Written:

Feb 7, 2026

Synthetix generates $82M in annualized fees from derivatives trading. Learn how SNX tokenomics captures value through staking rewards, fee burns, and Androme...

Synthetix has distributed over $30 million in fees to SNX stakers from more than $40 billion in perpetual futures trading volume. This article examines how Synthetix tokenomics create direct value accrual for token holders through a unique staking mechanism that channels 100% of protocol fees to SNX stakers.

Unlike many DeFi protocols that retain a portion of fees for treasury or team allocations, Synthetix passes all trading revenue to its stakers. This complete fee distribution model, combined with substantial collateralization requirements, creates an economic system where SNX stakers bear protocol risk in exchange for fee income.

What Is Synthetix?

Synthetix is a decentralized derivatives protocol that enables trading of perpetual futures and synthetic assets on Ethereum and other networks. The protocol allows users to gain exposure to various assets including cryptocurrencies, commodities, and foreign currencies without holding the underlying assets.

The protocol operates through a system of synthetic assets called Synths, which are ERC-20 tokens that track the price of real-world assets. Users can trade these Synths or access perpetual futures markets that generate trading fees for the protocol.

Synthetix eliminates traditional counterparty risk by using a pooled collateral model. SNX stakers provide collateral that backs all synthetic assets on the platform, acting as the counterparty to every trade. This model ensures deep liquidity and minimal slippage for traders.

The protocol launched in 2018 and has since processed billions in trading volume. Synthetix Perps, the perpetual futures product, has become one of the leading decentralized perpetual futures exchanges by volume and has generated significant fee revenue that flows directly to SNX token holders.

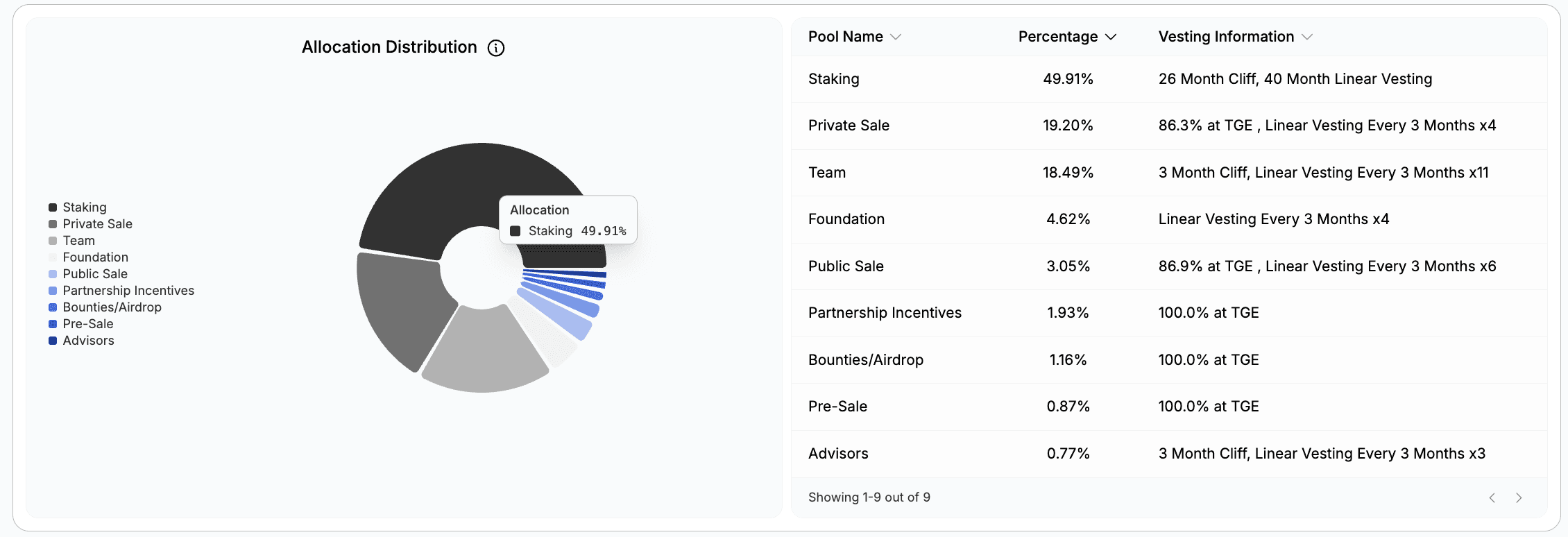

Synthetix Tokenomics: SNX Supply and Distribution

Token Supply

The SNX token serves as the primary collateral for the Synthetix protocol. The current circulating supply stands at approximately 343 million SNX tokens, representing nearly 100% of the total supply. This high circulation percentage indicates that the vast majority of tokens have been distributed and are available in the market.

The token supply began with an initial allocation of 100 million tokens at launch in 2018 when the project was known as Havven. The supply expanded through an inflationary rewards program designed to incentivize stakers and bootstrap liquidity in the early years of the protocol.

The distribution model focused on rewarding active participants. Rather than allocating large portions to venture investors or the team through unlocks, Synthetix distributed tokens primarily through staking rewards. This approach created a community-owned protocol where most tokens are held by users who actively participate in securing the network.

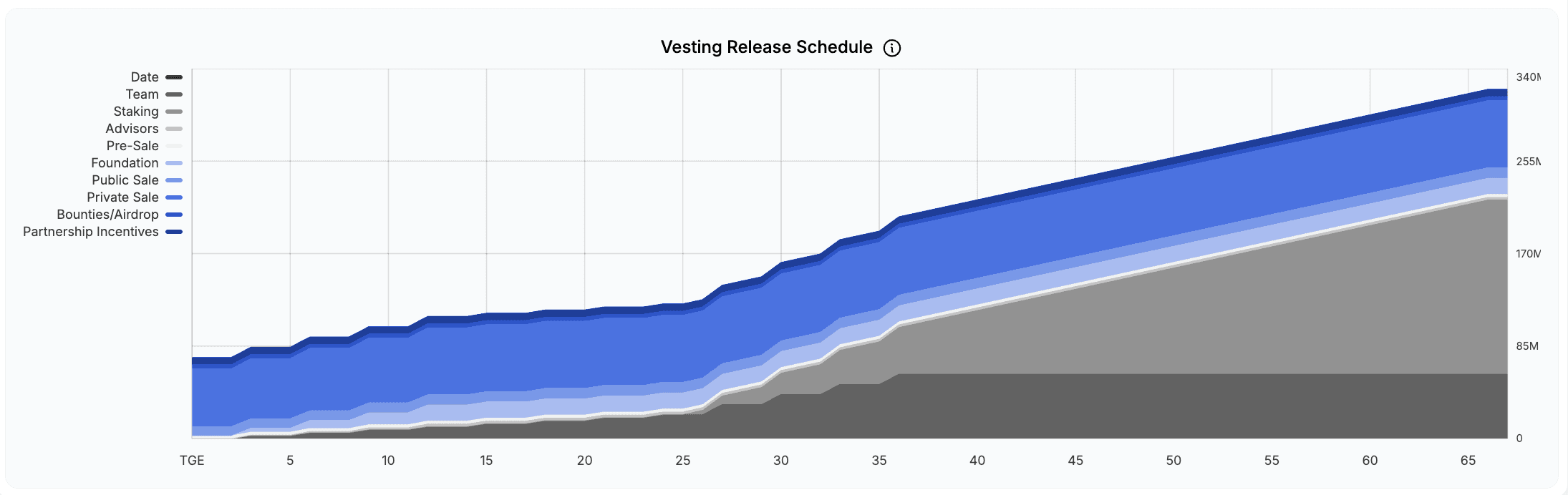

Inflation and Staking Incentives

Synthetix implemented a terminal inflation schedule that ended in 2023. The inflationary rewards program distributed new SNX tokens to stakers each week, creating an incentive structure that encouraged long-term participation and network security.

The weekly staking rewards were denominated in SNX and distributed proportionally based on each staker's debt share in the system. This mechanism ensured that stakers who maintained proper collateralization ratios received ongoing token incentives beyond trading fees.

Following the completion of the inflation schedule in 2023, the protocol shifted to a fee-only reward model. Stakers now earn exclusively from trading fees generated by Synthetix Perps and Synth exchanges. This transition marked a significant milestone as the protocol became entirely self-sustaining through organic revenue.

The end of inflation also means that SNX token supply is now fixed, with no new tokens being created through protocol emissions. This creates deflationary pressure when combined with the fee burn mechanism implemented in recent governance proposals, where fees reduce staker debt rather than being distributed as additional tokens.

How Synthetix Generates Revenue

Perpetual Futures Fees

Synthetix Perps generates the majority of protocol revenue through trading fees on perpetual futures markets. The protocol has facilitated over $40 billion in perpetual futures trading volume, generating more than $30 million in fees that have been distributed to SNX stakers.

Perpetual futures fees are charged on every trade executed on the platform. Traders pay a fee when opening and closing positions, with the fee percentage varying based on market conditions and the specific asset being traded. These fees typically range from 0.02% to 0.10% per trade depending on the market.

The Synthetix Perps product supports numerous markets including major cryptocurrencies like Bitcoin and Ethereum, as well as altcoins and other digital assets. Each market generates independent fee revenue that contributes to the total fee pool distributed to stakers.

Funding rates provide an additional revenue stream from perpetual futures. Traders holding positions pay or receive funding based on the difference between the perpetual contract price and the underlying asset price. These funding payments flow through the system and contribute to overall protocol revenue.

The protocol achieved substantial volume growth through integrations with front-end applications like Kwenta, Polynomial, and dHedge. These platforms built on top of Synthetix infrastructure, routing trades through the protocol and generating fees that benefit all SNX stakers regardless of which interface traders use.

Synth Trading Fees

Synth exchanges represent the second revenue stream for Synthetix. Users can trade between different synthetic assets on the platform, converting between Synths like sUSD, sBTC, sETH, and others without needing external liquidity pools.

The protocol charges exchange fees between 0.3% and 1% on Synth trades, with the typical fee set around 0.3% for standard exchanges. These fees are collected and distributed to SNX stakers through the same mechanism as perpetual futures fees.

Dynamic fee adjustments help protect the protocol during periods of high volatility. When the system detects rapid price movements, it automatically increases exchange fees to reduce the risk of frontrunning and oracle attacks. This dynamic pricing ensures the protocol maintains security while still facilitating trades.

Fee reclamation mechanisms prevent exploitation of oracle latency. When a user exchanges Synths, the protocol implements a waiting period before the exchange is finalized. If the price moves significantly during this window, the system adjusts the exchange to reflect the more accurate price, protecting stakers from losses due to stale oracle data.

The Synth trading volume has declined relative to perpetual futures as traders have migrated to the Perps product, which offers better terms and a superior trading experience. However, Synth exchanges continue to generate meaningful fee revenue, particularly for users seeking simple exposure to synthetic assets without the complexity of futures positions.

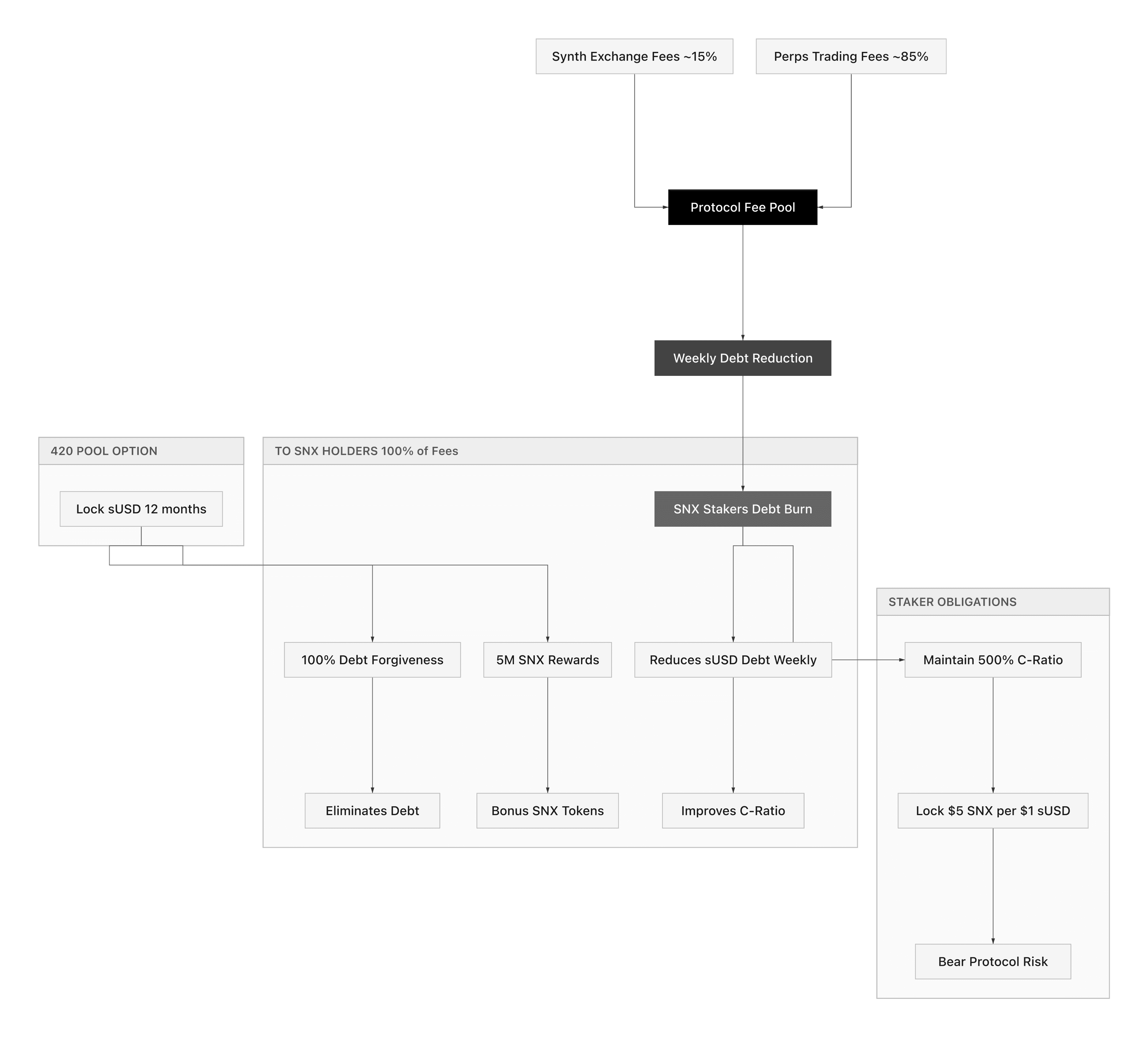

SNX Value Accrual: 100% Fee Distribution

Weekly Debt Reduction Mechanism

Synthetix distributes all protocol fees to SNX stakers through a weekly debt reduction mechanism. Rather than claiming fees as separate tokens, stakers automatically see their sUSD debt decrease each week based on their proportional share of the debt pool.

The debt reduction happens every Wednesday when the protocol takes the accumulated fees from the previous week and burns them against staker debt. This weekly cadence creates a predictable schedule where stakers can track their debt reduction and calculate their yield from protocol fees.

The mechanism operates through the debt shares system implemented in SIP-185. Each staker holds debt shares proportional to their staked SNX and minted sUSD. When fees are burned, the total debt pool decreases, and each staker's individual debt decreases proportionally to their debt share percentage.

This automated distribution eliminates the need for manual claiming, which reduces gas costs for stakers and ensures that all eligible participants receive their share of fees without taking any action. The weekly burn simply reduces debt in the background, improving the collateralization ratio of all active stakers.

The debt reduction mechanism replaced the previous fee distribution model where stakers claimed fees in sUSD. The new model provides equivalent economic value while improving user experience and reducing the complexity of managing staking positions.

Stakers must maintain their position and meet collateralization requirements before the Wednesday snapshot to be eligible for that week's fee distribution. This requirement ensures that only active stakers who are properly supporting the protocol receive fee rewards, preventing exploitation by users who might stake briefly to claim fees.

Staking Requirements and C-Ratio

SNX stakers must maintain a minimum collateralization ratio to participate in fee distribution and avoid liquidation. The target C-ratio currently stands at 500% on Layer 2 networks like Optimism, meaning stakers must hold $5 worth of SNX for every $1 of sUSD they mint.

The collateralization requirement creates a significant capital commitment for stakers. To earn fees, users must lock substantial SNX value as collateral, exposing them to price volatility in the SNX token. This tradeoff aligns incentives between stakers and the protocol, as stakers only profit when fee income exceeds their capital costs and price risk.

Stakers can adjust their C-ratio by either adding more SNX collateral or burning sUSD debt. When the SNX price increases, stakers naturally see their C-ratio improve, as the value of their collateral rises relative to their fixed debt. Conversely, when SNX price declines, stakers must either add collateral or burn debt to maintain their target ratio.

The protocol uses different target ratios on different networks. Layer 1 Ethereum stakers face a 400% target C-ratio, while Layer 2 stakers must maintain 500%. These differences reflect the varying risk profiles and liquidity conditions across chains.

Liquidation protections give stakers time to restore their C-ratio before facing penalties. If a staker's ratio drops below 200%, their position is flagged and enters a two-week grace period. During this time, the staker can add collateral or burn debt to increase their ratio back to 600%. Only if they fail to act during this period does liquidation occur.

The high collateralization requirements serve multiple purposes. They ensure the protocol remains overcollateralized and can absorb price shocks, they create accountability for stakers who earn fees, and they limit the supply of sUSD to maintain stability of the synthetic dollar.

12-Month Lock Incentive Program

Synthetix introduced the sUSD 420 Pool in April 2025, offering a unique incentive structure that distributes 5 million SNX tokens to participants who lock their sUSD for 12 months. This program aims to reduce circulating sUSD supply and restore the stable price peg to $1.

The 420 Pool requires complete commitment. Users who deposit sUSD into the pool cannot withdraw their funds for the full 12-month duration. This lock eliminates the ability to exit the position regardless of market conditions, creating substantial opportunity cost for participants.

In exchange for this lock, participants receive two key benefits. First, they earn a proportional share of 5 million SNX tokens distributed over the 12-month period. Second, and more importantly, participants see their debt forgiven linearly over the year, with 50% forgiveness after six months and complete debt elimination after the full 12 months.

The debt forgiveness mechanism provides powerful incentives for existing SNX stakers who hold sUSD debt. Rather than burning their debt manually, stakers can deposit their sUSD into the 420 Pool and watch their debt decrease automatically over time while earning additional SNX rewards.

The program achieved significant adoption, with over 170 million SNX migrated to the 420 Pool by mid-2025. This represents roughly half of the total SNX supply and established the 420 Pool as the dominant staking mechanism within the Synthetix ecosystem.

SNX rewards vest over three months beginning after the program ends on April 19, 2026. This vesting schedule means participants receive their SNX rewards gradually from April through July 2026, creating an extended reward period beyond the initial 12-month lock.

The 420 Pool demonstrates how Synthetix uses creative tokenomics to solve protocol challenges. By offering debt forgiveness and token incentives, the protocol successfully reduced sUSD circulation and improved the peg while creating value for long-term committed stakers.

Synthetix V3: Architecture Overhaul

Multi-Collateral Pools

Synthetix V3 represents a fundamental redesign of the protocol architecture, moving from a single global debt pool to a modular system of isolated liquidity pools that can accept multiple forms of collateral. This transition enables greater flexibility and reduces systemic risk compared to the V2 model.

The V3 architecture allows governance to approve any ERC-20 token as collateral for backing synthetic assets. At launch, the protocol supported diverse collateral types including SNX, ETH, USDC, sUSDe (Ethena's yield-bearing synthetic USD), and cbBTC (Coinbase's wrapped Bitcoin). This multi-collateral approach reduces dependence on SNX and opens the protocol to a broader base of liquidity providers.

Liquidity providers in V3 can choose which specific pools they want to delegate collateral to, rather than joining one universal debt pool. This selective participation allows stakers to support only the markets and assets they consider appropriately risky, rather than being exposed to the entire protocol's debt.

Markets tap into liquidity pools to generate the synthetic assets needed for trading. When a user wants to trade a perpetual future, the market draws from its designated pool, minting sUSD against the collateral to facilitate the trade. This modular structure means each market can have different risk parameters and collateral requirements.

The pool-based system creates opportunities for specialization. Some pools might focus on stablecoin-backed markets, while others could support more volatile assets with higher collateral requirements. This stratification allows different types of liquidity providers to find risk profiles that match their preferences.

Pool managers can configure various parameters for their pools, including which markets can access the pool, what collateral types are accepted, and what liquidation thresholds apply. This flexibility enables experimentation with different pool designs while maintaining security through isolated risk.

The V3 architecture positions Synthetix as a liquidity infrastructure layer that other protocols can build on top of. Rather than being solely a trading platform, Synthetix V3 functions as a permissionless system where anyone can create derivative markets backed by the protocol's liquidity pools.

Cross-Chain Deployment

Synthetix V3 launched with multi-chain support, initially deploying on Base as the first V3 implementation. The Base deployment used USDC denomination for both liquidity providers and traders, creating a stablecoin-native derivatives platform.

The protocol subsequently launched V3 on Arbitrum, introducing USDx as an Arbitrum-native stablecoin isolated to that deployment. USDx operates independently from sUSD used in V2 systems on Optimism and Ethereum, allowing the Arbitrum deployment to have separate risk parameters and collateral requirements.

However, Synthetix recently consolidated its cross-chain strategy. The protocol placed Arbitrum Perps into close-only mode and began shutting down deployments on multiple chains to focus resources on a single primary network. This strategic shift moved away from maintaining separate liquidity and infrastructure on each chain.

The consolidation recognizes that each chain deployment requires dedicated liquidity, maintenance, and support resources. By focusing on fewer chains, Synthetix can concentrate development efforts on improving core products rather than managing multiple independent deployments.

Optimism, where Synthetix V2 operates, faces an eventual sunset as the protocol migrates fully to newer architecture. The plan involves closing all remaining Synthetix functionality on Optimism, completing the transition to the more efficient V3 system.

The SNAXchain initiative aims to create a dedicated application chain for Synthetix that serves as an on-chain governance platform. This chain would coordinate Synthetix deployments across Ethereum mainnet and layer-2 networks, providing a unified governance layer even as the protocol operates across multiple chains.

The cross-chain evolution demonstrates the challenges of maintaining DeFi protocols across fragmented liquidity environments. While multi-chain deployment initially seemed beneficial for reaching more users, the practical difficulties of managing separate pools and systems led to a consolidation strategy focused on depth over breadth.

Synthetix vs Competitor Fee Comparison

Synthetix distinguishes itself through complete fee distribution to token stakers, allocating 100% of protocol revenue to SNX holders who provide collateral. This model contrasts sharply with competitors that retain significant fee portions for development, treasury, or other allocations.

GMX, a decentralized perpetual futures exchange, distributes approximately 30% of fees to GMX token stakers, with the remaining 70% paid to GLP liquidity providers. This split reflects GMX's two-token model where liquidity providers take on different risk than governance token stakers.

dYdX V4 implemented a similar full-distribution model where 100% of trading fees flow to DYDX token stakers. However, dYdX requires significantly lower collateralization, as stakers do not back trades with their capital. This creates less capital efficiency for stakers but also less risk compared to Synthetix's debt-backed model.

Perpetual Protocol distributes a portion of fees to vePERP holders who lock PERP tokens. The exact percentage varies based on governance decisions, but typically ranges from 50% to 80% of protocol fees going to stakers, with the remainder allocated to the insurance fund and ecosystem development.

Gains Network takes a different approach, buying back GNS tokens with trading fees rather than distributing fees directly. Approximately 50% of fees fund buybacks, 40% goes to gToken vault stakers who provide liquidity, and 10% supports the NFT bot collateral system.

The key differentiator for Synthetix lies in the collateralization model. While other protocols distribute fees to passive token stakers, Synthetix stakers actively back all trades with their collateral. This creates higher capital requirements but also justifies the complete fee distribution, as stakers bear protocol risk.

Fee generation per dollar of market cap provides another comparison metric. Synthetix generates substantial fees relative to its market capitalization, creating attractive yields for stakers. However, these yields come with the volatility and liquidation risk inherent in maintaining high collateralization ratios.

The competitive landscape continues evolving as protocols experiment with different fee-sharing mechanisms. Some trend toward lower staker distributions to fund development and growth, while others like Synthetix maintain the model of maximal value accrual to token holders who secure the protocol.

Key Takeaways

Synthetix distributes 100% of protocol fees to SNX stakers through a weekly debt reduction mechanism that automatically decreases staker debt proportional to their share of the debt pool. With over $30 million distributed from $40 billion in perpetual futures volume, the protocol creates direct value accrual for token holders who provide collateral.

The system requires substantial capital commitment, with stakers maintaining 400-500% collateralization ratios to participate in fee distributions. This high collateral requirement ensures protocol security but exposes stakers to SNX price volatility and liquidation risk if their ratio falls below critical thresholds.

The 420 Pool offers an alternative staking path, providing 5 million SNX in rewards plus complete debt forgiveness to users who lock sUSD for 12 months. This program has attracted over 170 million SNX, representing roughly half the total supply, making it the dominant staking mechanism.

Synthetix V3 introduces multi-collateral pools and modular architecture, allowing liquidity providers to choose specific markets and collateral types rather than joining one global debt pool. This flexibility reduces systemic risk and opens the protocol to diverse forms of collateral beyond SNX.

The protocol's tokenomics create alignment between stakers and the protocol. By requiring stakers to back all trades with their collateral while earning all fees generated by the system, Synthetix ensures that those who secure the network capture the value created by trading activity.

Synthetix Tokenomics FAQ

About the Author

Founder of Tokenomics.com

With over 750 tokenomics models audited and a dataset of 2,500+ projects, we’ve developed the most structured and data-backed framework for tokenomics analysis in the industry.

Previously managing partner at a web3 venture fund (exit in 2021).

Since then, Andres has personally advised 80+ projects across DeFi, DePIN, RWA, and infrastructure.