidity similar to stETH but relies on centralized infrastructure.

Platform characteristics reveal different strategic positioning. Lido remains the liquidity-heavy default for many users seeking maximum DeFi composability. Rocket Pool offers decentralization-forward pooled staking structures. Coinbase provides the simplest onboarding experience for less technical users.

The choice between platforms depends on user priorities: simplicity (Coinbase), liquidity and returns (Lido), or decentralization (Rocket Pool). For 2026, Lido maintains leadership through superior liquidity, extensive DeFi integrations, and the simplest approach to earning staking rewards while maintaining capital efficiency.

Lido also offers optimized staking vaults with potential yields of up to 8%, significantly higher than base staking rates. These vaults use the V3 architecture to provide enhanced returns through sophisticated staking strategies, creating additional value for lido staking participants.

Key Takeaways

Lido has established itself as the dominant liquid staking protocol, managing over $32 billion in total value locked and commanding 28% of the Ethereum staking market. Understanding lido tokenomics reveals how the protocol generates and distributes value across stakeholders.

The protocol's 10% fee on all staking rewards generates approximately $90 million in annualized revenue, split equally between node operators and the DAO treasury. This sustainable revenue model funds protocol development without requiring continuous token sales or external fundraising.

The LDO token captures value through governance control over treasury funds and protocol parameters. While LDO does not provide direct revenue distributions, token holders control approximately $45 million in annual treasury revenue and can vote on deployment strategies including development funding or token buybacks.

stETH represents the core innovation that drives protocol adoption, providing liquid staking rewards that can be used across DeFi. The rebasing mechanism and DeFi composability enable yield stacking strategies that generate returns significantly higher than base staking rates.

The V3 upgrade marks Lido's evolution from pure staking infrastructure into a multi-product DeFi platform. The introduction of stVaults enables customized staking strategies while retaining stETH exposure, expanding use cases and potential yield opportunities.

Compared to alternatives like Rocket Pool and Coinbase, Lido maintains competitive advantages in liquidity depth, DeFi integrations, and market share. The protocol's 76% market dominance reflects network effects that reinforce leadership positioning.

The governance framework provides LDO holders with meaningful control over value accrual mechanisms. By adjusting fees, treasury allocation, and protocol features, token holders can optimize lido tokenomics for long-term sustainability while balancing user competitiveness and protocol revenue.